GEXRPAECPTEAT IONS

With life in China’s metropolises moving at breakneck speed,few have the time to stop and smell the rosé: rather, a quick buzz with the notorious 60-percent alcohol content baijiu is how Chinese traditionally toasted their troubles away. From Hebei to Xinjiang, a growing number of plucky boutique wineries are trying to change this trend, but face challenges from uncontrollable weather conditions to the lack of Chinese wine-making machinery. With local governments now subsidizing wineries as an ecological path to rural development,a new age seems to be on the horizon for domestic vintage—provided they can shake their “Made in China” stigma and get connoisseurs to finally say “Cheers!”

两千多年前,汉使张骞将葡萄酒从西域带回中原;

一千三百多年前,唐朝诗人王翰写下“葡萄美酒夜光杯”;

今天,如何发展本土葡萄酒产业、打造中国葡萄酒文化成为新的挑战

At the age of 22, Emma Gao arrived in Bordeaux to begin a master’s program in wine-making, having never even tasted the beverage before. “I told my father that I didn’t want to work in agriculture, but he said he wouldn’t pay my tuition unless I studied enology,” Gao recalls,laughing.

Now co-owner of Silver Heights Winery in China’s Ningxia Hui Autonomous Region, Gao found it hard at first to keep up with her European classmates, whose families had been making wine for generations.

Her family vineyard’s story was quite different: Although the Ningxia government had been encouraging farmers in this northwestern desert region to plant trees to combat deforestation in the 1990s, Gao’s father failed to see how this would lead to long-term profit. After spending five years conducting business over glasses of wine in Russia, he decided to start his own winery instead, but first sent his daughter abroad to learn the ropes in 2000.

Silver Heights now employs 25 people full-time (and an additional 50 farmhands during harvest season),producing 80,000 bottles per year,although Gao hopes that soon they can increase that figure to 200,000 bottles and become a “mid-sized”winery. It has already been garnering positive reviews: President Xi Jinping toasted French president Emmanuel Macron with a glass of Silver Heights during the latter’s state visit to Shanghai last year.

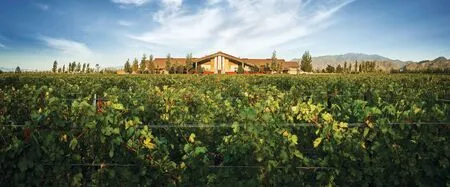

While the vineyard claims to be one of the first in the region,high-end “boutique wineries” have since proliferated as the Ningxia government provides subsidies and loans for the industry’s growth,viewing it as a means to stimulate rural economies without polluting the environment.

According to Richard Li, president of boutique winery Domaine Franco-Chinois (DFC), an important component of what the Ningxia government has done for the industry is building an association, which he hopes will be replicated in DFC’s Hebei province.

“If every boutique winery invests in its own marketing and promotion, it will be next to impossible for them to grow,” he comments, viewing regional wines as a branding opportunity for local governments, especially at international trade shows. “When you hear Bordeaux, you think of wine.As an agricultural product, wine is inherently associated with the land and can be used to promote the region as a whole.”

Although Chinese wineries like to claim that they are building on an over 2,000-year tradition of domestic viticulture, wine made from grapes has historically been overlooked by drinkers in favor of alcohols distilled from ingredients such as rice, sorghum, and plums. After the founding of the PRC in 1949,Chinese wineries were kept open and expanded by the state to create wines for hosting foreign visitors and to maintain the foreign exchange rate.

Since the market reforms of the 1980s, monolithic state-owned wine producers have taken over the market,including China’s ubiquitous Great Wall banquet wine (which skeptics note has yet to actually turn a profit).

Yantai’s Changyu Winery, originally founded in 1892 by Qing dynasty diplomat Zhang Bishi in Shandong province, has developed vineyards that are said to account for one-quarter of the entire country’s wine producing areas even today. Over the last decade,however, these big domestic brands have declined, viewed as stale by newly wealthy Chinese who preferred imported foreign wine instead.

Although taken into private hands in 2010, DFC also traces its roots back to the public sector as the brainchild of former premier Wen Jiabao andFrench president Jacque Chirac. First conceived as a Franco-Chinese joint venture in 1995, it broke ground some four years later, after countless studies to determine a location with the soil composition most conducive for grape-growing.

When Hebei province’s Huailai county was chosen, vines, equipment,and experts from France were sent to China to create one of the country’s first boutique wineries. Although non-commercial, DFC was built to provide a new business model for China’s wineries. According to Li, the wine-making industry in the 1980s and 1990s was dominated by wine brands with big production volumes that didn’t even own their own vines.Instead, they purchased grapes directly from farmers.

Because farmers often ignored grape quality to get a higher yield,or lacked the technical know-how to grow and pick quality grapes,winemakers found it difficult to produce exceptional wines. “We had to quickly change our method of cooperation with the farmers,” notes Judy Chan, CEO of Grace Vineyard in the northwestern Shanxi province,another early player in China’s boutique wineries. “Instead of buying grapes from them, we rented out the vineyards and hired them to work for us.”

DIFFERENT WINE REGIONS FACED DIFFERENT CHALLENGES, AND ALL OF THEM LED TO HIGHER PRODUCTION COSTS

Shandong-based Italian winemaker Denise Consentino says that in addition to the issue of educating farmers, “different wine regions have different challenges—from burying the vines to compensate for the cold winters of Ningxia or Xinjiang to the rainy seasons of Shandong or Shanxi. Even the Yunnan winerieshave a logistical issue, as the vineyards are so remote.”

Training programs for domestic winemakers have opened up across the country

Wineries in northern China must bury the vines during winter to keep them from freezing

In 2014, Consentino arrived in China to teach “wine culture,” wine tasting, and winery management as a professor at Northwest Agricultural and Forestry University in Shaanxi province, the first institution in Asia to provide a specialization in enology.She admits to not knowing much about China at the time, but quickly learned that while different wine regions of the country faced different challenges, all of them led to higher production costs.

Besides climate conditions, there are other components that often render domestic wine pricier than their international counterparts. Gao says that Silver Heights could have cut costs by buying Chinese machinery,but she was afraid to sacrifice quality,and imported all of her aging barrels and machinery directly from France instead.

DFC’s Li hypothesizes that China’s land policies will also render Chinese wines more expensive in the long term. “In Europe, you have wineries that were passed down from generation to generation, whereas in China you don’t own the land—you only have a right of utilization.”

Some industry watchers are skeptical about whether high-end Chinese wines can overcome these challenges.“I personally think that there can’t be more than a million people in the entire country who can really appreciate them at this point,” says