The Disruptive Potential Of CBDC

For fresh upstarts seeking to overtakemore advanced competitors in thesovereign currency arena, central bankdigital currency (CBDC) could be justthe ticket.

Nigeria, known for its struggleswith poverty, is home to around 87million people living in extremepoverty yet poised near the front of theglobal CBDC race after the launch ofthe eNaira in October 2021. It was thesecond officially launched CBDC afterthe Bahamas’ Sand Dollar.

Relatedly, Cambodia, one of thepoorest nations in Asia, was rankedsecond behind only the Bahamas onPwC’s April 2021 global retail CBDCdevelopment maturity rankings. PwCis a world leader in managementconsulting. The Chinese mainland, thefirst major economy to pilot a CBDC,took the third place on the rankings.

In contrast, the U.S. Federal Reservefinally published its long-anticipatedpaper on a digital dollar on January 20.The Fed hasn’t taken a position yet onissuing a U.S. CBDC.

The seemingly illogical globaldevelopment has become a starkreminder of how the global currencylandscape has been retooling itselfover recent years after the rise ofblockchain-based cryptocurrenciesfacilitated a break from conventionalmoney.

Underpinned by blockchain,a technology that permanentlyrecords transactions, typically in adecentralized and public databasecalled a ledger, cryptocurrenciesenable ownership of virtual propertywithout the need for central authority.

With Bitcoin and its manycounterparts increasingly considered a threat to sovereign money, it makes perfect sense for sovereign money to evolve into CBDCs.

As its name implies, CBDC refers to digital money issued by the central bank. While digital payments normally facilitate online transactions, most CBDC solutions seek to pack offline capacities, with Bluetooth and nearfield communication mostly proposed and resorted to as the underlying technology to support point-to-point payments.

Still, what makes it essentially different from all other cashless payment instruments including credit cards, electronic payment, and cryptocurrencies is that CBDC is a direct liability of the central bank, consequently considered the safest form of digital money. Other forms of cashless means are mostly liabilities on the balance sheet of commercial banks.

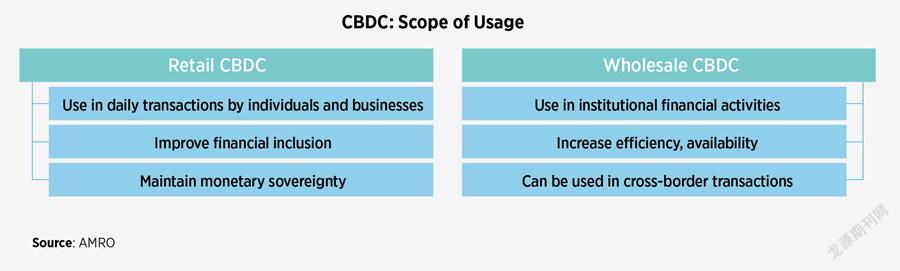

Generally, CBDC falls into one of two categories: a retail or general purpose CBDC if it’s intended to be used as a digital extension of cash by all individuals and businesses, or wholesale if it grants only restricted access by permitted institutions.

Understandably, CBDC has arrived at the mainstream of central bank roadmapping.

Out of 65 central banks responding to a CBDC-themed survey by the Bank for International Settlements (BIS) in late 2020, 86 percent revealed some form of active CBDC engagement, according to survey results released in January 2021.

Roughly 60 percent of surveyed central banks “are conducting experiments or proofs-of-concept,” while 14 percent are working on pilot projects.

The respondents, according to BIS, represent nearly 72 percent of the global population and 91 percent of the world’s economic output.

Early Movers

With CBDC initiatives bringing unbanked, underserved populationinto the payments system, weak links transformed into strengths in the case of the Bahamas and Cambodia.

With the prevalent use of smartphones making it easy to open a digital bank account, CBDCs have emerged as a lifesaver for many of the most financial inclusionhungry places that have been previously dampened by poor financial infrastructure, economic backwardness, or both.

It makes sense that some of the traditionally least-involved nations in the global financial sphere have been rushing to get a head start over more prominent economies.

The Bahamas is relatively well off, according to its US$27,196.69 per capita GDP in 2020, equivalent to 215 percent of the global average, according to Trading Economics data.

In comparison, China’s per capita GDP topped US$10,000 for the first time in history just in 2019, per official data.

The wealth failed to translate into a readily available network of banking facilities because the Bahamas, an archipelagic state consisting of more than 700 islands, is inherently unfriendly to the concept of automated teller machines or bank branches being physically built. Frequently severe weather adds to the cost of infrastructure maintenance.

With mobile devices vastly popular among the local population at a penetration rate of up to 90 percent according to media reports, CBDC has been deeply appealing to the island state since the concept emerged.

Among the Sand Dollar’s key specifications is its offline functionality that ensures that the digital fiat remains in work mode even if communication between islands gets disconnected in case of extreme weather events.

Cambodia’s move to a CBDC-like initiative can also be understood.

Amidst COVID-19-inflicted pressure, the National Bank of Cambodia (NBC) launched a CBDC-like payment system known as Bakong in October 2020, effectively funneling it to largely unbanked areas where residents are hugely handset-savvy, heralding a new era of central bank-backed financial inclusion.

Bakong, developed by the NBC in collaboration with Japanese blockchain firm Soramitsu, can be downloaded from app stores, enabling money transfers without the necessity of a traditional bank account.

Users of the Bakong app had reached roughly 270,000 as of November 2021, according to a January Nikkei Asia report citing Cambodian central bank data.

This, in addition to the central bank’s partnerships with local banks to operate and expand the payment system, resulted in the currency reaching roughly 7.9 million people, or about half Cambodia’s population, thereport revealed.

It’s noteworthy that disputes linger about Cambodia’s quasiCBDC approach because there’s no involvement of specially designed digital currency. Instead, Bakong allows digital payments both in U.S. dollars and Cambodian currency, riel, under the Southeast Asian economy’s dual-currency system.

Still, it offers a glimpse into marked CBDC progress across the ASEAN Plus Three bloc consisting of 10 ASEAN nations and China, Japan, and South Korea.

Arguing against the description of CBDC as a one-size-fits-all solution, the ASEAN+3 Macroeconomic Research Office, in a note in January, spoke highly of CBDC headway in the bloc.

Cambodia, alongside the Chinese mainland and South Korea, is considered home to many of the world’s most mature retail projects, while China’s Hong Kong Special Administrative Region, Japan, Singapore, and Thailand are reputed to have the world’s most mature wholesale CBDC projects, according to the note, citing PwC findings.

And the latest move came from Benjamin Diokno, governor of Bangko Sentral ng Pilipinas, the Philippines’ central bank, who announced plans to roll out a pilot CBDC implementation soon while addressing an event on CBDC in Manila at the end of February.

In Nigeria, the African CBDC trailblazer, the roadmap toward CBDC readiness has been fueled, likewise, by burgeoning mobile internet usage.

But Nigeria’s youth has unique enthusiasm for cryptocurrency after runaway inflation and weakened currency in the African country pushed its citizens to the edge, thereby leading to rampant use of Bitcoin among other cryptocurrencies as alternatives to the Nigerian naira.

As of press time, the naira’s spot exchange rate against the dollar was hovering well above 410, weakened substantially from around 300 at the start of 2020, per Trading Economics.

Its annual inflation rate fell marginally to 15.6 percent in January, official numbers showed.

Fears that cryptocurrencies could overtake the naira as a dominant currency of Nigeria have been cited for leading to the launch of the eNaira, months after a ban on local banks and financial institutions getting involved in crypto-related transactions.

De-dollarization

While financial inclusion is considered a major pull of CBDC availability, a much talked-about yet highly contentious factor behindCBDC initiatives is its resultant move, deliberately or not, away from the U.S. dollar-centric global financial regime.

As is well known, the dollarhas become the backbone of theinternational currency system sincethe Bretton Woods system of monetary management was created in July1944. The system required a currencypeg to the U.S. dollar which was inturn pegged to the price of gold. TheBretton Woods System collapsed inthe 1970s but continues to influenceinternational currency exchange andtrade through its creation of the IMFand World Bank and cementing the U.S. dollar’s role as the global currency.

Founded in 1973, the Belgium-based Society for Worldwide Interbank Financial Telecommunication (SWIFT) is, not surprisingly, denominated inU.S. dollars.

The dollar-denominated financialmessaging network, with three datacenters in the U.S., the Netherlands,and Switzerland, links global banksand handles a galaxy of daily paymentinstructions across 200-plus countries and regions and more than 11,000financial institutions.

This is why a cutoff from SWIFThas been described as a financialnuclear weapon. Kicking selectedRussian banks out of the SWIFTsystem as a sanction against Russiaamid the ongoing Russia-Ukraineconflict speaks volumes to the world’s continued focus on the greenback,Washington’s financial avatar.

Russia is considered second onlyto the U.S. in terms of financialinstitution membership in the system.

However, beneath the dollar’sseeming invincibility, rifts that tend to be detrimental to the dollar’s dominant role have become increasinglyconspicuous, a trend that has beengaining steam in the CBDC’s wake.

A striking example is Bakong,known for promoting a push awayfrom the dollar, which still dominates transactions in Cambodia, towardsCambodian riels.

With unabashed unilateralismduring the Trump era frustrating EU- US relations, even the EU has beenlooking away from the dollar.

The continent’s defiance wasevidenced by an EU plan to beef upthe global role of the Euro accordingto media reports on the January 2021dollar-distancing proposal.

“At times, unilateral actions bythird countries have compromisedlegitimate trade and investment ofEU businesses with other countries,”Bloomberg reported, citing thedocument it obtained.

The EU’s moves to strengthen theeuro over the dollar include creation ofa digital euro.

In July 2021, the GoverningCouncil of the European Central Bankannounced the launch of a 24-monthinvestigation phase of a digital europroject, aiming to address key issues indesign and distribution.

China’s efforts over the years toglobalize its currency have madeheadlines across the world, moreoverwhelmingly than the EU’s. Part ofthe internationalized yuan push wasthe launch of the yuan-denominatedCross-Border Interbank PaymentSystem (CIPS) in 2015.

Unlike SWIFT that handlespayment-related messaging and carriesinstructions, CIPS is a settlement andclearing system that still uses SWIFTmessaging and formats. As measuredby functionality, CIPS is tantamountto the Clearing House InterbankPayments System (CHIPS), the primaryclearing house in the U.S. for dollar-based electronic payments.

There’s speculation that CIPS couldrun its own messaging network andeventually operate independently fromSWIFT, although that remains a long-term vision.

The quick advance of the digitalyuan, officially called the DigitalCurrency Electronic Payment anddubbed e-CNY, has undoubtedly addedfuel to speculation over the yuan’s rivalry versus the dollar.

As a sign of fast-paced progress,the digital yuan was announced asthe preferred currency at the Beijing Winter Olympics.

For perspective, the dollar wasalready feeling pressure before thedigital yuan and a merely conceptual digital Euro began to invoke theirmagic.

In January, the yuan remained thefourth most active currency for globalpayments in value terms, with its share rising to a record high of 3.2 percent,according to SWIFT data. The dollartopped the ranking with 39.92 percentfollowed by the Euro’s 36.56 percent and the British pound sterling’s 6.3 percent.

Last January, the yuan’s share of global payments currency stood atmerely 1.65 percent, while the dollar accounted for 40.81 percent and the euro 33.58 percent.

As the digital yuan is technicallyready for cross-border use, albeitpresently mainly used for domesticretail payment, China’s central banksaid in July 2021 in a white paper on its digital fiat R&D progress, globalization of the yuan could be expedited muchmore efficiently than the current CIPS approach.

While CIPS still has to rely on SWIFT, the digital yuan, whose trials kickedoff in late 2019, puts China among themost pioneering in carving out a pathto global monetary clout independentof the conventional sphere of influence backed by CHIPS and SWIFT.

That said, the digital yuan hasyet to emerge as a game changer forinternational trade and could take along time.

In a bylined article in November,Arnold Gao, senior director analyst atmarket research firm Gartner, wrotethat in terms of internationalizationof the yuan, “it depends more on thepolitical and economic choices of thetrading partners because technology is the last-mile effort rather than a game changer.”

Acceptance of the digital yuan inoverseas markets might be subject touncertainties in China’s relations with its major trading partners includingEurope and Japan, said Cao Yin,managing director of the Shanghai-based Digital Renaissance Foundation.

Digital Dollar HesitancyWith the global race for CBDCreadiness all the rage, a big question mark hangs over a rather hesitant stance on the digital dollar.

China’s technological rise has shown to be worrying enough to unite U.S. legislators behind efforts such as the America COMPETES Act, which passed the House in February, and the U.S. Innovation and Competition Act, which passed the Senate last July. Both proposed funds to be allocated to semiconductor chip manufacturing. So why hasn’t the digital yuan prompted the U.S. to roll out its digital fiat?

For starters, with its population adequately banked, the U.S. is far less motivated to bank on a CBDC to improve its financial inclusion.

In 2019, 94.6 percent of U.S. households were banked, suggesting at least one household member had a checking or savings account, according to data from the Federal Deposit Insurance Corporation.

The U.S. leadership, as gauged by its banked population, nonetheless, is considered to have contributed to its lagging in adoption of mobile payments. By comparison, a large unbanked population in China energized usage of mobile payments.

The Fed’s January CBDC report only shattered the hopes of those hoping for the U.S. central bank to fire the starting pistol on the digital dollar.

The report mentioned the disturbing possibility of the dollar’s global use decreasing if CBDCs introduced by many foreign countries and currency unions grew more appealing than existing forms of the dollar.

A U.S. CBDC could preserve the global role of the greenback, the Fed said in the report. It cited the possibility of complex policy issues and risks resulting from the introduction of a CBDC as a digital liability of the Fed that is publicly available.

Efficacy of monetary policy implementation is one inhibitor of the Fed’s move toward the digital dollar.

Unanticipated surges in CBDC could “put upward pressure on the federal funds rate,” read the report, which also discussed more complicated interactions between a U.S. CBDC option and monetary policy implementation if CBDC were interestbearing at levels comparable to yields on other safe assets, notably factoring the potentially significant foreign demand for the digital dollar.

With the Fed policy making now centering on its pace of rate hikes, impacting global markets, a future state in which an American CBDC could make Fed moves all the more far-reaching in global monetary policy terms seems to justify a more prudent approach to the digital dollar.

Such concerns, however, are barely sufficient to prevent the Fed from setting out its CBDC trial, as the launch of a CBDC project is far from mature enough to be a factor to consider in monetary policymaking.

Cao offered an explanation: The digital dollar remains on the back burner of the Fed, whose top priority now is a finely calibrated cycle of rate spikes to tame its record-high inflation.

The U.S. consumer price index rallied 7.9 percent in February from the year before, its highest level in four decades, according to U.S. labor department figures.

A surge in crude oil prices amid the Russia-Ukraine tensions is seen as piling up the pressure on the Fed to normalize its monetary policy.

More plausibly, the hesitancy toward the launch of a U.S. CBDC, potentially amplified by inflation woes, testifies to Washington’s confidence in the dollar’s strength being the persistent foil preventing the imminent leap into the CBDC battlefield. After all, even Bitcoin is valued against the dollar.

It’s unknown, however, how long that boost of confidence will last, or if the digital yuan, alongside a rising number of CBDCs around the world, might someday facilitate a fundamental and transformative change to the global currency system.