Pandemic Scrambles the Semiconductor Supply Chain

Mitch Leslie

Senior Technology Writer

The automaker Ford was forced to halt production of 60 000-70 000 mostly built F-150 pickups that it could not complete [1].Its competitor General Motors removed features from some new models and shut down many of its plants for weeks and even months[2,3].Apple announced that it was cutting iPhone production by more than 10%[4].For some Canadian customers,the wait for new refrigerators and other appliances stretched to a year or more [5].

These were just a few of the consequences of the global shortage of semiconductors in 2021. The coronavirus disease 2019(COVID-19) pandemic, severe weather, and other factors have put unprecedented stress on the global supply chain for these devices, and their scarcity is already exacting an economic toll.The cost to automakers alone could be 210 billion USD in 2021[6]. Experts predict that supply will not catch up with demand for a year or more. ‘‘You cannot just step on the gas and expect the supply chain to get back up,”said Robert Handfield,a professor of operations and supply chain management at North Carolina State University in Raleigh,NC,USA.Along with short-term disruptions,the crisis will likely produce long-term changes in the semiconductor industry, altering where at least some microchips are manufactured and even how engineers design products that contain the devices.

The more than 640 billion microchips manufactured every year provide the brains for cell phones, computers, and other electronics, and manufacturers have incorporated them into a vast variety of other products,including electric toothbrushes,rice cookers,and robotic milking machines [7]. An automobile can contain more than 1000 chips, which control features such as the power windows, ignition, brakes, navigation system, and airbags [8,9].

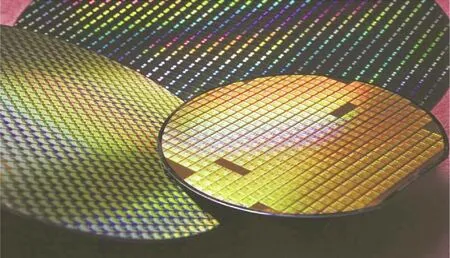

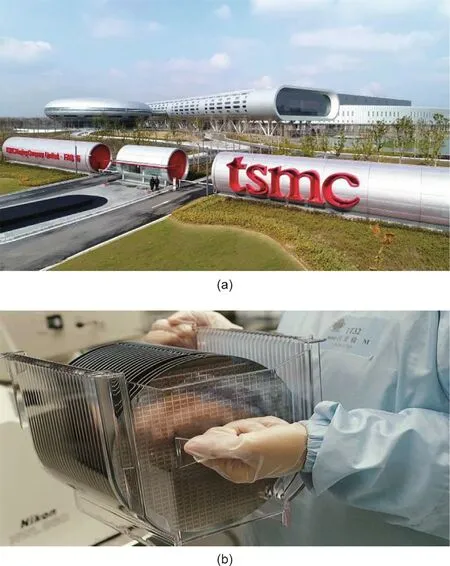

The supply chain for semiconductors is a prime example of globalization. Most of the silicon for microchips comes from a quarry in North Carolina that has the world’s purest quartz deposits [10]. Plants that are concentrated in Japan and other Asian countries perform the next step,turning powdered silicon into thin wafers [11]. Expensive, super-clean factories, or ‘‘fabs,” then pattern microchips’ electronic circuits onto the silicon wafers (Fig. 1)[12]. The United States used to conduct much of this work, manufacturing 37%of the world’s chips in 1990[13].However,its share has shrunk to 12% [13], and Asian fabs now predominate. Taiwan Semiconductor Manufacturing Company (TSMC) alone produces more than half of the world’s custom chips (Fig. 2), which firms such as Apple rely on [14].

Fig.1. Manufacturers use these 12 in(1 in=2.54 cm)silicon wafers to produce the most sophisticated microchips, which, along with other less advanced chips, have become increasingly difficult to obtain due to pandemic-related supply chain disruptions. Having passed through a TSMC fabrication plant, or ‘‘fab,” the wafers now carry dozens of microchips. Each chip will next be tested, cut free, and packaged for final use.Credit:Taiwan Semiconductor Manufacturing Co.,Ltd.,with permission.

Before they are ready for installation, microchips need to be tested, cut from the wafers, and packaged, procedures often completed by facilities in countries like Vietnam and Malaysia [11].Only then are the globetrotting chips shipped to the factories,often in China, which use them in products. Other countries such as Chile, Turkey, and the Netherlands contribute raw materials and machinery that are essential for producing semiconductors [15].

The semiconductor supply chain may seem convoluted, but its complexity makes economic sense, said Willy Shih, a professor of management practice in business administration at Harvard Business School in Boston,MA,USA.Each step in the manufacturing process is so complex and demanding that ‘‘you need to specialize,” he said. As a result, before the recent disruptions ‘‘we had a very tiered supply chain that was efficient from a cost standpoint.”

Still, previous disasters revealed vulnerabilities in the chip supply chain. The earthquake that shook Japan in 2011, for example, slowed global automobile production because it shut down the factory of a major chip supplier [16].

Fig. 2. (a) TMSC’s Fab 16, located in Nanjing, China, produces chips for the automobile industry and other users. It is currently undergoing a 2.8 billion USD expansion so that it can process 40 000 wafers each month. (b) In one of the fab’s clean rooms,a worker moves a batch of microchip containing 8 in silicon wafers to the next manufacturing step. Credit: Taiwan Semiconductor Manufacturing Co.,Ltd., with permission.

The COVID-19 pandemic that began in late 2019 distorted supply and demand and caused much bigger disruptions. Because so many people were staying home, demand for chip-containing products like laptop computers, smart phones, appliances, and video game consoles soared [17]. And because new fabs cost billions of dollars to build, chipmakers ‘‘are laggards on capacity.They do not invest in extra capacity beforehand,” said Patrick Penfield,a professor of supply chain practice at Syracuse University in Syracuse, NY, USA. Thus, production could not keep up with rising demand. Other unexpected events in 2021, including a fire at the same Japanese factory that shut down after the 2011 earthquake and the February freeze in Texas [18], which closed several plants, also worsened the supply problem [11]. Further delays ensued when COVID-19 outbreaks forced some of the factories in Vietnam and Malaysia that cut and package microchips to shutter[11].

Automakers were left scrambling in 2021 because early in the pandemic, plummeting sales spurred them to slash production and cancel many of their semiconductor orders [19]. When they later decided to boost production as consumer interest picked up, they found that other companies making products that were in high demand, such as exercise machines and appliances, had already booked the microchip factories’ capacity, said Shih.

The market for semiconductors has been so competitive that wait times for orders hit a record of nearly 22 weeks in October 2021,compared with around 12 weeks in late 2019[20].However,manufacturers managed to squeeze more output from existing factories and by mid-2021 were shipping record numbers of chips[21]. As supply rises, demand for at least some types of semiconductors may also fall. Many of the products that consumers snapped up early in the pandemic, such as laptop computers, are long-lasting, and their sales will likely decrease, Shih said.Nonetheless, he, Penfield, and Handfield think that shortages will continue until late 2022 or 2023.

Construction of more fabs will be one legacy of the chip crisis,with companies such as TSMC, Intel, and Micron announcing multibillion dollar plans to scale up capacity[22,23].But the shortage may also fundamentally alter the structure of the semiconductor supply chain. Companies that make and use microchips will re-evaluate their sources, said Thomas Rose, a professor of media processes at the Rheinisch-Westfälische Technische Hochschule Aachen University in Aachen, Germany. Cutting costs has been the priority, but now ‘‘they have to think about the added value of having reliability in the supply chain” and whether customers will pay more to increase it, Rose said.

To keep chip supplies flowing, the European Union, the United States, Japan, China, and other countries or regions are looking to boost domestic production [22,24]. Although these efforts began before the COVID-19 pandemic, the recent shortage has made them more urgent.Given the importance of microchips to national economies and defense, ‘‘you are foolish if you do not do some of this manufacturing in your own country,” said Penfield.

Yet whether the European Union or individual countries can shorten the supply chain remains to be seen. For one thing, huge investments will be necessary. In 2021 the United States government proposed a plan to spend 52 billion USD to spur domestic chip production [21]. But TSMC plans to invest almost twice that amount over the next three years [25].

Another obstacle is that the industry leaders, TSMC and to a lesser extent Republic of Korea’s Samsung Electronics, have raced ahead technologically. They are the only two companies making the 5 nm generation of chips that is critical for products such as the latest generation of iPhones. Santa Clara, CA-based Intel, formerly the world’s biggest semiconductor maker, will not begin manufacturing its much-delayed equivalent until 2022 [26].

The idea that the United States or other countries can become self-sufficient in microchip manufacturing in the near future is‘‘nonsense,” said Handfield. ‘‘You cannot just build a semiconductor supply chain. It is going to take ten years at least.” But some measures to protect against supply shocks are feasible.Most products require basic microchips, not cutting-edge 5 nm models, and even iPhones rely on standard chips to perform tasks like controlling the display and managing power consumption[11].Individual countries could increase their output of these less powerful semiconductors.And smaller,less expensive fabs might allow countries to meet their needs for chips that are critical for defense and other key sectors of the economy,Handfield proposed.The leading companies could also contribute by relocating some of their manufacturing facilities.TSMC,which is building a 5 nm chip factory in the United States,in Phoenix,AZ,has already started this process[27].

Increasing design flexibility may also help improve semiconductor supply chain resilience. The microchips in automobiles must meet higher standards for reliability and durability than the chips in devices such as smartphones and are hard to replace[28]. But for many other products, Shih said, manufacturers can opt for ‘‘putting more functionality in software and using more general-purpose parts for which there are substitutes.”

- Engineering的其它文章

- Science and Technology for Combating Global Water Challenges

- Brain-Computer Interface Speaks Up

- Solar Geoengineering to Reduce Global Warming—The Outlook Remains Cloudy

- A Multi-Stage Green Barrier Strategy for the Control of Global SARS-CoV-2 Transmission via Cold Chain Goods

- Next-Generation Imaging: New Insights from Multicolor Microscopy in Liver Biology and Disease

- One-Step Reverse Osmosis Based on Riverbank Filtration for Future Drinking Water Purification