Status quo of China’s nonwovens and industrial textiles industry,2017

By Zhao Zihan

In 2017, the nonwovens and industrial textile industry in China continued to deepen the reform of the supply-side structure and ensured the sustained and stable development through technological innovation and refined management. The investment in fixed assets continued to maintain a rapid growth, and the quality of operations maintained a good level. Exports reversed the slow growth or even declining trend in recent years. Due to the fluctuation of the price of major fiber raw materials and the rapid increase in the effective supply of some products, the profitability of the industry slightly decreased compared with the same period of last year; the growth rate of industrial added value fell to 4.0%; and the total profit growth in some areas declined.

Overall performance of the industry

Production growth rate falls

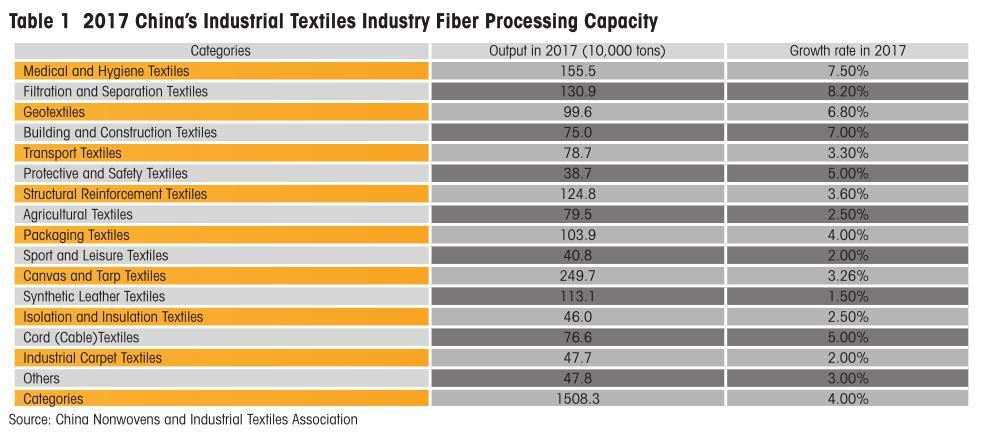

Since the 12th Five-Year Program period, the production of Chinas industrial textiles industry has maintained a rapid growth. The total fiber processing has increased from 9.1 million tons in 2011 to 14.5 million tons in 2016, an average annual growth of 8.1%, making it the largest in industrial textiles producing, trading, and consumption in the world. The rapid growth of Chinas industrial textiles is mainly due to the construction of Chinas high-speed rail, highways and water conservancy infrastructure, the gradual tightening of environmental protection policies, the improvement of peoples living standards and the improvement of medical and health standards. In 2017, Chinas economic structure was accelerated, and the industrial textiles industry was facing a more complicated development environment. The growth rate of production fell back to 4.00%, and the total fiber processing volume for the year was 15.083 million tons (The total amount of industrial fiber processing includes the amount of fiberglass used). Various fiber processing is shown in Table 1. The production of textiles for filtration and separation, medical and hygiene, geotechnical and building & construction continued to maintain a relatively high growth rate, while the growth rate of production of textiles for synthetic leather and textiles for sport and leisure was relatively lower.

Investment maintains a rapid growth

Fixed asset investment is an important indicator of industry vitality and entrepreneurial confidence. It can be seen from Table 2 that in 2017, although the growth rate of the industrys production declined, the investment in fixed assets continued to maintain a rapid growth. The total investment amounted to RMB 84.925 billion, which represented a year-on-year increase of 2.76%. It was at the highest level in all textile industries and was 18 percentage points higher than the investment in 2016, re-entering the rising period. The investment in nonwovens accounted for 44.1% of the entire industry, with a growth rate of 22.38%; the investment growth rate of rope cables was close to 50%; the investment in canvas and tarp was increased by 26.22%; the investment growth in filtering, geotechnical, transportation and other fields reached 28.41%. The tyre cord fabric industry continued its decline for many years, and investment dropped by 22.85%. The investment in fixed assets in the industry is mainly the increase in new production capacity, especially in the fields of spunbonded nonwovens, spunlace nonwovens, geotechnical textiles, building & construction textiles, and filtering and separating textiles. And the companies also put more investment in driving the technological transformation and upgrading of existing equipment, especially energy conservation & emission reduction and smart manufacturing.

Good economic benefits

According to data from the National Bureau of Statistics, in 2017, the main business income and total profit of enterprises above designated size in the industrial textile industry in China were RMB 289.75 billion and RMB 16.51 billion respectively, an increase of 5.19% and a decrease of 3.90%. It is the first falling that total profits had ever seen since the 12th Five-Year Program. The reasons for the decline are as follows: First, the ribbons and tyre cord fabric sector continued to slump. In 2017, the main business income in this area was reduced by 3.44%, and the cost was reduced by only 1.89%, resulting in a decrease in its gross profit margin by 1.41 percentage points. The total amount has been reduced by nearly 30%. Second, in 2017, the price fluctuations of major chemical fiber raw materials made it difficult for enterprises to transfer all price pressures to users in a short period of time, affecting the profitability of the company. Third, the industrys investment has been active and production capacity has grown rapidly in recent years. It is difficult for the market to fully absorb the new capacity in the short term, which has led to fierce competition among companies in some areas and the sales price of products has been under greater pressure. According to the survey conducted by the association, it is difficult for companies to generally reflect the sales price of products in escalation with raw materials. Customs data also show that the export prices of most commodities have declined to varying degrees.

Of the five categories of products given by the National Bureau of Statistics, the other industrial textiles including filtration, geotechnical, protective, and automotive textiles exhibited the best development (see Table 3), and the total income from main operations and total profit are respectively RMB 44.262 billion and RMB 2.874 billion, with an increase of 13.35% and 22.28% respectively. The gross profit margin was 15.53%, an increase of 0.51 percentage point, and the profit rate was 6.49%, an increase of 0.47 percentage point, which was nearly 0.8 percentage point higher than the industry average, reflecting the good development potential and profitability. The development of enterprises in this area is in good condition. On the one hand, these products have high technological content and strong market competitiveness, playing an increasingly important role in all fields. On the other hand, these areas are facing markets of high-speed development including environmental protection, infrastructure construction, and transportation, etc., enjoying ample room for development.

Rebounded imports and exports

With the technological advancement of Chinas industrial textiles, the further promotion of the “Belt and Road” Initiative, and the economic recovery of major developed countries, the companies in the industry have made great progress in exploring the international markets. In 2017, the industrial textiles industry exported 24.261 billion U.S. dollars, a year-on-year increase of 5.99%, reversing the situation in which exports have been growing at a low rate for many years or even declined. In the same period, the imported industrial textiles worth 7.054 billion U.S. dollars, a year-on-year increase of 12.18%. The economy is full of vitality and the demand for high-tech and high-quality products is still relatively strong.

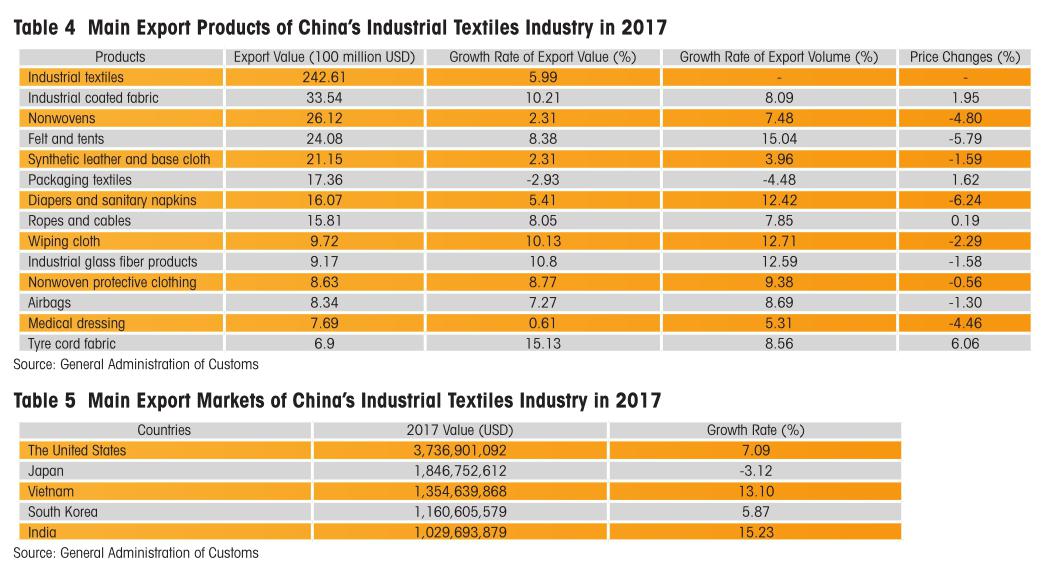

The main export products

In 2017, the export value of major products maintained a varying degree of growth. The export value of industrial coated fabrics, wiping cloth, industrial fiberglass products, and tyre cord fabrics increased by more than 10%. Felt cloth, tents, ropes and cables, nonwoven protective clothing and airbags also enjoyed faster growth, but the packaging textiles decreased by 2.93%, and the medical dressings was basically the same as last year (as shown in Table 4).

The main export markets

Figure 1 shows that Asia is the largest export market of industrial textiles in China, accounting for 47.2% of annual exports, followed by North America and the European Union with a share of 16.9% and 15.7%, respectively. The share of Africa and Latin America is 6.6% and 6.9% respectively.

The United States is still the largest country where Chinese industrial textiles are exported. Table 5 shows that in 2017, export value amounted to 3.74 billion U.S. dollars, an increase of 7.09% year on year. Japan was the second largest one, but exports fell by 3.12%. In recent years, Chinas exports of industrial textiles to Vietnam and India have grown relatively rapidly, which were respectively 1.35 billion U.S. dollars and 1.03 billion U.S. dollars in 2017, with respective growth rates of 13.1% and 15.23%. The top five countries in export value accounted for 37.8% of Chinas total exports. In addition, Chinas Hong Kong, Germany, Indonesia, Russia and the Philippines are also important markets. The export value of these 10 countries and regions accounted for 51% of the total.

Coated fabrics, synthetic leather and its base cloth, and nonwovens are Chinas major export products to India and Vietnam. Export value is relatively large, but in terms of export prices, Vietnam is higher than India. Vietnam and India are countries with rapid economic growth around China. The demand for various industrial textiles is relatively large. Chinas industrial textile industry has strong advantages in equipment manufacturing, technological innovation, product quality, etc. It is superior to European and American countries and other developed countries in terms of price, and geographically adjacent to it, the overall advantages are very obvious. It is to continue to increase the development of these two markets.

Imports

In 2017, China imported industrial textiles of 7.054 billion U.S. dollars, an increase of 12.18% year on year. Among them, diapers and sanitary napkins saw the largest amount of imports, reaching 1.423 billion U.S. dollars. Imports of nonwovens, industrial coated fabrics, airbags, and industrial fiberglass products were also relatively high, at 883 million U.S. dollars and 768 million U.S. dollars, 638 million U.S. dollars, and 606 million U.S. dollars respectively. In addition to airbags, the imports of the other four categories of products were all increasing; however, the import prices of major products declined at different rates. Japan, China Taiwan, South Korea, the United States, and Germany are the main sources of imported industrial textiles in China, with imports accounting for 78.4% of the total.

Status quo of key sectors

Medical and hygiene textiles

Medical and hygiene textiles are widely used in the industrial textiles industry. From the perspective of disposable sanitary products, the market for womens sanitary napkins is relatively mature and has a high penetration rate. It also maintains a natural growth every year at about 5%, and the quality of products continues to grow toward high levels. Baby diapers are still a market with rapid growth at about 15%. The industry continues to innovate in surface materials, absorbent cores, product design, etc. Chinese market has been able to lead the innovation and development of the global diaper industry; and adult incontinence products are still in the market cultivation period of very large potential, with an annual growth of more than 30%. However, to achieve a breakthrough needs a relatively long-term process based on joint efforts from the level of economic development, consumption habits, and related national policies. Wiping products(dry towels and wipes) is another high-growth market with a growth rate of more than 10%. In particular, as economic conditions improve and the pace of life accelerates, the scope of application and use of disposable wiping products will continue to expand. In 2017, the investment and production of spunlace nonwovens and spunbonded nonwovens for sanitary materials continued to grow at a high rate. Chinas sanitary materials also actively explore overseas markets. In 2017, the export value of diapers and sanitary napkins reached 1.607 billion U.S. dollars, an increase of 5.41% year on year, of which adult incontinence goods exports reached 240 million U.S. dollars.

- China Textile的其它文章

- Dear readers

- D&Y Group accelerates overseas layout based on the Belt and Road

- Status quo of chemical fiber industry in 2017 and forecast of 2018

- Economic operation of knitting industry in 2017

- A brief introduction to the operation of domestic cocoon silk industry in 2017

- Hubei nonwoven industry:There is still room for brand cultivation