Editor’s Letter

Hatty Liu

Shakespeare has written, “Neither a borrower nor a lender be/ For loan oft loses both itself and friend.” Chinese proverbs are a bit more pragmatic: “A loan returned in time makes it easier to borrow the next time. A loan not returned makes it impossible to borrow again.”

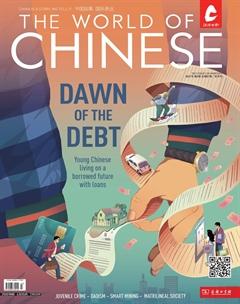

Though banks in China never even provided loans to consumers until 1987, consumer finance—like all other facets of the economy—has grown at breakneck speed ever since. Skipping over credit cards (and credit ratings), Chinese consumers are writing IOUs to online micro-lending platforms via e-commerce and mobile payment apps. But the countrys short history of dealing in credit has had serious consequences, with the government seemingly powerless to regulate predatory lenders who exploit consumers naivety about borrowing.

Our cover story looks at this looming debt crisis and its solutions—from young Chinese taking tips from celebrity “wealth management” gurus to the risky culture of person-to-person lending that persists in villages too poor or isolated to access financial services. We focus on Chinas rising concern about juvenile crime and the age of criminal responsibility; investigate how 5G technology is transforming the dangerous job of mining; journey to Sichuan and Yunnan to visit one of the last matrilineal cultures in the world; and more, inside.