Margin trading,short selling,and bond yield spread

Kaijuan Gao,Wanfa Lin

aHunan University,China

bWuhan University,China

1. Introduction

Compared to the abundant information about the equity market provided by analysts,there is little information about the bond market.Furthermore,the lag in the credit rating of bonds creates a poor information environment.Therefore,information that spills over from the equity market to the bond market may be important.Specifically,margin trading activities on a stock may reveal good news about the firm,whereas short sellers may transmit bad news to the bond market.Thus,margin trading or short selling may affect bond yield spread.

Short selling activities could transmit bad news about a stock price and help to avoid a stock crash(Hong et al.,2008).In addition,short sellers try to acquire private information to increase their pro fit,which intensi fies the absorption of information into stock price(Xiao and Kong,2014).Accordingly,as short sellers seek negative information,managers could make timely disclosures of bad news(Li and Zhang,2015)to facilitate accounting conservatism(Chen and Liu,2014b),decrease earnings management(Fang et al.,2016;Massa et al.,2015;Chen and Liu,2014a),and reduce overinvestment(Jin et al.,2015).Margin trading helps to transmit positive information,which leads to higher stock prices(Chu and Fang,2016).Additionally,insiders may purchase stocks through margin trading to earn arbitrage pro fits(Zhang et al.,2016).Therefore,optimistic investors use leverage to buy securities and pessimistic investors sell borrowed securities.These transactions reveal positive and negative private information,which results in stock price return with intrinsic values.By causing information to spill over into the bond market,margin trading and short selling may affect the bond yield spread.

Developed capital markets have permitted margin trading and short selling of securities for many years.As an emerging market,China’s capital market is relatively young,suggesting a concomitant need to enhance regulations and guide investors’rationality.However,after 20 years of development,the capital market in China has made great progress.To incorporate more information into stock price(Miller,1977),the China Securities Regulatory Commission(CSRC)launched a trial period of margin trading and short selling in March of 2010.This offers researchers an opportunity to explore the effects of margin trading and short selling on bond yield spread.Kecske´s et al.(2013)have verified that in an American setting short selling leads to lower credit ratings and higher spreads.However,margin trading and short selling in China possess some special characteristics.First,margin trading and short selling are very popular in America,but they are only pilot schemes in China.The 900 firms that allow the short selling of stocks also allow leverage buyouts.Short selling delivers bad news,and thus leads to increased bond yield spreads,whereas margin trading may release good news into the bond market.Second,after the introduction of margin trading and short selling in America,regulators realized the potential risks of these transactions and developed appropriate regulations.However,these transactions are still new in China.The current regulatory system needs to be improved,as insufficient regulations may provide opportunities for speculators.Third,due to the absence of short selling,Chinese investors are more used to margin trading.Although both short selling and margin trading are approved,short selling transactions account for a smaller proportion of the total transactions.Securities re financing has been allowed since February 2013,which has increased the number of short selling transactions.However,lenders of securities for re financing face liquidity and market risks.Given the lower interest rates of securities re financing,lenders have no desire to engage in re financing transactions.Fourth,the interest rates of financing and re financing are not always adjusted.The current interest rate is not consistent with brokers’capital costs.Short selling fees and securities re financing fees for these securities are the same for all stocks,and as a result borrowing fees do not reveal the lending value,which discourages stock owners from lending out their securities.Lastly,brokers’self-management of their business and social securities fund have limited the opportunities for margin trading and short selling,leading to weaker trade size and effects.Therefore,margin trading and short selling effects may be different in the Chinese stock market than in America,and it is necessary to examine the effects of margin trading and short selling on bond yield spread in China.

We examine the relationship between bond yield spread,margin trading,and short selling based on monthly bond data for the 2008 to 2015 period.We find that margin trading and short selling both decrease bond yield spread,even after the application of the propensity score matching method,which eliminates the selection biases in our data.Additional tests show that margin trading leads to lower leverage and higher credit rating,which results in lower bond yield spread,whereas short selling reduces bond yield spread by lowering earnings management.

This study makes several contributions.First,it examines the information spillover effects between the stock market and bond market.Previous studies have come to different conclusions about spillover(Fleming et al.1998;Shi et al.2013).Fleming et al.(1998)concluded that there are links between the stock market and the bond market.However,Shi et al.(2013)found no significant interaction between the stock market and bond market using Chinese data.This study finds that positive information in the stock market can be transmitted to the bond market.Therefore,this study contributes to the literature on the spillover effects.In addition,the effects of margin trading and short selling on bond yield spread are explored in this study.Merton(1974)and Jiang(2008)studied the relationship between firm characteristics and bond yield spread.Longstaffand Schwartz(1995)and Wang et al.(2015)examined the effect of the bond yield spread on macro perspective.This study contributes to the understanding of bond yield spread by finding that margin trading in the stock market transmits positive information to the bond market,and short selling in the stock market decreases yield spread by improving monitoring.These results can be helpful for regulators.

2. Literature review

2.1. Effects on bond yield spread

Previous studies have identi fied the in fl uences of credit rating,information environment,stock ownership,and contagion effects on bond yield spread.First,credit rating has been shown to explain bond yield spread.Higher crediting ratings lead to a lower bond yield spread(Ziebart and Reiter,1992;He and Jin,2010;Wang and Zhang,2013).When credit rating agencies provide positive information about firm credit risk,the interest rate of the short-term financing bond becomes lower.This effect is more significant when firm size is smaller or information asymmetry is more severe(Shen and Liao,2014).Second,information transparency lowers the bond yield spread by limiting investors’speculation for default risk(Sengupta,1998;Yu,2005).Given the higher transaction costs of bond covenants,investors have to request higher interest rates for default risk(Bharath et al.,2008),especially for bonds with lower information quality.Bond issue spread increases when a firm reports a restatement(Baber et al.,2013).Short selling may increase bond yield spread because short selling firms may conceal bad news(Kecske´s et al.,2013).Third,ownership structure affects bond yield spread.Founder family ownership decreases the spread when the family owns more shares.Moreover,a conflict between shareholders and creditors increases the spread(Anderson et al.,2003).Management ownership increases firm value and elevates bond returns.However,when management ownership is too high,managers over-emphasize the risk as creditors,which may eliminate the relationship between bond return and ownership(Bagnani et al.,1994).State ownership increases the spread by raising the policy risk,although this effect remains weak during financial crises(Borisova et al.,2015).Lastly,contagion effects may impact bond yield spread.Jarrow and Yu(2001)pointed out that customer default risk is embedded in bond price and these connections are ampli fied when customers purchase more commodities.Jorion and Zhang(2009)studied customer default risk and risk of credit default swaps.They concluded that customers’declaration of bankruptcy increases the risk of credit default swaps.

Risk free interest rates,investor sentiment,monetary policy,and political uncertainty impact bond yield spread.Longstaffand Schwartz(1995)noted that a decrease in the risk free rate leads to an increase in bond value,suggesting a rise in bond yield spread.Duffee(1998)found that an increase in treasury yield causes increases in callable bond prices,which decreases the bond yield spread.Xu and Yang(2013)stated that investor sentiments in the stock market reduces investment demands in the bond market and thus causes lower yield spread.According to Wang et al.(2015),volatility of monetary policy increases bond yield spread by expanding the liquidity risk of bonds.They also argued that credit scale and product market environment have negative correlations with bond risk premiums.Luo and She(2015)found that a turnover in party secretary or mayor causes municipal bond costs to increase by increasing risk,and this effect is more significant when uncertainty is high or when a city has greater pressure from debt payments.

These studies examined bond yield spread based on firm characteristics,inter- firm relationships,and the macroeconomic environment.Kecske´s et al.(2013)revealed that bond investors’awareness of bad news that leads to short selling increases bond yield spread.However,as we described above,margin trading and short selling in China are different than in America,and it is necessary to explore the effects of margin trading and short selling on bond yield spread in the context of China.

2.2. Short selling and bad news

Some studies have discussed the relationship between bad news and short selling.Dechow et al.(2001)pointed out that firms with poor performance tend to be faced with short selling,indicating that short selling reveals negative information.Additionally,account information quality impacts short selling.Desai et al.(2006)found that short sellers tend to increase short selling before restatements and that stock price decreases after restatement;furthermore,short sellers’position also decreases.Karpoffand Lou(2010)documented that short sellers uncover bad news;in fact,abnormal short selling increases in the 19 months before financial mis-conduct is discovered.Using Chinese data,Chang et al.(2014)found that after the approval of margin trading and short selling,target firms’stock price efficiency improves,indicating that bad information is embedded into the price through short selling.Li et al.(2015)pointed out that margin trading and short selling increase stock liquidity and ownership breadth and decrease information asymmetry.Xiao and Kong(2014)also argued that short selling integrates bad news into stock prices.

Short selling may impact accounting information.Fang et al.(2016)concluded that earnings management incurs costs and increases pro fit.The SEC’s exemption of stock price tests has encouraged short selling,leading to a decrease in earnings management.Massa et al.(2015)revealed that short sellers may decrease earnings management through discipline.Chen and Liu(2014a)also identi fied this phenomenon in China.In another study,they noted that short selling improves accounting conservation(Chen and Liu,2014b).Zhang et al.(2016)documented a decrease in financial restatements due to short selling,which they attributed to incentive contracts and analyst following.Some studies have found that short selling improves information disclosure quality.Li and Zhang(2015)showed that before short selling,mangers disclose bad news with lower precision and lower readability.According to Zhang et al.(2016),short selling provides opportunities for insider trading.

Previous studies have mainly concluded that negative information causes short selling,and thus leads managers to reduce earnings management and increase disclosure quality.However,there is little research on the effects of margin trading.Some studies have explored the effects of short selling in the bond market.Kecske´s et al.(2013)pointed out that short sellers occupy a larger position among firms with bad news.Due to the information spillover between the stock and bond markets,bonds with more stock short selling have higher yield spreads.Erturk and Nejadmalayeri(2012)veri fied that short selling increases bond price.Christophe et al.(2015)concluded that short selling leads to a decrease in firm value;thus, firms identi fied as short selling targets have lower bond returns.Henry et al.(2010)argued that credit rating downgrades lead to an increase in short selling.It was reported by some studies using American data that short selling increases bond yield spread,but margin trading and short selling in China have different targets,scales,and regulations.Therefore,margin trading and short selling may have different impacts in the Chinese and American bond markets.In this study,the discussion of the effects of margin trading and short selling on bond yield spread is based on Chinese data.

3. Institutional background and research hypothesis

3.1. Development of Chinese bond market

The Chinese bond market has developed in the 30 years since the first treasury bonds were issued in 1981.In the early state of the bond market,from 1981 to 1991,transactions were mainly completed over the counter.In the second stage,from 1992 to 1996,the bond market gradually moved towards standardization,and bonds were traded through an exchange.The third stage lasted from 1997 to 2001.During this stage,the inter-bank market throve.The last stage began in 2002.In recent years,bond products have become more and more diversi fied.

During the first stage of the Chinese bond market,from 1981 to 1991,bonds were traded over the counter.The Chinese government releasedRegulations of the People’s Republic of China on State Treasury Bondsin 1981.The Treasury Department issued treasury bonds by apportionment.However,treasury bonds could not be freely traded.They had value,but there was no market for treasury bonds.In 1988,the treasury department began to issue treasury bonds through commercial banks and post office counters;thus,the treasury bond primary market appeared.In the same year,the Treasury Department began a trial of trading treasury bonds in 61 cities,introducing a secondary market for treasury bonds.When the Shanghai Stock Exchange was established in 1990,it became possible to deposit a material bond on the exchange and to trade book entry treasury bonds on the exchange.Counter and exchange markets existed together for the first time.In 1991,the number of cities allowing treasury bond trading was expanded to 400.Both the counter trading and exchange trading of the treasury bond secondary market were available at that time.Financial bonds,enterprise bonds,and short financial bonds were also issued during this stage.The Industrial and Commercial Bank of China and the Agricultural Bank of China began to issue financial bonds in 1985,which was the beginning of financ-ing bonds.Interim Regulations on Enterprise Bond Managementwas released in 1987.Enterprise bonds were regulated by the Chinese government and only enterprises owned by the people could issue enterprise bonds.The issuing needed to be approved by the Central Bank and the State Development Planning Commission,the predecessor of the National Development and Reform Commission.In the second half of 1988,short financing bonds became more common.In 1989,the Central Bank allowed the issuance of short financing bonds to increase liquidity.Although firms remained the issuers of enterprise and short financing bonds,the requirement of the approval of the Central Bank and State Development Planning Commission indicated the similarity of the treasury bonds and the other two bond products.

The bond market started to be normalized in the 1991 to 1996 period.During this stage,bond trading was mainly completed on the exchange.In 1991,treasury bonds began to be issued with syndicate underwriting.Treasury bond auctions began in 1995,indicating the beginning of the marketization of the treasury yield.In 1992,the Shanghai Stock Exchange launched treasury bond forward contracts,but the market was thin due to the limited number of investors with investment experience.TheNotice on Adjust Condition of Treasury Bond Issuancewas released in 1993,which attempted to protect investors’interests,and thus increase the volume and forward volume on the exchange.However,short selling and artificial repurchasing appeared in the treasury bond market in 1995,possibly due to the secret ballot of over-the-counter bonds considered by the government.Over-the-counter sales were prohibited and the securities exchange became the only legal transaction area for the bond market.In 1996,there were a variety of treasury bond products and the basic exchange bond market was built.During this stage,bond categories were being specified.Enterprise bonds were not popular in these early stages.In 1992,the total value of issuance amounted to RMB 68.4 billion and covered seven categories.However,in 1993,theRegulations on Enterprise Bondwere released to constrain the development of the bond market.During this period,the issuance of short financing bonds was paused.In 1993 and 1994,there was a default of short financing bonds.Therefore,the Central Bank terminated the issuance of short financing bonds.The issuance of financial bonds shifted from commercial banks to policy banks after the latter were established in 1994.

The interbank bond market grew vigorously from 1997 to 2001.The rising stock market meant more money moved from the bond market to the stock market.The Central Bank required the commercial banks to put their treasury bonds,short financing bonds,and policy financial bonds into the China Government Securities Depository Trust&Clearing Company.Since then,the national bank market has been launched.In 1998,the Central Bank’s promotion of an open market promoted a dynamic interbank bond market.In the same year,the Treasury Department issued bonds through the interbank bond market,which increased the inventory of bonds.In addition,new members joined the interbank bond market and by 2000,the interbank bond market covered most of the financial systems of China.At the beginning of 2000,theRegulations on National Inter-Bank Bond Market Transactionwere released,in which bilateral market makers were mentioned.In August 2001,the Industrial&Commercial Bank of China,Agricultural Bank of China,and China Construction Bank were authorized as bilateral market makers.A market maker system between the interbank and bond market was established to promote the development of the interbank bond market.In 1997,the Department of State released theTrial Procedures on Convertible Bond.This was the first time that convertible bonds were issued in China.After 1999,policy banks became the major issuer of financial bonds.The China Development Bank and China Import and Export Bank issued financial bonds through an open bidding process.By 2000,most financial bonds were issued in this way.In 1999,the Central Bank proposed that enterprise bonds should be approved by the State Development Planning Commission.Since then,enterprise bonds have been mainly raised by approved large-and medium-sized projects.Firms with small projects are not allowed to issue enterprise bonds.

Since 2002,the bond market has contained a variety of products.Access to the interbank bond market has been transferred from a chartered system to a system of put on records.This transition expanded the range of participants in the market.In 2002,15 treasury bonds were issued to the interbank,exchange,and over-the counter markets,allowing the exchange of bonds between different markets.Since then,the Chinese bond market has been united,multi-layered,and mainly exchanged on the interbank market.To avoid a trade surplus shock to the treasury bond market,the Central Bank launched the Central Bank bill,which was one of the most effective tools for open market operations.In 2003,an interim measure on broker bonds was released.This regulation allowed brokers to issue bonds only with the approval of the CSRC,which was intended to solve the financing problems of the brokers.Short financing bonds with the registered system reappeared on the market in 2005.After two years,theTrial Methods on Corporate Bond Issuancewere released.The first corporate bond,which was the 07changdian bond,launched on the Shanghai Securities Exchange,marking the beginning of financing with corporate bonds for listed companies.In 2008,a medium-term note with the registration system was issued,which enriched the term of bond products.Most notes lasted for between 1 and 10 years.Local treasury bonds were issued by the Treasury Department in 2009,which filled the local bond gap.In November of the same year,small or medium collection bonds were issued with the registration system on the interbank bond market.Super short-term financing bonds were issued on the interbank market in 2010.This term for this kind of bond was shorter than 270 days,and it required the issuer to have high credit worthiness.After one year,Shanghai,Zhejiang,Guangdong,and Shenzhen began issuing their own debt.However,the Treasury Department could charge for the payment on capital and interest.On February 15,2012,Shandong Hailong’s rating was downgraded from BB+to CCC and the bond rating was downgraded from B to C.Shandong Hailong was faced with default risk.Since then,several credit bonds have defaulted.In 2014,the 11Chao Ri Bond defaulted,which was the first defaulted public bond in China.In 2015,theMeasure on Corporate Bond Issuance and Transactionwas released.This measure expanded the list of potential issuers,enriched the issuance format,added bond trading places,and simplified the audit process.

After 30 years of development,the Chinese bond market has grown to offer a variety of products.There are a variety of issuers trading on the interbank,exchange,and over-the-counter markets.At present,the interbank bond market is mainly monitored by the Central Bank and the China Banking Regulatory Commission.The products traded on this market are treasury bonds,local treasury bonds, financial bonds,enterprise bonds,medium bonds,and short financing bonds.The exchange market is currently regulated by the CSRC and the National Development and Reform Commission.The products traded on this market are book-entry treasury bonds,local treasury bonds, financial bonds,enterprise bonds,corporate bonds,and convertible bonds.According to the statistics issued by the Central Bank,the size of bond issuance in China has reached RMB 36.1 trillion,of which the interbank bond size is 32.2 trillion.By 2016,the total deposit in bonds was 63.7 trillion,including 56.3 trillion in the interbank bond market.Currently,the Chinese bond market is ranked as the third largest global bond market after the American and Japanese markets.

Although the Chinese bond market is one of the top three global bond markets,most bond products here are treasury and financial bonds;corporate bonds have had a late start.TheTrial Methods on Corporate Bond Issuanceprovided policy for the issuance of corporate bonds.In September 2007,the 07Chang Dian Bond was issued publicly.This was the first corporate bond in the Chinese bond market.In 2013,the Third Plenary Session of the Eighteen Session approved theDecisions on Numbers of Major Issues about Deepen Reform in all round Way of Central Committee of the Communist Party of China.This declaration discussed the development and standardization of the bond market and the improvement of direct financing,offering great opportunities for the development of the bond market.In 2015,theMethods on Corporate Bond Issuanceexpanded the issuance range and simplified the audit process,which activated the corporate bond market.Like enterprise bones,corporate bonds can relieve financing problems in non- financial firms.However,there are differences between corporate bonds and enterprise bonds.First,the issuance of corporate bonds must be approved by the CSRC,whereas enterprise bonds must be approved by the National Development and Reform Commission.Second,requirements for corporate bond issuance are lower than those for enterprise bonds.1(1)The production and operation of the company conforms to the provisions of laws,administrative regulations,and the articles of incorporation,and conforms to the national industrial policies.(2)The internal Control system of the company is sound,and the integrity,rationality,and validity of the internal Control system do not have significant deficiencies.(3)The bond is rated by a credit rating agency as fine.(4)The latest audited net assets of the company shall comply with the relevant laws and administrative regulations and the relevant provisions of the CSRC.(5)Average distributable pro fits over the latest three accounting years are no less than interest fees of corporate bonds of one year.(6)The balance of the accumulated corporate bonds after the issuance does not exceed 40%of the net assets of year end;the accumulated corporate bonds of the financial companies are calculated according to the relevant provisions of financial enterprises.In the end,the issuance of enterprise bonds is guaranteed and approved by the government.However,money raised by corporate bonds does not have to be connected to projects and a guarantee is not necessary.Therefore,corporate bonds are more market-oriented than enterprise bonds.

3.2. Corporate bond pricing mechanism

Currently,all corporate bonds have a face value of RMB100,and they are issued at par in China.Apart from a small number of bonds that are paid two or four times a year,most bonds are paid annually.The interest is calculated as simple interest.Most bonds offer fixed or accumulated interest;only a small number offer floating interest.Off line requests and the placement of bookkeeping together determine the interest rate.First,the issuer and broker reach an agreement based on market interest,terms,and credit rating.Then,the issuer announces an issuance and offers the bonds publicly on line and accepts inquiries from institutional investments off line.Finally,the issuer and broker reach an agreement on interest based on the level of institutional investors’interest.

In the secondary market,corporate bonds are exchanged on the Shanghai or Shenzhen Security Exchanges.Corporate bond transactions are based on net price and full price settlement,so bid prices do not contain accrued interest;however,accrued interest is included in transaction settlements.Price is determined by supply and demand.Market risk affects the price(Gao and Zhou,2015).Price,terms,interest rate,and face value determine the yield spread.In particular,a higher price may predict a lower yield spread.Beaver(1966)points out that a bond’s default risk is affected by accounting performance.A higher default risk predicts a higher yield spread.Merton(1974)concludes that volatility affects price.When volatility increases,default risk and yield spread both increase.Therefore,accounting performance and the volatility of assets could both impact bond price.

Investors in the secondary market cannot access private information as institutions do in the primary market.Therefore,investors in the secondary market have greater need for public information.However,the information environment of the bond market is poorer than that of the stock market(Gebhardt et al.,2005).For one thing,many analysts and a lot of mediation are involved in the stock market,whereas few analysts focus on the bond market.These analysts in the bond market offer little private information to investors.Furthermore,credit rating agencies prove lagged information on bonds.Therefore,information on the stock market may spill over into the bond market.More speci fically,margin trading may deliver positive information to the bond market and short selling of stock may transmit negative information to investors in the bond market,which leads to changes in yield spread.

3.3. Relationship between margin trading,short selling and bond yield spread

Margin traders predict that a stock price will increase in the future,so they pay a deposit and borrow stocks from brokers.When the stock prices increase,they sell the stocks and pay back the brokers the money they borrowed.Leverage deals transfer positive information about firms(Chu and Fang,2016),which may include information about firms’better accounting performance.The information is transferred between markets(Fleming et al.,1998)and due to the poorer information environment of bond market,investors in the bond market will learn of the good performance or lower volatilities of target firms from margin trading.

Accounting information may predict default risk(Beaver,1966;Shi and Jiang,2013);speci fically, firms with better performance may have low default risk.Lower default risk causes higher prices and lower yield spread.Therefore,margin trading may cause a decrease in the yield spread.However,bonds have distinctive characteristics.Stockholders get residual income and bear limited liabilities(Jensen and Meckling,1976),whereas bondholders bear the downside risk and get a fixed income(Fischer and Verrecchia,1997).As a result,bondholders pay more attention to risks(Gao and Zhou,2015).Therefore,margin trading information about better performance or lower risk may not attract the attention of bondholders.In this case,margin trading may not impact bond yield spread.

Conversely,short sellers predict a decrease in a stock’s price.Therefore,they pay a deposit to borrow stocks and sell out.When the price drops,short sellers buy the stocks and pay back the brokers.These transactions transfer bad information about firms,as they are indicators of poor performance,high volatilities,or poor information quality(Dechow et al.,2001;Desai et al.,2006).This information is transferred between markets(Fleming et al.,1998),and investors in the bond market gain the negative information about the target firms.

Badly performing firms may have a higher default risk,which causes a lower price and higher yield spread.In addition,the bad news that prompts short selling may increase speculations on default risk and lead to fur-ther increases in the yield spread(Sengupta,1998;Yu,2005).Therefore,short selling may increase the bond yield spread.However,even if there is no bad news,speculators may manipulate prices by short selling to generate a decrease(Goldstein and Guembel,2008).This kind of transaction does not transfer information about firms.So,short selling may not affect the bond yield spread.In addition,short selling may increase the probability of being funded by earnings management.This may decrease firms’earnings management(Fang et al.,2016).Accordingly,short selling may decrease speculation on default risk by increasing accounting information,and thus decreases bond yield spread.Therefore,short selling may decrease bond yield spreads.

The above discussion leads to the following hypotheses.

Hypothesis 1.Margin trading on the stock market does not impact the bond yield spread.

Hypothesis 2.Short selling on the stock market does not impact the bond yield spread.

4. Research design

4.1. Model and variables

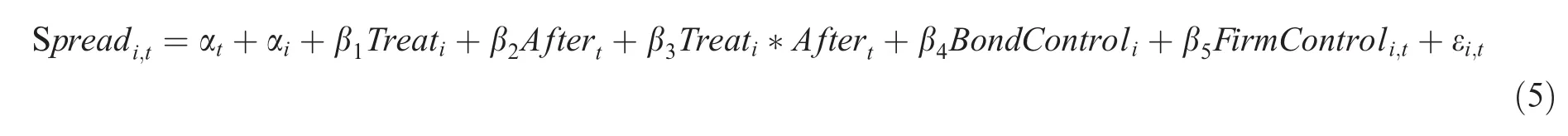

Margin trading and short selling targets are only part of the bond issue process.Our setting provides a quasi-natural experiment that can avoid endogeneity problems in the study of the effects of margin trading and short selling on bonds.Due to the temporal variations in the targets,this study uses a difference in differences model with fixed effects of the month and bond(Bertrand and Mullainathan,2003).Armstrong et al.(2012)used this model to study corporate governance and the information environment.Zhou and Chen(2005)applied this model in a Chinese setting.Jin et al.(2015)explored the relationship between short selling and investment by using this model.Zhang et al.(2016)also used this model to study the effect of short selling on restatement.The model applied in this research is as follows:

In this model,spread is the monthly bond yield spread,which is calculated as the yield spread of the closing price minus the treasury bond yield spread with the same term and same issuance time(Kecske´s et al.,2013).atis the month fixed effects,and aiis the bond fixed effects.Longis the margin trading amount divided by negotiable market capitalization.Short sellingis the short selling amount multiplied by 100 and divided by negotiable market capitalization.2To avoid an over-large coefficient in the late report,we multiply the number of securities traded by 100 and then divide the number of shares in circulation by 100.β1is the effects of margin trading on bond yield spread.β2is the effects of short selling on bond yield spread.

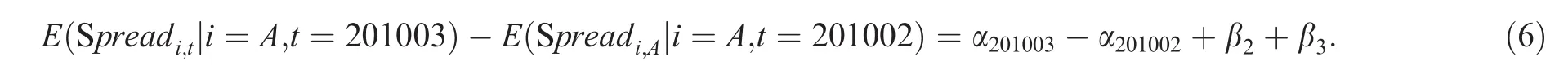

For example,if Firm A is targeted in March 2010,the margin trading amount isLongAand the spread change is

The controlled firm A-is not affected by margin trading and the time trending change is

Therefore,the margin trading effects on the bond yield spread of firm A is

Finally,β1measures the effects of margin trading on bond yield spread.If β1is significantly negative,margin trading could decrease the bond yield spread;if β1is significantly positive,margin trading could increase the bond yield spread.The effect of short selling on yield spread are the same as the effects of margin trading.Ifβ2is significantly negative,short selling could decrease the bond yield spread;if β2is significantly positive,short selling could increase bond yield spread.

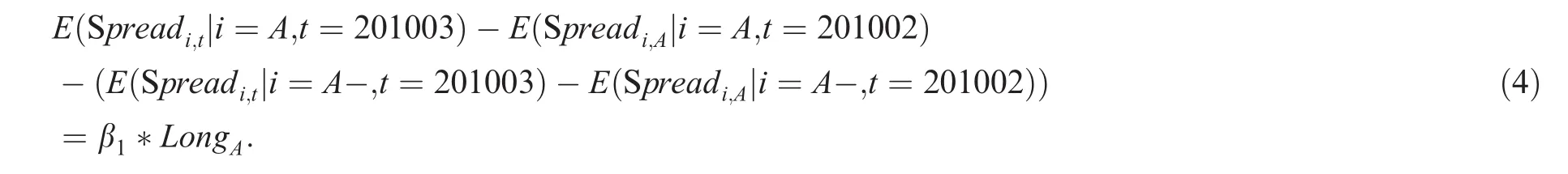

Table 1 Statistics of margin trading and short selling.

In Equation(1),margin trading and short selling values are the total amount for one month,and the yield spread is determined at the end of the month.So there is a period of time between variables,which avoids reverse causality problems.In addition,the bond variables includeBond Rate,which is the bond’s credit rating,3Credit ratings range from BBB to AAA.For BBB Bond Rate is 1;for BBB+Bond Rate is 2;for A-Bond Rate is 3;for A Bond Rate is 4;for A+Bond Rate is 5;for AA-Bond Rate is 6;for AA Bond Rate is 7;for AA+Bond Rate is 8;and for AAA Bond Rate is 9.andBond Term,which is the log of its maturity.4The size of the bond issuance and other variables are not included in the Control variable because this study controls the bond fixed effect.The issuance size of each bond and the other variables changing over time does not affect the results in the model.Firm Control variables includeSize,calculated as the log of assets;Age,calculated as the log of firm age;Leverage;ROA;PPE,which is the ratio of fixed assets to total assets;Capx,which is the ratio of capital expenditure and total asset;Institution Share,which is the shareholding ratio of institutional investors;Manager Share,which is the shareholding ratio of managers;Analyst,which is the log of the number of analysts following the firm plus one;SOE;Board Size,which is the size of the board;Independence,which is the ratio of independent directors to independent directors number;andReturn Vol,which is the monthly volatility of the stock price.

4.2. Observations and data sources

On March 31,2010,China approved margin trading and short selling for 90 stocks.After four revisions of the list,the number of targeted stocks had risen to 900 by September 22,2014.The timeline is illustrated in Table 1.986 stocks were added to the list and among them,86 stocks were deleted during 2010 to 2014.On March 31 of 2010,90 stocks were on the list,which accounted for 9.128%of the including targets number.By July 1 in the same year,5 stocks were deleted and other 5 stock were added.The including and excluding percent were 0.507%and 5.814.At the end of the month,1 stock was deleted,which only account for 0.101%of the total including targets.In 2011,190 stocks were included.It implies that including percent was 19.270%.When it comes to January 31,2013,including percent was 27.992%while excluding percent was 62.791%.From March 6 to May 2 in 2013,there was no including stocks but 5 stocks were deleted because of the risk warning or delisting.On September 16,2013,206 stocks were added and the total targets number was 700.In the first half of 2014,5 stocks were deleted for the risk warning.On September 22 of 2014,218 stocks were including on the list which account for 22.11%of the total including targets.Therefore,the five recruiting periods were mainly realized on March 31,2010,December 5,2011,January 31,2013,September 16,2013,and September 22,2014.On every day of these 5 dates,the including stocks accounted for more than 9%while on the other 11 dates,the number was less than 1%.

On August 14,2007,Trial Methods on Corporate Bond Issuancewas released.This marked the formal development of corporate bond in China.As only two bonds were issued in 2007,our dataset excludes the bonds issued in 2007.Our dataset includes all of the corporate bonds publicly listed on the Shanghai or Shenzhen Security Exchange from 2008 to 2015.After excluding financing bonds and floating interest rate bonds,we have 12,241 bond-month observations representing 468 bonds.These observations are merged with the data on margin trading and short selling.We exclude observations with negative yield spread,missing data,and an issuance year after 2015.All of the variables are winsorized at the 5%and 95%levels.The final dataset contains 8662 bond-month observations.The margin trading and short selling target data are obtained from the on line disclosures of the Shanghai or Shenzhen Securities Exchange.Bond data are from the WIND and CSMAR databases,whereas the margin trading and short selling transaction data and other Control variables are from the CSMAR database.

5. Empirical results

5.1. Statistics description

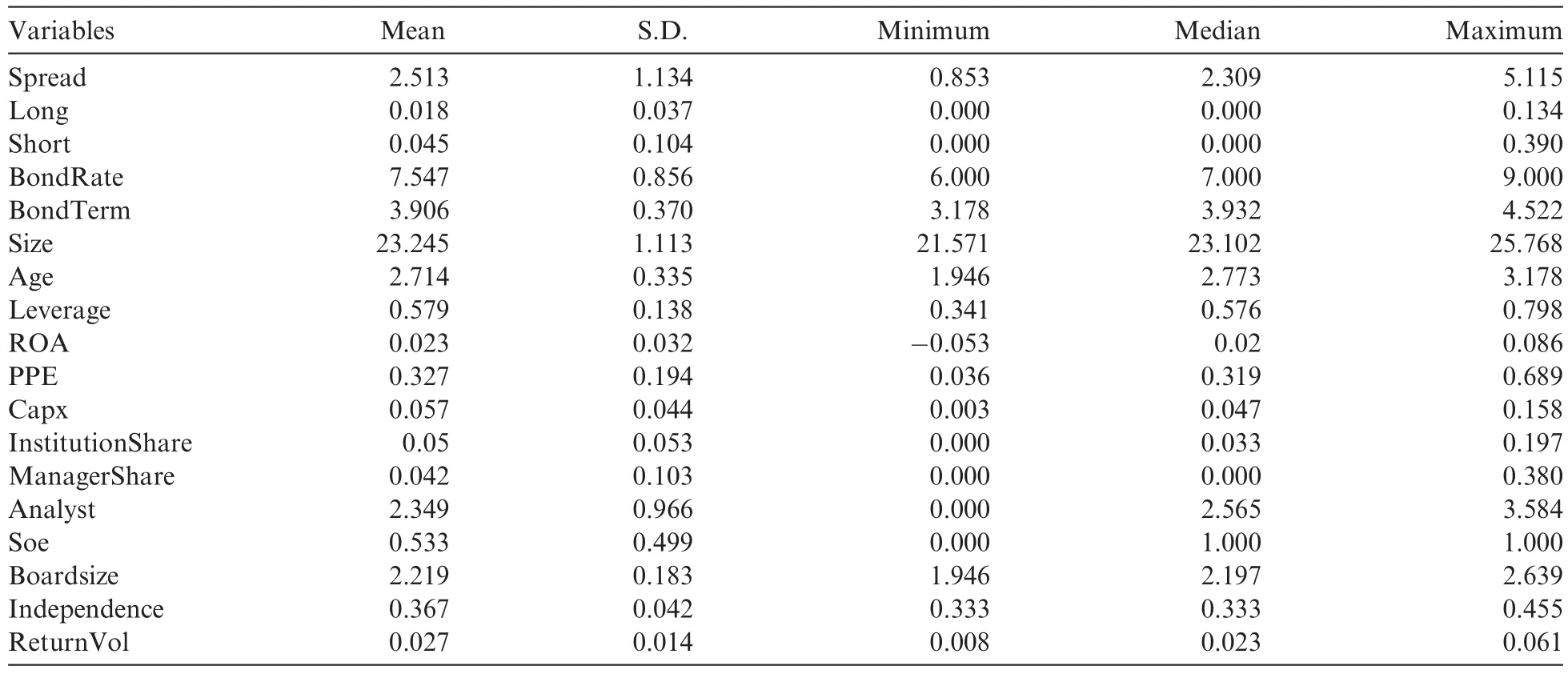

Table 2presents the variables’statistics.The bond yield spread varies from 0.853 to 5.115,the mean value is 2.513 and the standard deviation is 1.134.These figures indicate that the distribution of the bond yield spread is reasonable.The mean ofLongis 0.018,indicating that,on average,1.8%of stocks are margin traded.The mean ofShortis 0.045,indicating that,on average,0.045%stocks experience short selling.The smallest value forBond Rateis 6 and the largest is 9,indicating the high credit rating of the observations.All of these results could be explained by issuer characteristics.

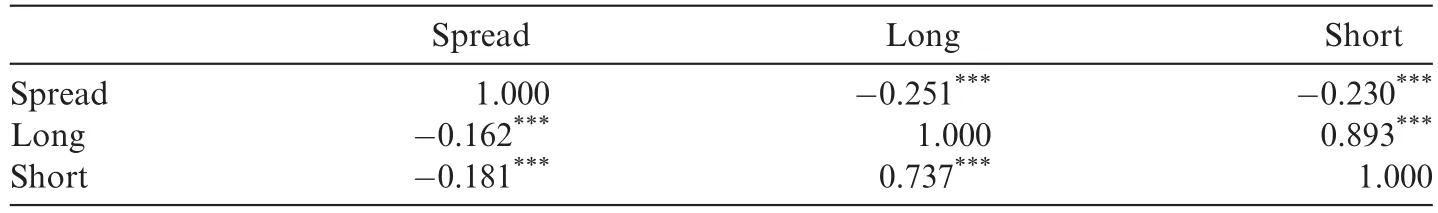

Table 3reports the coefficients of the correlation between the independent and dependent variables.The values on the lower left of Table 3 are the Pearson correlation coefficients and those on the upper right are the Spearman correlation coefficients.The result shows that margin trading and short selling both have significantly negative correlations with bond yield spread,possibly indicating that margin trading and short selling decrease bond yield spread.

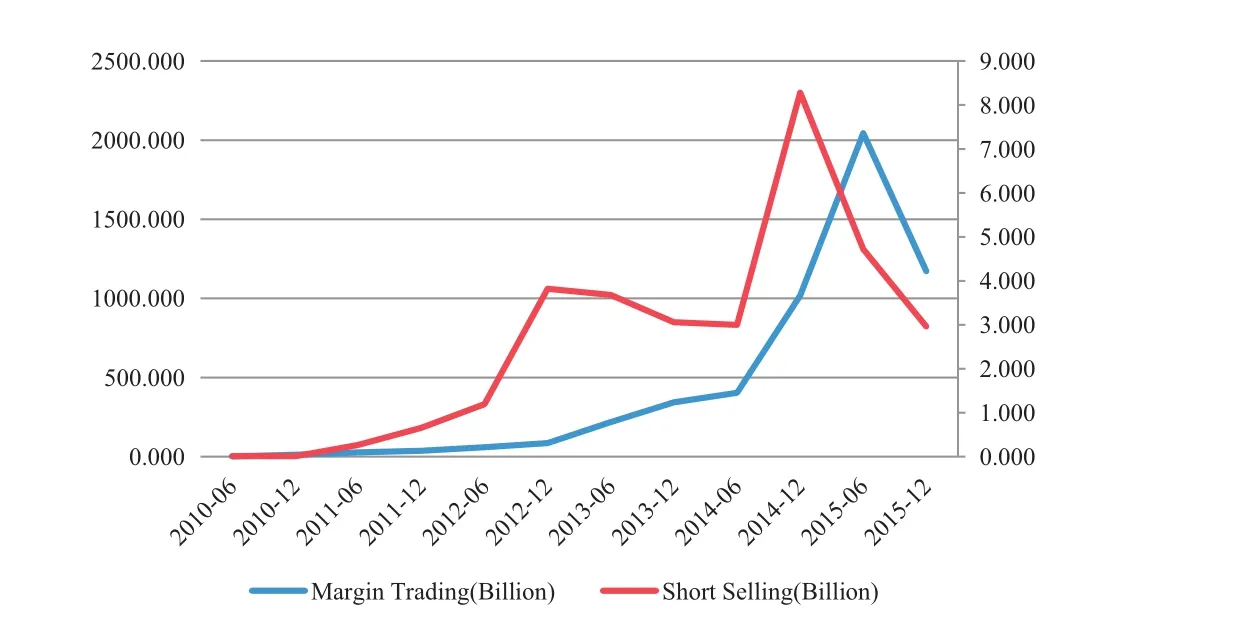

Fig.1 describes the transaction status of margin trading and short selling in China.The left axis is the volume of margin trading and the right axis is the volume of short selling.Fig.1 shows that the volume of shortselling over weighs the volume of margin trading.During the 2010 to 2012 period,there was only a small amount of margin trading and short selling.This changed around 2015.

Table 2 Descriptive statistics.

Table 3 Correlation:Pearson(Spearman)correlation coefficients are below(above)the diagonal.

Fig.1. Trends in margin trading and short selling.

5.2. Multivariate regression analysis

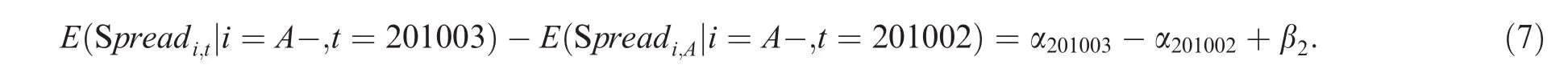

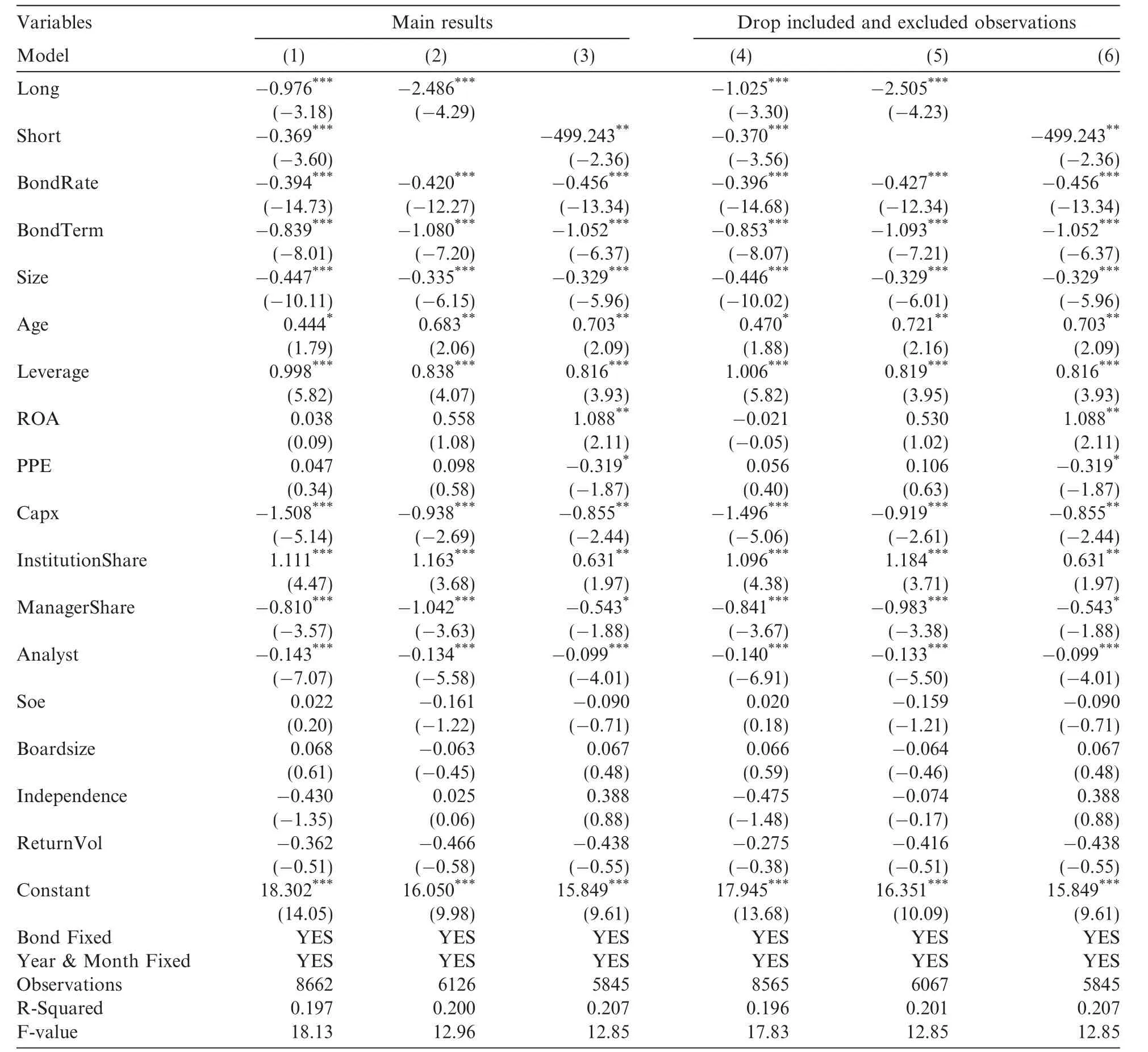

Table 4reports the results of the regressions.In the first column of Table 4,the dependent variable is bond yield spread.The independent variables are margin trading and short selling.The observations include all of the margin trading and short selling observations.The second column drops the short selling observations and the independent variable is only margin trading.The third column drops the margin trading observations and the independent variable is only short selling.Columns 4 to 6 drop observations with different excluded or included targets.

In column 1 of Table 4,the coefficients ofLongandShortare-0.976 and-0.369.They are both significant at the 1%level,indicating that margin trading and short selling both decrease bond yield spread even when bond characteristics and firm characteristics are controlled.In column 2 of Table 4,the coefficient ofLongis significantly negative,suggesting that margin trading can explain a lower bond yield spread.In column 3 of Table 4,the coefficient ofShortis significantly negative,indicating that short selling causes lower bond yield spread,perhaps for the following reasons.Margin trading transfers positive news to the bond market,whereas short selling decreases managers’earnings management,which leads to lower bond yield spreads.In additional tests,this study tests these mechanisms.Column 1 of Table 4 reports the coefficients of the Control variables.It shows that bond rate,size,and leverage all lower bond yield spread.These results are consistent with previous research(Wang and Zhang,2013).

5.3. PSM+DID analysis

Implementing Regulations for Margin Trading and Short Sellingoutlines the qualifications for target stocks such as list time,outstanding market value,shareholders,turnover rate,highs and lows,and volatilities.Tar-get stocks may have characteristics that are different from non-target stocks.5Implementing Regulations for Margin Trading and Short Selling stipulates that the choice of an underlying asset for the financial margin must meet the following criteria.(1)The stock must have been trading for more than three months.(2)The capital stock of the share in the long position is no less than 100 million or the value is no less than RMB 500 million.The capital stock of the share in the short position is no less than 200 million or the value is no less than RMB 800 million.(3)The number of shareholders is not less than 4000.(4)In the previous three months,none of the following circumstances occurred:daily average turnover rate is lower than 15%of the benchmark index daily turnover rate,and the average daily turnover amount is less than RMB 50 million;the deviation between the mean of the amplitude and the average of the benchmark index is more than 4%;and the fluctuation range is more than five times the volatility of the benchmark index.(5)The stock trade is not subject to a risk warning.To avoid this bias,propensity score matching is used along with the difference in differences method.

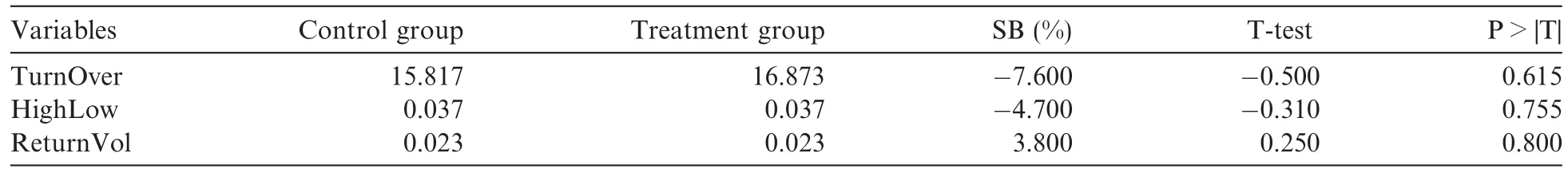

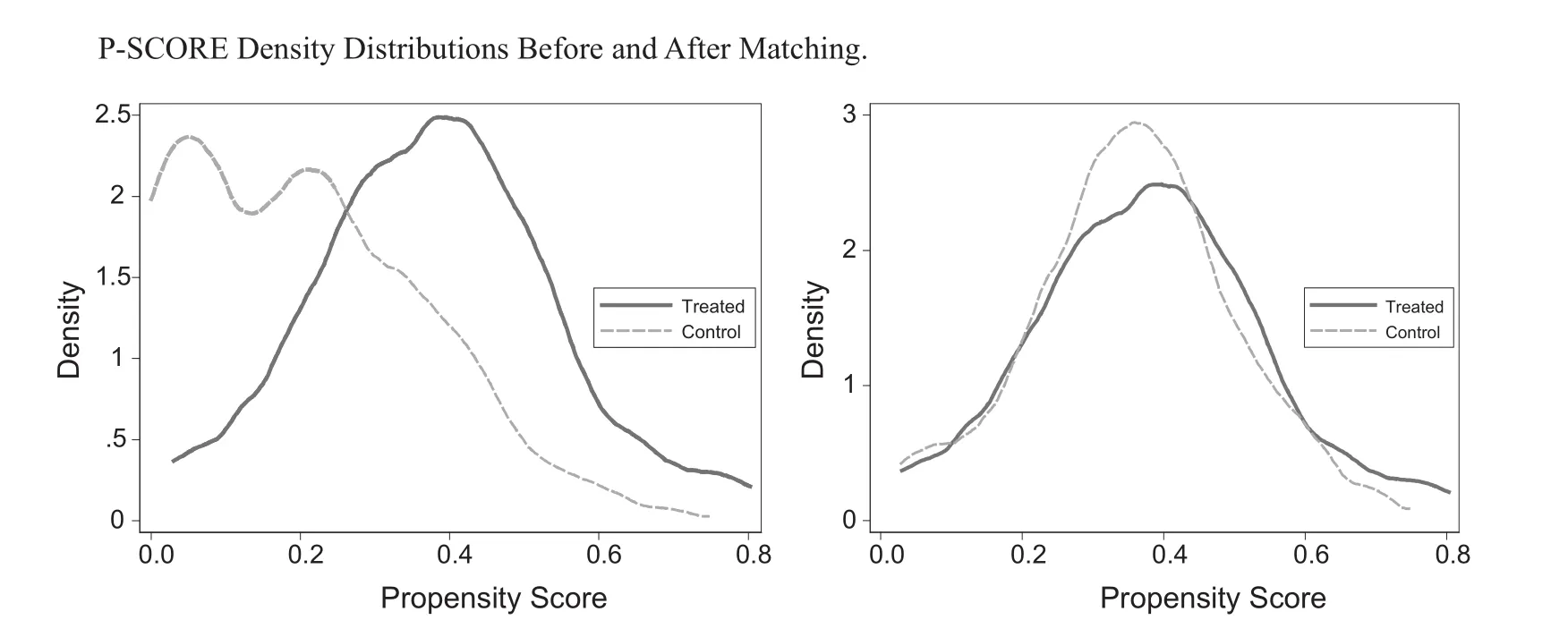

First,the observations for firms with less than 4000 shareholders,less than 0.1 billion outstanding shares,and monthly volumes of less than 50,000 million are all excluded.Then,the observations are grouped by the period when the stocks were targeted and exchanged.Then,we run a logit regressions using daily turnover,daily high and low,and daily return volatilities as Control variables.Next,the non-replacement near neighbor method of propensity score matching is used to match each target with a Control observation.This process identi fies 79 targets as a treatment group and 79 non-targets as a Control group.We test whether the observations are balanced and commonly supported.The results of the variables’balance,given in Table 5,show that there are no differences between the treatment and Control groups.Therefore,our observations after matching are balanced.Fig.2 shows the p-scores of the treatment and Control groups before and after matching.Before matching,the p-score of the treatment group is higher than that of the Control group.However,after matching,the p-scores of the two groups are the same.Fig.2 proves that the treatment and Control groups satisfy the common support criteria after propensity score matching.

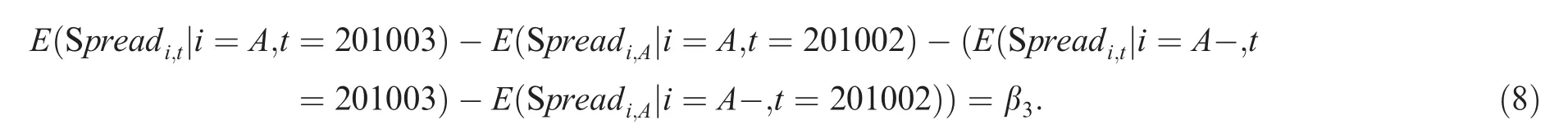

After matching,we analyze the effects of margin trading and short selling using the difference in differences method.We use theAfter,Treat,andTreat*Aftervariables.TheAftervariable is equal to 1 after an observation that has been a target or a target’s Control group.Treatis equal to 1 if an observation belongs to treatment group.The model is as follows:

For example, firm A became a target in March 2010,so the margin trading or short selling effects on the bond spread can be calculated as follows:

The Control firm A-cannot have been affected by margin trading,so the time trending change is calculated as follows:

Therefore,the margin trading and short selling effects on the bond yield spread of firm A are

In the end,β3measures the effects of margin trading or short selling on bond yield spread.If β3is significantly negative,margin trading or short selling decreases bond yield spread;if β3is significantly positive,margin trading or short selling increases the bond yield spread.

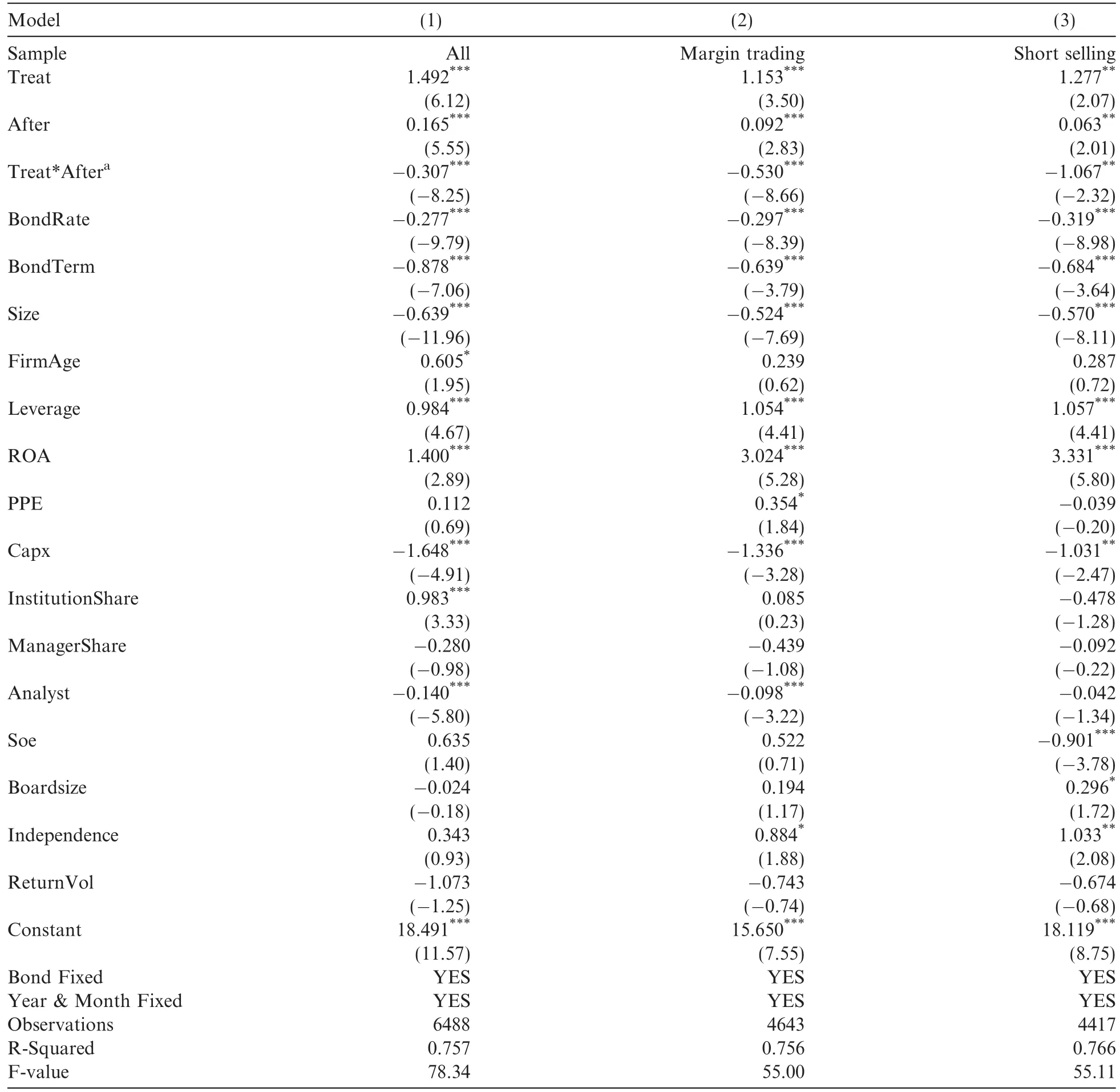

Table 6reports the regression results for the post-match DID analysis.Column 1 shows the regression results of the margin and bond yield spread.Column 2 presents only the effects of margin trading on bond yield spread.Column 3 presents only the effects of short selling on bond yield spreads.As shown in column 1,the coefficient ofTreat*Afteris significantly negative at the 1%level.As shown in column 2,the coefficient ofTreat*Afteris significantly negative at the 1%level after excluding the short selling sample,indicating that margin trading alone can reduce the bond yield spread.As shown in column 3,the coefficient ofTreat*Afteris significantly negative at the 5%level after excluding the margin trading sample,indicating that short sellingalone can reduce the bond yield spread.In summary,the analysis of the PSM+DID shows that both margin trading and short selling can reduce the bond yield spread,which is consistent with the results given in Table 4.

Table 4 Main results.

Table 5Balance test.

Fig.2. P-SCORE density distributions before and after matching.

5.4. Other robustness analysis

In August 2012,China began a pilot scheme of using securities to re finance businesses,allowing security companies to re-lend,through margin trading,to long-buyers,which increased the amount of margin trading.In February 2013,as part of the official pilot securities re financing business,the security companies were allowed to borrow from institutional investors and re-lend to short sellers,which increased the amount of short selling.This study’s analysis of the post-August 2012 sample shows that the effect of margin trading on the bond yield spread is present in this period.The analysis of the post-February 2013 sample shows that short selling securities has a negative effect on the bond yield spread,further proving the reliability of our conclusions.

This study also conducts robustness tests to examine the effect of variable selection on the results.First,we select an alternate measure of bond yield spreads,which is equal to the bond closing maturity rate at the end of the month minus the bank one-year deposit interest rate.Second,to eliminate the effects of industry or annual heterogeneity in the short selling and margin trading of securities,we adjust the short selling and margin trading data by industry and year.Third,the degree of margin trading is measured as the percentage of all share transactions that is made up of margin trading and the degree of short selling is measured as the percentage of all share trading that is made up of short selling.Fourth,as the total amount of short selling is small,the net amount can only measure the effect of margin trading on bond yield spread.In this study,after the proportion of short selling is deducted from the total short trading,we find the minimum is zero,indicating that there are no times when the amount of short selling is greater than the amount of margin trading.Therefore,the impact of the short selling of securities on bond yield spreads cannot be measured in this analysis.To ensure the robustness of the results,this study adopts the net amount to analyze the impact of margin trading on yield spreads.Fifth,the current short selling and margin trading are regressed with the next period yield spread to avoid a reverse causal relationship.The results of these robustness analyses are consistent with the conclusions of the main regression.Further details of these analyses are omitted due to space limitations.

6. Further analysis

6.1. Path through which margin trading affects the yield spread of bonds

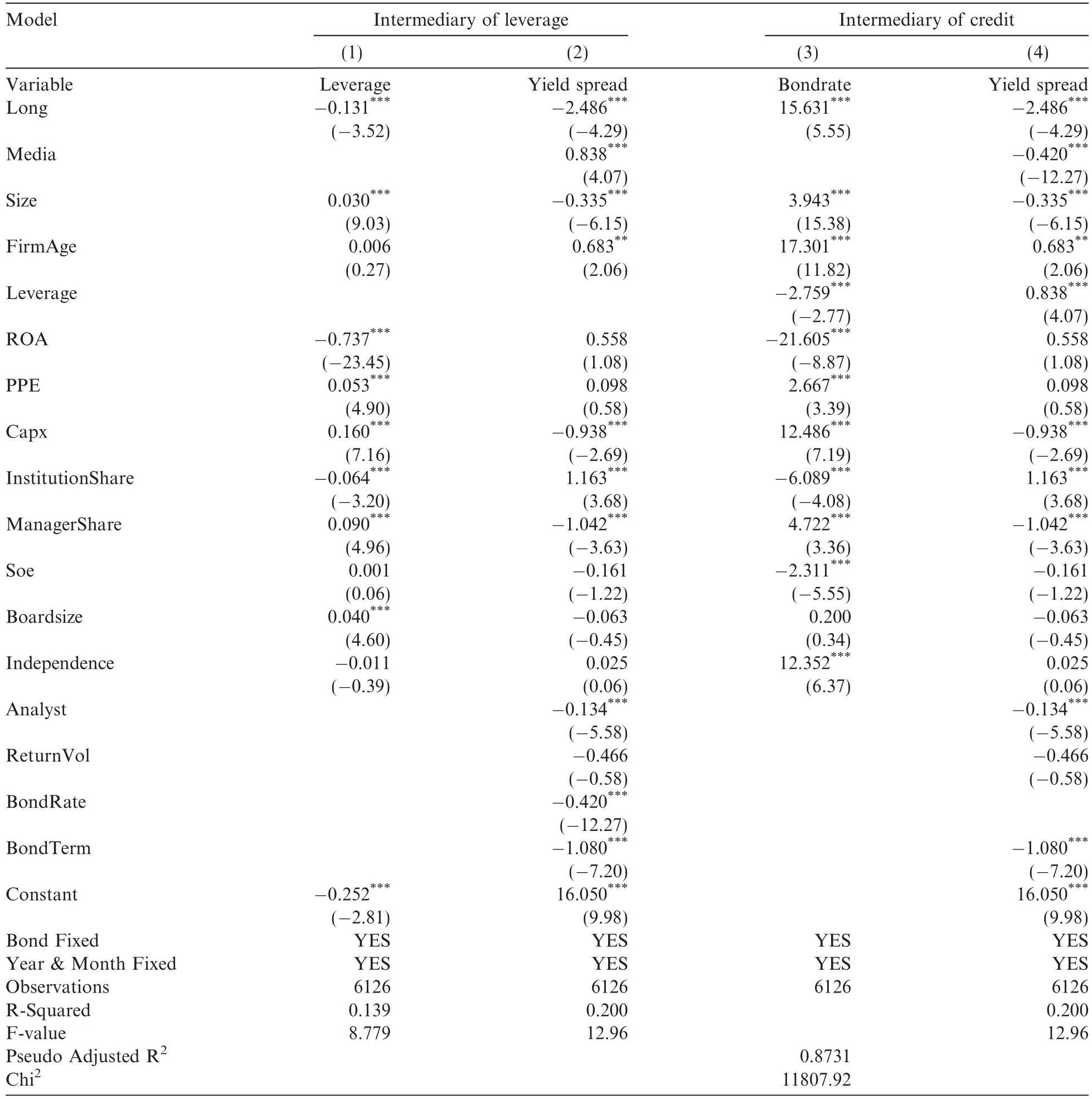

This section explores how margin trading affects bond yield spreads.Previous research has indicated that low leverage(Shi and Jiang,2013)and high credit rating(Ziebart and Reiter,1992)are positive information inthe bond market.To see whether margin trading transactions can identify such information,we examine the intermediary effect(Media)of leverage and credit rating.The results are shown in Table 7.

Table 6 PSM+DID analysis.

In columns 1 and 3 of Table 7,LeverageandBond Rateare the dependent variables,andLongis the independent variable.In columns 2 and 4,we regress the asset-debt ratio(Leverage),credit rating(Bond Rate),and margin trading position(Long)with the yield spread(Spread).As shown in column 1,the coefficient ofLongis significantly negative at the 1%level,indicating that stock market investors prefer companies with lower asset-debt ratios.As shown in column 2,the coefficient ofMediais significantly positive at the 1%level.In other words,Leverageis positively correlated with the yield spread.The Sobel Z value,calculated with the mediation effect model,is 2.662,the p value is 0.008,and the coefficient of margin trading is significantly negative at the 1%level,indicating that asset-debt ratio(Leverage)is one type of optimistic information transmitted by a long transaction.This positive information decreases the bond yield spreads.

Table 7 Path of optimistic information in margin trading.

The coefficient ofLongshown in column 3 of Table 7 is significantly positive at the 1%level,indicating that the credit rating of the bond issued by the company that has margin trading is higher;the coefficient ofMedia,shown in column 4 of Table 7,is significantly negative.In other words,the higher the bond credit rating(Bon-d Rate),the lower the credit spread.The Sobel Z value,calculated with the Mediation Effect model,is 5.057,the p value is zero,and the margin trading position is significantly negative at the 1%level,indicating that credit rating is another intermediary.Table 7 shows that companies with margin trading have lower asset debt ratios and higher credit ratings.This kind of optimistic information is passed on to the bond market and reduces the bond yield spreads,supporting the argument that margin trading transmits a company’s optimistic information to the bond market and thus reduces the bond yield spread.

Table 8 Mechanism of short selling’s governance effect.

6.2. Path through which short selling affects the yield spread of bonds

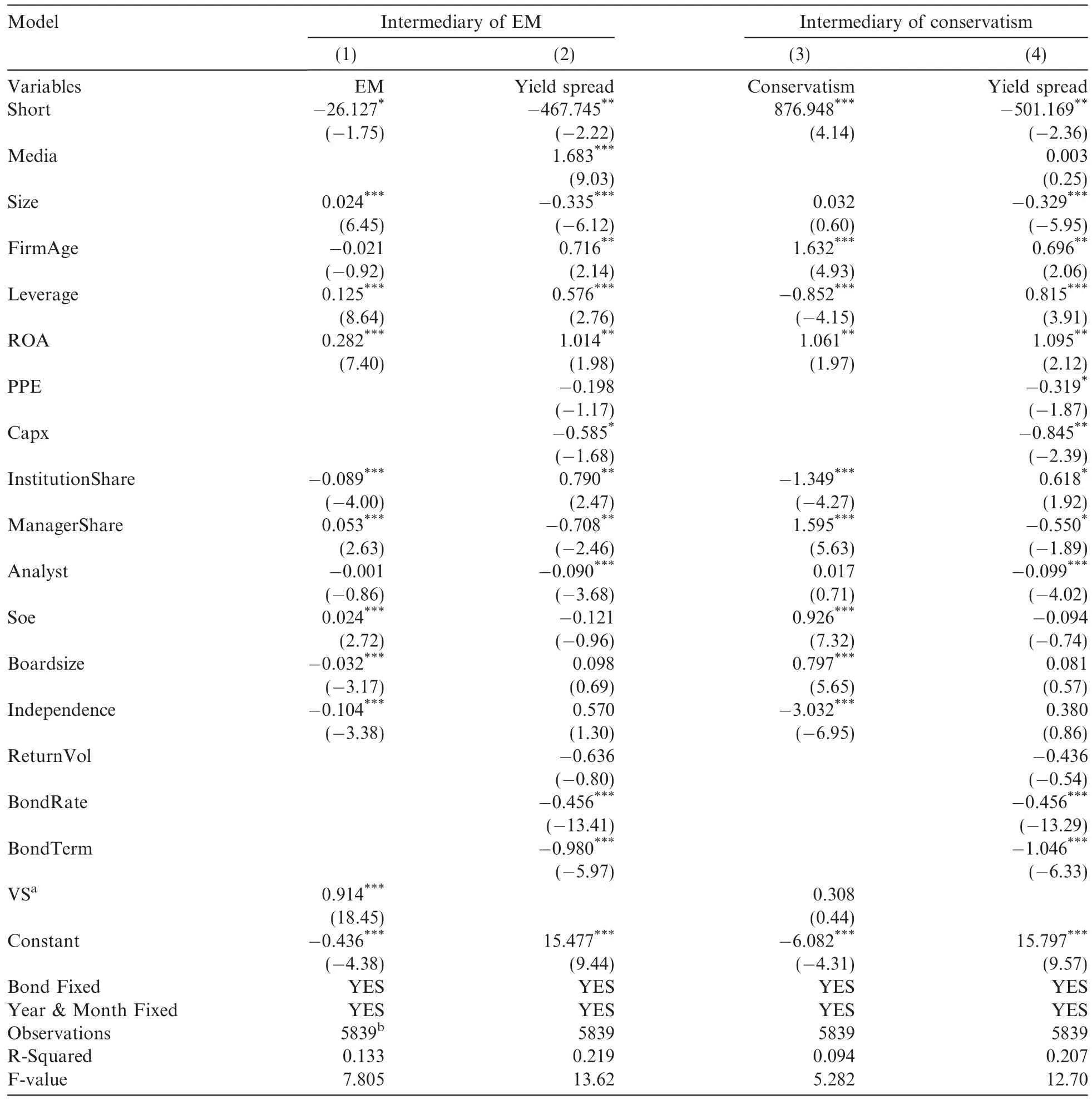

Short selling of securities increases the information contained in stock price and thus reduces the motivation for earnings management(Fang et al.,2016;Chen and Liu,2014a).This restriction on the opportunistic behavior of executives may reduce the information asymmetry between bond investors and firms,and thus reduce the bond yield spreads.Table 8 presents the results of an examination of the mediating effects of earning managements and the accounting conservatism.

In columns 1 and 3 of Table 8,earnings management(EM)6EM is the absolute value of earnings management as calculated by the Jones model(Jones,1991).and accounting conservatism(Conservatism)7Conservatism is measured as in Khan and Watts(2009).are the respective dependent variables,and short selling(Short)is the independent variable.Columns 2 and 4 show the results of regressing earnings management(EM),accounting conservatism(Conservatism),short selling(Short),and yield spread(Spread).The results show that the coefficient of short selling is significantly negative at the 10%level,indicating that earnings management is lower in companies associated with short selling.As shown in column 2,the coefficient ofMediais significantly positive at the 1%level.In other words,Mediais positively correlated with the credit spread.The Sobel Z value is 1.718,the p value is 0.086,and the short selling position is significantly negative at the 5%level,indicating that earnings management is one of the paths through which short selling decreases bond yield spreads.

As shown in column 3 of Table 8,the coefficient of short selling is significantly positive at the 1%level,indicating that the short selling of the securities improves accounting conservatism.As shown in column 4,the coefficient ofMediais not significant,indicating that accounting conservatism does not affect the bond yield spread and the short selling of securities does not reduce the bond yield spread by increasing accounting conservatism.This result is not surprising.From the debt contracting perspective,accounting conservatism forces listed companies to report bad news in a timely fashion,which helps creditors to supervise the listed companies and to renegotiate debt contracts;therefore,accounting conservatism may reduce the bond yield spread.However,from the contractual cost of bond contracting perspective,the existence of transaction costs increases the costs of forming bond contracts.Even if accounting conservatism ensures that bad news is reported in a timely fashion,the cost for bond investors in the public market to renegotiate the bond contract is higher(Bharath et al.,2008).Therefore,higher accounting conservatism may increase the cost of contracts,making bond investors more dependent on bond prices and requiring higher bond yield spreads.In this case,accounting conservatism may increase bond yield spreads(Li,2013;Liu and Magnan,2016).

This study finds that short selling can reduce the yield spreads of bonds.However,Kecske´s et al.(2013)pointed out that short selling of securities conveys bad news,resulting in higher yield spreads.The explanation for this inconsistency may lie in the poor governance environment of listed companies in China and the short selling habits of investors.Listed companies with poor governance,to avoid being stalled by short sellers,tend to improve their level of governance and reduce opportunistic behavior.However,when it comes to making transactions in China’s securities,institutional investors are only involved in a limited way,and individual investors’understanding of short selling and private information is insufficient for them to understand the bad news about listed companies being transmitted by these transactions.

7. Conclusions

This study examines the impact of margin trading and short selling on bond yield spreads using corporate bonds data from the 2008–2015 period.The results show that(1)margin trading and short selling of stocks have significantly reduced the yield spreads of bonds;(2)companies involved in margin trading have lower asset-debt ratios and higher credit ratings than those that are not,which also reduces the yield spreads;and(3)the effect of short selling reduces bond yield spreads indirectly by reducing earnings management.Previous studies of the economic consequences of margin trading and short selling focused on the stock market and corporate governance.This study explores the possible impact of margin trading and short selling on the bond market through the spillover effect of stock market information.It concludes that the margin trading and short selling of securities is a“carnival”both for the stock market and the bond market,proving that stock market information can spill over into the bond market through margin trading and short selling and have widespread effects.These results will be useful for regulators and policy advisors.

Acknowledgements

We acknowledge financial support from the National Science Foundation of China(Project No.71602148),the MOE(Ministry of Education,China)Project of Humanities and Social Sciences(Project No.16YJC630065),and the Fundamental Research Funds for the Central Universities(Project No.531107051035).

Anderson,R.C.,Mansi,S.A.,Reeb,D.M.,2003.Founding family ownership and the agency cost of debt.J.Finan.Econ.68(2),263–285.

Armstrong,C.S.,Balakrishnan,K.,Cohen,D.,2012.Corporate governance and the information environment:evidence from state antitakeover laws.J.Account.Econ.53(1–2),185–204.

Baber,W.R.,Gore,A.K.,Rich,K.T.,Zhang,J.X.,2013.Accounting restatements,governance and municipal debt financing.J.Account.Econ.56(2/3),212–227.

Bagnani,E.S.,Milonas,N.T.,Saunders,A.,Travlos,N.G.,1994.Managers,owners,and the pricing of risky debt:an empirical analysis.J.Finan.49(2),453–477.

Beaver,W.H.,1966.Financial ratios as predictors of failure.J.Account.Res.4(1),71–111.

Bertrand,M.,Mullainathan,S.,2003.Enjoying the quiet life?Corporate governance and managerial preferences.J.Poli.Econ.111(5),1043–1075.

Bharath,S.T.,Sunder,J.,Sunder,S.V.,2008.Accounting quality and debt contracting.Account.Rev.83(1),1–28.

Borisova,G.,Fotak,V.,Holland,K.,Megginson,W.L.,2015.Government ownership and the cost of debt:evidence from government investments in publicly traded firms.J.Finan.Econ.118(1),168–191.

Chang,E.C.,Luo,Y.,Ren,J.,2014.Short-selling,margin-trading,and price efficiency:evidence from the Chinese market.J.Bank.Finan.48(C),411–424.

Chen,H.,Liu,F.,2014a.The governance roles of margin trading:a perspective of earning management.Account.Res.09,45–52(in Chinese).

Chen,H.,Liu,F.,2014b.The governance roles of margin trading:a perspective of accounting conservatism.Chin.Account.Rev.(Z1),277–294(in Chinese)

Christophe,S.E.,Ferri,M.G.,Hsieh,J.,King,T.H.D.,2015.Short selling and cross-section of corporate bond returns.Working Paper.Chu,J.,Fang,J.,2016.Margin trading,short selling and deterioration of crash risk.Econ.Res.J.5,143–158(in Chinese).

Dechow,P.M.,Hutton,A.P.,Meul broek,L.,Sloan,R.G.,2001.Short-sellers,fundamental analysis,and stock returns.J.Finan.Econ.61(1),77–106.

Desai,H.,Krishnamurthy,S.,Venkataraman,K.,2006.Do short sellers target firms with poor earnings quality?Evidence from earnings restatements.Rev.Account.Stu.11(1),71–90.

Duffee,G.R.,1998.The relation between treasury yields and corporate bond yield spreads.J.Finan.6(53),2225–2241.

Erturk,B.,Nejadmalayeri,A.,2012.Equity short selling and the cost of debt.Working Paper.

Fang,V.W.,Huang,A.H.,Karpoff,J.M.,2016.Short selling and earnings management:a controlled experiment.J.Finan.71(3),1251–1294.

Fischer,P.E.,Verrecchia,R.E.,1997.The effect of limited liability on the market response to disclosure.Contemp.Account.Res.14(3),515–541.

Fleming,J.,Kirby,C.,Ostdiek,B.,1998.Information and volatility linkages in the stock,bond,and money markets.J.Finan.Econ.49(1),111–137.

Gao,Q.,Zou,H.,2015.A comparative study on the secondary market pricing of China’s enterprise bonds and corporate bonds.J.Finan.Res.01,84–100(in Chinese).

Gebhardt,W.R.,Hvidkjaer,S.,Swaminathan,B.,2005.Stock and bond market interaction:does momentum spill over?J.Finan.Econ.75(3),651–690.

Goldstein,I.,Guembel,A.,2008.Manipulation and the allocational role of prices.Rev.Econ.Stud.75(1),133–164.

He,P.,Jin,M.,2010.The impact of credit rating on Chinese bond market.J.Finan.Res.04,15–28(in Chinese).

Henry,T.R.,Kisgen,D.J.,Wu J.,2010.Do equity short sellers anticipate bond rating downgrades?Working Paper.

Hong,H.,Kubik,J.D.,Stein,J.C.,2008.The only game in town:Stock-price consequences of local bias.J.Finan.Econ.90(1),20–37.Jarrow,R.A.,Yu,F.,2001.Counterparty risk and the pricing of defaultable securities.J.Finan.56(5),1765–1799.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the firm:managerial behavior,agency costs and ownership structure.J.Finan.Econ.3(4),305–360.

Jiang,J.,2008.Beating earnings benchmarks and the cost of debt.Account.Rev.83(2),377–416.

Jin,Q.,Hou,Q.,Li,G.,Xie,Y.,2015.Deregulation on short sale constraint,corporate investment and valuation.Econ.Res.J.10,76–88(in Chinese).

Jones,J.J.,1991.Earnings management during import relief investigations.J.Account.Res.29(2),193–228.

Jorion,P.,Zhang,G.,2009.Credit contagion from counterparty risk.J.Finan.64(5),2053–2087.

Karpoff,J.M.,Lou,X.,2010.Short sellers and financial misconduct.J.Finan.65(5),1879–1913.

Kecske´s,A.,Mansi,S.A.,Zhang,A.J.,2013.Are short sellers informed?Evidence from the bond market.Account.Rev.88(2),611–639.Khan,M.,Watts,R.L.,2009.Estimation and empirical properties of a firm-year measure of accounting conservatism.J.Account.Econ.48(2–3),132–150.

Li,J.,2013.Accounting conservatism and debt contracts:efficient liquidation and covenant renegotiation.Contemp.Account.Res.30(3),1082–1098.

Li,Y.,Zhang,L.,2015.Short selling pressure,stock price behavior,and management forecast precision:evidence from a natural experiment.J.Account.Res.53(1),79–117.

Li,Z.,Chen,C.,Lin,B.,2015.Does short selling improve price efficiency in the Chinese stock market?Evidence from natural experiments.Econo.Res.J.04,165–177(in Chinese).

Liu,M.,Magnan,M.,2016.Conditional conservatism and the yield spread of corporate bond issues.Rev.Quant.Finan.Acc.46(4),847–879.

Longstaff,F.A.,Schwartz,E.S.,1995.A simple approach to valuing risky fixed and fl oating rate debt.J.Finan.50(3),789–819.

Luo,D.,She,G.,2015.Official’s turnover and issuance of local government.Econo.Res.J.06,131–146(in Chinese).

Massa,M.,Zhang,B.,Zhang,H.,2015.The invisible hand of short selling:does short selling discipline earnings management?Rev.Finan.Stud.28(6),1701–1736.

Merton,R.C.,1974.On the pricing of corporate debt:the risk structure of interest rates.J.Finan.29(2),449–470.

Miller,E.M.,1977.Risk,uncertainty,and divergence of opinion.J.Finan.32(4),1151–1168.

Sengupta,P.,1998.Corporate disclosure quality and the cost of debt.Account.Rev.73(4),459.

Shen,H.,Liao,G.,2014.Can credit rating agencies provide incremental information?Empirical tests based on short-term financing bonds.Finan.Trade Econo.08,62–70(in Chinese).

Shi,D.,Jiang,G.,2013.Accounting information and corporate bond credit rating migration.Account.Res.03,43–50(in Chinese).

Shi,Y.,Ding,W.,Yuan,S.,2013.Market interconnection,risk spillover effect and financial stability:a perspective of spillover effect analysis on stock market and bond market.J.Finan.Res.03,170–180(in Chinese).

Wang,X.,Zhang,C.,He,J.,2015.Macroeconomic volatility and the risk premium of short-term financial bond.J.Finan.Res.01,68–83(in Chinese).

Wang,X.,Zhang,C.,2013.Reputation mechanism,credit rating and cost of the medium term note in the inter-bank market.J.Finan.Res.08,150–164(in Chinese).

Xiao,H.,Kong,A.,2014.A study on the mechanism of the impact of the securities margin trading on the fl uctuations of the special nature of the stock price:a test based on the difference-in-difference model.Manage.World 08,30–43(in Chinese).

Xu,H.,Yang,G.,2013.Cross-market impacts of investor sentiment in the stock markets–on the effect of investor sentiment on bond issue costs.J.Finan.Econo.02,47–57(in Chinese).

Yu,F.,2005.Accounting transparency and the term structure of credit spreads.J.Finan.Econo.75(1),53–84.

Zhang,J.,Bai,X.,Meng,X.,2016a.Does margin trading and short selling promote insider trading?Evidence from listed companied in China.J.Finan.Res.6,176–192(in Chinese).

Zhang,X.,Zhou,P.,Li,C.,2016b.Short selling and earning quality:evidence from corporate financial restatement.J.Finan.Res.8,175–190(in Chinese).

Zhou,L.,Chen,Y.,2005.The policy effect of tax-and-fees reforms in rural China:a difference-in-differences estimation.Econo.Res.J.8,44–53(in Chinese).

Ziebart,D.A.,Reiter,S.A.,1992.Bond ratings,bond yields and financial information.Contemp.Account.Res.9(1),252–282.