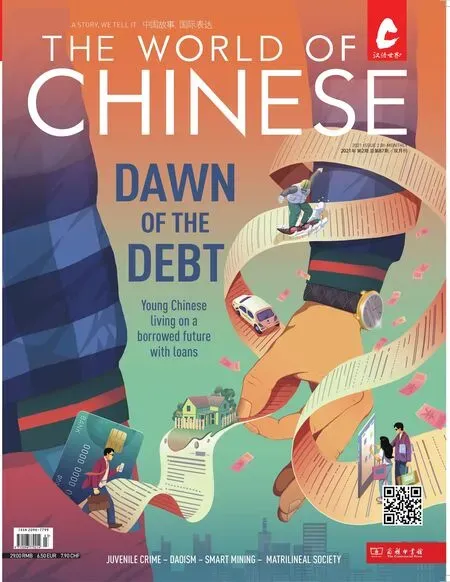

YOUNG AND IN DEBT

With temptations to consume but little financial savvy,young Chinese fall prey to online lending platforms

“When I wake up every morning,the first thing that comes to my mind is the debt I still owe,” says Wang Jun, a 23-year-old who works in an internet cafe in Chizhou, central China’s Anhui province.

The middle school graduate has to commute 43 kilometers into the city to work each day, but he had no choice but to take the job, if only so his nerves wouldn’t be stretched every time the phone rings.“It often turns out to be the collectors, who threaten to call everyone in my contact list unless I repay my debts immediately.”Wang discovered consumer loans in 2015, the same year Ant Financial Group launched Huabei,a virtual credit card service that now counts over 300 million users nationwide.After taking loans from Huabei and a dozen other online lending platforms, he racked up an outstanding balance of nearly 80,000 RMB, of which he has paid back just 25 percent over the past six years.

Most of the money Wang borrowed was spent on meals,hobbies, and shopping sprees—though later, he started taking out loans from one platform to pay the balance on another.“It’s very tempting to use services like Huabei when you have no money to spend.They allow you to get money quickly without checking up on your financial situation,” he says.

The proliferation in recent years of easy-access online lending platforms has introduced a growing number of Chinese consumers to the joy of buying on credit—and the despair of living with debt.As of January 2019,Chinese have collectively racked up an outstanding balance of 9.3 trillion RMB (about 1.4 trillion USD) in consumer loans, excluding mortgages and auto loans.This is almost triple the 3.5 trillion RMB (563.1 billion USD) they owed in January 2015.

However, consumer finance remains a relatively new concept to the country.Although China’s commercial banks began providing consumer loans in 1987, only those with a stable income and a history of borrowing and repaying loans on time could qualify to borrow, which ruled out most of the population.

In an attempt to spur domestic consumption, the China Banking Regulatory Commission, now the China Banking and Insurance Regulatory Commission (CBIRC),began allowing domestic and foreign companies to offer personal loans in 2009.These companies offered loansfaster than banks in amounts up to five times the applicant’s monthly salary, and gave customers longer repayment times than credit cards.

Gadgets and luxury goods are among the items young consumers are going into debt to buy

Since 2013, favorable policies and an increasingly mature e-commerce and internet sector have boosted the growth of China’s consumer finance market.Many Chinese tech giants have jumped on the bandwagon.Alibaba’s Ant Financial has launched Huabei and Jiebei, another online lending service that offers cash loans to individuals.JD’s Baitiao service allows customers to pay for purchases from the site in installments, while the Tencent-backed WeBank offers Weilidai, a micro-lending service through its WeChat mobile payment platform.

These tech giants have an advantage in data technology, and access to vast amounts of personal information.This allows them to evaluate a borrower’s credit-worthiness and calculate the loan amount within minutes or even seconds.

Huabei, for example, offers a lending quota ranging from 500 RMB to 50,000 RMB, calculated from big data and Ant Financial’s Zhima Credit system, which gives users a credit score of 350 to 950 based on five criteria: identity (such as one’s job or product preferences),behavior (including spending and payment patterns), credit history,“performance capacity” (including one’s assets), and “networking” (such as the spending and credit history of one’s social contacts).

Youths are the main driving force behind the rise of consumer finance.According to market research on China’s consumer credit markets in 2018, released by the Academic Center for China’s Economic Practice and Thinking at Tsinghua University,66 percent of the customers of consumer finance products (excluding housing loans) are under the age of 39.People between the ages of 40 and 49 constituted 33 percent of borrowers, while those aged 50 or above made up just 1 percent.

Credit card ownership rates remain low in China

The statistics reflect a generational shift in attitudes toward consumption.People of the older generation,survivors of war and famine, are reluctant to live beyond their means and tend to save money for the future.Thanks to them, China still has one of the highest personal savings rates worldwide, with the national savings rate peaking at 51.8 percent in 2018 before dipping slightly to 44.2 percent in 2019.

However, Chinese born after the reform period—many of whom are single children—focus more on living in the present and instant gratification,even if it means spending beyond their means.

“The painful experience of struggling through poverty and the fear of uncertainty got my parents’generation to save money as much as they could, but those of us born in a period of exponential economic growth, and living in a time of endless opportunities and optimism, tend to see money as a thing to be spent,”Ge Kun, a college student from Beijing, tells TWOC.“Spending helps improve one’s quality of life and fits into the bigger picture of China’s‘consumption upgrade’ strategy.”

This strategy, first proposed by the Ministry of Commerce in 2017,aims to boost consumer spending and transform it into the main driver of China’s economic growth,moving away from the exportoriented model of the past.This led to favorable policies, such as individual income tax cuts, measures to encourage banks to issue more consumer credit, and the promotion of e-commerce in rural areas.

However, the ease of getting loans and a regulatory vacuum leads to problems and abuses.There is no institution in China that supervises the online lending industry.No one enforces rules on who can borrow and how much, what risks lenders must disclose, and what methods credit agencies can use to collect.In 2016, a second-year university student named Zheng Dexing jumped to his death from a hotel building.He had racked up debts totaling almost 590,000 RMB from a dozen online finance companies to sustain his gambling habit.

The tragedy raised public concern and outrage over predatory online lenders known as “campus lenders,”who target college students with little financial know-how and often living away from their families for the first time.Some lenders offer easy terms to start with, but then chargestaggering interest rates and use violent methods to collect.

Some online lending platforms even demand nude photos from female borrowers as collateral.In April 2017, a college student in Xiamen committed suicide after collectors pressed her to pay up, or else have her nude photos go public.This practice has since been outlawed in China.

In response, China’s Ministry of Education banned online lenders from serving college students in 2017.A representative at the March 2021 meeting of the National People’s Congress proposed banning college students from signing up for credit cards and pay-by-installment services altogether.

More regulations have been introduced to normalize lenders’behavior.In 2020, draft rules jointly issued by the People’s Bank of China and the CBIRC sought to raise the bar for online micro-lenders to provide loans, also limiting the amount they can lend out.The rules require online micro-lenders to jointly fund at least 30 percent of any loan with banks, and they must also have at least 5 billion yuan in registered capital if lending across province.Before, each province could set their own capital threshold, which were all well below 1 billion yuan.

The central government is planning to force tech giants to share all the consumer loan data in their possession with nationwide credit agencies, and also introduce a consumer finance rating system.Although there is no measure of consumer credit risk equivalent to the FICO score in the US, China is piloting a “social credit” system in several cities.This attempts to merge financial credit scores with a broader quantification of social and civic integrity for citizens and corporations.

Meanwhile, consumers should cultivate a “rational attitude toward consumption” to guard against the excessive borrowing and hidden risks of online lending, the CBIRC warned in a notice last year.

A lack of financial knowledge is a pressing problem.A study published in the International Journal of Psychology in 2013 found that Chinese college students were less knowledgeable about credit cards than US students, and were unable to distinguish between credit and debit cards.

A survey by Tencent Education and the data company Mycos in January 2021 found that close to 70 percent of college students had little or no knowledge of how to tell whether a campus loan service followed proper regulations.Wang says he had no idea of what the interest rate was for the lending service he used, and still doesn’t know whether their collection methods are legal or not.

Wang now regrets his rash attitude toward spending.“I thought I was being clever,” he says of his habit of borrowing from multiple platforms,banking on them not to share data, “but it turned out there were consequences that I have to bear.”

Ge, though, considers himself to be a disciplined consumer (though it also helps to have supportive parents).“It’s necessary to keep your head.Never borrow more than you can repay,” he warns.

Putting his (borrowed) money where his mouth is, he has only taken out a 2,000 RMB loan from

Huabei so far to buy a pair of AirPods.Out of the allowance of 1,500 RMB he receives from his parents, he put aside 200 RMB toward repaying the debt each month until he cleared the outstanding balance.“I didn’t want to ask my parents for money, but I really wanted AirPods, so consumer loans were very helpful for me.”

Ge still holds a positive attitude toward consumer loans.“Thanks to these loans, I can afford expensive items without saving for months or even years, and I can enjoy them in advance,” he says.“Time is so precious.Why should we stubbornly delay gratification when we can get satisfaction quicker?”