BOC BRUNEI FINANCING CHINA-BRUNEI COOPERATION

By Wang Fengjuan, Liao Bowen

Wang Xiaolin, governor of the Brunei Branch of Bank of China (Hong Kong).

A white three-story building with a signboard bearing the inscription “Bank of China”(BOC) in Chinese, English and Jawi stands in Bandar Seri Begawan, the capital of Brunei. On December 20,2016, the BOC Brunei Branch officially opened, an event listed as one of the“top 10 news stories of the year in Brunei” by Sin Chew Daily, a newspaper circulated throughout Malaysia and neighboring countries including Brunei and Indonesia.

“The BOC Brunei Branch was thefirst Chinese-fundedfinancial institution in Brunei, and its establishment signaled that Chinesefinancial institutions had achieved full coverage of ASEAN countries,” remarks Wang Xiaolin,governor of the BOC Brunei Branch. For banking practitioners, Brunei’s longterm political stability and friendly relations with China provide favorable conditions to developfinancial business.

“The launch of the BOC Brunei Branch was a milestone event for Brunei,” says the president of the Monetary Authority of Brunei Darussalam. “It has inspired more Chinese entrepreneurs to set their sights on Brunei and invest in the country. Brunei is also opening its door to more Chinesefinancial institutions.”

Financial Support for Bilateral Cooperation

In recent years, the Brunei government has eyed developing Brunei into a regionalfinancial center by taking advantage of its geographical location at the heart of Southeast Asia.The Brunei International Financial Center, established in 2000, aims to attract more foreign investment through providing value-addedfinancial services for investors to create more job opportunities and prompt domestic economic growth.

However, Citibank withdrew from the Bruneian market in 2014, and then in 2016, HSBC announced that it would gradually contract its Brunei operations including retail banking, commercial banking and global banking services.In contrast to the withdrawal trend of other foreign-funded banks, the BOC began to prepare to land in Brunei in thefirst half of 2016 as an important measure to carry out China-Bruneifinancial cooperation under the Belt and Road Initiative.

It took onlyfive months for the BOC Brunei Branch to open after selection of its location. “The reason the branch could be established in such a short time was the Brunei government’s support and trust of BOC,” explains Wang Xiaolin. “As a landmark project for economic diversification of Brunei,it flashed a green light for more Chinese enterprises to enter the Southeast Asian country.”

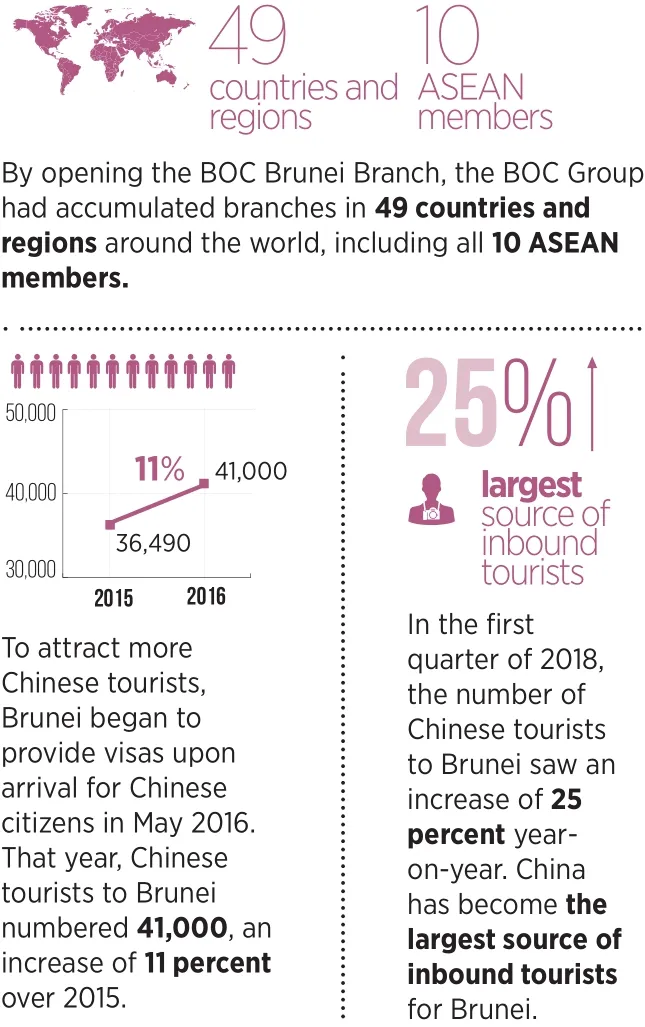

By opening the BOC Brunei Branch,the BOC Group had accumulated branches in 49 countries and regions around the world, including all 10 ASEAN members.

The BOC Brunei Branch official inauguration on December 20, 2016.

According to Chinese Ambassador to Brunei Yang Jian, the establishment of the BOC branch in Brunei lifted cooperation between the two countries to a new level. “The BOC Brunei Branch will offer qualityfinancial services to both Bruneian and Chinese enterprises,” she declares. “It will serve Bruneian society and facilitate bilateral economic and trade cooperation.”

“The BOC will play a positive role infields such as serving foreign direct investment, propelling the development of small and micro enterprises and promoting China-Brunei economic and trade cooperation,” asserts Bruneian Minister of Home Affairs Abu Bakar Apong. He added that as increasing numbers of Chinese companies have settled in Brunei, China has become Brunei’s largest trading partner and the two countries will achieve win-win cooperation in even more realms under the guidance of Brunei Vision 2035 and the China-proposed Belt and Road Initiative.

The BOC Brunei Branch was thefirst Chinese-fundedfinancial institution in Brunei, and its establishment signaled that Chinesefinancial institutions had achieved full coverage of ASEAN countries.

Serving Enterprises and Clients

Thanks to its rich experience in overseas markets, solid business foundation, strong capital strength,excellent operation and efficient management, the BOC has performed superbly in the market and clients’ eyes alike with its ability to provide more convenientfinancial services to local enterprises. “Seizing the opportunities presented by the Brunei government’s eager promotion of industrial diversification, investment solicitation and the development of small and medium-sized enterprises, our Brunei Branch optimizes the BOC’s advantages in client and product resources in thefields of RMB services, China-related businesses and small and mediumsized enterprises and has become a top provider of qualityfinancial services and a model of compliance withfinancial supervision rules,” says Wang Xiaolin.

Foreign-funded banks account for 20 percent of Brunei’sfinancial market. At the end of 2016, the BOC officially began operations in Brunei.Some former HSBC clients and local individual account-holders gradually embraced the BOC Brunei Branch, and its corporate clients number more than 200. “Both the Brunei Investment Agency and the Monetary Authority of Brunei Darussalam have opened business accounts at the BOC, which has critical importance for the BOC’s operations in Brunei,” notes Wang.“This also solidifies confidence in our Brunei Branch.”

After the International Monetary Fund (IMF) approved the RMB’s inclusion in its Special Drawing Rights (SDR) basket in 2016, Chinesefundedfinancial institutions began to provide RMB clearing services for ASEAN countries, becoming important channels for cross-border RMB settlement between China and ASEAN countries. “Among our clients, the contractor of Hengyi’s petrochemical project on the island of Pulau Muara Besar has entrusted our Brunei Branch to handle business services and payroll,and Beibu Gulf Port Group uses us to carry out basic settlement,” reveals Wang. He added that the BOC Brunei Branch will providefinancing support for regional infrastructure connectivity and international production capacity cooperation and facilitate all sorts of currency transactions between China and ASEAN countries by enhancing currency swaps.

Shamshad Akhtar, executive secretary of the United Nations Economic and Social Commission for Asia and the Pacific (ESCAP), once remarked that Chinesefinancial institutions in ASEAN countries have considerably consolidated economic connections within ASEAN and injected powerful impetus into the robust development of China-ASEAN economic and trade relations. In particular, the establishment of the BOC Brunei Branchfilled the void of Chinesefinancial institutions in ASEAN countries and provides

more convenient and higher-quality services for Brunei’sfinancial industry,enterprises and individual customers.

It is noteworthy that the rapid development of tourism has also provided opportunities for overseas expansion of the RMB and the BOC. To attract more Chinese tourists, Brunei began to provide visas upon arrival for Chinese citizens in May 2016. That year,Chinese tourists to Brunei numbered 41,000, an increase of 11 percent over 2015. In thefirst quarter of 2018, the number of Chinese tourists to Brunei saw an increase of 25 percent year-onyear. China has become the largest source of inbound tourists for Brunei.

“The BOC provides comprehensivefinancial services in Brunei,” stresses Wang Xiaolin. “With the founding of our Brunei Branch, UnionPay, Visa and MasterCard credit cards issued by Chinese banks can now be used throughout Brunei.”