A Silver Lining

By Li Xiaoyang

Air purifiers, body fat scales and water filters seem to be the modern bywords of citizens pursuing a high-quality life. Once exclusively possessions of the young, they are now used across the age spectrum. Data released by Fanli.com, a Chinese online shopping discounts site, shows that purchases of these goods by those over 50 have signif icantly increased.

As China sees a rising elderly population with demands of a healthier and higher-quality life, the potential of the silver economy is ready to be unleashed. Ranging from medical facilities to diet products and even smart devices, their needs are creating a blue ocean market.

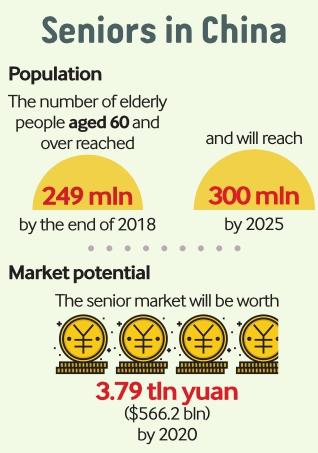

According to a report released by the China National Commission on Aging, Chinas senior market will be worth 3.79 trillion yuan ($566.2 billion) by 2020. However, products and services targeting the elderly are still inadequate.

To better cope with an aging population, Chinas State Council General Offi ce has recently released a regulation to improve elderly care services and meet the diverse and multi-tiered needs of elderly people by 2022.

“Elderly consumption has traditionally focused on basic necessities. But nowadays, growth of traditional consumption has slowed, while diversified market demands are steadily driving the improvement of products and services for the elderly,” said Wang Lili, a researcher with the China Research Center on Aging.

An emerging market

Offi cial data shows that the number of elderly people aged 60 and over in China reached 249 million by the end of 2018, accounting for 17.9 percent of the total population. In 2017, the number of new elderly people exceeded 10 million for the fi rst time. From 1999, when China fi rst witnessed an aging population, to 2018, the net increase of Chinas elderly population was 118 million, the largest cohort of those over 60 in the world.

According to a blue paper jointly released by the Chinese Aging Well Association and the Social Sciences Academic Press, the number of people aged 60 and above will reach 300 million by 2025.

The report suggests that domestic seniors are paying more attention to health-related information with an increased demand for related services, especially those who are incapacitated, single or of more advanced years.

As the income of the elderly generation improves, an increasing number have higher requirements regarding the quality of life, with clear growth in industries such as recreational activities. As Wang suggested, daily expenditure makes up a large share of senior consumption, and elderly consumers have a high loyalty for care products and brands. Elderly Chinese people are also increasingly embracing online, customized, experience-oriented and smart consumption patterns, creating new market demands and driving the silver economy.

A way to go

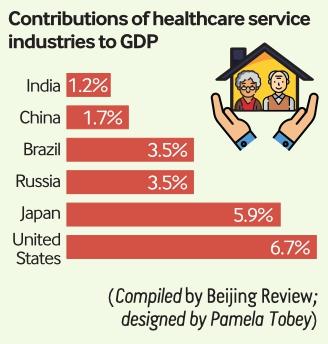

Chinas senior care industry has seen rapid development in recent years, while its contribution to consumption is less prominent than those in developed and emerging economies.

In Japan and the United States, two highly developed nations, proportion of healthcare service industries in total economic yields is 5.9 percent and 6.7 percent respectively, while the figure for China stands at 1.7 percent. China only has around 2,000 types of products targeting elderly people, while there are more than 60,000 types in the global market, the report said.

With the rising demands of domestic seniors, suffi cient market supply is not yet in place. The report indicates that the growth of the silver economy is still restrained by low-quality services and products.

Chinas fast and ongoing urbanization has inadvertently resulted in an expanding group of empty-nesters. Those without children nearby are more prone to be cheated into buying lowquality products, such as some self-proclaimed nutrition supplements, which are nothing more than a pill made of sugar and starch. Research shows around 37 percent of senior Chinese people have experienced fraud, possibly as a result of being lonely.

The current elderly care service is in need of supply-side reform to create new alternatives to meet the expectation of the elderly, since over 82 percent of Chinese seniors still prefer to stay at home in their winter years. Wang said that the appetite for moving to a care home diminishes as people age. She said domestic seniors receiving in-home care have been increasing as the population ages and people live longer.

Multi-pronged efforts

According to the blue paper, China has grown old before becoming rich. Once the aging population can no longer be supported by the countrys economic growth, great challenges will materialize.

The matter is becoming more pressing as the parents of Chinas one child generation grow older. Its typical for a married couple who come from this group to support four elderly parents, posing an even greater pressure for the couple if any of the parents develops an illness and requires round the clock care. The supply of services to these families falls short as public nursing institutions generally focus on services for those who can take care of themselves.

To narrow the gap between supply and demand in the senior market and cope with the aging pressure, the report emphasizes that efforts should be made to enhance the quality of elderly care and improve facilities. Commercial pension insurance providers are encouraged to deliver long-term services.

Elderly care institutions, as well as urban and rural communities, are also expected to establish service centers where devices such as hearing and walking aids, as well as other assistive products can be rented.

In Zhuhai, south Chinas Guangdong Province, 10 canteens have been established to free seniors from the diffi culties of cooking. Currently, these canteens can serve 500 elderly people per day. Local authorities have announced they will add another 18 canteens this year, extending its functions to cover medical treatment and healthcare.

The issuance of the regulation is expected to bring some changes to the table. A system will be developed to evaluate the skills of caregivers and provide them with education and training opportunities. It also stresses the need to establish a supervision system, deepen reform of public-funded elderly care organizations and improve targeted investment by the government.

Since fraud targeting the elderly is still rampant, the regulation demands protection of the elderlys rights and interests and proposes measures dealing with illegal fund-raising conducted among the elderly population.

Enterprises are encouraged to design and produce diversified, personalized and userfriendly products for seniors to meet their needs, such as developing dieting products suitable for older peoples composition.

According to Wang, the mentality of elderly consumers is slightly different from other groups of buyers for they tend to focus on the quality of goods while also preferring bargains. In this regard, enterprises need to develop products more in line with their demands to tap into the consumption potential.

As she predicted, Chinas senior market will continue to be dominated by products such as rehabilitation devices, health products and nursing materials.

According to Wu Yushao, Deputy Director of the China National Commission on Aging, the industries targeting seniors are expected to expand while providing identifi able benefi ts at the same time. “Elderly care industries will serve as key forces for upgrading Chinas consumption, improving peoples wellbeing and promoting employment,” Wu concluded.