Less Is More

By Wang Jun

After their personal income tax threshold was raised from 3,500 yuan ($500) to 5,000 yuan ($720) as of October 1, Chinese taxpayers burdens will be further reduced with details of new deductible items clarifi ed.

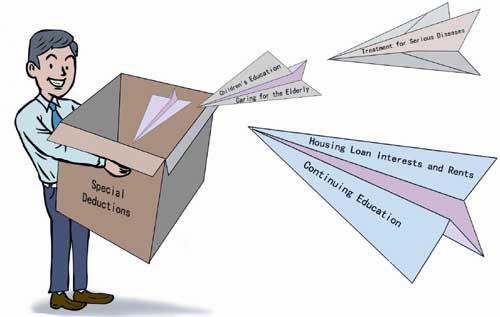

According to the Individual Income Tax Law amended on August 31, taxable incomes will have special deductions for childrens education, continuing education, treatment for serious diseases, caring for the elderly, as well as housing loan interests and rents. On October 20, authorities unveiled draft temporary measures on these deductions for public feedback for two weeks.

The final rules for special deductions will go into effect as of January 1, 2019.

Education expenses

The deduction for childrens education will cover both pre-school education, starting with 3-year-olds, and academic education starting from primary school to doctoral programs. The amount will be 12,000 yuan($1,730) annually for each child from the parents taxable income.

Gan Li, head of the Research Institute of Economics and Management of the Southwestern University of Finance and Economics, told Xinhua News Agency that the 12,000-yuan deduction can largely cover average childrens expenditures for different educational stages throughout the country. It is equivalent to two monthsaverage wage of an urban employee.

“Deductions based on a universal and fixed sum for different regions and different educational stages will help simplify the tax structure, reduce taxation costs and prevent fraud,” Gan said.

For continuing education, 4,800 yuan($690) for academic studies or 3,600 yuan($518) for professional qualif ication or certificate training will be deducted annually for each taxpayer.

Xu Jianguo, a professor at the School of Public Finance and Taxation at the Zhongnan University of Economics and Law, told Xinhua that the different deductions take into consideration that fees for continuing academic education, especially on-the-job postgraduate education, are generally higher than those for non-academic education.

Recreational training courses such as painting or sports are not included in the deductible items because they are not deemed closely related to professional skills.

Medical costs

In terms of medical costs for serious diseases within any tax year, money paid by each patient above 15,000 yuan ($2,160) in the medical insurance system will be deducted up to the annual cap of 60,000 yuan ($8,640).

Since a unifi ed medical insurance program covering both urban and rural areas has been established in China, only a small percentage of the medical bills are paid by patients themselves. Therefore the annual cap of 60,000 yuan is estimated to be able to cover most of the expenditures incurred for serious illnesses.

Sun Gang, a research fellow with the Chinese Academy of Fiscal Science, said that according to the World Health Organization, when a familys medical expenditure is above 40 percent of its total expenses, it is defined as disastrous medical expenditure. Calculated by this standard, the disastrous medical expenditure for average Chinese families is about 16,000 yuan ($2,296). Considering the incomes and the risk-tolerant capacity of different taxpayers, it is reasonable to set the deduction threshold for medical costs at 15,000 yuan.

“Setting the deduction threshold for medical costs at 15,000 yuan shows solicitude for families with seriously ill patients,”Sun said.

Housing expenditure

As for mortgage interests for a taxpayer or his or her spouses fi rst home, 12,000 yuan is tax deductible each year for the couple during the period of installment.

Gan said limiting deduction to loan interests for a first home is in line with the real estate regulation policy to restrict housing speculation and ensure basic housing needs. The 1,000-yuan ($144) monthly deduction standard also takes into account the average monthly interest of 1,025-1,189 yuan ($148-171) on housing loans offered by commercial banks.

According to Gan, in countries such as the Republic of Korea, Mexico and Italy, the deductible amount for housing loan interests normally accounts for 10 to 15 percent of per-capita monthly wages, while in China, the proposed proportion is 15 percent, which is at a comparatively higher level.

For home rents, the deduction will be 14,400 yuan ($2,075) each year in mega and large cities such as Beijing, Shanghai, provincial capitals and other cities designated by the State Council, 12,000 yuan each year in medium-sized cities with a population above 1 million, and 9,600 yuan($1,380) each year in small cities.

Sun said that such deduction standards for home rents are consistent with the average rent level throughout the country and take into consideration the different rent levels in different regions.

Spending on aging parents

For taxpayers who are supporting parents above 60 years, the deduction will be 24,000 yuan ($3,460) each year for an only child, or be divided among all siblings if there is more than one child.

Liu Yi, a professor at the School of Economics at Peking University, told Xinhua that the deduction offered for supporting seniors is in line with stipulations in the law on the protection of the rights and interests of the elderly and retired, which is acceptable to society.

“Among the deductible items, only the standards for home rents vary in different regions, with all the other items having universal standards. This will make deductions much easier,” Liu said.

“For a person whose monthly salary is 20,000 yuan ($2,882), before the tax reform, he had to pay 3,120 yuan ($449) in personal income tax each month. But after the latest reform, it may decrease by 2,290 yuan ($330) at most, with the tax burden lowered by 73.4 percent. Such a range of tax cuts will obviously be felt by average people,” Gan said at an interview with Peoples Daily.

The tax relief range will vary with each individual, depending on his or her income and how many deductible items he or she can claim. “In general, the heavier family burden a person assumes, the more deductions he or she will enjoy,” Gan said.