Pattern of Opening Up, Integration and Reshaping Economic Geography—A New Economic Geography Analysis of the Belt and Road Initiative and the Yangtze River Economic Belt

Duan Wei & Wu Fuxiang*

Abstract: Since the 18th National Congress of the Communist Party of China, the central government has implemented several regional development plans,including the Belt and Road Initiative and the Yangtze River Economic Belt,aiming to reshape the economic geography of China. This paper is based on the Belt and Road Initiative and the Yangtze River Economic Belt and outlines the pattern of opening up. To analyze the impact of the pattern of opening up on the regional integration of China’s economic geography, this paper has developed a new economic geography model comprised of four regions and two countries. From this, it draws some conclusions. First, the change of pattern of opening up will lead to shifting centripetal and centrifugal forces from the international market. The greater the scale of neighboring markets,the stronger the agglomeration force will be; the more product varieties made in neighboring countries, the more potent its dispersion force. Second,developing an inland international trade corridor will decentralize industry distribution and reduce the impact of external market integration on home countries. Third, the inland international trade corridor could alter the effect of domestic market integration on the economic geography. When domestic integration occurs prior to international integration, further integration of a domestic market leads to greater industrial distribution along a bell-shaped curve, which describes economic activities from dispersion to agglomeration to decentralization. Therefore, developing an integrated market system of major countries and opening a corridor between China and Europe is not only the key to reshaping China’s economic geography but also the path to solving the problems of the Heihe-Tengchong Line.

Keywords: pattern of opening up; regional integration; reshaping economic geography; the Belt and Road Initiative; Heihe-Tengchong Line

1. Introduction

China, after implementation of the reform and opening-up policy 40 years ago,has benefited abundantly from globalization,promoting dramatically its industrialization and urbanization. However, the global trade scale has been shrinking since the U.S. subprime mortgage crisis seriously hampered global economic recovery and China’s economic restructuring. Trade is one of the main driving forces of economic growth and now that this growth has slowed, there is less room for China’s economic growth. For example,many small and medium-sized enterprises have clustered in China’s coastal areas and engaged in trade. Because of the slowdown in trade many of these enterprises have gone out of business. Also,the existing global production system has been built based on marine transportation corridors. As a result, in China, coastal areas have been more and more advantageous during the international division of labor and more open in comparison to inland areas. Gradually, these two types of areas have been divided by the distinctive “Heihe-Tengchong Line.”Areas on the north side of the “Heihe-Tengchong Line” are underdeveloped. The issue becomes one of principal social contradictions in China in the new era. It should be solved by a new regional development pattern.

The economic geography must be reshaped in China to develop new trade growth drivers and solve unbalanced economic development on both sides of the “Heihe-Tengchong Line.” Consequently, since the 18th National Congress of the Communist Party of China, the central government has implemented several regional development plans, including the Belt and Road Initiative and the Yangtze River Economic Belt. The new pattern of opening up is outlined based on the Belt and Road Initiative and the Yangtze River Economic Belt. The pattern of opening up, which used to focus on coastal areas in Southeast China, has been expanded westward and eastward simultaneously to expand opening up in inland and border areas facilitating the integration in China and the world. In the Vision and Proposed Actions Outlined on Jointly Building the Silk Road Economic Belt and the 21st-Century Maritime Silk Road, it has been put forward that infrastructure connectivity is a priority while investment and trade cooperation are a major part of implementing the Belt and Road Initiative. The Outline of the Yangtze River Economic Belt Development Plan proposes accelerating the building of comprehensive transportation corridors and constructing new allround pattern of opening up.

In theory, the new pattern of opening up conforms to characteristics of integration,correspondingly leading to a change in the structure of economic geography. On one hand, international trade will absolutely change with respect to scale and structure based on policies regarding communication and facilities connectivity. On the other hand,changes in the trade structure will lead to a flow of domestic factors in production, leading to a redistribution of productivity. It should be noted that the impact of integration may vary under different development stages. According to the new economic geography, integration leads to agglomeration or dispersion of economic activities. For example,in the C-P model designed by Krugman, regional integration led to agglomeration of economic geography.①Krugman,1991The economic geography became decentralized after negative externality was added in the model.②Helpman,1998Krugman and Helpman reached opposite conclusions because they concentrated on different development stages of integration. Pfluger and Tabuchi thought that industrial agglomeration would increase first and decrease later along with intensified integration.①Pfluger & Tabuchi, 2010The process formed a bellshaped curve. Krugman focused on the right side of the curve, in which the integration level was lower,while Helpman focused on the left side where the integration level was higher. How will economic geography develop in China? Will it develop from the right side of the bell-shaped curve to the left side? If these issues cannot be explained by any theory, they will affect major decisions made on industrial distribution and hinder implementation of prospective regional plans.

The marginal contribution of this paper is that it builds a new economic geography model comprised of four regions and two countries with asymmetrical geographical conditions. It introduces the crowding effect as the variable. Based on numerical simulations, it compares the relationship between the integration levels and industrial distributions under different pattern of opening ups to predict and analyze the evolving economic geography pattern in theory. Furthermore, it considers changes in the pattern of opening up and highlights the competition diversion effects caused by international trade. After combining two evolution directions of economic geography, i.e., “from dispersion to agglomeration”and “from agglomeration to dispersion,” which have been put forward by Krugman and Helpman respectively, this paper analyzes international trade along a bell-shaped curve, which describes economic activities from “dispersion to agglomeration to decentralization.”

2. Literature Review

It has been demonstrated in theory and in practice that international trade will influence productivity distribution. An immense number of theoretical studies have been conducted on the combination of trade and productivity distribution from two perspectives. First is the theory of comparative advantage highlighting the role of First Nature. Second is the theory of new economic geography stressing the function of Second Nature.②Krugman, 1993“First Nature” refers to natural endowments such as natural factors of production and geographical conditions. Adam Smith alluded to the concept of absolute advantage while David Ricardo developed the law of comparative advantage. The Heckscher-Ohlin theory of comparative advantage emphasized factor endowment. These underlined the decisive effect of initial factor endowment. The theory of comparative advantage has been primarily applied to analyzing international trade issues. It is also suitable for solving regional trade issues in a country.③Huang & Li, 2006However, differences in initial factor endowments cannot clearly explain phenomena such as late development or intra-industry trade.As a result, some scholars tried to endogenize the theories of comparative advantage and the division of labor. For example, Grossman and Helpman introduced monopolistic competition to the frame of international trade to study dynamically specific trade models brought by technological advantages in each point of time.④Grossman & Helpman,1991Yang Xiaokai, after considering the transaction costs and endogenizing division of labor, described the dynamic comparative advantage caused by internal connections between the trade model and the division of labor and gave consideration to the role of exogenous comparative advantage.①Yang,1999

“Second Nature” refers to the impacts on economic activities caused by entities’ endogenous selections in the economic system. The new economic geography put forward by Krugman is a major school.②Krugman, 1991“First Nature” is crucial. However,it is biased to consider the exogenous factor as the only thing that impacts trade and productivity distributions. Along with enhanced integration at all levels, change of trade barriers has exerted significant impact on economic geography.The spatial distribution of industries has been endogenized after the introduction of economies of scale and trade costs, generating a broader view for analysis of the new economic geography.③Liang, 2005The new economic geography relaxes the assumption of factor mobility, making it more vivid to clarify the internal mechanism of reshaping economic geography.

Some scholars have already realized that domestic and international economic activities should be associated to study regional issues. As a result, they tried to combine conditions of “First Nature” and “Second Nature” to conduct research.For example, Behrens et al.,④Behrens et al., 2007Behrens,⑤Behrens, 2011and Xu Deyou and Liang Qing,⑥Xu & Liang, 2012based on changes in the costs of foreign trade and domestic trade, applied the new economic geography model comprised of two countries and multiple regions to study the impact of trade costs on industrial distribution.Yin Hongpan thought that China’s economic geography could be reshaped via redevelopment of“First Nature” conditions in Central and Western China in combination with the new pattern of opening up.⑦Yin, 2012An Husen and Liu Junhui applied the theory of new economic geography to analyze the impact of the establishment of the China-Japan-South Korea Free Trade Zone.⑧An & Liu, 2014When the level of trade liberalization is lower, the market scale is the main factor influencing the industry scale and the welfare level. The comparative advantage plays the key role in the case of free trade. Behrens et al.believed that the most vulnerable part of the new economic geography lies in geographical factors.⑨Behrens et al., 2006Consequently, Behrens et al. assumed a region in a country as a port for international trade. They have successfully merged geographical factors in the frame of new economic geography to achieve results which are closer to reality.

Industrial distribution and trade in China has already been analyzed from different perspectives.Lin Yifu and Liu Peilin pointed out that the increasingly widening income gap in different regions is caused by the deviation of the industrial structure and the comparative advantage in Central and Western China.⑩Lin & Liu, 2003China joined the WTO to boost international integration to restrain further widening of the income gap. Cai Fang,after comparing total factor productivity in all regions, thought that in the post financial crisis era, the labor-intensive industry may not inevitably transfer to foreign countries. It can transfer to Central and Western China.①Cai, 2009Jin Xiangrong et al.studied the impact of infrastructures on regional and interregional trade.②Jin et al., 2012The government needs to consider the industrial distribution in two regions when investing in construction of infrastructures.Hu Anjun and Sun Jiuwen thought that the manufacturing industry would transfer along with decreased trade cost and relative changes in the market scale in a country.③Hu & Sun, 2012They also proved with data that industries in Eastern China have been successively transferred to Central and Western China according to elasticity of substitution of industries. Ni Pengfei et al. explored the reasons for urbanization lagging behind industrialization from the perspective of international trade and believed that the larger the proportion of net exports is, the more severely urbanization lags behind industrialization.④Ni, et al., 2014

All these studies agreed that reshaping economic geography is essential for optimization of China’s industrial distribution. It can be seen from existing papers that few theoretical studies have been conducted on the new pattern of opening up outlined by the Belt and Road Initiative and the Yangtze River Economic Belt. Nor are there many research tools with respect to the issue. This paper considers both “First Nature” and “Second Nature”factors and extends the analysis frames developed by Ottviano and Ypersele⑤Ottviano & Ypersele, 2005and Behrens et al. to theoretically analyze the Belt and Road Initiative and the Yangtze River Economic Belt from the perspective of the new economic geography.⑥Behrens et al., 2006It focuses on dynamic evolution of the trade patterns and stages of economic development. It analyzes the impact of integration in different regions to discuss the profound influence on China’s economic development in the future under the new pattern of opening up.

3. Basic Models Based on Changed Pattern of opening up

3.1 Free Capital Models in Two Countries and Four Regions

This paper uses the model designed by Behrens et al. and assumes that the economic system comprises two countries, four regions, two departments and two types of factors.⑦Behrens et al., 2006These two countries are H and F. H consists of two regions,i.e., A and B. A and Eastern China share similar conditions. In this paper, A is referred to as the port area. B is equal to Central and Western China and is referred to as the inland area. F is the sum of countries except H in the world and comprises the regions of F1 and F2. F2 is like Europe, Central Asia and Western Asia while F1 is parallel to Pan Pacific.Regarding the two departments, one is traditional and featured by perfect competition, that is, fixed scale and payment, while the other is modern and featured by monopolistic competition with incremental scale and payment. Labor and capital are two factors of production. Labor is applied to the traditional department while the capital goes to the modern department.

Labor cannot flow among regions but can flow between the traditional and the modern departments. Capital, which is applied to the modern department exclusively, frequently flows among regions. In the model, parameter λ, which indicates spatial distribution of capital in H, is an endogenous variable, standing for the proportion of capital in A in total capital in H. Output in modern departments in A, B, F1 and F2 is nA,nB, nF1 and nF2 respectively. The total output of economic entities is. If the modern department is featured by monopolistic competition with incremental scale and payment,manufacturers manufacture single and different products respectively. N also stands for the number of manufacturers in modern departments in these two countries. Suppose each manufacturer spends one unit of capital as fixed input to manufacture different industrial goods. Total capital in H amounts to K. In that case, nA+nB=K. Capital invested in A is λK and (l-λ) K in B. Workers share equally the capital and the final capital gain. Total capital in F is σK, in which nF1=σ1K, nF2=σ2K and σ1+σ2=σ. As a result, n=(1+σ)K.

Consumers’ utility functions are quasilinear and the formula is:

Their budget constraint is:

In which qi(v) and pi(v) stand for consumption and price of differential industrial products v manufactured by modern departments in i. piZ and Zi are consumption and price of traditional products consumed in i. yi is the consumers’ income; the initial endowment of traditional products Z0 > 0 to ensure positive consumption. α> 0, indicating consumers’ preference for differential industrial products; γ> 0, standing for substituting capacity among differential products. β> 0, being the condition for quadratic utility sub-function of quasilinear preference to be convex. It represents preference for a certain product category.

When the first-order condition to maximize consumers’ utility is sloved, the demand function is:

In

which stands for the price index in region i.

Suppose workers can move around between the two departments and the cost is zero to transport traditional products. In general, if the traditional department depends on a unit of labor to produce a unit of product, we can determine standard salary per worker and pricing of traditional products in two regions, that is,.

If initial labor and capital distribute symmetrically in H, the number of workers and the capital amount are L/2 and K/2 in the two regions respectively.①The hypothesis of symmetry is applied to simplifying difficulty of the model solution so that the study can be concentrated on impact caused by regional integration. In fact, analysis on integration will not be affected even if initial labor and capital do not distribute symmetrically in the two regions.In F1 and F2, suppose the numbers of workers are φ1L and φ2L respectively and φ1+φ2=φ,which is a constant value. Moreover, φ1>φ2, that is,the market in F1 is larger than that in F2. Suppose φ1/φ2=σ1/σ2,②Yan Yingen, 2014i.e., the ratio between market potential equals to that of capital in the two regions.It can be seen that the market scale and capital are proportional to the export volume. Hence, M, the market scales in these regions, should be:

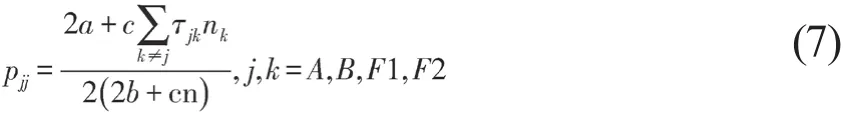

Based on profitability of domestic producers, the manufacturer may master certain monopoly power and can adopt the strategy of price discrimination in different markets. Profits made by producers in A and B can be divided as:

In which πjk stands for profits made by the manufacturer in j from selling products in k.Pjk is the price of products manufactured by the manufacturer in j and sold in k. τjk is the trade cost to transport products from j to k to be sold and τjk=τkj. After the first-order condition is solved to maximize profits, pricing of manufacturers that cross regions to sell products is:

If the trade cost is zero to sell products manufactured locally in the local market, i.e., τjj=0,it can be deduced from formula (5) retail prices of products in these regions:

Capital gains in two regions can be obtained after formulas (6) and (7) are put into formula (5).In Krugman’s analytical framework, he focused on agglomeration instead of dispersion in the economic system. In fact, China's manufacturing industries are suffering excess capacity. In that case,industrial agglomeration tends to drive the surging of prices of factors of production such as land and labor. Moreover, it results in urban diseases such as population explosions, traffic jams, environmental pollution and shortages of housing and job opportunities. Hence, this paper adds to the model an additional congestion cost①Wu & Duan, 2017and sets the formula of capital gain as:②Suppose the labor market is perfectively competitive. Profits made by enterprises are capital gain.

In which δˉnA stands for the sum of negative externality and δˉ>0 is a constant. Externality is in direct proportion to the number of manufacturers.

3.2 Trade Terms under Various Pattern of opening up

Judging from development histories in all countries, economic activities often cluster in coastal regions. On one hand, these regions house natural maritime trade corridors. On the other hand, the ocean freight cost drops along with improved navigation technology. However, along with globalization and advanced transportation,trade terms in a region can be redefined by artificial means. For example, based on the “Silk Road Economic Belt,” a brand new inland international trade corridor can be developed. Other policies on regional integration can also contribute to less separation of markets. This paper is based on that background and sets a new international trade corridor between B and F2. Consequently,the international trade pattern and the domestic industrial distribution will change accordingly.

Change of trade terms will be discussed in three stages respectively based on the integration degree and progress made on construction of the trade corridor. In the first stage, A is the trade center for manufacturers in H. Manufacturers from B must cover the extra trade cost to be engaged in international trade. A, being like the eastern coastal area of China, is closer to the international market.On the contrary, B is equal to Central and Western China. However, the trade cost differs from A to different international markets. For example, the cost is higher for manufacturers from A to trade in F2 than in F1. Suppose τAF2=θτAF1, in which θ>1,The trade costs at the first stage are:

In the second stage, an international trade corridor is established from B to F2. Moreover,τBF2<τAF2+τBA. As a result, manufacturers from B no longer need to transport goods to A to sell goods to F2. Moreover, regarding the trade cost, τAF2≤τBF2, i.e., A still enjoys the absolute advantage regarding trade cost. Manufacturers in A and F2 continue trading via the former international trade corridor. Trade between F1 and A or B is the same as that in the first stage. In general, to facilitate calculation, the trade cost between B and F2 is set as θτ. Hence, trade costs at the second stage are:

In the third stage, manufacturers in B enjoy advantages with respect to the trade cost when trading with F2. As a result, τAF2>τBF2. In the context, when τAF2≤τAB+τBF2, i.e., the integration level is low, the trade pattern is equal to that in the second stage. When τAF2>τAB+τBF2, i.e., the integration level is higher, trade between H and F2 takes place in B. The trade pattern between F1 and A or B is the same as that in the first and second stages. In general, to facilitate calculation, the trade cost between B and F2 is set as τ. Hence, trade costs at the third stage are:

Three trade conditions are listed in formulas(9)-(11b) under the pattern of opening up. Next, this paper will analyze domestic industrial distribution under different trade conditions.

4. Pattern of opening up, Integration and Industrial Distribution

4.1 Long-term Equilibrium under Different Pattern of Opening up

Capital flows between A and B for a long term.The flow direction depends on capital gain. The gap of regional capital gains is:

The gap of regional capital gain determines the industrial layout. In the system, both dispersion balance (0<λ<1) and agglomeration balance (λ=0 or λ=1) exist. The relationship between the industrial layout coefficient and the capital gain gap is:

In the model, the domestic capital distribution is under the influence of interregional and international trade costs, while trade cost is related to geography and opening patterns. This paper mainly discusses the distributed equalization of Δr=0. In the case of distributed equalization, the industrial distribution coefficient is a continuous function of various parameters. So, it is helpful for analyzing acting forces of shaping economic geography. Assume that πjk>0, j, k=A, B, F1, F2, i.e. trade occurs between any two regions. The following text discusses and analyzes three different stages of industrial distribution.

4.1.1. The first stage of trade pattern

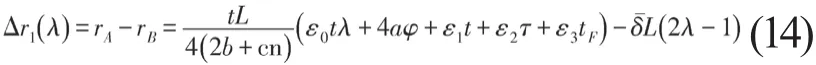

Combining the trade cost equations (9), (5)-(8), and (12), we can get the balanced capital gain difference:

In the classic new economic geography model,symmetric equilibrium usually exists when the initial labor is uniformly distributed. But if the advantage of First Nature is considered, the symmetrical productivity distribution is no longer balanced. Furthermore, when there is no complete concentration but partial equilibrium, we can get the industrial share in region A:

4.1.2 . The second stage of trade pattern

Combining the trade cost equations (10), (5)-(8),and (12), we can get the trade condition of this stage:

Where

When an interior solution exists to partial equilibrium, we can get the industrial proportion in the western region:

From the equation (17), we can know that in the first stage of trade pattern, industrial distribution is largely affected by the total international market; but in the second stage of trade pattern, the distribution of international markets becomes an important factor of industrial distribution, because of the assumption that the location advantage of region B is partially eliminated.

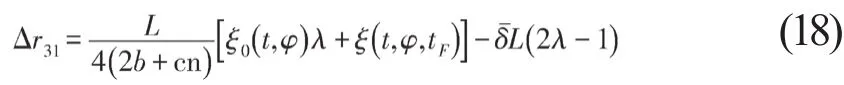

4.1.3. The third stage of trade pattern

In the stage three trade pattern, discussion is divided into two parts regarding the domestic trade cost. First, the domestic integration level is not high,namely τ+t≥θτ. Considering the trade cost equations(11a), (5)-(8) and (12), we can get this:

Where

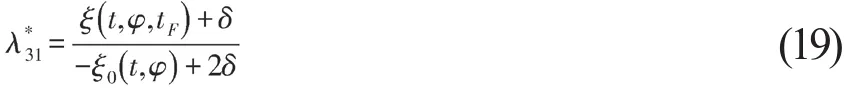

When an interior solution exists to partial equilibrium, we can get the industrial proportion in the western region:

Second, the domestic integration level is relatively high, namely τ+t<θτ. Considering the trade cost equations (11b), (5)-(8) and (12), we can get the gap in capital gains:

Where

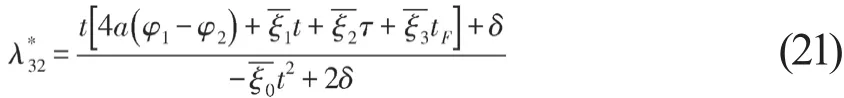

When an interior solution exists to partial equilibrium, we can get the industrial proportion in the western region:

In the third stage of trade pattern, the absolute location advantage of the region A is eliminated as the two regions have their own location advantages.Region A has a cost advantage over the region F1 and region B has a cost advantage over region F2.In this case, the two foreign regions’ difference in market capacity and capital stock determines the distribution of domestic industries.

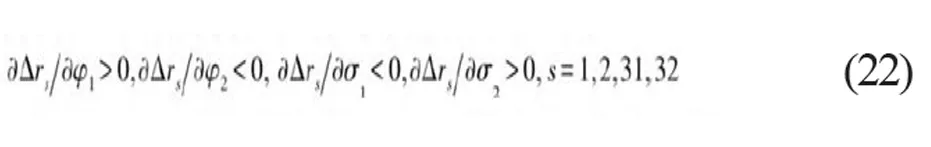

As the model considers geography and trade countries’ natural conditions, the acting force affecting domestic capital flow becomes stronger.By taking a derivative with respect to market variables, we can get this:

The equation (22) reveals that the market expansion in region F1 and the increase in imports from region F2 both provide a centripetal force which makes domestic enterprises move to eastern regions; while the market expansion in region F2 and the increase in imports from region F1 both provide a centrifugal force which fosters a scattered layout of domestic enterprises. Thus, we come to proposition 1.

Proposition 1: In the two-country four-region model of local capital flow, a pair of acting forces from the international trade market affects the site selection of enterprises. Located in certain regions,enterprises can benefit from their adjacency with international markets, or the “centripetal force.”Also, they face competition from their counterparts in the neighboring international market, or the“centrifugal force.”

From proposition 1, we learn that the domestic industrial layout can be effectively balanced if the two forces from the international market are utilized reasonably. The centripetal and centrifugal forces from the international marketplace improve the analysis of new economic geography in the open framework. In the new economic geography model based on the D-S framework, the centripetal force brought about by the home market effect is the main acting force. Especially in countries with a large trade scale, the home market effect is augmented at port areas under the open framework. In this paper, the model introduces geographically different international markets and considers the competition effect caused by foreign products. Thus, it better reflects the influence of opening-up over domestic industrial layout.

4.2 Impact of regional integration on industrial layout

In addition to overseas markets and industries,the domestic industrial layout is influenced by regional integration. One of the essential features of regional integration is reduction of trade barriers.First, the impact of the integration of international markets on industrial layout is analyzed. Then the derivative of T is taken through the difference of capital gains in three stages. The result is as follows.

As Country H is more open to the outside world,it narrows the economic distance between Country F, and t lowers. At the moment, region A which is closer to the international market will benefit more by opening up, and more capital will flow to region A.

Country F’s internal economic distance tp also has an effect on its domestic industrial layout.According to the equation (5), the result ∂πA/∂tF<0,∂πB/∂tF<0 can be obtained. Capital gains of the two regions of Country H will lower with the domestic integration of Country F. For the change of regional difference in capital gains,

The equation (24) shows, if the domestic economic distance of Country F is shortened, the gap in capital gains between region A and region B will be obviously narrowed. Under the trade pattern in the first and second stages, enterprises in Eastern China are more sensitive to foreign integration because international trade is one of the important channels for those enterprises. Most Chinese enterprises are in Eastern China, so narrowing of the foreign economic distance will heavily affect the economy of China. ∂Δr32∂tF=0 means under the trade pattern in the third stage in the context of low domestic trade costs, two domestic areas can disperse the impact of foreign integration on domestic economies. Thereout, the following propositions can be derived.

Proposition 2: In the two-country four-region model in which capital flows partially, the closer economic distance between the home country and the international market will enhance the attraction of the port area to domestic capital. As the internal trade cost of the international market lowers, the profits of domestic enterprises will also drop.The capital gains of the port area will lower more quickly. Furthermore, when both regions have relative geographical advantages, the economic impact of the integration of the international market on domestic industries will be dispersed.

From the perspective of stable industrial development and industrial safety, the third stage of trade pattern is better to resist economic risks caused by the changes in the international situation.For example, the reduction of trade barriers due to the free trade agreement reached by Country F1 and Country F2 will lower the trade benefits of Country H, and region A will experience the largest drop. As a result, the impact of the closer overseas economic distance on Country H’s industries also depends on the clustering degree of industries in region A. The higher the degree the more losses Country H will bear.

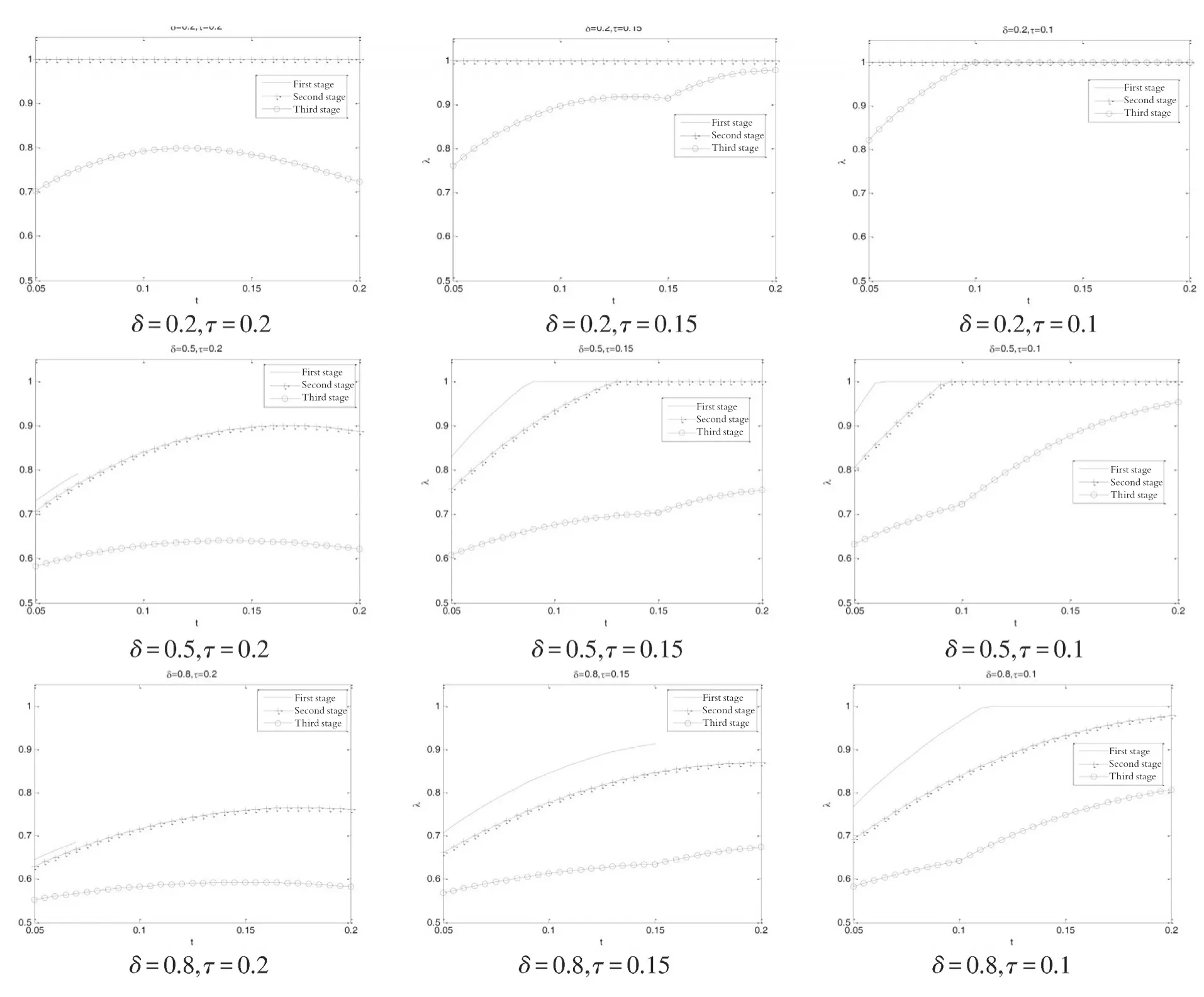

The relationship between domestic trade costs and industrial layouts is more complicated. The impact of the domestic trade costs on industrial layouts is different in the different contexts of opening up, at the different international trade costs and under the condition of different crowding effects.In this paper, analysis was conducted by means of numerical modeling. Values were set by referring to parameters in the papers of Behrensetal①Behrensetal, 2007as well as Wu Fuxiang and Cai Yue.②Wu & Cai, 2014Let a=b=cK=1,θ=2, φ1=σ1=2, φ2=σ2=1, i.e. the international close to region A is larger and with more competitive products. Values are assigned when the conditions of full opening up are satisfied. When δ=0.2, 0.5,0.8 and τ=0.2, 0.15, 0.1, the numerical modeling is conducted for industrial layout coefficients in the equations (15), (17), (19) and (21). The results are shown in figure 1.

In figure 1, the horizontal axis stands for domestic trade cost <, while the vertical axis represents industrial layout coefficient λ. Obviously,at each group, λ*1≥λ*2≥λ*3. With the gradual improvement of the second international trade channel, the industrial proportion of region A will decrease, and the industrial layout will be more balanced. It is apparent that as new trade channels are developed, the regional advantages of region B in international trade will be weakened. In addition,increases of the crowding effect δ will result in dispersion of industrial layouts. Thus, the following propositions can be derived.

Proposition 3: In the two-country four-region model in which capital flows partially, unlike a single international trade channel, new channels can lead domestic industries to a dispersive layout.Besides, with the changes in development stages,negative externalities of economic agglomeration are becoming stronger and the industrial layouts will bemore balanced.

Figure 1 Relationship between Industrial Layout and Domestic Trade Cost

Proposition 3 shows that reinventing the opening-up pattern can change the industrial layout of the country through market forces. In this case,the government does not intervene in industrial transfers through administrative means, so the more decentralized balance is stable. In addition, the restriction of the development space and the reduction of the agglomeration dividend are the internal factors that lead to industrial decentralization.Especially in the stage of excess domestic capacity,further agglomeration will only aggravate negative externalities, and the decentralization of investments in geographical space is the inevitable result of capital gains.

Next, an analysis of the impact of domestic market integration on industrial layouts. When the cost of international trade is higher than the cost of domestic trade (t = 0.2), a change in the openingup pattern will change the flow of domestic capital.In the case of a single international trade channel,the integration of a domestic market is still an important driving force to promote industrial agglomeration in accordance with the theory of the classical New Economic Geography. But when the opening-up pattern reaches the third stage, the economic geography pattern will evolve along the inverted U-shaped bell curve. On the one hand,the appearance of the bell curve comes from the congestion effect in the agglomeration area; on the other hand, it comes from the change of the openingup pattern. When the cost of international trade is relatively small, international integration is always the centripetal force to promote the accumulation of capital to ports. So here comes the following proposition.

Proposition 4: In the two-country four-region model of partial capital flow, when the cost of international trade is higher than the cost of domestic trade, the relationship between the cost of domestic trade and the difference between regional capital gains is an inverted U-shaped type. However, when both regions have relative geographical advantages,the impact of lowering domestic trade costs on industrial layouts is uncertain. When the export market size of the two regions is similar or foreign products have little impact on the domestic market,the domestic trade costs and agglomeration levels are positively correlated.

Proposition 4 points out the geographical conditions of the space bell curve which is the general rule of economic geography evolution, and the only way for the development of great powers. However,under certain circumstances, the space bell curve is difficult to form. One is that the market is severely divided and cannot be unified, which hinders the agglomeration of economic activities. The other is that the geographic conditions are so different that the core areas become “black holes” that the capital cannot escape, thus the peripheral area faces the risk of industrial hollowing. Therefore, the numerical simulation results in Fig. 1 show that the bell curve can only appear in the third stage of the opening-up pattern because the proximity to the port area has absolute location advantage in the international trade system dominated by sea transportation.

Besides, the necessary condition for the bell curve is that the negative externalities of economic agglomeration are more obvious. Because the core area is limited by the carrying capacity of resources,the higher the economic density is, the greater the negative externalities it will bear. When the marginal profit of agglomeration is less than the marginal cost, the competitive effect will slop over some industries in the core area and form the industrial spillover effect to the peripheral area.

5. Conclusion and implications

Based on the perspective of domestic capital flow, this paper developed a model for two countries and four regions, and made a theoretical analysis of the effects of the new patterns of regional development, such as the “Belt and Road” Initiative and the Yangtze River Economic Belt, on the domestic economic geography. The conclusions of the study are: First, the openness of the national industrial distribution may be affected by international trade partners, that is, a larger international market scale in the vicinity of the region may lead to a powerful agglomeration in the industry of the region, more competitive products in the region nearby, and thus the greater dispersion force for the industry to escape from the region. Second, construction of international trade channels for the inland is conducive to reducing the impact of the international market changes on the domestic industries depending on the market forces to balance the industrial distribution. Third, after the international trade channel is opened to the inland,as the international trade cost is greater than the domestic trade cost, the domestic market integration would result in the evolution of the industrial distribution along the path of the “bell-shaped curve” of “agglomeration and then dispersion.” On the contrary, when the international trade cost is relatively smaller than the domestic trade cost, the domestic market integration may facilitate further agglomeration. The implications of this study lie in the following aspects:

First, to open up the international trade channel by land and deepen the opening-up is key to cracking the Heihe-Tengchong Line problem. In the principle of the priority given to infrastructure, overland international trade can be normalized through initiative exchanges among the countries along the Silk Road Economic Belt and joint construction of the railways and partial highways across the Eurasian continent. Geographically, the northern region of the Heihe-Tengchong Line is nearer to the international trade partner countries along the economic belt and it is necessary to enhance the industrial matching between the Chinese central and western cities and their trade partner countries. On one hand, the central and western regions need to make the most of the resources, energies and trade on the continent to upgrade the capital deviation importing more complicated production lines.On the other hand, thanks to the eastern region’s slackening the entry barrier to some fields by adopting the managerial approach to the “negative list,” the enterprises in the region are confronted with intense international market competition, the bankrupt enterprises are upgraded into new forms and consequently partial production capacity is transferred to the fairly advantaged central and western regions.

Second, deep the reform of international capacity cooperation. In the process of infrastructure construction, on one hand the countries along the Silk Road Economic Belt can realize industrialization, bring along employment, and achieve economic growth through productivity output; on the other, China’s own export structural changes and increased exports of investment goods are conducive to promotion of the country’s name brands and standards in some fields.Establishment of specialized investment funds is aimed to minimize financing costs and thus the soft barrier to investment, which can be achieved through reasonable assessment of investment risks, enhancement of the awareness of social responsibilities of Chinese enterprises, and setup of the enterprises’ good reputations. Moreover, given the industrial park cooperation as a carrier, the park construction experience can be publicized to the Belt and Road region, domestic enterprises attracted to the industrial parks in the respective host countries,and the domestic enterprises’ spillover effect on the host countries.

Third, establishment of a universal market system in the big country, China, allows priority to deepening of its opening-up and reshaping the country’s economic geography. Before the opening up policy is fostered, a country in the region should prioritize its opening to the inside. Only a united and integrated domestic market can offset the regional economical unbalancing leaded by the openingup. We can build a comprehensive transportation corridor based on the economic development belt along the Yangtze River, develop the globalized economy based on the domestic needs, and make full use of the local market, the advantage of international production elements, and the internationally innovative elements for development of local innovative economy.

Contemporary Social Sciences2018年5期

Contemporary Social Sciences2018年5期

- Contemporary Social Sciences的其它文章

- The Historical Development of Literary Anthropology in China

- Cultural Structure of Solar Terms and Traditional Festivals

- The Development of China’s Intellectual Property Law over the Past Forty Years of Reform and Opening Up

- The Evolution, Characteristics of Poverty and the Innovative Approaches to Poverty Alleviation

- Balance and Sharing: Women’s Childcare Time and Family’s Help

- Social Security Internationalization During China’s Reform and Opening Up from 1978 to 2018— Viewed from the Paradigm of a Community with a Shared Future for Mankind