Managing Risks

By Wang Jun

After five months of discussions and the soliciting of public opinion, Chinas central authorities issued a new guideline on asset management products and services on April 27, aiming to ensure the stability of the fi nancial market and prevent fi nancial risks with tightened regulation targeting the elimination of regulatory arbitrage in the sector.

Uniform regulation

Asset management business among Chinese fi nancial institutions has grown rapidly in recent years.

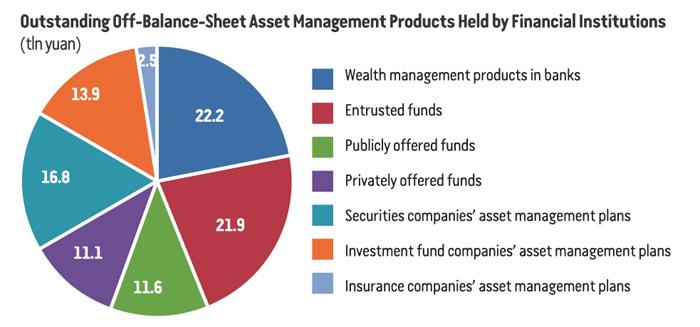

According to fi gures from the Peoples Bank of China (PBC), by the end of 2017, the outstanding off-balance-sheet asset management products held by all financial institutions had totaled 100 trillion yuan ($15.75 trillion). Among them, 22.2 trillion yuan ($3.5 trillion) of funds were off-balance-sheet wealth management products in banks; 21.9 trillion yuan ($3.45 trillion) were entrusted funds managed by trust companies; publicly offered funds and privately offered funds accounted for 11.6 trillion yuan ($6.3 trillion) and 11.1 trillion yuan ($1.75 trillion), respectively; while the asset management plans of securities companies, investment fund companies and their subsidiaries as well as insurance companies totaled 16.8 trillion yuan ($2.65 trillion), 13.9 trillion yuan ($2.19 trillion) and 2.5 trillion yuan ($393.7 billion), respectively.

“Regulatory arbitrage activities are common because of inconsistent regulation rules and standards for similar kinds of asset management businesses, causing multi-layer investment, unclear risk limits, and potential liquidity risks in capital pools, wide spread implicit repayment guarantees and other problems. It actually led to a shadow banking system with insufficient regulation outside the offi cial fi nancial system,” said a press release from the PBC.

These problems have interrupted macro control, increased social fi nancing costs, affected the quality and efficiency of the fi nancial sector to serve the real economy, and exacerbated the transfer of risks from the fi nancial sector to other industries and markets, said the PBC.

To address these problems, the new guideline adopts classified regulation on different types of products and applies uniform regulation to the same type of products. The plan divides asset management products into publicly offered products and privately offered products on fund sources.

For the use of capital, asset management products are divided into fixed income products, equity products, commodities, fi nancial derivative products and mixed products.