Current Effect of “4+7” Drug Centralized Volume Procurement and Suggestions for Future Improvement

Piao Huiling,Wei Xingchen,Wang Nan,Wang Xing,Zhou Yusheng,Dong Li

(School of Business Administration,Shenyang Pharmaceutical University,Shenyang 110016,China)

Abstract Objective To explore the impact of the “4+7” city drug centralized procurement policy implemented from April 1st,2019 on China’s pharmaceutical market and the differences between this pilot scheme and the first volume procurement,so as to put forward some suggestions for this policy and improve the drug price formation mechanism.Methods The characteristics of the “4+7” volume procurement policy and its improvements were summarized through literature research,and the distribution of the winning enterprises in volume procurement was shown by the chart.Then the overall situation of pharmaceutical enterprises in China was analyzed.Results and Conclusion According to the main distribution of enterprises in the alliance region,we can see that the first round of bid-winning enterprises with 25 varieties are mainly distributed in the eastern coastal cities of Jiangsu,Zhejiang,Shandong,and Guangdong,which shows a trend of developing to provinces of Sichuan,Hubei,and Hunan.With the increase of volume procurement inland cities will be included in the future.This pilot scheme of volume procurement is a reform of the entire pharmaceutical industry.It has improved the market structure and promoted the transformation and upgrading of regional medicine representatives.The most important thing is to enable the public to better enjoy the benefits brought by the low-priced drugs.However,for some pharmaceutical enterprises and drug retail industry,it is a challenge.Therefore,it is necessary to improve the policy and strengthen market supervision and management.

Keywords:volume procurement; 4+7; drug bidding

The “4+7” city drug centralized volume procurement has been in operation for a long time since it was fully implemented on April 1,2019.According to the results given by the responsible personnel of the joint procurement office for drug centralized purchase,it can be seen that the pilot scheme is generally stable,its progress exceeds expectations,and the costs of patients’ medication are significantly reduced.By the end of August,1.7 billion tablets from the 25 varieties had been purchased in the “4+7” cities,and the agreed total purchase amount was better than expected.The selected drug procurement accounted for 78% of the purchase of generic drugs[1].

On the premise of consistency evaluation,Sunshine Medical Procurement All-in-One (SMPA)has released “Opinions of Nine Departments Including the National Healthcare Security Administration on the State Organizing the Pilot Scheme of Centralized Drug Purchase and Enlarging the Scheme Range”to promote the price reduction of drugs.The reform has an overall goal of providing low-price drugs with high-quality so that the results of the reform can benefit more people.The government promotes drug centralized procurement in the “4+7” cities so that it can gain experience for further implementation of this scheme.The relevant policies and measures should be optimized to ensure the long-term stable supply of selected drugs,which will guide the healthy and orderly development of the pharmaceutical industry.Besides,the scopes and form of centralized procurement as well as the corresponding procedures are stipulated.

1 The second round of “4+7” implementation

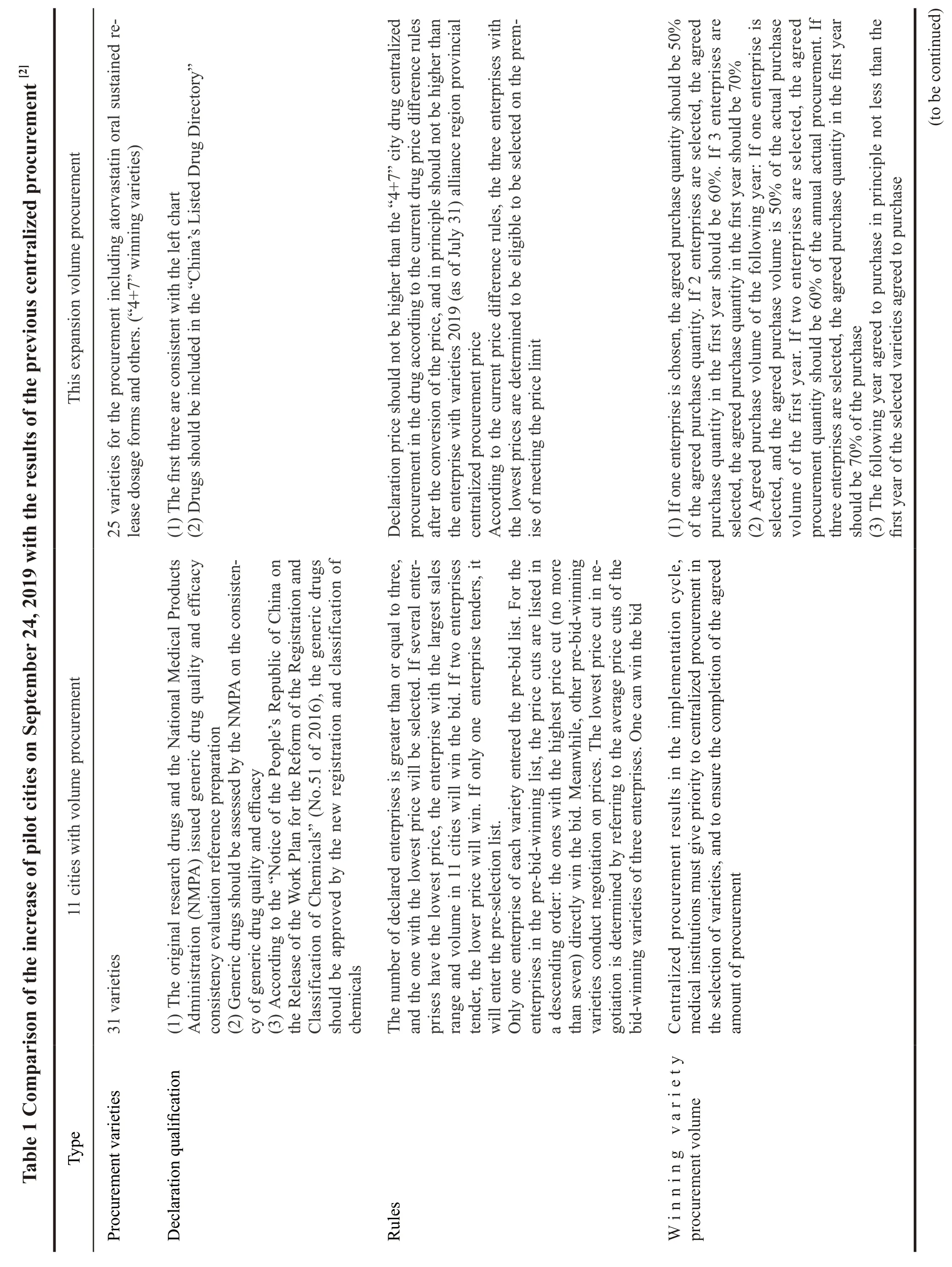

On September 1,2019,SMPA officially announced the “Document on Centralized Drug Procurement in the Alliance Region”.The government organized the centralized drug procurement in pilot cities (hereinafter referred to as “4+7” cities).For the increase of pilot cities,a series of comparisons were made with the previous centralized drug procurement,and the differences are shown in Table 1.

1.1 Basic information of second round of purchased items with quantity

This alliance area includes Shanxi,inner Mongolia,Liaoning,Jilin,Heilongjiang,Jiangsu,Zhejiang,Anhui,Jiangxi,Shandong,Henan,Hubei,Hunan,Guangdong,Guangxi,Hainan,Sichuan,Guizhou,Yunnan,Tibet,Shaanxi,Gansu,Qinghai,Ningxia,and Xinjiang (including Xinjiang production and construction corps),which does not cover the“4+7” cities.

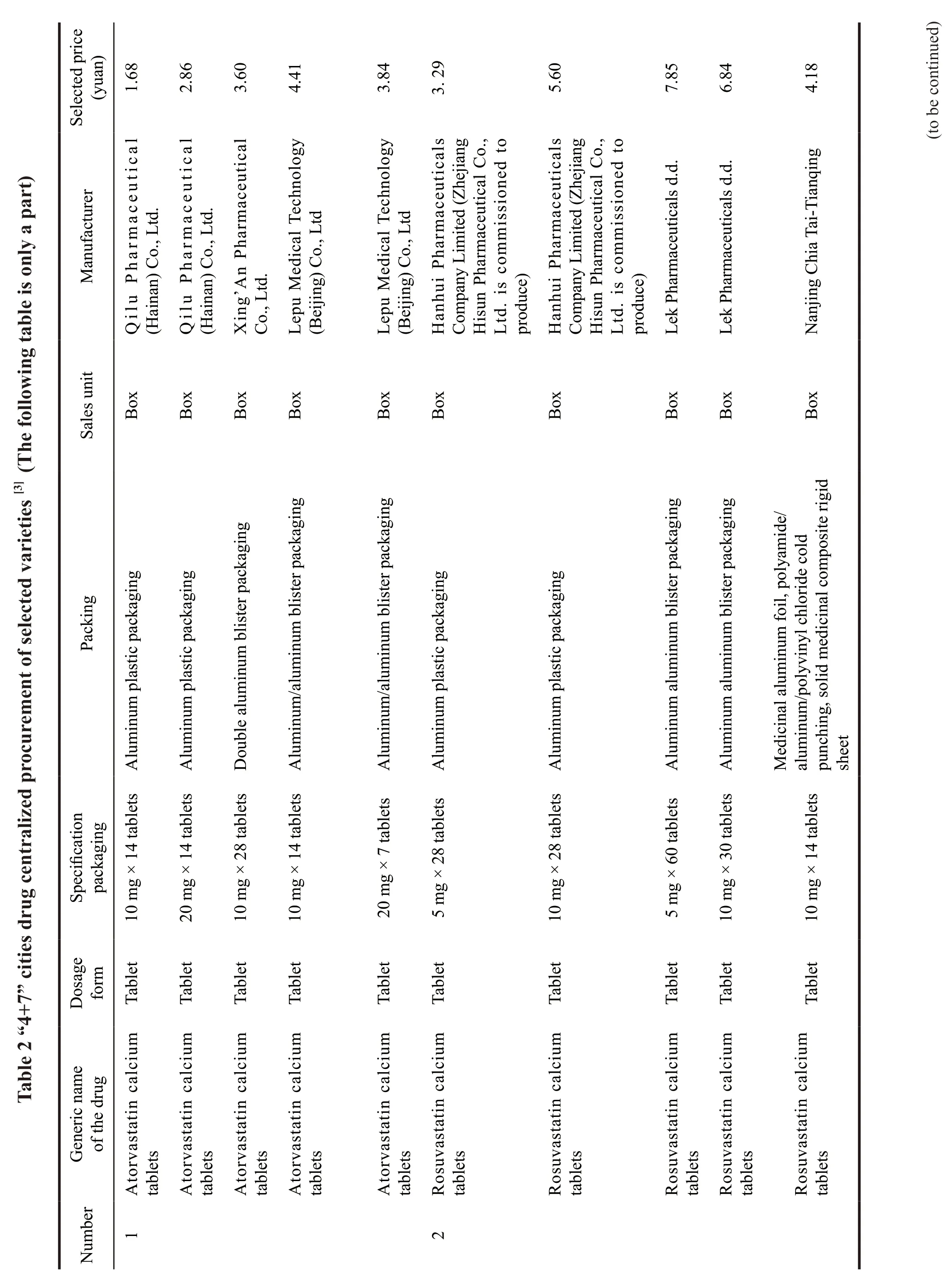

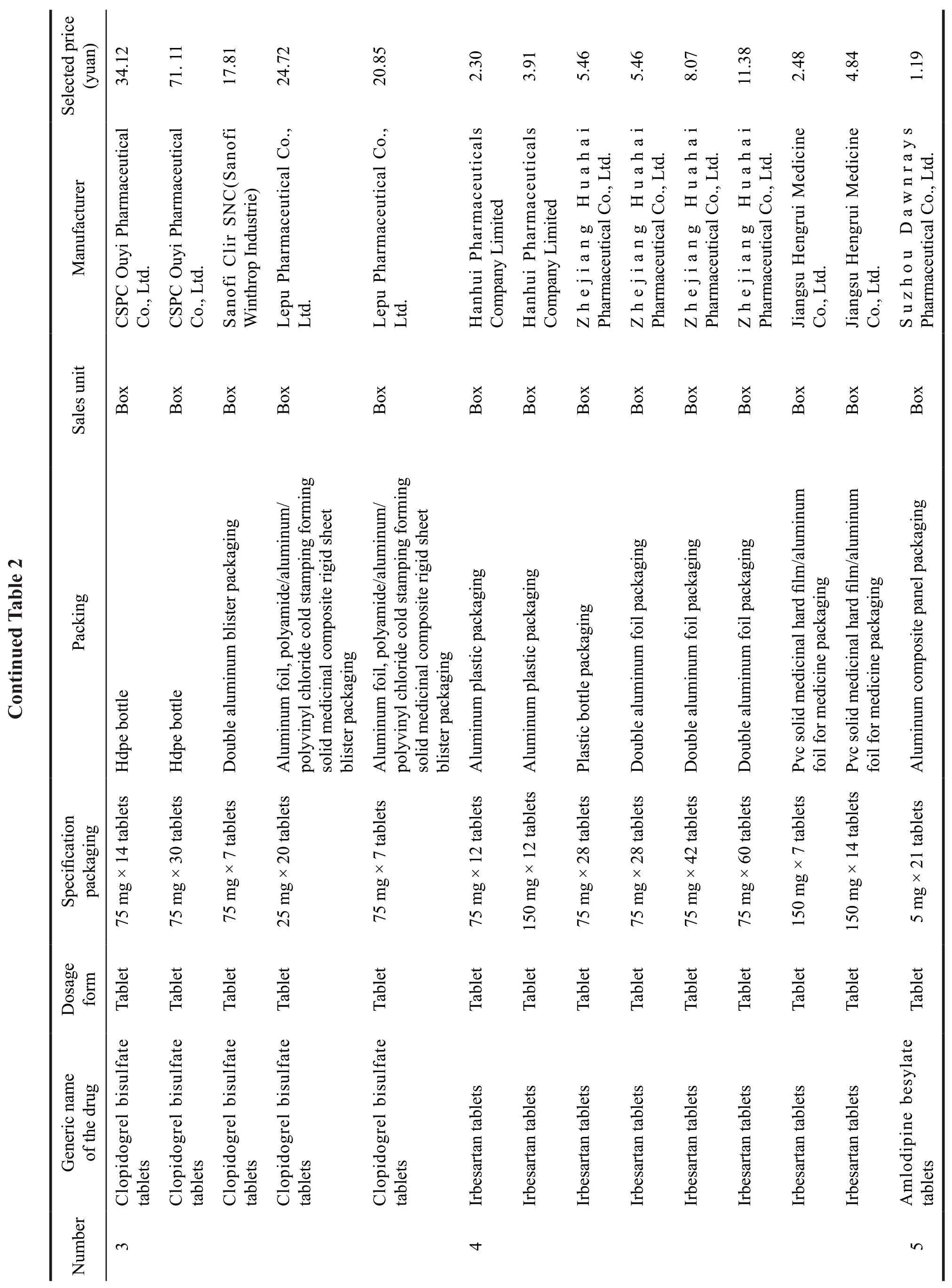

Subsequently,on September 30,2019,SMPA publicized the notice of successful drug centralized procurement in the alliance area,and a total of 25 products won the bid.From this list,we can see the volume procurement mode is dominated by medical insurance bureau,and drug prices will be cut in the future.Meanwhile,procurement mode also changes,from the previous single bid to three bids,which is more market oriented.Therefore,enterprises have to rely on competition to gain market share.Specific varieties are shown in Table 2.

After the release of the alliance’s drug supply and procurement catalog,we can see that Zhejiang Huahai Pharmaceutical Co.,Ltd.became the most successful enterprise,whose seven varieties of“irbesartan tablets,irbesartan hydrochlorothiazide tablets,losartan potassium tablets,fusinopril sodium tablets,lisinopril tablets,paroxetine hydrochloride tablets and risperidone tablets” all won the bid.The price of each corresponding drug was greatly reduced.The amlodipine besylate tablet of Chongqing Yaoyou Pharmaceutical Co.,Ltd.was even cut to 0.49 yuan,with the highest reduction.More examples show that the prices of drugs are greatly cut.Rosuvastatin of Jingxin Pharmaceutical won the bid with a price of 21.8 yuan in 2018.However,it did not win with the offer of 5.6 yuan this year.The enterprises that finally won the bid were Haizheng Pharmaceutical,Sandoz,and Chia Tai-Tianqing.The bids for 10 mg were 0.20 yuan/film,0.22 yuan/film and 0.30 yuan/film respectively.After the “4+7” city centralized volume procurement,China’s pharmaceutical industry has reached a consensus that generic drug market has low profits.

Drugs from a total of 77 enterprises would be purchased by the alliance,resulting in 45 enterprises with 60 products to be selected.Compared with the lowest purchase price in the alliance in 2018,the average price decreased by 59%.Compared with the price in the “4+7” pilot cities,the average reduction is 25%.Among them,three major varieties drop to the bottom price.Amlodipine from China National Pharmaceutical Group and Dawnrays Pharmaceutical’s was 0.06 yuan/piece,compared with the price of “4+7”cities,it dropped 60%.Entecavir from Dawnrays Pharmaceutical was 0.18 yuan/tablet,cut down 71%.Atorvastatin calcium tablets from Qilu pharmaceutical was 0.12 yuan/tablet,a decrease of 78%.Finally,Huahai,Qilu,Chia Tai-Tianqing became the last winners,five products of Qilu won the bid with a super low price.5 enterprises who were successful at the first “4+7” procurement lost the bid.

As a result,the bid-winning price of this volume procurement was greatly cut.For example,atorvastatin of 10 mg was offered by Qilu Pharmaceutical at 1.68 yuan/box.Clopidogrel bisulfate tablets were given three prices from different enterprises.CSPC Pharmaceutical Group quoted 34.12 yuan/box,Sanofi quoted 17.81 yuan/box,and Lepu Pharmaceutical offered 20.85 yuan/box.

As to anti-cancer drugs,the price reduction continues,Take gefitinib as an example,AstraZeneca offered 547 yuan for 0.25 g × 10 pieces of specifications,but Qilu Pharmaceutical dropped to 257 yuan.

1.2 The strategic distribution of the second round of carrying volume procurement

As to the distribution of bidding enterprises,the government makes a careful plan,see Fig.1.

According to the main distribution of the bidding enterprises in the alliance,we can see that after the first round of volume procurement,with a certain adjustment,the 25 varieties of selected enterprises are mainly distributed in Jiangsu,Zhejiang,Shandong,Guangdong and other eastern coastal cities.At the same time,they have a tend to expand to inland provinces such as Sichuan,Hubei and Hunan.With the expanding volume of purchasing range,enterprises in inland provinces will participate in the future.

2 Impact of second round of volume procurement

According to the data from China Pharmaceutical Industry Information Center,China’s generic drug market in 2016 reached about 1 trillion yuan,which is expected to be 1.4 trillion yuan by 2020.Affected by drug centralized volume procurement,more and more generic drug sales will drop,and some varieties will fell by more than 90%[4].Therefore,the generic drug market may finally dominate by three or four giants due to the drug procurement scheme.Therefore,the main products of enterprises will change,from general generics to innovative drugs.Creation plus generics is the direction of most pharmaceutical enterprises in the future.

Hengrui Medicine’s annual report in 2018 show that it has invested a total of 2.670 billion yuan in R&D,accounting for 15.33% of its sales revenue that year.Although Hengrui Medicine invested a lot of research and development (R&D) funds,for many years main source of income for Hengrui Medicine is still the generic drugs.Generic drugs accounted for 86% of Hengrui’s revenue in 2018,while innovative drugs accounted for only 14%[5].

However,when the “4+7” volume procurement was announced on September 24,Hengrui Medicine has only one product,namely,irbesartan tablets,to be selected.It means Henrui lost the battle against Qilu Pharmaceutical Co.,Ltd.and Huahai Pharmaceutical Co.,Ltd.,to a certain extent.In the future,with more volume of the number of varieties purchased,Hengrui’s other generic drugs are bound to be affected.It is also the cause of Hengrui Medicine to speed up its transformation.Not only Hengrui Medicine,Chia Tai-Tianqing,Hicin Pharmaceutical are actively increasing the R&D of innovative drugs.

Volume procurement has a very large impact on the entire pharmaceutical market.With the change from business tax to value-added tax and consistency evaluation systems in place,pharmaceutical enterprises are inclined to innovate.At the same time,the government has issued a series of policies to encourage drug innovation,further accelerating the expansion of the domestic innovative drug market.

2.1 The second round of volume procurement brought a lot of quality changes

2.1.1 Improving the competitiveness of high-quality enterprises and the market structure

According to the 2019 semi-annual reports released by major bulk drug enterprises,their preparations and other businesses are growing steadily,and the prices of drug ingredient varieties are rising year on year.In the future,with the continuous advancement of the supply and the tightening of environmental protection supervision,the bulk drug industry will be further improved to accelerate the integration.Some experts believe that the enterprise production costs increasing and the impact of environmental production will kick several drug companies out of the market.At the same time,a few high-quality enterprises will continue to transform,which can help them to gain more international market share.Besides,after the pilot expansion,the purchase of 25 varieties of drugs with volume will cover all regions of the country,which will have higher requirements on the product quality,capacity supply and cost control of enterprises.Enterprises will face greater competitive pressure,which will promote the optimization of the industry,gradually changing the situation of small scale and low quality to large scale,and modernization of the industry.

2.1.2 Promoting enterprise R&D

With the standardization of generic drug quality(through consistency evaluation),R&D will focus on improving clinical value of the drug.Meanwhile,R&D with exclusive dosage forms and first imitation as the pursuit of the quality stratification will lose value.With the acceleration of generic drug substitution,the life cycle of new varieties will be significantly shortened,which forces enterprises to invest more resources in new drug R&D.By comparing the current R&D investment in China,we find that the investment is small,which offers opportunities for many enterprises.Fig.2 shows the R&D investment of the top 50 global pharmaceutical enterprises in 2019.

We counted the R&D investment of the top 50 global pharmaceutical enterprises in 2019 and compared them by country.Two of them are Chinese pharmaceutical companies,one is Sino Biopharmaceutical Limited and the other is Hengrui Medicine.Although most pharmaceutical enterprises are lagging behind in R&D investment than foreign enterprises,this is a positive sign.In the future,more Chinese pharmaceutical enterprises will become the top ones.

Taking Sino Biopharmaceutical Limited as an example,its strategy is to focus on the bestselling generic drugs which are hard to produce.In the future market,generic drugs that are easy to produce cannot obtain huge profits for enterprises.For example,AstraZeneca’s budesonide suspension was sold 6.6 billion yuan last year,and there are still no enterprises that can produce its generics.Therefore,this phenomenon will speed up the development and imitation of the pharmaceutical enterprises.

2.1.3 Benefiting the public more

To reduce the burden of drug costs for patients,the pilot scheme included a total of 25 provinces participating.Compared with the minimum purchase price of the same product in these cities in 2018,the prices of the selected drugs in the pilot scheme decreased by an average of 59%.The superposition of price reduction and the drug substitution greatly reduce the burden of patients.The second benefit is to improve the quality of drugs for patients.The expansion of the pilot program adheres to volume procurement,and 50%-70% of the market purchases are given to selected drugs that pass the consistency evaluation of generic drugs.Therefore,it achieves the effect of quality improvement and price reduction.Besides,various measures are taken to ensure the use of the selected varieties in hospitals.Judging from the experience of the “4+7” pilot scheme,the proportion of drugs purchased with the same generic name through the consistency evaluation has greatly increased.After the pilot scheme is fully implemented,it is expected that the quality of drugs will be significantly improved.The results of the pilot mid-term evaluation conducted by a third-party organization showed that the drug costs on patients have been reduced,especially for patients with chronic and critical illnesses.More than 90% of patients are in favor of the pilot policy.

2.1.4 Promoting the transformation and upgrading of the pharmaceutical representative industry

The State Council has issued regulations in the“Opinions on Further Reforming and Improving Drug Production,Circulation and Use Policies” that medical representatives can only engage in activities such as academic promotion and technical consultation,but not drug sales.Otherwise,their untrustworthy behavior will be recorded in their personal credit history.The clarity of this specification has further raised the threshold of medical representatives and optimized their team.Medical representatives in the future are only to conduct academic promotion,which requires them to have medical and pharmacy education as well as practical experience.Meanwhile,they should possess marketing knowledge and promotion skills for drug promotion and publicity.Those people who have a non-medical background and cannot undertake academic promotion will be removed from the medical representative team.The procurement and usage of drugs are borne by the government,so enterprises do not need so many sales staff and save the marketing expenses.Therefore,the marketing of the enterprise will be weakened,which mainly depends on the requirement and implementation of volume procurement.

2.1.5 Improving the situation of the pharmaceutical industry

The expansion of the pilot scheme follows the principle of large quantity with low price,which also guarantees the use of selected varieties and timely payment.It will improve drug purchase and sales model in China,reduce the transaction costs of public relations,sales and delayed payment.Besides,it can guide doctors and patients to use drugs rationally,improve the situation of the pharmaceutical industry and reduce the corruptions in the process of purchasing and selling drugs.

2.1.6 Promoting enterprises to carry out generic drug consistency evaluation

The expansion of the pilot scheme takes consistency evaluation as the short-listed criterion for generic drugs to participate in centralized procurement,allowing generic drugs to compete with the original research drugs.If the manufacturers of the same type of drugs that have passed the consistency evaluation have reached three,those varieties that have not passed the consistency evaluation will no longer be selected,which will promote enterprises to speed up the consistency evaluation and upgrade the product structure.Volume procurement has created huge market opportunities for generic drugs that have passed the evaluation.Therefore,the pilot scheme will stimulate pharmaceutical companies to accelerate their process of consistency evaluation.

2.1.7 Saving medical insurance funds and eliminating gray income

The medical insurance funds saved in centralized procurement will be returned to the hospitals by the medical insurance department through appropriate channels.The remaining funds are mainly used to increase the salary of medical staff.The National Health Commission of the People’s Republic of China will guide the hospitals to formulate the salary standard for medical staff.When the salary structure of medical staff is reasonable,it can eliminate their gray income.

2.1.8 Accelerating substitution of import drugs

The 12 varieties in Shanghai’s third bid directly squeeze out the products from foreign-funded enterprises.The State-run centralized drug volume procurement will also cause many original research drugs to remain 30%-40% of the market share,which accelerates the replacement of the original drugs by domestic varieties that have passed the consistency evaluation.As far as the varieties in the 289 catalog are concerned,a lot of original research drugs still take up more than 50% of the hospital market share,which provides a large space for the substitution of domestic varieties.

2.2 Some problems also arise

2.2.1 Price depression effect

Due to the huge price difference,many patients left their provinces for the pilot areas to buy drugs after the first round of volume procurement.It also results in drug black market.Some criminals seek huge benefits through inter-regional sales and prices,and the low-price effect becomes more obvious.

2.2.2 Monopoly of active pharmaceutical ingredients(APIs)

At present,there are some problems in the supply of APIs in China,such as the monopoly.Soon after the introduction of “4+7” pilot scheme,they negotiated with the person in charge of the API enterprises,but the price of APIs fluctuated.Pharmaceutical companies must supply a large number of selected drugs.Once the price of the APIs increases,it may directly cause the bid-winning company to stop supply.

2.2.3 Public resistance to the selected drugs

If the government does not publicize the volume procurement policy to the public properly,it may cause the public resistance to the selected drugs.Drugs are crucial for patients.A sudden cut of the price will make people suspicious of the quality of the drugs,which may cause people to resist the use of such drugs.The price cannot be ridiculously high,but it cannot be too low either.

2.2.4 Quality risk of drugs

When the price of drugs is cut low,and companies still need profits,they will think of other ways to make money.For example,the excipients,APIs,and craftsmanship will be used to increase profits.In this way,the efficacy of the drugs cannot be guaranteed and the supervision mechanism must be strengthened.

2.2.5 Clinicians’ prescription rights are restricted

On April 14,2019,the total purchases of 25 selected varieties in 11 pilot areas reached 438 million pieces,completing 27.31% of the total agreed purchases.It took less than a month to complete nearly 30% of the total amount[7].Official data from the Xiamen Municipal Medical Insurance Bureau show that volume procurement was officially launched for two months.As of May 15,2019,Xiamen had 25 selected drugs.The total purchase quantity was 12.67 million (pieces/piece),and 59% of the agreed purchase volume in the region was completed.Moreover,it only took 2 months for Xiamen to complete almost 60% of the purchase volume[8].When many people are optimistic about volume procurement,the question why it was completed so quickly arose.The implementation of volume procurement had a bullwhip effect.The government implemented volume procurement,requiring hospitals to complete the specified volume.Due to this reason,some hospitals gave priority to purchasing drugs in quantities.Meanwhile,they did not allow other drugs to be used,or even stopped buying other drugs.Therefore,volume procurement interrupts the normal clinical needs.

2.2.6 Retail pharmacies are losing profits

After carrying out volume procurement,people can see that the drug prices in retail pharmacies are more expensive than that of hospitals.Patients will flock to the outpatient clinics of the hospital to prescribe drugs.For an ordinary outpatient doctor,one-third of his patients want him to prescribe drugs,but hospitals limit the number of patients.This seriously affects patients’ medical treatment,and greatly reduces the turnover of retail pharmacies.From Fig.3 and Fig.4,the sales of retail pharmacies are falling regardless of whether it is the pilot city or non-pilot city.

2.2.7 Survival problems of some manufacturers

Some experts believe that,in the short term,volume procurement will reduce the price of drugs,but in the long term,the profit of pharmaceutical enterprises will decrease,which will be difficult for them to invest more in R&D.In the past,bidding was mostly based on various factors such as quality and original individual pricing.Therefore,Chinese generic drug companies still had ways to obtain profits.Now the price becomes the only factor,the profits of generic drug companies will decline.But the profit rate of our generic drug companies is still much higher than that of international companies.

3 Suggestions on improving drug volume procurement policy

In view of the above-mentioned problems,it is an unavoidable topic.We should actively solve these problems in the process of implementing the pilot scheme.

3.1 Encouraging market linkage and expanding the scope of the pilot scheme slowly

Because of the effect of price depression caused by the problem of volume procurement,there are some black markets for drugs in some cities.The solution to this problem requires slow running-in.It cannot be solved by directly promoting the pilot scheme to all the cities in China.This policy is good for the patients,but for many pharmaceutical companies,it will have a huge (even irreversible) impact.This is because we must proceed step by step and seek an optimal path to reform market under the game of interests of all parties.Slowly expanding the scope of the pilot not only can save time for drug enterprises to transform and improve,but also ensure the quality of drugs for the safety of patients.At the same time,market linkage is encouraged so that patients can go to surrounding cities to get cheap drugs and reimbursement there.

3.2 Cracking down on the monopoly of APIs

The biggest problem caused by “4+7” volume procurement is the monopoly of APIs.For this problem,the government must guarantee the market structure in the early stage to avoid vicious competition.When the policy was just introduced at the beginning,some APIs became scarce quickly.This situation should be prevented immediately by taking some effective measures such as negotiation with the API enterprises,priority approval of the urgent clinically needed drugs.Besides,a drug report system should be established.Now the NMPA has already taken many measures in these areas.For example,hospitals and pharmacies should make daily statistics on drugs and rare APIs,and then they can arrange a supply network for shortage of drugs as well as pass monitoring and early warning.Through this system,shortages can be detected,and the problems can be solved in time.The pharmaceutical enterprises that do not comply with the system will be punished.

3.3 Ensuring the quality of drugs to benefit the public

Because the price of some drugs is reduced greatly,patients who are familiar with this drug for a long time may question the price.This situation is common in many places.Therefore,hospitals must guarantee to provide patients with first-class quality and low-price drugs.In addition,doctors and nurses in pharmaceutical hospitals should strengthen policy publicity to solve patients’ problems.

3.4 Formulating a reasonable quantity of drugs to be purchased and gradually improving patients’ habit of medication

The contradiction caused by volume procurement is the doctor’s prescription rights and the patients’demands for certain drugs.From the perspective of patients,their habits and dependence on drugs cannot be changed overnight.In order to complete procurement in the hospitals,patients must change their drugs.Although the efficacy may not change much,it is not so easy for patients to agree with this decision.Therefore,some patients may go to other hospitals to seek previous drugs when they are offered different drugs.This may even cause conflicts between doctors and patients.Therefore,hospitals will vigorously recommend the selected drugs to the patients.Meanwhile,they should not completely give up the previous drugs for some patients.From the doctor’s point of view,there are two issues,one is doctor’s own prescription habit,and the other is the commissions of drug.Even today,there are quite a few such cases.The commission of the drug leads to the general distrust of patients in doctors.Due to many factors,the prescription rights of doctors are complicated and difficult to solve.Therefore,the best way is to determine the prescription rights of doctors by the drug reserves of the hospital’s pharmacy.In a word,it is necessary to keep balance between patients’medication and doctor’s prescription rights.

3.5 Strengthening the cooperation between retail pharmacies and pharmaceutical enterprises

At present,it is difficult for retail pharmacies and pharmaceutical enterprises that have not won the bid to survive.For the pharmaceutical retail industry,the market needs to assess the risk of delisting and make strategic choices.At the same time,retail pharmacies should focus on the essence of value to provide the best services to consumers.With the gradual deepening of the reform of medical insurance payment,the dividend space brought by the price increase will gradually drop.For retail pharmacies,improving consumers’ loyalty through professional services,and to better cooperate with upstream brand suppliers is their urgent tasks.

For pharmaceutical enterprises,once they fail the bid,they will not have market share in the “4+7”urban hospitals.Therefore,they must reduce the sales team and enter the third terminal retail markets by evaluating input and output or choosing the contract sales organization (CSO) model.If the original brand fails the bid,it must prepare for the transfer from the hospital channel to retail pharmacies,which can maintain its price system.

The pharmaceutical enterprises that fail the bid must cooperate with the retail industry at this stage to ensure their interests and capital flow needs.In the long run,these companies should evaluate the degree of policy advancement and their own capabilities,especially product line capabilities to make strategic choices.They must create an innovation-driven or low-cost-driven core competitiveness to meet the continuous supply of new products.

This time,the government used its monopoly market position to directly reduce medical insurance expenses,completely changing the rules of the game.The past pattern of generic drugs will be completely rewritten,the market will play a role in improving the price formation mechanism.Through volume procurement and price linkage,full competition between original drugs and generic drugs is realized.Besides,the structure of pharmaceutical enterprises and product structure are promoted.By squeezing out the cost of drug sales and changing the sale with commission model,the environment for drug sales is purified.As the gray bribery competition pattern changes to a real market-based competition,many pharmaceutical enterprises will be kicked out of the market.Coupled with the liberalization of the domestic market to a certain extent,foreign companies enter the generic drug war will have a long-term and far-reaching impact on the market.

4 Thoughts on the potential problems of the volume procurement in the future

The most ideal effect of various policies formulated by the government is to provide patients with lower-priced but better-quality drugs.However,this policy may cause some of the originally good low-profit drugs to be directly eliminated from the market due to profit problems.

Secondly,the production model will change,which requires the products to pass the consistency evaluation.Due to the failure to pass the consistency evaluation,Hengrui Medicines,accounting for 80%of the national market,missed two bids.Competent pharmaceutical enterprises will find ways to solve the supply of APIs,increasing the scale of production for bidding.Jin Chunlin,the director of the Shanghai Municipal Health Development Research Center,worries that among the pharmaceutical enterprises that have won the bid,those non-APIs enterprises may face a crisis.In the future,if the pharmaceutical enterprises do not have enough supply of APIs or the API suppliers raise prices,they will face big trouble.After all,there was once a monopoly of chlorpheniramine and nitroglycerin before[4].

The third is the change in marketing concepts.The main battlefield of prescription drugs is in hospitals,and the low prices of drugs in hospitals make it more difficult for enterprises to change.Therefore,volume procurement has a certain impact on retail pharmacies and e-commerce platforms.Whether retail and e-commerce platforms can make up for the loss of volume procurement,it is hard to tell for most varieties.

There will certainly be some other problems in the future.No policy is so perfect to cover everything.We can wait for the problems to arise and solve them in time.A successful policy is faced with numerous obstacles.At the beginning,some people asserted that volume procurement would fail,but it has now become the consensus of society and the industry.Volume procurement has become the biggest driver of changes and upgrades in the pharmaceutical industry.

- 亚洲社会药学杂志的其它文章

- Empirical Study on Improving Customer Satisfaction of Retail Pharmacies by Using Quality Control Circle

- Research on Improving Customer Value by Using QCC in Drugstores Based on Customer Life Cycle

- Statistical Analysis of Defective Items of Pharmaceutical Wholesale Enterprises

- Policy Suggestions on Procurement of Basic Infusion Against the Background of Volume Procurement

- Research on Development Strategy of Online Pharmacies Based on Blockchain Technology

- Research on Risk ldentification of Supply Chain Management in Pharmaceutical Wholesale Enterprises

——Taking Enterprise A as an Example