Financial Law Protection Approach and System Construction of Economic,Social and Cultural Rights— International Comparison and Chinese Experience

TU Yunxin

Abstract:Under Article 2(1) of the International Covenant on Economic,Social and Cultural Rights,States undertake three primary obligations,namely “obligations of progressive realization,”“obligations of non-retrogression” and “obligations to the maximum available resources.” In a domestic constitutional setting,it has been firmly established that protection of economic,social and cultural rights is unavoidably linked to all kinds of economic resources,this so-called “resource-dependence dilemma” has posed serious constitutional challenges to fulfilling our commitments to human rights.It is therefore not only useful but also necessary to transform the three primary legal obligations under ICESCR into specific and concrete fiscal obligations.This article provides three approaches for a systematic construction of a financial analysis of economic,social and cultural rights protection.First,States should identify all the available revenues in a democratic process.Second,the budget allocation of economic resources per se is a matter of allocative justice,and State legislatures must act in a way that meets the essential requirements of allocative justice.Lastly,States are bound by certain legal principles to deal with reasonable budget expenditure,and this is the primary obligation for the executive.Based on intensive international comparisons of selected jurisdictions and China’s rights realities,this article proposes bifurcated solutions for China’s constitutional protection of economic,social and cultural rights both on horizontal and vertical levels regarding its ongoing fiscal reforms.

Keywords:economic,social and cultural rights ◆ financial law ◆source of revenue ◆ budget allocation ◆ budget expenditure

Disputes about economic,social and cultural rights,as second-generation human rights,not only include the conflicts between positive and negative rights,the legal nature of positive rights,the justiciability of the rights and other basic theoretical issues,but also extend to the relationship between these rights and the affordability of national economic and financial resources.The development history of the human society for thousands of years has shown that the realization of human rights cannot be separated from the economic and social conditions on which the rights depend.Some scholars in China have put forward the view that “the decisiveness of resources on rights” and further maintain that rights are matches between available social resources and instinctive human demands.1Available social resources are a variable,which means that the carrying capacity of a society changes in different periods.Human needs,as a part of human consciousness derived from the gradual accumulation of social experience and exploration,reflect the changes of objective social conditions.It also changes with the changing social resources.Rights are a function of one of the above two variables.He Zhipeng,Basic Theory of Rights:Reflections and Construction (Beijing:Peking University Press,2012),117.The dual dialectical relationship between rights and development shows that the economic foundation,which the realization of human rights depends on,is vital to development itself,and in turn,development can feed back to achieve the realization of rights.Economist Amartya Sen has profoundly pointed out that freedom is not only the primary purpose of development,but also the main means thereof.2Amartya Sen,Development as Freedom,trans.Ren Ze and Yu Zhen (Beijing:China Renmin University Press,2012),7.The realization of freedom is not only to avoid the interference of a state’s public power.More importantly,freedom should be regarded as a means to realize personal development and perfect personality.

In discussing the protection of economic,social and cultural rights,the finiteness and limitation of economic and financial resources have long been issues discussed by theoretical and practical circles.In recent years,the academic circle has come to regard the insufficient protection of rights or the insufficient allocation of rights as the root causes of civil livelihood problems;they no longer remain in the form of insufficient supply of material resources or,more precisely,insufficient budget input.3Chen Zhi,“Controversy,Reflection and Reconstruction of Financial Rights for Civil Livelihood”,Legal Forum 2 (2013);Zheng Lei,“The Constitutional Right Dimension of Civil Livelihood”,Journal of Zhejiang University 6 (2008).In 1990,the Committee on Economic,Social and Cultural Rights (CESCR) adopted General Comment 3,which seeks to clarify the legal nature of the obligations of States Parties to theInternational Covenant on Economic,Social and Cultural Rights.The content of General Comment 3 is twofold:first,it acknowledges the limitations of economic,social and cultural rights arising from limited resources;second,it sets out two types of obligations of States Parties under the Covenant:obligations of “progressive realization” and of “immediate realization.”4Committee on Economic,Social and Cultural Rights,General Comment 3,The Nature of States Parties’ Obligations,1990,U.N.Doc.E/1991/23.Whether in the obligations of“progressive realization” or the obligations of “immediate realization,” when taking the right to social security as an example,the protection of economic,social and cultural rights can only develop into a more mature realistic system under the premise of ensuring budget resources.5Maw-In Tsai, “Financial Law Thinking on Social Security”,SJTU Law Review 1 (2014).

I.Raising of the Issue:The Financial Dimension of the Protection of Economic,Social and Cultural rights

After World War II,modern countries generally established the obligations of states to undertake survival care for citizens under their jurisdiction through their constitutions and ordinary legislation.Many constitutionalists and human rights jurists are keenly aware that the protection of economic,social and cultural rights certainly involves the validity of the right remedy and the mandatory economic basis,that is,the fiscal and tax issues.Meanwhile,the fiscal and tax law circle also strongly realizes that the fiscal and tax law has different value and function orientations under different state forms,and the reform of the fiscal and tax law often becomes the forerunner and driving force of national development and social progress.6Liu Jianwen and Hou Zhuo,“The Role of the Fiscal and Tax Law in the Modernization of National Governance”,Law Science 2 (2014).This paper focuses its exposition on the functional design of finance in the protection of constitutional rights,trying to analyze the constitutional problems that cannot be avoided in the protection of economic,social and cultural rights in modern countries from the perspective of the functional structure of finance.To this end,the paper will try to clarify the following issues:What is the institutional root of the contradiction between rights protection and budget revenue and expenditure? Why does the acquisition or realization of rights depend on state finance and taxation? Furthermore,why is the protection of economic,social and cultural rights deeply embedded in the economic structure of modern fiscal and tax countries? To what extent does a state’s fiscal and tax rule of law need to be adjusted with proper timing to meet the people’s constitutional expectations of economic,social and cultural rights?

The choice of the traditional protection paths of economic,social and cultural rights is based on what is known as the “normative violation approach” in the academic circle,that is,to use the normative basis of rights to deduce in what sense the national public power violates the basic rights of citizens,or in what sense it deviates from its national protection obligations.With the deepening of the research into the protection mechanism for economic,social and cultural rights in the academic circle,an increasing number of scholars have begun to reflect on the defects and deficiencies of the traditional approaches,and turn to an institutional approach to the protection of rights,that is to say,to study the systematic obstacles to the realization of rights through the supervision and implementation mechanisms of rights from the perspective of the overall system design.In fact,the protection of civil and political rights,or economic,social and cultural rights is not realized automatically by the law operating by itself in a vacuum without.Both types of rights need certain economic and social resources as their material basis,and their realization relies on certain systems.Therefore,in research into the protection mechanisms of basic rights,the academic circle presents the research ideas of the coexistence of the normative approach and the institutional approach.Without denying the significance of economic,social and cultural rights in the normative sense,how to analyze the realization of rights from the institutional perspective of the empowerment structure has become a hot issue.

In the protection of basic rights,the “material” payments or services provided by a state must involve the issue of the expenditure and allocation of a state’s finance (finazielle afuwendungen) at the constitutional level.Scholars have sensitively captured this issue.The discussion on the protection of economic,social and cultural rights in the academic circle has gradually turned to the protection of rights under the “financial constitution.” When discussing the paying function of basic rights,many scholars usually distinguish “right to protection (teilhaberecht) and “right to claim payment”(leistungsrechte) conceptually.Among them,teilhaberechtrefers to people’s right to request the use of the existing public resources or equipment of a state,whileleistungsrechterefers to people’s request for positively creative paying from a state on the basis of specific reasons.As forteilhaberecht,most scholars acknowledge that people are entitled to enjoy the right to claim for reasonable use of the public facilities of a state.However,whether people have the right to request the state to create certain facilities or give certain material subsidies,scholars such as Hans Jarass,Robert Alexy,Christian Starck and others think that this right relates to various factors such as a state’s financial capabilities,the allocation of a state’s resources and the adjustment of the overall interests of the society (sozialen ausgleich).As a result,unless it is within the scope of “minimum guarantee” for the people’s survival,it is within the legislators’ political decision and discretion.7Vgl.Hans D.Jarass,“Grundrecht als Wertenscheidung bzw.Objektiverechtliche Prinzipie in der Rechtsprechung des Bundesverfassungsrichts”,AÖR20/1985.S.389;Robert Alexy,Theorie der Grundrechte,2.Aufl.,Frankfurt a.M.,1994,Suhrkamp,S.466;Christian Starck,“Staatliche Organisation und Staatliche Finanzierung als Hilfen zu Grundrechtsverwirklichungen?”,in FG-BVerfG,Bd.II,S.516 ff.Konrad Hesse,a German constitutional jurist,pointed out that the “principle of social state” needs to build a “planning,regulating,paying,allocating state that can enable individuals and the social life to coexist.”8Konrad Hesse,Grundzüge des Verfassungsrechts der Bundesrepublik Deutschland,trans.Li Hui (Beijing:The Commercial Press,2007),167.Hesse’s view has been endorsed by Professor Keh-Chang Gee,a tax jurist in China’s Taiwan,who further maintains that the construction of a paying state under the “principle of social state” requires the state to have financial and economic adjustment and adaptation.In order to ensure that all nationals “meet the need of minimum survival right in line with human dignity,” a contemporary “social state” actually integrates various elements and characteristics of “an intervening tax state,” “a planned social state,” “a guarantee paying state,” and “a state ruled by law with limited economic freedom.” Through the adjustment of tax policies and the redistribution of finance,on the one hand,the state guarantees the vitality of the national economy,enabling nationals to cope with the increasing budget expenditure of contemporary states;on the other hand,the accumulation of the national finance also needs to guarantee the citizens’ basic right to subsistence.9Keh-Chang Gee,Science of State and State Law (Taipei:Cross-Strait Publishing Co.,Ltd,1996),55-57.Professor Tsi-Yang Chen also believes that:“The practice of the content of the principle of a social state is not regulated by the constitution or law but depends entirely on the state’s capacities to pay.As a result,the realization of the principle of a social state depends on various states’ financial capacities,with differentiated degrees.”10Tsi-Yang Chen,Constitutional Jurisprudence (Taipei:Angle Publishing House,2004),245.As a result,the protection of economic,social and cultural rights requires the adjustment of a state’s financial structure.In other words,a state’s economic resources are limited,whose constraints lead to the fact that the proper allocation of financial resources is related to the protection and realization of basic rights.First,constitutions recognize and affirm that the purpose of a contemporary state is to promote the public welfare of the people.Second,constitutions acknowledge the limitations of national resources and affirm that legislators can make a limited distribution of welfare resources based on their judgment and discretion.Thirdly,constitutions should make legislators bound by the “principle of equality” and“principle of proportionality” when they make a limited distribution of social resources.In other words,the proper allocation of welfare resources requires legislators to implement the spirit of “treat equals equally,unequals unequally,” and when defining and determining the scope of beneficiaries,they shall not take the specific position or status of the beneficiaries as the sole basis for differentiated treatment,otherwise,it is suspected to violate the “principle of equality.” Furthermore,the purpose of the allocation of social welfare resources by legislators must be aimed at achieving legitimate public interests,and it should maintain balance between the means and the purpose of legislation.

As Taiwanese Scholar Maw-In Tsai has said,although there are assorted dangers corresponding to social security,in fact,all of them can be summed up into factors such as “insufficient income” or “insufficient money.” As long as there is enough income,nearly all of them can be tackled.The reason for the need for a social security system is inseparable from the fact of insufficient income.Social security is a system in which a state re-allocates by means of its public power and determines its responsibilities and paying modes.11Maw-In Tsai, “Financial Law Thinking on Social Security”;Maw-In Tsai,“Financial Issues of Social Security”,in Issues and Challenges of Constitutional States,ed.the Editorial Board of Celebrating Papers on Professor Chih-Hsiung Hsu’s 60th Birthday (Taipei:Angle Publishing Company,2013),595.Social welfare resources are the material basis for realizing the protection of economic,social and cultural rights.When discussing this issue,the academic circle and the policy circles should give prioritized attention to the limitation of social resources.In terms of the fiscal and tax law,a state’s financial resources in a certain period and stage cannot be used exhaustively for social security.In fact,from a more macro perspective,the solution to the contradiction between the protection of economic,social and cultural rights and the limitation of national fiscal and tax resources should consider multiple constitutional and legal issues.The first issue is “the source of budget revenue.” This is closely related to national economic and social development,social labor,and wealth accumulation.The second issue is ensuring a fair match between the state’s revenue scale and citizens’ tax capacities;it is an issue of tax justice and fair burden in public law.The third level is the structure and division of budget expenditure.In other words,it is a horizontal issue of how a state’s budget expenditure should be distributed in different fields,and it is also a vertical issue involving how central and local budget expenditure should be divided.The fourth issue is the proportion of social security expenditure in a given financial model,which is directly related to the material basis for the protection of economic,social and cultural rights.Therefore,the academic circle in China and abroad regard the proportion of social security expenditure in a country’s GDP as an important indicator to measure a country’s social security level.Besides,international human rights monitoring mechanisms have also adopted this method to carry out quantitative analysis of the protection of economic,social and cultural rights.The fifth issue is the implementation of the social security expenditure,especially the issue of fair distribution in the paying administration;it is an issue involving the application of the principle of equality,proportion and right relief.

II.A State’s Fiscal Obligations for the Protection of Economic,Social and Cultural Rights

Under the dual constraints of the International Human Rights Covenant and their domestic constitutions,states must provide all available resources and take all possible measures to ensure the realization and enjoyment of economic,social and cultural rights of their citizens.12Sun Shiyan,“Observation of the Five Years since the Entry into Force of the ‘Optional Protocol to the International Covenant on Economic,Social and Cultural Rights’”,Human Rights 6 (2018).Meanwhile,a state’s total economic,social and cultural resources are limited under certain time-space conditions.It is precisely this limitation of resources that constitutes the restrictive factor for a state to protect and realize citizens’ economic,social and cultural rights.13If a state or region’s economic,social and cultural resources are sufficient,the protection of economic,social and cultural rights will become a practical issue in accordance with the requirements of Article 2 (1) of International Covenant on Economic,Social and Cultural Rights.In Economics,there is a phenomenon known as the “resource curse”.In other words,the economic growth rates of countries or regions rich in resources are slower than those poor in resources.Richard M.Auty,Economic Development and the Resource Curse Thesis,in E-conomic and Political Reform in Developing Countries,O.Morrissey,F.Stewart eds.,(London:Palgrave Macmillan,1995);Richard M.Auty,“Natural Resources,Capital Accumulation and the Resource Curse”,61 Ecological Economics 4 (2007).Xie Jiwen,“Overseas Research on the ‘Resource Curse’:A Literary Review”,Economic Theory and Business Management 9 (2010).On the basis of recognizing that the basic rights of citizens are subject to a certain level of economic,social and cultural development,the protection of economic,social and cultural rights is bound to be inextricably intertwined with a state’s finance.The core problem to be solved by the state fiscal guarantee obligation of economic,social and cultural rights is a tough issue with the rights’ dependent on resources.In order to put forward solutions from a practical perspective,we must first have a clear and definite definition of the state obligations for economic,social and cultural rights in theory,and then transform the state obligations in the sense of “hermeneutics” into the state fiscal obligation in the sense of “practice.”

The academic circle has conducted considerable research into the corresponding state obligations for the protection of economic,social and cultural rights.Based on the existing achievements,Chinese scholars have summarized several different viewpoints,such as “dichotomy,” “trisection,” “quartation,” and “quinquepartite”obligations.According to the “dichotomy” view,state obligations can be divided into negative and positive obligations,behavioral and resulting obligations,immediate and progressive obligations,respect and security obligations,substantive and procedural obligations,general and core obligations,confirmation and safeguard obligations,among others.14Gong Xianghe,Research on the Justiciability and its Degree of Social Rights (Beijing:Law Press,2012),70-73.With regard to the “trichotomy” view,Professor Henry Shue argues that,for any basic right,the state is obliged “to avoid deprivation,” “to protect the individuals from deprivation” and “to help the person deprived.”15Henry Shue,Basic Rights:Subsistence,Affluence,and U.S.Foreign Policy (Princeton:Princeton University Press 1996),52-53.Asbjφrn Eide,a well-known scholar of human rights law,has put forward states have the “obligation to respect,” the “obligation to protect,” and the “obligation to fulfill” basic rights.Chinese scholars Sun Shiyan and Gong Xianghe propose that the three levels of state obligations for social rights are the “obligation of respect,” “obligation of protection,”and “obligation to pay.” From the perspective of constitutional hermeneutics,16Richard M.Auty,78-84;Sun Shiyan,“On State Obligations under International Human Rights Law”,Law Review 2 (2001).Professor Zhang Xiang put forward that a state should undertake “negative non-interference obligations,” “positive paying obligations,” and “state protection obligations” under a functional system of basic rights.17Zhang Xiang,Legal Construction of Fundamental Rights Norms (Beijing:Higher Education Press,2008),43-63;Zhang Xiang,Constitutional Hermeneutics:Principles,Technology and Practice (Beijing:Law Press,2013),138.According to the “quartation” view,as proposed by the Netherlands Institute for Human Rights,for instance,in a seminar with a theme of“The Right to Food:From Weak Law to Strong Law,” state obligations can be divided into “obligations to respect,” “obligations to protect,” “obligations to fulfill,” and “obligations to promote.”18Liu Huawen,On the Asymmetry of State Obligations under International Covenant on Economic,Social and Cultural Rights (Beijing:Peking University Press,2005),17.Under the “quinquepartite” view,human rights jurists Henry J.Steiner and Philip G.Alston have proposed that state obligations include five categories,namely,to respect the rights of others,to establish necessary mechanisms for the realization of rights,to prevent any infringement of rights,to provide goods and services for the satisfaction of rights,and to promote the realization of rights.19Henry J.Steiner and Philip G.Alston,International Human Rights in Context:Law,Politics,Morals;Text and Materials (Oxford:Oxford University Press,2000),182.Chinese scholar Huang Jinrong defines state obligations as general legal obligations,specific legal obligations,international obligations,core obligations and priority obligations.20Huang Jinrong,A Theory on the Justiciability of Economic and Social Rights (Beijing:Social Sciences Academic Press,2009),232-237.In the above theoretical research results,human rights law scholar Eide’s three-level theory of state obligations has had a relatively wider impact.The Masstricht Guidelines on Violations of Economic,Social and Cultural Rights21Masstricht Guidelines on Violations of Economic,Social and Cultural Rights,Maastricht,January 22-26,1997.and a number of the official documents of the UN Commitee on Economic,Social and Cultural Rights have stressed the three kinds of state obligations to respect,protect and fulfill.

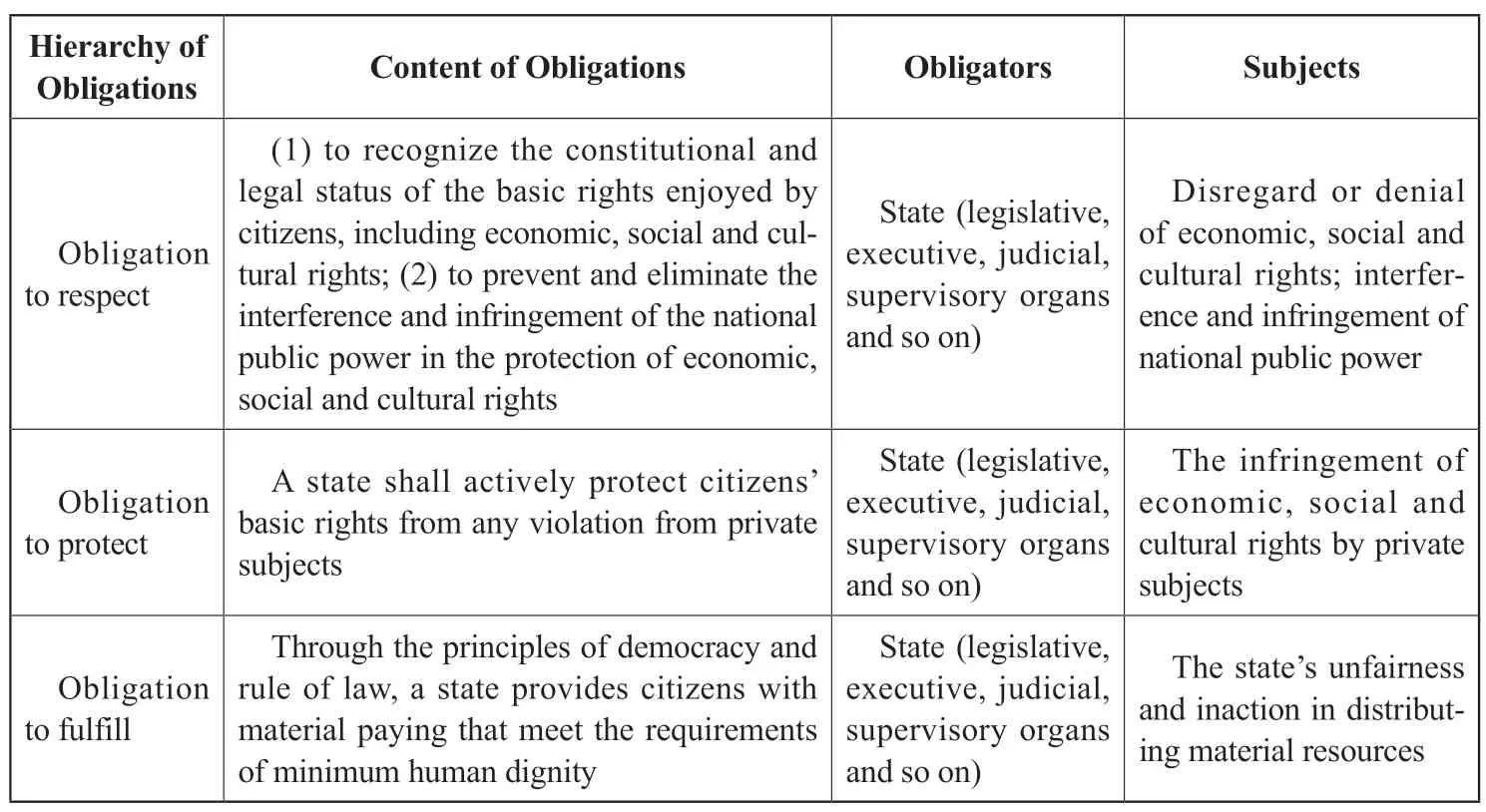

The author of this paper thinks that the system of state obligations corresponding to the protection of economic,social and cultural rights has strong persuasiveness by adopting the three-level obligations theory of “obligation to respect,protect and fulfill,” the obligation to respect corresponds to the function of basic rights as defense rights,the obligation to protect to the function of “third-party effect” of basic rights,and the obligation to fulfill to the active paying power and functions of basic rights.For details,see Table 1.

Table 1 Hierarchy of State Obligations in the Protection of Economic,Social and Cultural Rights

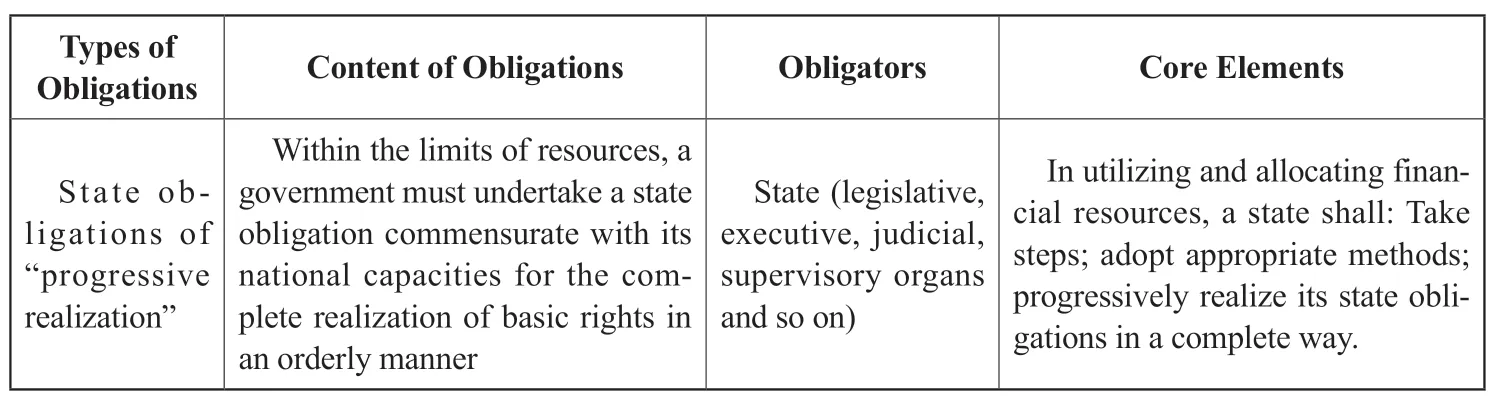

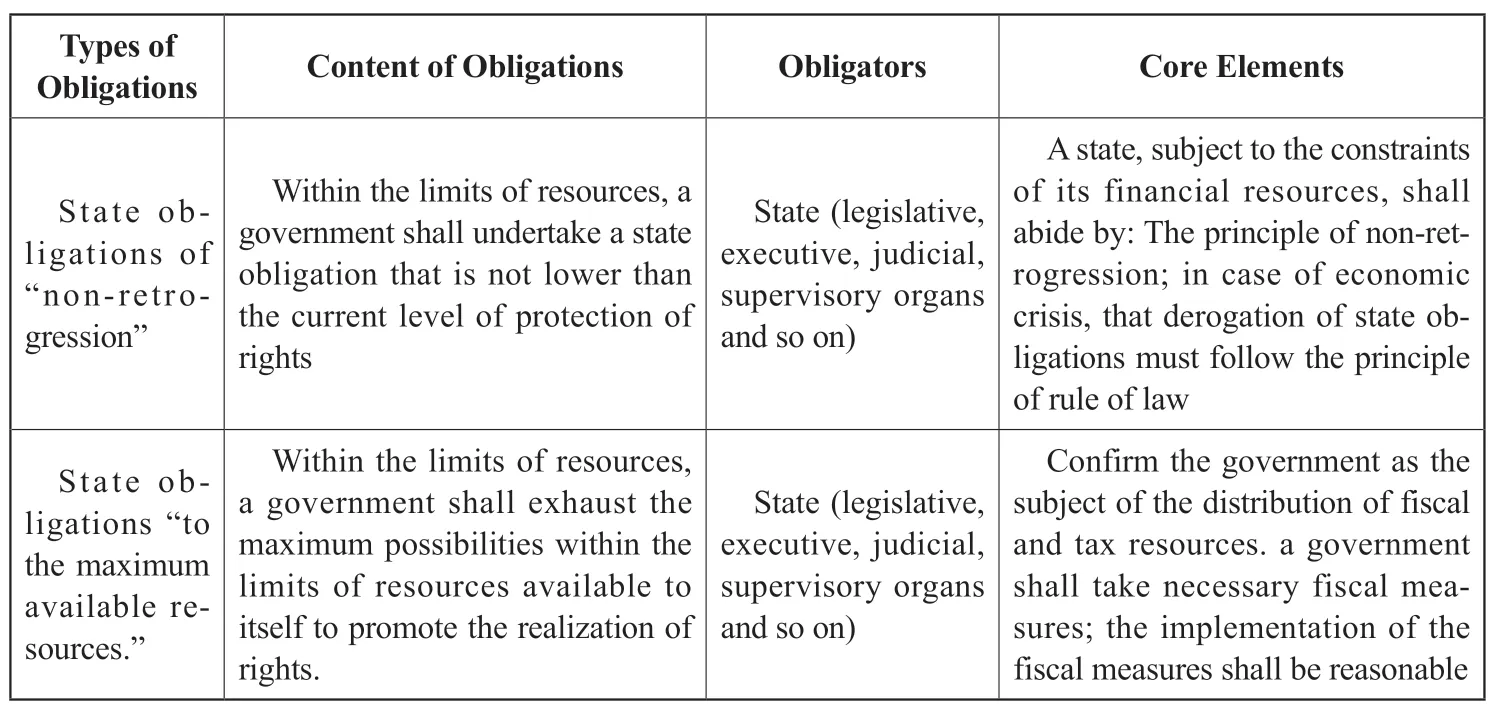

The construction of the system of state obligations corresponding to the protection of economic,social and cultural rights is an issue clarifying the attribute and structure of rights from the perspective of “hermeneutics.” However,how to implement the system of state obligations from the perspective of fiscal and tax resources allocation is an issue in need of separate review.Therefore,the author of this paper believes that it is necessary to realize a cognitive paradigm shift from “hermeneutics”to “practice.” For this purpose,the main way is to transform the state obligations in the sense of “hermeneutics” into three kinds of state fiscal obligations in the sense of practice.In other words,in its obligations to protect economic,social and cultural rights at different levels,a state must make use of its financial resources and by means of specific finance instruments progressively carry out in accordance with the principle of rule of law.For details,see Table 2.

Table 2 System of a State’s Fiscal Obligations for the Protection of Economic,Social and Cultural Rights

Continued

A.State fiscal obligations of “progressive realization”

In a general sense,the “progressive realization” of state obligations refers to a state undertaking obligations to protect the economic,social and cultural rights of its citizens that are compatible with its national capacities and aim at achieving the full realization of basic rights in a progressive manner.22O’Connell,et al.,Applying an International Human Rights Framework to State Budget Allocations: Rights and Resources (New York:Routledge,2014),67.Under such obligations,the dimension of national capacities is multi-faceted,which includes not only the state’s ruling and governance capacity,but also the state’s capacities in advancing human rights.From a budget perspective,a state’s capacities to implement the human rights covenants are restricted by its level of economic and social development.A state’s financial resources are not unlimited.As a result,a state undertakes fiscal obligations which can match its capacities.At the same time,“obligations of progressive realization” require a state to take steps based on existing financial resources,so as to progressively realize to the maximum extent their obligations to guarantee human rights.Centering on the “obligations of progressive realization,” the theory and practice circles have paid attention to in what sense and to what extent a state undertakes its obligations.To clarify this issue,we can use the jurisprudence of theInternational Covenant on Economic,Social and Cultural Rightsfor further exposition.Article 2 (1) of theInternational Covenant on Economic,Social and Cultural Rightsexpressively stipulates23International Covenant on Economic,Social and Cultural Rights (ICESCR),G.A.Res.2200 A (XXI),21 U.N.GAOR Supp.(No.16) at 49,U.N.Doc.A/6316 (1966),993 U.N.T.S.3,entered into force Jan.3,1976.that:“Each State Party to the present Covenant undertakes to take steps,individually and through international assistance and cooperation,especially economic and technical,to the maximum available resources,with a view to achieving progressively the full realization of the rights recognized in the present Covenant by all appropriate means,including particularly the adoption of legislative measures.” This can be understood as follows:

First,state fiscal obligations to guarantee economic,social and cultural rights require the state to adopt progressive fiscal measures to promote the realization of those rights.In General Comment 3,the CESCR interprets the term “taking steps,”maintaining that the obligation to “take steps” in Article 2(1) is not limited by other issues.CECR also takes note of a number of other different texts in order to understand the complete meaning of this phrase.The obligation is expressed as to “take steps” in the English text,s’ engage apres agirin the French text;anda adoptar medidasin the Spanish text.Thus,while the full realization of the rights can be progressively pursued,theInternational Covenant on Economic,Social and Cultural Rightsstipulates that the State Parties must take s to achieve this target within a reasonably short period after its entry into force.Such steps should be thorough and concrete,and be aimed at fulfilling the obligations of the Covenant as clearly as possible.24U.N.Doc.E/1991/23,annex III at 86 (1990).From the perspective of state fiscal obligations to the protection of economic,social and cultural rights,“taking steps” means that a state,based on the existing finance rule of law,shall have fair allocation of financial resources so that the social resources are sufficient to support the realistic needs for the state to protect human rights.

Second,state fiscal obligations for the protection of economic,social and cultural rights require the state to adopt appropriate means to provide legislative,administrative and judicial support for the realization of the rights.In General Comment 3,CESCR explains the term “appropriate means.” In CESCR’s view,a state’s legislation in the protection of the economic,social and cultural rights is in many cases particularly required and,in some cases,may even be essential.25Ibid.In other words,legislative means,which CESCR has particularly emphasized,are essential for the realization of the content of the Covenant.In addition to legislation,the means that may be considered appropriate include judicial,administrative,educational,social and other aspects.The “appropriate means” have an extremely broad scope,with a probable large gap between what should be and what is.CESCR stresses that,in terms of the political and economic systems,various principles embodied in the protection of economic,social and cultural rights cannot be mistaken for the requirements of a socialist or capitalist system,or of a centrally planned economy and/or a Liberville field economy;nor can it be attributed to any other specific attribute.In this regard,CESCR reaffirms that economic,social and cultural rights can be realized in various economic and political systems,as long as the systems involved recognize and reflect the interdependent and indivisible nature of the two sets of human rights affirmed in the preamble toInternational Covenant on Economic,Social and Cultural Rights.In this regard,the CESCR also notes the relevance with other human rights,in particular the right to development.26International Covenant on Economic,Social and Cultural Rights (ICESCR),G.A.Res.2200 A (XXI),21 U.N.GAOR Supp.(No.16) at 49,U.N.Doc.A/6316 (1966),993 U.N.T.S.3,entered into force Jan.3,1976.This paper maintains that state fiscal obligations to the protection of economic,social and cultural rights especially emphasizes the legislative means,without denying the influence of administration and justice on the allocation of the national finance power.Under the guidance of the constitutional spirit of “no taxation without representation,” the principle of popular sovereignty can be best reflected in the distribution of social financial resources by legislation,and it is through the representative democracy that people participate in a state’s economic governance.Executive power is the operational power to execute state finance,and its operation must be controlled by “the principle of law priority,” “the principle of law reservation,” and “the proportionality principle,” while judicial power is more embodied in case-based justice.When citizens’ economic,social and cultural rights encounter unfair budget allocation,the state should allow qualified citizens to bring judicial proceedings against the relevant public decision-making organs.

Third,state fiscal obligations to the protection of economic,social and cultural rights are a concept of time and space in a gradual dimension.If a state under theInternational Covenant on Civil and Political Rightsprimarily undertakes state obligations of “immediate realization,” then a state,underInternational Covenant onEconomic,Social and Cultural Rights,primarily undertakes state obligations of“progressive realization,” In General Comment 3,the CESCR explains the concept of“progressive realization.” The CESCR maintains that the concept of progressive realization equates to the acknowledgement that all economic,social and cultural rights generally cannot be fully realized in a short period of time.In this sense,these obligations are significantly different from the obligations under Article 2 of theInternational Covenant on Civil and Political Rights,which contain the obligations to immediately respect and ensure all relevant rights.However,the long-term or progressive realization ofInternational Covenant on Economic,Social and Cultural Rightsshould not be misinterpreted as a delay in the fulfillment or elimination of obligations.On the one hand,it is an arrangement requiring flexibility and reflecting the realities of the present world and the difficulties faced by any states in striving for the full realization of economic,social and cultural rights;on the other hand,it must be understood in the context of the overall objective ofInternational Covenant on Economic,Social and Cultural Rights,which is to establish clear obligations for State Parties to achieve the full realization of the rights involved.As a result,it establishes the obligation to pursue its objectives as quickly and effectively as possible.Moreover,any means of retrogression in this regard require the most prudent consideration and sufficient justification,so as to take into account the integrity of the rights provided for in the Covenant and be subject to “the maximum use of its available resources.”27Ibid.

B.State fiscal obligations of “non-retrogression”

The state obligations of non-retrogression mean that a state undertakes state obligations not lower than the current level of rights protection when protecting citizens’economic,social and cultural rights.In a sense,“state obligations of non-retrogression” and “state obligations of progressive realization” are semantically consistent,because “progressive” means “non-retrogressive,” both from the perspective of jurisprudence and from the conventional understanding of the words.However,from the perspective of the logical relationship between the two kinds of state obligations,“state obligations of progressive realization” are a positive type of obligation,while “state obligations of non-retrogression” are,of a reverse and negative perspective,to prevent a state from arbitrarily reducing the level of rights protection.The state fiscal obligations of “non-retrogression” to the protection of economic,social and cultural rights require that the state’s budget expenditure on the protection of citizens’ basic rights should not be lower than the existing level.Opponents may point out that “obligations of non-retrogression” become impossible during periods of national economic crisis(e.g.,a national financial crisis,epidemic crisis,war crisis and so on) when revenues suffer a sharp decline.One possible response is that,in times of a crisis,basic rights may be “derogated” to varying degrees,but the “derogation” should be temporary rather than permanent,and meanwhile,the “derogation” itself shall also follow the basic principles of the rule of law.

In fact,state obligations of “non-retrogression” gives a state some “margin of appreciation.” In other words,a state can derogate from the performance of its state obligations in a specific historical period on the basis of legitimate reasons.Since the case of “Handyside vs The United Kingdom”28Handyside vs The United Kingdom,5493/72,Council of Europe:European Court of Human Rights,4 November 1976.in 1976,the “margin of appreciation”theory developed by European human rights law has recognized differences between states,and respected to some extent the freedom of the legislative organs of states,which in fact created a limited right for States Parties to “derogate from” their obligations under the Covenant.”29“Margin of appreciation” is “marge d’appréciation” in French and “Ermessensspielraum” in German.In the sense of public law (especially administrative law),the Conseil d’ État of France and the Bundesverwaltungsgericht of Germany affirm in their cases that the administrative organs enjoy,within reasonable limits,the freedom to judge uncertain legal concepts without judicial review.See also S.Greer,“The Margin of Appreciation:Interpretation and Discretion under the European Convention on Human Rights”,Council of Europe,2000,5;George Letsas,“Two Concepts of the Margin of Appreciation,” Oxford Journal of Legal Studies 4(2006):705-732.The theory of “margin of appreciation” was extended to the field of general human rights law after the subsequent legal development of a series of important decisions of the European Court of Human Rights,which was accompanied by a great theoretical controversy.30Janneke Gerards,“Margin of Appreciation and Incrementalism in the Case Law of the European Court of Human Rights”,Human Rights Law Review 3 (2018):495-515.

In clarifying state obligations of “non-retrogression” to the protection of economic,social and cultural rights,Ariranga Pillay,chief justice of Mauritius and former chairman of CESCR,noted that a state may reduce its state obligations at a given time due to the state’s economic and social development,provided that the following four legal requirements are met.

First,the measures of retrogression taken by a state must be temporary.In other words,a state’s failure to fully protect the economic,social and cultural rights of its citizens due to its limited resources can only take place in the context of a particular economic crisis,and such means of retrogression must be limited to a particular stage.

Second,the measures of retrogression taken by a state must meet the principles of necessity and proportionality.It must be based on necessity for a state to fail to fully protect the economic,social and cultural rights of its citizens due to limited resources,and it must be proportionate between the measures taken by a state and the objectives achieved by its public policy.

Third,the measures of retrogression adopted by a state must be consistent with the principles of equality and non-discrimination.Measures of retrogression taken by a state on the basis of its limited resources must apply equally to the subjects concerned and,subject to such resource constraints,a state must exhaust all possible measures,including taxation,to ensure that the economic,social and cultural rights of the vulnerable groups are not under influence of discrimination.

Fourth,the measures taken by a state must meet the minimum core obligations required for the protection of economic,social and cultural rights.31Audrey Chapman and Sage Russell,Core Obligations:Developing a Framework for Economic,Social and Cultural Rights (Antwerp:Intersentia,2002).The minimum core obligations are one of the “obligations of immediate realization” to which states are bound,as elaborated by CESCR in General Comment 3.The CESCR,based on the considerable experience gained by itself and its predecessor in the consideration of State Parties’ reports over more than a decade,maintains that it is the responsibility of each State Party to undertake minimum core obligations to ensure that the realization of each right at least reaches the most basic level.As a result,with a large number of individuals deprived of food,basic primary health care,basic housing or the most basic form of education,such a State Party is in breach of its obligations underInternational Covenant on Economic,Social and Cultural Rights.A failure to regard theInternational Covenant on Economic,Social and Cultural Rightsas having established such a minimum core obligation would be equal to depriving it of its raison d’être.Meanwhile,it must be noted that any assessment of whether a State Party has fulfilled its minimum core obligations must take into account the resource constraints in that state.Article 2(1) imposes obligations on each State Party to take the necessary steps“to make every effort.” If a State Party is to attribute its failure to meet the minimum core obligations to a lack of resources,it must demonstrate that it has made every effort to use all available resources as a matter of priority to meet the minimum obligations.32International Covenant on Economic,Social and Cultural Rights (ICESCR),G.A.Res.2200 A (XXI),21 U.N.GAOR Supp.(No.16) at 49,U.N.Doc.A/6316 (1966),993 U.N.T.S.3,entered into force Jan.3,1976.Meanwhile,The Maastricht Guidelines on Violations of Economic,Social and Cultural Rights expressively sets out the “minimum core obligations” of states.The“minimum core obligations” imply a non-derogable obligation of immediate realization as undertaken by states.

C.State fiscal obligations “to the maximum available resources”

State obligations “to the maximum available resources” means that,in the protection of the economic,social and cultural rights of its citizens,a state must,within the limits of its available resources,exhaust the maximum possibilities to promote the realization of rights.Under these obligations,a state’s budget income and expenditure must meet the minimum needs of its citizens for economic,social and cultural rights.When judging whether a state is doing this with “the maximum available resources,”the first tough issue is to determine the benchmark for the minimum core state obligations;the second is to judge whether a state has exhausted all possible measures to meet the constitutional requirements “to the maximum available resources.” The issues arising from the above issues also include:Who is best able to assess the distribution of fiscal and tax resources in a state,how to distribute fiscal and tax resources in different social fields,and how to determine the rationality of the distribution of fiscal and tax resources in a state.According to the common sense of logical reasoning,a state’s fiscal and tax resources are limited in a specific period.Under this premise,the resources occupied by a state may exceed the resource limit required by the protection of economic,social and cultural rights,or may be lower than the resource limit required thereby.If the resources occupied by a state exceed the resource limit required by the protection of economic,social and cultural rights,then the next issue is how to divide the financial resources fairly in different areas of social public needs and how to implement the protection of economic,social and cultural rights.If the resources occupied by a state are lower than the resource limit required by the protection of such rights,then the state is faced with the urgent issue of how to do “to the maximum available resources.” It is also the most difficult issue facing the protection of economic,social and cultural rights.

In General Comment 3,the CESCR explains the term “to the maximum available resource.” The CESCR stresses that,even in cases where there is a clear lack of available resources,a State Party remains under an obligation to strive to ensure the widest possible enjoyment of the rights under such conditions.Furthermore,the obligation to monitor the extent to which economic,social and cultural rights are realized or,in particular,not realized,and the obligation to develop strategies and programs for the promotion of rights must not be derogated in any sense by resource constraints.33Ibid.In the case of “Mazibuko and Others vs City of Johannesburg and Others” in 2009,the Constitutional Court of South Africa clarified for the first time that the state obligations under section 27(2) of theConstitution of the Republic of South Africa(Everyone has the right to have access to sufficient food and water.) The court’s examination of the measures taken by the government focused on three issues:(1) whether the government had taken measures to implement these rights;(2) whether the measures taken by the government were reasonable;and (3) whether the government had violated the state obligations of progressive realization.On the issue of what measures the government should have taken to progressively realize economic,social and cultural rights,the Constitutional Court of South Africa ruled that,in general,the court was not the appropriate organ to judge how resources are allocated.34Ordinarily it is institutionally inappropriate for a court to determine precisely what the achievement of any particular social and economic right entails and what steps government should take to ensure the progressive realization of the right.Para.60,Mazibuko and Others v City of Johannesburg and Others (CCT 39/09) [2009]ZACC 28;2010 (3) BCLR239 (CC);2010 (4) SA 1 (CC) (8 October 2009).Although the judiciary is not the best appropriate organ to determine the allocation of resources in a country,it is undeniable that,as the state organ to protect basic rights,it should and can judge whether the measures taken by the government are legally justified.The judgment jurisprudence of the Court of Final Appeal of the Hong Kong Special Administrative Region in the cases of “Kong Yunming vs The Director of Social Welfare”35Kong Yunming v The Director of Social Welfare,FACV2/2013 (17 December 2013).and “Yao Man Fai George vs The Director of Social Welfare”36Yao Man Fai George v The Director of Social Welfare,FACV2/2013.went further.In these two cases,the court examined in depth the population growth benefiting from the CSSA scheme in Hong Kong,the relationship between “the One-way Permits Scheme” (OWP) and“the seven-year residence requirements” under the CSSA scheme,and the budget expenditure of the existing CSSA scheme,trying to make a judicial judgment on whether the Hong Kong SAR government had undertaken its obligations “to the maximum available resources.” The Court of Final Appeal of the Hong Kong Special Administrative Region held that measures taken by the government to ensure social welfare must be subject to judicial review.The court ruled that the government’s policies or specific measures should comply with the “justification test”:first,whether there is a legitimate purpose for differentiated treatment;second,whether there is a reasonable connection between this differentiated treatment and the achievement of policy objectives;third,this differentiated treatment is necessary to achieve the objectives,that is,there is no better alternative.37Qin Jing,“Breakthrough and Conservatism:The Thinking and New Progress of the Trial of Welfare-Related Cases of the Court of Final Appeal of the Hong Kong Special Administrative Region”,Journal of Comparative Law 6 (2015).Justice Robert Ribeiro argued that the courts are not the best actors in the allocation of social resources,but meanwhile,the courts could not stand by when the legislative or administrative proposals under review failed to meet the basic needs of Hong Kong residents guaranteed by the Constitution.38Ibid.Justice Kemal Bokhary pointed out that CESCR’s General Comment requires prudent compliance with the principle of “obligations to the maximum available resources” when welfare policies of retrogression and derogation are formulated.Especially when the policy of retrogression involves the basic needs of certain vulnerable groups,and the implementation of the policy of derogation will have a significant negative impact on those concerned,the court should put forward higher burden of proof requirements for the government so as to prove the rationality of the policy of retrogression.39Ibid.

III.Analytical Framework for Financial Law Protection of Economic,Social and Cultural rights

“For finance,there will certainly be politics;for politics,there will certainly be revenue.” Finance is the lifeline to ensure the effective operation of a modern government.Since a state has undertaken three kinds of overall state obligations to protect economic,social and cultural rights,the allocation of a state’s financial resources must be based on the protection of people’s basic rights.The famous international financial expert Alexander Hamilton pointed out:“Among the tools to ensure the parliament’s effective supervision of the government,the power to control the budget is considered to be the most perfect and effective weapon,and any constitutional use of such a weapon can arm the direct representatives of the people,correct all deviations and implement all legitimate and useful measures.”40Liu Jianwen,“National People’s Congress,Government and Citizens in Budget Governance”,Wuhan University Journal (Philosophy and Social Sciences) 3 (2015).From this,we can see that the protection of rights depends on the financial resources of the government.As a result,the protection of economic,social and cultural rights must be put in the framework of a country’s fiscal and tax revenue for any in-depth review.For a fiscal and tax analysis on the protection of economic,social and cultural rights,international theory has developed three different theoretical frameworks:The first is the revenue-focused analysis on the sources of the fiscal and tax resources;the second being the budget allocation analysis on the justice of the allocation of the available fiscal and tax resources;and the last being the budget expenditure analysis on what principles a government should follow in the budget expenditure.41Megan Manion,et al.,“Budget Analysis as a Tool to Monitor Economic and Social Rights:Where the Rubber of International Commitment Meets the Road of Government Policy”,Journal of Human Rights Practice 1 (2017):146-158.These can be summarized as follows.

A.Protection of economic,social and cultural rights in the sense of sources of revenue

As far as its core meaning is concerned,the sources of revenue refer to the “sources of financial revenue.” In other words,the revenue-focused analysis of the protection of human rights means that we should analyze and understand how a government enriches its treasury through financial means.There are many ways for a modern government to coordinate and arrange sources of revenue.In the field of coordinating and arranging sources of revenues for social security,there are only two basic ways:Tax payments with taxation as a source of revenue and insurance payments with social insurance premium as a source of revenue.42Committee on Economic,Social and Cultural Rights,General Comment 3,The Nature of States Parties’ Obligations,1990,U.N.Doc.E/1991/23.Sources of revenue are the material basis for the protection of economic,social and cultural rights.The construction of an effective organization for the protection of economic,social and cultural rights therefore cannot be separated from continuous fiscal and tax revenue.It echoes with the saying that” “When the big river has water,small rivers are full;when the big river has no water,small rivers are dry.” The general public’s concern for the protection of economic,social and cultural rights lies in the adequacy of sources of revenue;otherwise,the general citizens regard the protection of economic,social and cultural rights as talk beyond reach.From the theoretical perspective,the following issues should be further clarified and reviewed to analyze the protection of economic,social and cultural rights through the approach of “sources of revenue.”

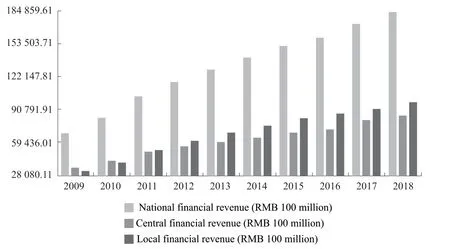

First,the amount of a state’s financial revenue depends on the level of economic and social development of a country in the ultimate sense.In a common sense,the higher the level of economic and social development,the higher the people’s ability to bear fiscal and tax revenue,and the more substantial the government’s revenue and the national treasury will be.In other words,the improvement of the productive forces with the scientific and technological revolution as the core is to solve the problem of“water in the big river.”

Second,the sources of a state’s financial revenue also involve “the fairness of the overall financial burden,” that is,national public power is used to acquire some of the material wealth of the citizens and society through the tax law and other governance tools for the purpose of serving the public’s interests.However,such methods may greatly limit the materials on which the citizens depend for their survival and development.In other words,the excessive financial burden may derogate the protection of the citizens’ right to subsistence.As a result,modern states generally need to examine whether the financial burden can be accepted by the general public in a general sense through parliamentary democratic procedures,that is,“tax constitutionalism.”43Liu Jianwen,“Suggestions on the Tax Constitutionalism in China”,Law Science Magazine 1 (2004).Although the formation of the financial revenue need not be adjusted on the basis of the economic suffering of individual citizens,a state must be limited by the resolution of the majority of the representative organs in the democratic process.In the fiscal and tax law,the fairness of this financial burden can be examined by means of the principle of “the Ability-to-Pay Taxation.”44The principle of the Ability-to-Pay Taxation requires that an individual’s tax burden should be measured according to the ability of the taxpayer to pay tax.It is a basic principle of a modern tax law system to judge how much tax or how much tax burden a taxpayer pays or shoulders in accordance to the taxpayer’s ability to pay taxes.Among them,the income is from the objective net income.With the basic living expenses of such an individual and his/her families deducted,it is regarded as taxable income.The property is for grasping the taxpayer’s possible due income as the object of taxation.If there is no due income,it should not be taxed,so as to avoid excessive infringement of people’s property rights.See Chen Qingxiu,“The Ability-to-Pay of Taxation and the Principle of Regulating Tax with Substance (Upper)”,The Taiwan Law Review 8 (2001).

Third,the sources of a state’s financial revenue are related to the principle of tax equity.The principle of tax equity has many dimensions;it is also closely related to the principle of “the Ability-to-Pay Taxation.” The tax equity mentioned here focuses on the analysis of the equality of certain tax burden on different tax objects,that is,the issue of “equal rights” guaranteed by the constitution.According to the research of Chinese scholars,tax equity should be reflected in at least four aspects:the first is the equity of tax distribution,that is,the institutional equity,which refers to the equity of tax distribution among governments;the second is the equity of tax setting,that is,the system equity,which refers to the equity of the taxation system design,including horizontal equity and vertical equity in traditional theories;the third is the equity of tax collection,that is,the administrative equity,which refers to the equity of tax collection and management;the fourth is the equity of tax uses,that is,the rights and interests equity,which refers to the taxpayer’s supervisory rights and equal benefits in the uses of tax.45Lin Xiao,“Four Manifestations of Tax Equity and Reshaping China’s Tax Equity Mechanism”,Taxation Research 4 (2002).Chinese scholars point out that there are two standards to measure the principle of tax equity,namely the principle of benefits and the principle of abilities.In the principle of benefits,how much a taxpayer benefits from public goods provided by the government is used as a criterion to judge the amount of their tax liability and whether the tax burden is fair.Those who benefit more should pay more tax.In the principle of abilities,a taxpayer’s ability to pay tax is used as a criterion to judge the amount of tax and whether the tax burden is fair.Those with strong ability to pay tax should pay more,while those whose ability is weaker should pay less.46Liu Jianwen and Xiong Wei,Basic Theory of Tax Law (Beijing:Peking University Press,2004),129;Liu Jianwen and Chen Licheng,“Outline of General Theory of the Fiscal and Tax Law”,Contemporary Law Review 3 (2015).

Fourth,sources of a state’s financial revenue are related to the extent of state obligation on the protection of basic rights “to the maximum available resources.” The state obligation “to the maximum available resources” requires a state to make the best possible use of available resources in the protection of economic,social and cultural rights.Besides,in cases with a clear lack of available resources,a state remains obliged to strive to ensure the widest possible enjoyment of the rights under such conditions.In this sense,to get sufficient sources of revenue,a state is required to reduce and regulate tax evasion and other phenomena that may impair sources of revenue through scientific and reasonable tax system designs under the principle of tax revenue legalism.

B.Protection of economic,social and cultural rights in the sense of budget allocation

The core issue of budget allocation is how a government’s financial resources should be divided into different social fields.A state can make use of the distributive value of the fiscal and tax law to promote the realization of the value goal of distributive justice.47Xu Mengzhou et al.,Reform and Perfection of Finance and Tax Legal System (Beijing:Law Press,2009),33.Chinese scholars have pointed out that there are two functional attributes of the fiscal and tax law:first,the fiscal and tax law has the function of income distribution.In other words,it involves in the process of the national income allocation of the nationals by fiscal and tax means,so as to allocate among the state,enterprises and residents;second,the fiscal and tax law has the function of ensuring the distribution order.In other words,it ensures the equity of the national income distribution procedure and the equity of the distribution result through the financial and legal form.48Liu Jianwen,“Income Distribution Reform and Fiscal and Tax Legal System Innovation”,China Legal Science 5 (2011).From the perspective of realizing the functional value of a state’s finance and taxation,the allocation of a state’s financial resources needs to maintain the financial needs of legislative,administrative,supervisory,judicial,national defense,foreign affairs and other institutions or departments;besides,it has a more important value to provide social public services.In a government’s financial governance,the proportion of financial resources allocated into social security is an important reference index to measure the level of a state’s economic,social and cultural rights.There are two points in need of being stated as follows.

First of all,the ultimate goal of budget allocation is to realize the public management functions of a state.The functional measures by which a state realizes its functions are to allocate financial resources to the public field.A government should take into account the needs to provide all members of society with public security,order,protection of citizens’ basic rights,social conditions for economic development,among others.

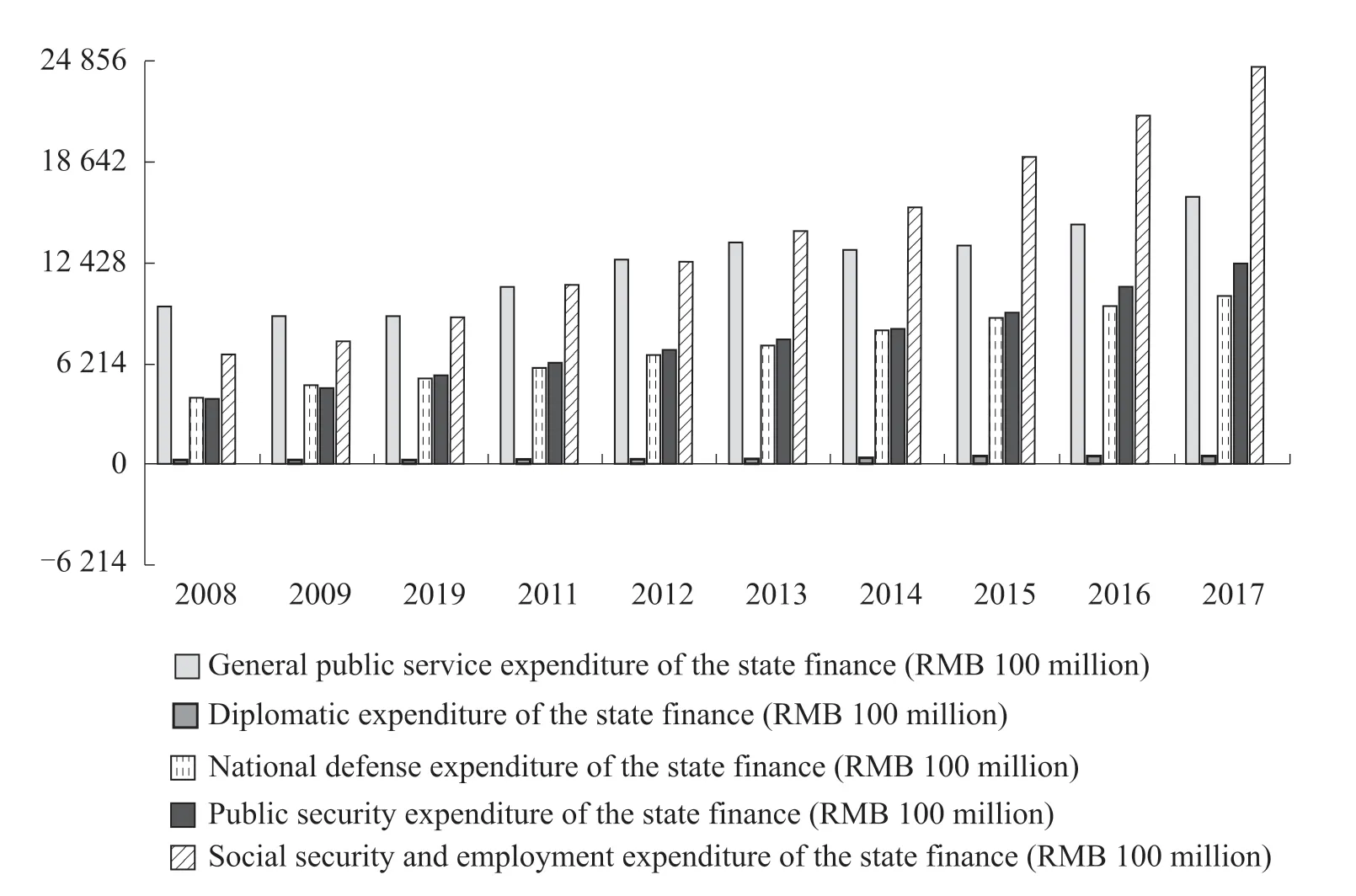

Second,the proportion of budget allocation in different social fields has a profound impact on the protection of basic rights.The scope and targets of budget allocation is greatly widespread.How much financial resources should be allocated to maintain the government’s daily expenditure,provide social public services and ensure the basic rights of citizens reflects a government’s target value orientation in financial arrangements.The academic circle mostly adopts the way of horizontal comparison to analyze a government’s allocation of financial resources in the fields of social order maintenance;public facilities maintenance;science,education,culture and sports;foreign affairs;national defense;among others.For this reason,a government has priority areas for the allocation of financial resources in different years.In the sense of the finance and tax,how to evaluate and measure whether a government has fulfilled its state obligations to protect the basic rights of citizens has been transformed into whether a government has invested certain financial resources into those social fields needed for the basic rights.This point is particularly significant for the protection of economic,social and cultural rights.

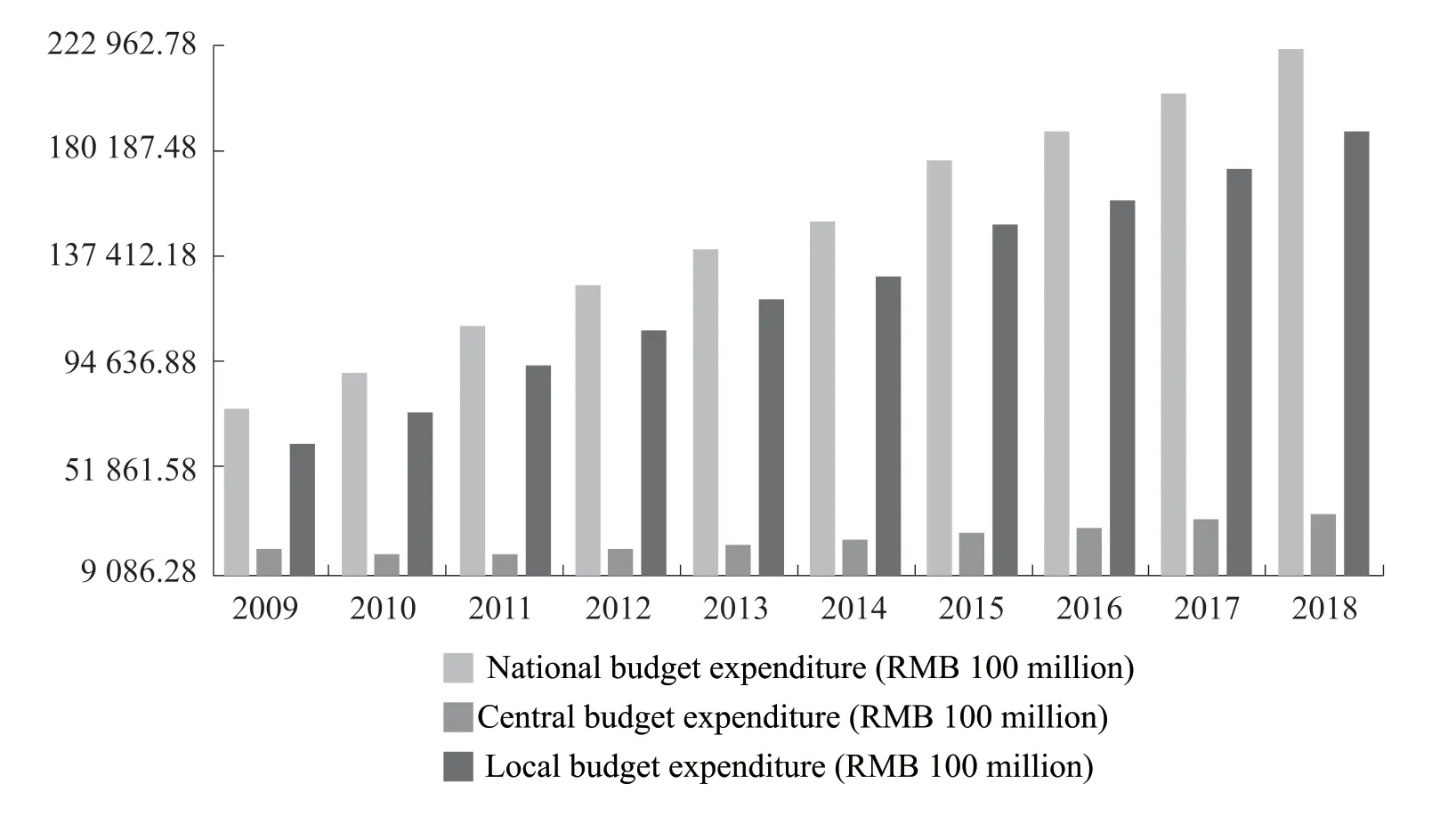

C.Protection of economic,social and cultural rights in the sense of budget expenditure

Budget expenditure is a financial activity in which a state uses a its financial funds in all fields of society according to a predetermined budget.Sometimes,a state’s budget expenditure exceeds the scope of the budget;this leads to the problem of a financial deficit;sometimes,a state’s budget expenditure is less than the scope of the budget;this will result in a financial surplus.At the end of the financial process,budget expenditure is an integral part of the national fiscal and tax system.Fiscal and tax law has developed a series of principles and systems to regulate the state’s budget expenditure activities.One of the development directions of modern fiscal and tax law is to construct a system of democratic financial rules that can restrict the financial power,thus providing a theoretical basis for a state to formulate the financial constitution (basic law) or the tax constitution (basic law).49Brennan and Buchanan,Constitutional Economics,trans.Feng Keli et al (Beijing:China Social Sciences Press,2005),3.Chinese scholars point out that at the budget level,the control and expenditure of public property should conform to the rule of law,being open and transparent,and gradually realizing financial democracy;at the tax system level,the acquisition of public property should be strictly legal,and reasonably undertake appropriate economic and social functions;at the level of intergovernmental financial relations,the ownership of public property should be clarified according to the principle of “matching financial power with administrative power,and matching administrative power with expenditure responsibility.” Meanwhile,it should promote the legislation for the division between financial revenue and expenditure at proper timing.50Liu Jianwen,“On the Legitimacy of Fiscal and Tax System Reform:Governance Logic in the Context of Public Property Law”,Tsinghua University Law Journal 5 (2014).

As mentioned above,the protection of economic,social and cultural rights involves the material basis on which the rights are realized.In modern states,social security funds are considered to be the most important guarantee in the sense of the sources of revenue for the protection of economic,social and cultural rights.The financial affairs of social security refer to the deployment and management of the funds needed for social security and the use of the funds for this purpose.Its core lies in the application of “paying for protection” with financial funds.The most important aspect is to guarantee the sources of revenue,which is centered on “paying” and the payment of the management expenses for operation.51Liao Qinfu,“Concepts and Construction of Principles of Social Security Financial Law — Centered on the Theory of Sources of Revenue for Long-term Care Services”,Public Finance Review 5 (2015).Maw-In Tsai,Financial Issue of Social Security,595.In a modern financial system of “government spending with parliamentary deliberation,” the budget expenditure for social security is subject to the democratic deliberation procedure and the actual process of political operation of a state.Insufficient expenditure on social security will inevitably affect the implementation of state obligations under the protection of economic,social and cultural rights.For this there are many reasons.For example,the priority issues in the political deliberations might not include social security,and politicians and legislators may consider issues such as social order and safety to be more urgent;poor budget supervision and implementation lead to inadequate implementation of the expenditure on social security;other reasons include the national economic situation,adjustments in government monetary policy,increased extra budgetary spending,among others.

D.Reflection on the limitations of the fiscal and tax analysis on economic,social and cultural rights

In dealing with the relationship between a state and its people,the protection of basic rights is the primary responsibility of the government.It is such protection that constitutes the purpose of a government’s existence.The fiscal and tax analysis provides a theoretical framework different from “norms theory” and “rights theory” for the protection of economic,social and cultural rights;it is an institutional thinking.The fiscal and tax analysis puts the protection of economic,social and cultural rights in a structure of sources and expenditure of budget.It reverses the allocation structure of financial resources through state obligations,with a purpose to solve the issue of the protection of right “depending on resources.” Finance reflects the focus and direction of a state’s governance.The allocation of financial resources presents a clear understanding on what kind of resources the government has invested in what matters.52Maria Socorro I.Diokno,“A Rights-Based Approach towards Budget Analysis”,International Human Rights Internship Program,1999.In the practice of international human rights,the African Commission on Human and Peoples’ Rights has adopted a view similar to thePrinciples and Guidelines on Economic,Social and Cultural Rights in the African Charter on Human and Peoples’Rights.53Guidelines and Principles on Economic,Social and Cultural Rights in the African Charter on Human and Peoples’ Rights (adopted on 24 October 2011),para 15.In other words,the tax obligations of individuals under54The African Charter on Human and Peoples’ Rights,also known as the Banjul Charter,was adopted by the Organization of African Unity on 28 June 1981 and entered into force on 21 October 1986.Organization of African Unity (OAU),African Charter on Human and Peoples’ Rights (“Banjul Charter”),27 June 1981,CAB/LEG/67/3 rev.5,21 I.L.M.58 (1982).Article 29(6) ofAfrican Charter on Human and Peoples’ Rightsimply that states should ensure a fair and effective financial system to ensure the realization of economic,social and cultural rights.55Ben Saul,David Kinley and Jaqueline Mowbray,The International Covenant on Economic,Social and Cultural Rights:Commentary,Cases,and Materials (Oxford:Oxford University Press 2014),145.In the case of “African Commission on Human and Peoples’ Rights vs Republic of Kenya” in 2017,56African Commission on Human and Peoples’ Rights vs Republic of Kenya,ACtHPR,Application No.006/2012 (2017).the African Court on Human and Peoples’ Rights heard the largest public interest case since the establishment of the court.In this case,the Commission filed eight major categories of rights violations with the court on behalf of 35,000 complainants.The African Court on Human and Peoples’ Rights made it clear that the Government of Kenya is liable for property compensation for breach of its state obligations to protect basic rights in respect of the protection of indigenous peoples’ rights to land,property,culture and natural resources.On the enforcement of sentences,it is through its constitutional process that the Government of Kenya fulfills its responsibilities and obligations regarding the protection of its international human rights through the redistribution of financial resources.

The fiscal and tax analysis of economic,social and cultural rights is not flawless,and the use of financial means to compel a state to fulfill its obligations on the protection of basic rights is also worthy of a profound review in the theoretical and practical circles of the science of law.

First,the theoretical assumption of the fiscal and tax analysis of the protection of economic,social and cultural rights is based on the positive correlation between a relatively perfect level of financial resources and the level of protection of economic,social and cultural rights.In fact,there is a great deal of factors affecting the level of protection of economic,social and cultural rights.The financial resources are only one of many resources for the protection of basic rights.However,based on the concept that “for finance,there will certainly be politics;for politics,there will certainly be revenue,” financial resources play a prominent role in a state’s public life.As a result,finance has become the main factor affecting the protection of economic,social and cultural rights.

Second,the fiscal and tax analysis of the protection of economic,social and cultural rights often focuses on the proportion of social security funds in the total financial resources.In a certain period,financial resources are allocated by the government to different areas of a society according to the political consultation process of legislators.In the field of social security,the overall allocation of financial resources does not mean that the objects of social security have equal access to the rights protected by the constitution of a state.In other words,even if the proportion of social security funds in all financial resources has greatly increased,it cannot be taken for granted that there will be an enhanced level of protection of economic,social and cultural rights.In fact,the key to the protection of economic,social and cultural rights is not the expansion of the total amount of social security funds,but the justice in the allocation of financial resources.Based on this yardstick of justice,legislators are able to measure how the budget expenditure affects the actual enjoyment of economic,social and cultural rights by different groups of citizens.

Third,the fiscal and tax analysis of the protection of economic,social and cultural rights not only needs to pay attention to the allocation of financial resources in the macro structure,but also how the financial resources are implemented in the specific social security field through the division of administrative power between the central and local governments.In other words,the protection of economic,social and cultural rights is a realistic process in the order of democracy and rule of law.The realization of this process is not only related to the debate on the theory of sources of revenue,but also involves the budget allocation of social security by the central and local governments and how to supervise the implementation of the social security finance.

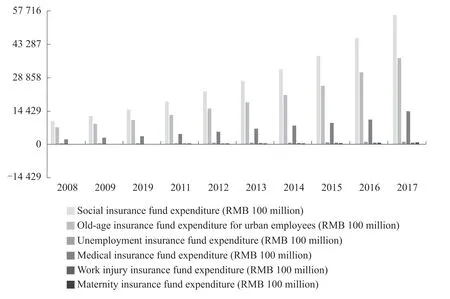

IV.Construction of the Fiscal and Tax Law System for the Protection of Economic,Social and Cultural Rights in the Chinese Context

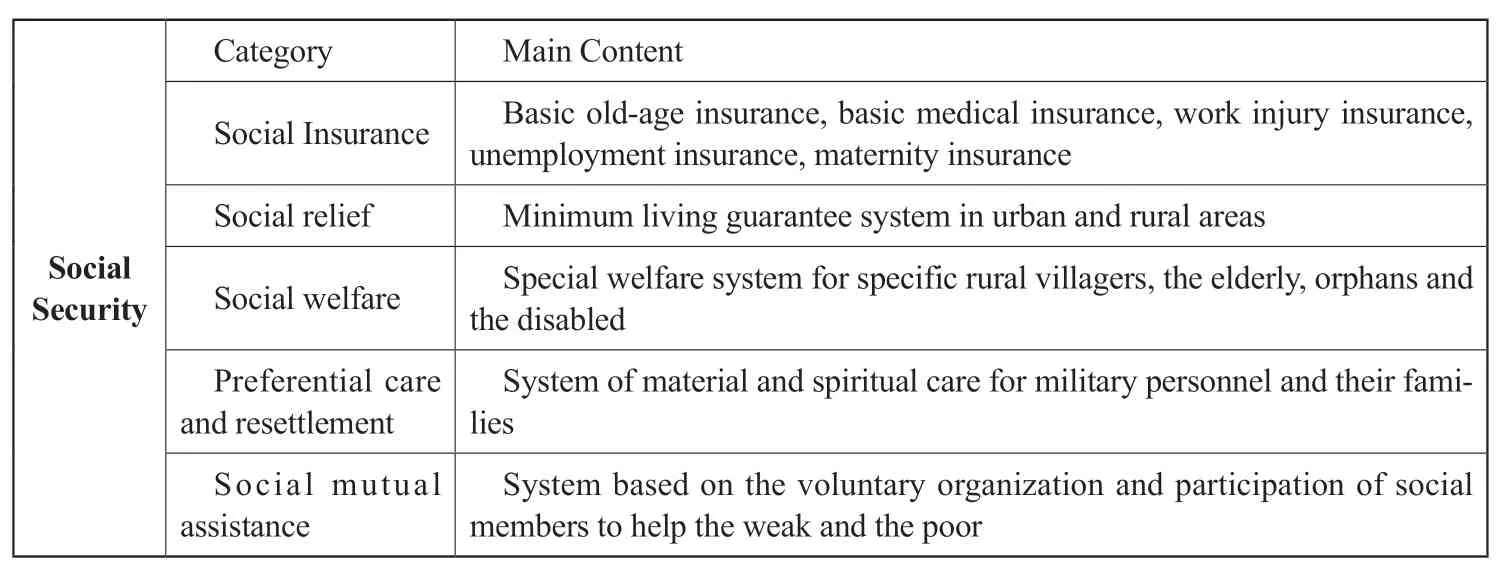

In recent years,the overseas academic circle has an increasing focus on the protection of economic,social and cultural rights from the perspective of the fiscal and tax analysis.For example,in recent years,Aoife Nolan,Rory O’ Connell and Colin Harvey are all committed to study how public finance has a profound impact on the protection of economic,social and cultural rights.57Aoife Nolan,Rory O’ Connell and Colin Harvey,Human Rights and Public Finance:Budgets and the Promotion of Economic and Social Rights (West Sussex:Hart Publishing,2013);Aoife Nolan et al.,Economic and Social Rights after the Global Financial Crisis (Cambridge:Cambridge University Press,2014);Rory O’Connell et al.,Applying an International Human Rights Framework to State Budget Allocations (London:Routledge,2016);Aoife Nolan,“Economic and Social Rights,Budgets and the Convention on the Rights of the Child”,The International Journal of Children’s Rights 2 (2013):248-277.Chih-Hsiung Hsu,Maw-In Tsai,Liao Qinfu and others from China’s Taiwan have been exploring how the finance and taxation can act on the protection of citizens’ right to subsistence in accordance with the lowest human dignity from the perspective of the social security finance.The civil law system and the common law system refer to economic,social and cultural rights in the same content,despite using different terms.In the constitution of the fiscal and tax law,there is no breakdown of budget expenditure for the direct implementation of theInternational Covenant on Economic,Social and Cultural Rights.Instead,the expenditure on social security is mostly used to implement the material conditions of the basic rights as stipulated by a state’s constitution.Based on the above reasons,it is indeed necessary to construct a system and systematic framework for the protection of economic,social and cultural rights with the social security finance as the core.The social security system was originally a relief law aimed at the poor,and then gradually expanded to social insurance focusing on specific occupational fields,and finally gave rise to an “all-citizen insurance” system aimed at the citizens.58Tsi-Yang Chen,Constitutional Jurisprudence,245.China’s social security system has undergone a long history of development,having formed a comprehensive system covering social insurance,social relief,social welfare,preferential care and resettlement,social mutual assistance.In this system,social insurance is the most important core.In accordance with the provisions of Article 2 of theSocial Insurance Law of the People’s Republic of China,the state has established a social insurance system including basic old-age insurance,basic medical insurance,work injury insurance,unemployment insurance and maternity insurance to ensure citizens’ rights to obtain material assistance from the state and the society in accordance with the law under the circumstances of old age,illness,work injuries,unemployment and maternity.In fact,these rights are the core content as declared and protected by theInternational Covenant on Economic,Social and Cultural Rights.As a result,the economic,social and cultural rights enjoyed by Chinese citizens are specifically implemented through the rule of law in social security,as shown in Table 3.

Table 3 Composition of China’s Social Security System

A.Construction of a horizontal system for fiscal guarantee of economic,social and cultural rights

From the perspective of the theory on sources of revenue,a state “opens sources”of revenue mainly through taxes,fees and other ways.“Who enjoys public financial power through what procedures” is the root problem in allocating a state’s financial power.The first problem to be solved in the construction of the financial law system for the purpose of protecting economic,social and cultural rights is the horizontal division of the allocation of a state’s financial power.In the general theoretical sense,the aforementioned horizontal division of finance refers to the horizontal allocation of financial power among state organs.Chinese scholars have pointed out that the allocation of the financial affairs power can be divided into fiscal legislative power,fiscal executive power and fiscal judicial power.In other words,in the horizontal allocation of a state’s power,Chinese scholars have put forward the problem of the operation mode of a state’s public financial power.

The discussion on the horizontal allocation mode of financial power in China’s theoretical circle mainly focuses on the opposition between “parliament-led financial power” and “administration-led financial power.” In jurisprudence,the parliament-led financial power is an inevitable result following the historical logic and constitutional logic.However,in the allocation of financial resources in reality,the executive branch often enjoys the power of budget preparation and proposal,and financial execution,which causes the problem of the “administration-led mode” in the horizontal allocation of a state’s financial power.59Zhu Daqi and He Xiaxiang,“The Supremacy of Legislature and the Dominion of Executive:Ideality and Reality in Fixing the Power of Budgeting”,Journal of Renmin University of China 4 (2009).In theory and form,a state’s financial power must be included in a framework featuring the rule of law with the “parliament” as its core;it is an inevitable requirement from the notion that “no taxation without representation.” However,in the practical operation,a state’s financial policy and the allocation of various financial resources must be implemented by the government.More importantly,the government has the “power to serve a ball” to bring up the financial budget plan to the representative organs and the budget plan from the representative organs is finally implemented by the government.The supreme status of parliament and the actual dominance of the administration seem to be accepted at the same time,with the center of financial power unknowingly transferred from parliament to administration.60Ibid.The emergence of this trend is in fact closely related to the expansion of the scale of a modern government.After free capitalism entered the stage of monopoly capitalism,states have continuously intervened in the economy,especially in those sudden economic crises which objectively require states to respond and adjust rapidly in financial policies.To maintain economic growth and social stability,the expansion of executive power makes the government often take up the role of “savior of the market.” As for the allocation of financial power in modern states,the government’s financial power is mainly manifested as follows:(I)the financial executive power.In other words,after the representative organ has adopted the budget in accordance with democratic political procedures,the government must consider the annual budget as a “law” to implement.(II) The power of financial revenue.Namely,a government’s financial revenue must be based on the principle of the rule of fiscal law.Under a framework of law and in legal and reasonable ways,it obtains certain financial revenue,which includes taxes,fees and public debts.(III) The power of budget expenditure.In other world,under the constraints of laws and policies concerning public finance,the government also has the power to “spend money.” A government’s power of budget expenditure mainly reflects its general public service expenditure in order to maintain its own operation,its macro-control expenditure in intervening and regulating economic activities,its social security expenditure in ensuring people’s living standards and so on.(IV) The power of fiscal management.In other words,a government also has statutory power over the management and operation of financial funds.A government must manage the treasury’s funds and state-owned assets according to economic laws.Meanwhile,it has management power over government procurement,allocation of funds from taxes,and others.