Feb.2020

by Cotton Incorporated

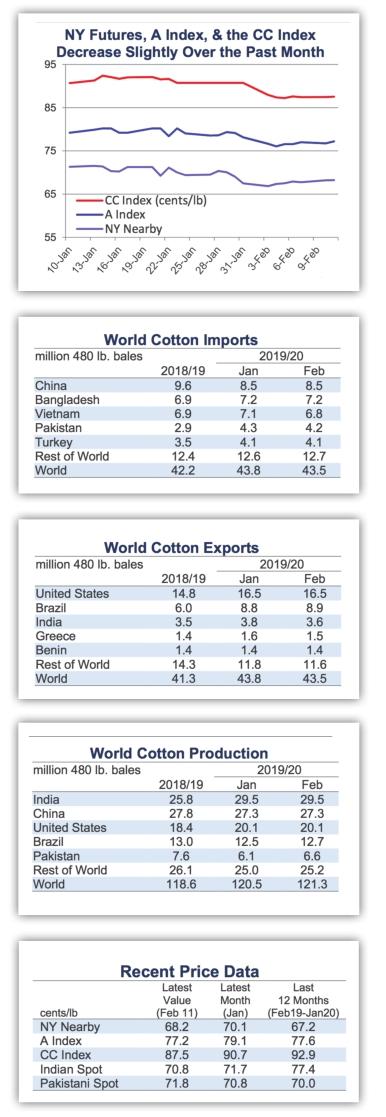

Recent price movement

Most benchmark prices decreased over the past month.

? The nearby March NY futures contract fell from 71 to 68 cents/lb. Open interest is migrating out of March and into the May contract. Values for May futures also decreased and commonly traded at levels a little less than one cent higher than March futures. Prices for the December contract, which are a reflection of expectations after the 2020/21 harvest, traded slightly higher than values for both March and May and are currently just below 70 cents/lb.

? The A Index declined from 79 to 77 cents/lb.

? In international terms, the China Cotton Index (CC Index 3128B) decreased from 91 to 87 cents/lb. In domestic terms, prices eased from 13,800 to 13,400 RMB/ton. The RMB weakened slightly against the dollar over the past month, from 6.93 to 6.98 RMB/USD.

? Indian cotton prices (Shankar-6 quality) slipped from 73 to 71 cents/lb. In domestic terms, values fell from 40,500 to 39,400 INR/candy. The Indian rupee was stable near 71 INR/USD.

? Pakistani prices were stable near 71 cents/lb in international terms. In domestic terms, values held close to 9,000 PKR/maund. The Pakistani rupee was also steady, consistently trading near 155 PKR/USD.

Supply, demand, & trade

The latest USDA report featured an increase to the forecast for world production in 2019/20 (+850,000 bales to 121.3 million) and a decrease to the forecast for 2019/20 world mill-use (-1.2 million bales to 119.0 million). An upward revision to last crop years production (+454,000 to 118,603 million), lifted the estimate for 2019/20 beginning stocks. In combination, the increase in beginning stocks, the increase in production, and the decrease in consumption resulted in a 2.5 million bale increase to the projection for 2019/20 ending stocks (82.1 million bales). This figure is slightly above levels maintained since 2016/17 (between 80.0 and 80.8 million bales).

The largest country-level revisions to production figures included those for Pakistan (+500,000 bales to 6.6 million), Brazil(+200,000 to 12.7 million), and Tanzania(+100,00 to 500,000).

For mill-use, the largest updates were for China (-1.0 million bales to 37.5 million), Vietnam (-300,000 to 6.8 million), Pakistan (+200,000 to 10.8 million), and Turkey(+100,000 to 7.2 million).

The global trade forecast was lowered 285,000 bales to 43.5 million. In terms of imports, the biggest changes were for Vietnam (-300,000 bales to 6.8 million), Pakistan (-100,000 to 4.2 million), South Korea(-100,000 to 600,000), India (+100,000 to 2.3 million), and Malaysia (+250,000 to 1.0 million).

- China Textile的其它文章

- Dear readers

- The diary of battle against the epidemic

- Duan Xiaoping:Firm confidence,adapt to change,win in the future

- How is the progress of all industries in the second week of resumption of work?

- Industry survey:Progress on resuming production

- Survey on the work resumption of 4,650 enterprises in 19 clusters of cotton textile enterprises