GROWING MARKET FOR IMPORTS The considerable potential of the Chinese consumer market is alluring goods from around the globe

By

Goods ranging from Thai fruit to Norwegian salmon and German cars had filled the 300,000-square-meter Shanghai exhibition area of the Second China International Import Expo (CIIE) when it opened on November 5.More than 3,000 businesses from 150 countries and regions including about 250 Global Fortune 500 companies and industry leaders from around the world exhibited their competitive products,generating enthusiasm among Chinese companies and consumers alike.

The success of the CIIE provides a thumbnail sketch of Chinese consumption trends:Imports are becoming more appealing to Chinese consumers.“China’s middleincome population is the biggest in the world,”declared Chinese President Xi Jinping in his keynote speech at the opening ceremony of the second CIIE.“The huge Chinese market points to a potential that is simply unlimited.”

Considerable Consumption Potential

Chilean cherries displayed at the Second China International Import Expo in Shanghai.

China is already an economic power after four decades of exponential growth since the launch of reform and opening-up policies in 1978.The total volume of retail sales of consumer goods soared from 155.86 billion yuan(about US$24 billion) in 1978 to 38.0987 trillion yuan (about US$5.4 trillion) in 2018,an average annual growth rate of 15 percent.The contribution rate of consumption to China’s economic growth has remained at more than 50 percent since 2015,and the increasing consumption power is greatly upgrading domestic consumption.

Foreign brands of consumables such as food,garments and household appliances are gaining popularity with increasingly savvy Chinese consumers seeking better living standards and high-quality products,which is creating vigorous momentum for expansion of the Chinese import market.In recent years,Tmall Global,JD Global,Suning International and other Chinese e-commerce platforms have joined hands with a growing number of international brands in reporting stunning sales performances in China thanks to fast emergence of new consumer markets particularly favored by millennials.

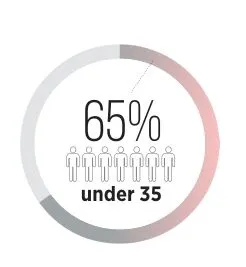

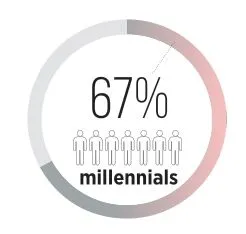

A report from Hong Kong-based Fung Business Intelligence showed consumption by people under the age of 35 accounting for 65 percent of the consumption growth in China.Since 2016,consumption by this demographic has been growing at an average annual rate of 11 percent,twice the rate of consumers over 35.Contrasting their parents,millennials aspire for more of a quality lifestyle and are willing to pay for better food,education and travel.Millennials now account for 67 percent of the total number of Chinese outbound tourists.Young Chinese travelers spend more than twice the average of their Asian peers according to a survey commissioned by the Singapore Tourism Board.

In November 2019,Deloitte China joined hands with the China Chamber of International Commerce (CCOIC) and AliResearch to release Inclusive Growth Drives Consumption Upgrading:China’s Imported Goods Market Research.The report provided in-depth analysis of the growth in Chinese consumption of imports,with particular focus on the recent consumption upgrading trend radiating from first and second-tier cities to third,fourth and fifth-tier cities and county-level regions,which are incrementally becoming stronger consumer markets for imports.

The huge Chinese market points to a potential that is simply unlimited.

The total volume of retail sales of consumer goods soared from 155.86 billion yuan (about US$24 billion) in 1978 to 38.0987 trillion yuan (about US$5.4 trillion) in 2018,an average annual growth rate of 15 percent.The contribution rate of consumption to China’s economic growth has remained at more than 50 percent since 2015.

China’s domestic production is far from satisfying the increasingly diverse needs of the huge Chinese consumer market,so opening the market wider to the outside world has become a clear choice.Recognizing this trend,the Chinese government has rolled out measures to provide institutional guarantees for the opening of Chinese market.In June 2018,China’s State Council announced a plan to increase imports especially in categories concerning livelihood improvement such as daily consumables,medicines and equipment for rehabilitation and senior care.It also required to lower tariffs on some commodities,reduce intermediate circulation links,optimize the customs clearance process for imports and promote Authorized Economic Operator(AEO) mutual recognition with foreign customs to streamline the import of global goods.

Top Imports

According to a 2019 survey of the supply and demand of major consumer goods released by China’s Ministry of Commerce,79.6 percent of Chinese consumers had purchased imported consumer goods,of whom 41.7 percent reported that at least 10 percent of their purchases were imports.About 24.1 percent of respondents revealed plans to increase purchases of imported products within six months.Imported cosmetics products,maternalinfant care products,watches and glasses were highly sought after by Chinese shoppers.

A report from Hong Kong-based Fung Business Intelligence showed consumption by people under the age of 35 accounting for 65 percent of the consumption growth in China.

Since 2016,consumption by this demographic has been growing at an average annual rate of 11 percent,twice the rate of consumers over 35.

Millennials now account for 67 percent of the total number of Chinese outbound tourists.

Young Chinese travelers spend more than twice the average of their Asian peers according to a survey commissioned by the Singapore Tourism Board.

So,what items are among the most popular imported goods for Chinese consumers?

According to the report China’s Imported Goods Market Research,consumption upgrades have spurred rapid growth for China’s crossborder e-commerce retailers.In addition to maternal and infant products,foreign items in several other categories are rising in demand among Chinese consumers —primarily cosmetics and personal care products,pet products,digital home appliances and fashionable clothing and accessories.

Cosmetics and maternalinfant care products have seen the fastest growth and largest proportion among imported consumer goods.The beauty and cosmetics category accounted for only 20.8 percent of cross-border e-commerce sales in 2014 but reached as high as 32 percent in 2018,largely thanks to a policy launched by China’s Ministry of Finance in September 2016 to cancel or lower tariffs on cosmetics and skin care products.Chinese women are willing to spend more on facial and skin care products.Maternity and infant products remain the second largest category among imported goods via cross-border e-commerce despite slightly slowing growth,rising to 19 percent in 2018.

The imports section of a supermarket in Zhenjiang,Jiangsu Province.

A chef cuts a huge tuna at a high-end grocery in Guangzhou,Guangdong Province.

Digital home appliances and pet products have emerged as new favorites.Since 2014,retail sales of imported digital home appliances in China have maintained an increase of more than 100 percent with unit prices for products in this category growing by 132 percent between 2014 and 2018 and the proportion of total sales volume skyrocketing from 1.8 percent in 2014 to 6.3 percent in 2018.Chinese consumption of pet products has increased remarkably in recent years with a share rising tenfold from 0.1 percent in 2016 to 1.1 percent in 2018.Digital home appliances and pet products have become the two fastest growing categories among imported consumer goods in China.

Apparel and accessories are becoming potential growth points for cross-border e-commerce retailers.Young Chinese are showing diverse preferences for shopping with increasingly personalized tastes.They are more inclined to purchase high-end consumer goods that reflect their personalities.Fashionable apparel and accessories help with the personalization.In recent years,the rising popularity of light luxury goods complemented by marketing strategies of international fashion brands has made chic clothing and accessories the pillar offerings of many e-commerce platforms.Tmall Global,for example,has seen steady growth in clothing sales.The average unit price for products in this category increased from 517 yuan(US$73.5) in 2014 to 694 yuan(US$98.7) in 2018,up 34 percent.Even brighter prospects for this market are on the horizon.

Where Are the Opportunities for Southeast Asia?

Payments for imported consumer goods by category (2014-2018)

Another trend for China’s imported consumer goods market is import source diversification characterized by an increasing number of import source countries.By 2019,Tmall Global alone had introduced nearly 22,000 overseas brands across 4,300 categories and from 78 countries into the Chinese market,more than 80 percent of which were imported to China for the first time.Diversified import sources result from the development and popularization of cross-border e-commerce platforms as well as reduced international trade barriers.Japan,the United States,Australia,Germany and South Korea remain top source countries for Chinese imports,each with competitive edges in certain categories.For example,Japan and South Korea are the most popular destinations for Chinese tourists,whose enthusiasm for skin care products from these two Asian neighboring countries is another boon.

But where are the opportunities for Southeast Asian countries?

At the second CIIE,Charoen Pokphand (CP) Group from Thailand rented 12 business units to exhibit a wide variety of food and agricultural products including poultry,seafood,instant food,ready-to-eat meals,bird’s nests,rice and rice processed products,condiments,Thai desserts,fruits,coffee and pet food.Ye Jian,vice chairman of the agricultural and animal husbandry food enterprise(Chinese region) of CP Group told China Report ASEAN that the Thai food conglomerate brought nearly 400 kinds of products to the exhibition including many new products by the group.“I hope that the Expo will help introduce our company’s high-quality,safe,healthy and delicious products from all over the world to China to better meet the needs of Chinese consumers,promote the development of trade between Thailand and China and share opportunities with China,”Ye proclaimed.

CP Group’s success in the Chinese market can be largely attributed to its clear understanding of its advantages.Across the vast ASEAN region,the member states contrast each other in the level of economic development,which determines the diversity of their exports to China.For example,Singapore is well developed in the petrochemical industry and manufacturing,so its main exports to China are electrical machinery,electrical products and petrochemicals as well as optical,photographic and medical equipment and parts.In contrast,the relatively low economic development level of Cambodia means its main exports are wood,clothing and rubber.

Notably,food specialties from different ASEAN countries enjoy great popularity among Chinese consumers.JD.com,a leading Chinese e-commerce platform,provides various real-time ranking data for Chinese consumers.In its ranking of imported food brands released this December,three of the top 10 were from ASEAN countries:Oishi prawn crackers from Vietnam,Gemez Enaak noodle snack from Indonesia and Uncle MO dried figs from Malaysia.In the ranking of imported coffee brands,five of the top 10 came from the ASEAN countries of Vietnam,Singapore and Malaysia.The ranking list of imported snacks featured a stunning performance by ASEAN countries,with their brands grabbing first,third,and fifth to ninth places:Lipo cream egg cookies from Vietnam,Bike Boy cereal bar with chocolate from Malaysia,Danisa butter cookies from Indonesia,Cocon multi-flavor pudding from Malaysia,Bento squid seafood snack from Thailand,Gotogo cake roll from Malaysia and DAN D PAK crisp cashews from Vietnam.

In addition to food,other local specialties from Southeast Asian countries are also highly sought after by Chinese consumers.Thai latex pillows,for instance,occupy nine of the top 10 imported pillow brands on JD.com.Mahogany furniture from Laos,emerald jewelry from Myanmar and incense from Vietnam all sell well in the Chinese market.

Even so,to seize greater success in the Chinese consumer market,ASEAN exports need to better meet the rising expectations of Chinese consumers who are notoriously picky.A Ministry of Commerce report showed that Chinese consumers highly value safety when buying food,maternal and infant products,cosmetics and passenger cars,while in categories of garments and footwear,watches,and jewelry,they make decisions based on design and style.Compared to leading global brands,ASEAN imports in the Chinese market generally perform weaker in brand trust and the greatest sector remains agricultural and fishing products and processed products with low added value.For such reasons,ASEAN products still have massive potential to serve the Chinese market.

- China Report Asean的其它文章

- BINGE BUYING IN NUMBERS Online shopping-driven economics

- FLAGSHIP OF BRUNEI-CHINA COOPERATION A refinery and petrochemical plant begins commercial operation in Brunei

- EMPOWERING REMOTE INDONESIA Chinese-funded power plant helping boost development in isolated regions of Indonesia

- DAWN OF AN ERA OF NEW CONSUMPTION

- SHARING REAL CHINA A journey of discovery by mainstream ASEAN media

- JEFFREY CHEAH:SUSTAINABLE DEVELOPER A Malaysian entrepreneur leads with concrete action