Accruals quality,underwriter reputation,and corporate bond underpricing:Evidence from China

Si Xu,Gungming Gong,Xun Gong

aSchool of Economics and Management,South China Normal University,ChinabBusiness School of Hunan University,China

cCollege of Finance and Statistics,Hunan University,China

1.Introduction

A growing number of studies have documented that information asymmetry theory can explain the underpricing of firms’initial public offerings(IPOs)(Rock,1986;Cai et al.,2007;Zheng and Stangeland,2007).Jog and McConomy(2003) find that IPO firms that do not include earnings forecasts face higher underpricing,although this difference is concentrated among small firms.Schrand and Verrecchia(2005)conclude that firms with more frequent disclosures before the IPO are associated with lower underpricing.Leone et al.(2007)document that IPO underpricing decreases when issuers disclose more specific information in the ‘uses of proceeds”section of their prospectus.In addition,Boulton et al.(2011)study the relationship between earnings quality and international IPO underpricing and find that IPOs are underpriced less in countries where public firms produce higher quality earnings information.

Although there is a sizable body of research on the impact of information asymmetry on IPO underpricing,the vast majority of that research focuses on equity markets.Given the inherent differences between equity markets and bond markets,such as market liquidity,conclusions drawn from studies of equity underpricing may not provide reliable indications of the patterns of bond underpricing(Cai et al.,2007;Liu and Magnan,2014).Due to the asymmetric payoff function and their fixed claims on corporate assets,bondholders have stronger incentives than equity investors to demand high-quality financial reporting to reduce the information asymmetry problem(Ball et al.,2008).More specifically,Bessembinder and Maxwell(2008)point out that a corporation issues bonds at different points in time with contracts that vary in terms of bond features,and that these distinct bonds are traded separately.From this perspective,bonds differ substantially from equity;therefore,bond and equity investors could have different expectations of the supply of financial information.In this study,we consider corporate bond offerings made by public firms(including initial bond offerings(IBO)and secondary bond offerings,(SBO)).1Glushkov et al.(2014)indicate that public companies can be divided into three categories through their choice on listing paths:(1)traditional IPOs with no public debt outstanding;(2)private firms undertaking an initial public debt offering;and(3)all public firms that undertake public debt offering for the first time.They find significant differences between these types of firms in several aspects.As all issuers of Chinese corporate bonds are listed firms,our research focuses on the third category.We then focus on the quality of borrowers’ financial information and examine how it relates to bond underpricing in the context of the information asymmetry problem in China.

In addition,a growing number of studies have documented that reputable underwriters can signal and certify the quality of issuers’ financial information during IPOs(Chemmanur and Krishnan,2012;Yang et al.,2017).Cooney et al.(2001)show that there is a negative relation between underwriter reputation and underpricing,which is consistent with the certification role of underwriters.Brau and Fawcett(2006) find that hiring a top investment bank to underwrite an IPO is a positive signal,and Kim et al.(2010)also provide evidence that reputable underwriters are able to differentiate the quality of issuers and to reflect this information in the underwriting spread.Thus,reputable underwriters can reduce information asymmetry between issuers and public investors(Dong et al.,2011),which to some extent can mitigate the negative impact of low information quality on bond underpricing.

Based on these findings,this study focuses on the effect of accounting information quality on the costs of corporate bonds.We argue that more precise and reliable earnings mitigate adverse selection costs by reducing information asymmetries between the issuer and bondholders.Accordingly,we first document that firms with lower accruals quality are associated with higher bond underpricing.One mechanism that can mitigate this uncertainty is the presence of a reputable underwriter,which can signal and certify issuer accruals quality.Thus,we infer and verify the second conclusion,that is,the impact of low accruals quality on underpricing is partially offset by employing a reputable underwriter.However,in our additional tests,we find that this association is only robust for initial bond offering,whereas no significant association is found for the secondary bond offering.

To broaden our tests,we use path analysis to evaluate the extent to which reputable underwriters reduce the negative effect of poor accruals quality on underpricing.In our path model,we posit an indirect link through reputable underwriters between accruals quality and bond underpricing.We follow the procedure in Bhattacharya et al.(2012)to weight the relative importance of both direct and indirect paths.Our path analysis results show that although high-quality underwriters have a significant mediation effect on the relationship between accruals quality and bond underpricing,only approximately 11%of the total effect of accruals quality on underpricing can be attributed to the indirect path through reputable underwriters.The results again indicate the predominant role of accruals quality in determining bond underpricing and highlight the importance of information quality in bond financing.

We perform a battery of sensitivity tests to assess the robustness of our findings.First,we use a treatment effects model to mitigate the potential endogeneity problem of accruals quality.In addition,as previous studies show that corporate governance,issuer market risk and coupon rate are likely to impact bond underpric-ing,we control for these factors in our regression analyses and find qualitatively similar results.Finally,our hypotheses are generally supported when we adopt alternative measures of underwriter reputation.

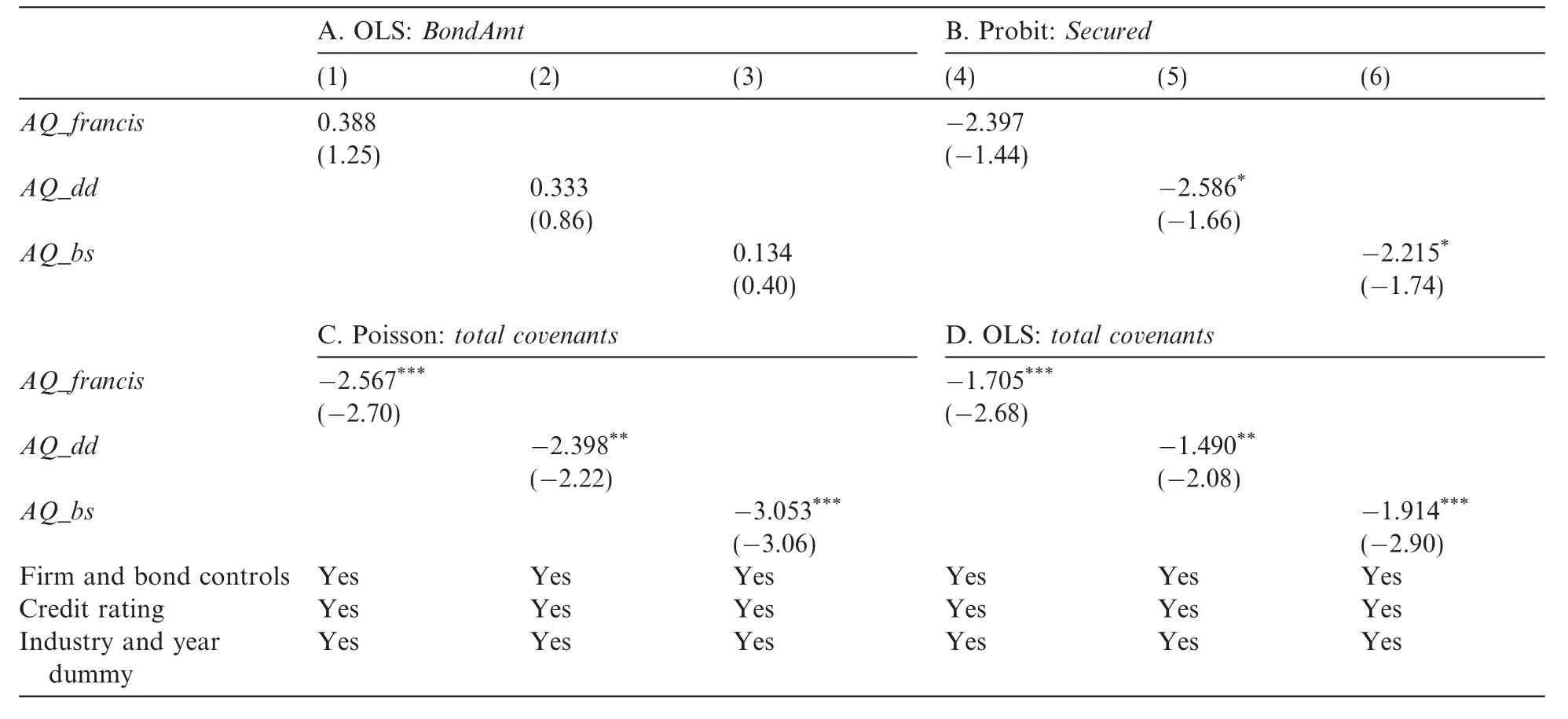

In the additional analysis,we find that firms with low accruals quality face more restrictive non-price contract terms such as greater collateral requirements and stricter covenants than firms with high accruals quality.The other non-price term such as bond issuing amount,it shows expected signs in the regression but does not turn out to be statistically significant.

Our study contributes to the literature in several ways.First,it complements previous studies of underpricing by investigating the association between accruals quality and the underpricing of corporate bonds.However,prior studies typically focus on equity underpricing(Rock,1986;Allen and Faulhaber,1989;Sherman and Titman,2002;Ellul and Pagano,2006;Boulton et al.,2011),the role of financial information in bond underpricing is unclear due to the inherent differences between the bond market and equity market(Cai et al.,2007).As an extension,our study uses firms’accruals quality to explain the underpricing of newly issued corporate bonds by focusing on the Chinese setting.

Although Cai et al.(2007)provide support for the information asymmetry view of corporate bond underpricing,our study differs from theirs in three ways.First,we study whether information asymmetry theory can explain bond underpricing by focusing on Chinese firms.Second,our study extends the underwriter literature by examining the role of underwriters in mitigating the adverse impact of poor accruals quality on bond underpricing.Third,we use path analysis to evaluate the extent of the mediation effects of reputable underwriters.While Boulton et al.(2011)argue that the impact of low accruals quality on underpricing is partially offset by hiring reputable underwriters,we provide empirical evidence that a firm’s accruals quality outweighs its use of reputable underwriters in reducing bond underpricing.To the best of our knowledge,this is the first study to estimate the mediation effects of underwriters between accruals quality and bond underpricing.Our results show that the direct link between accruals quality and underpricing dominates the indirect link mediated by reputable underwriters.

Finally,our study has important implications for management strategy.Our evidence indicates the nature of the association between accruals quality and bond underpricing,implying that when there is a trade-off between accruals quality and reputable underwriters,increasing the quality of information has a bigger payoff,in the sense that it has a greater impact on lowering bond underpricing than employing high-quality underwriters.Overall,our study shows how important it is to improve the accruals quality in bond financing.

The rest of this paper is organized as follows.We present an overview of China’s institutional background in Section 2,develop the hypotheses in Section 3 and describe the data and variables in Section 4.We present the research design and discuss the results of our main tests in Section 5.We provide robustness tests and additional tests in Sections 6 and 7,respectively.We present our conclusions in Section 8.

2.Institutional background2We are especially grateful to the referee who suggested that we should provide more detailed information about the development of corporate bonds in China.

In 2004,the Chinese Communist Party recognized the usefulness of capital markets and the importance of developing the corporate bond market in itsOpinions of the State Council on Promoting the Reform,Opening and Steady Growth of Capital Markets(Pessarossi and Weill,2013).In 2007,the government made a major regulatory change in the market with the decision to issue corporate bonds.This reform was regarded as a milestone in market development.

Since the reform,the traditional quota issue system has been replaced by a more market-oriented approval system,which immensely simplifies the issuing process.Corporations are no longer required to provide collateral,and the uses of bonds have been expanded beyond fixed asset investment to include the repayment of bank loans,supplement of working capital,etc.The most important reformation is that the People’s Bank of China(PBOC)no longer controls the offering yield of corporate bonds.Before the reform of mid-August 2007,there was an upper limit on offering yields;they had to be less than 1.4 times the comparable bank deposit rate for enterprise bonds.In the post-2007 period,there are still several requirements that issuers must meet before bond issuance.According to corporate bond issuance rules published by the China Securities Regulatory Commission(CSRC),corporations that are allowed to issue corporate bonds must meet the following requirements:(1)the average distributable profits over the latest three years must be sufficient to pay the one-year interest of the corporate bonds;(2)the accumulated outstanding balance of the company’s corporate bonds must not exceed 40%of its net asset value after this issuance;and(3)the bond must be highly rated.Therefore,we infer that bond issuers are generally financially healthy and less likely to default.After this reformation,China’s corporate bonds market developed rapidly.In 2013,the corporate bond issuance amounted to about RMB170 billion.Notably,as of March 2014,the first corporate bond default occurred when a Shanghai-based solar power company failed to pay out interest.Shortly thereafter,in May 2015,Xiangeqing Co.,Ltd became the first corporate bond issuer to fail to repay principal.

As capital providers,bondholders are interested in ensuring the timely repayment of the bond and interest that are claims on the borrower’s future cash flow and assets.Reliable financial statements provide important information to lenders,who need to evaluate the borrower’s credit worthiness and default risk;however,unreliable financial statements,e.g.,those associated with earnings management,distort the quality of reported earnings,which can impact bondholders’estimates of future cash flows(Cohen and Zarowin,2010;Ge and Kim,2014).The Chinese corporate bond market is more of an institutional investor’s arena than the equity market;approximately 90%of corporate bonds are institutionally owned.Institutional investors are generally believed to be more professional than individual investors,and are thus more likely to take the issuer’s accounting quality under consideration when allocating the wealth they manage.In conclusion,as the default events become more frequent,investors pay more attention to firms’accounting quality.

3.Related literature and hypothesis

3.1.Accruals quality and corporate bond underpricing

Although various models are used to explain underpricing in the literature,the most common is information asymmetry model.3Cai et al.(2007)also suggest a liquidity model to explain corporate bond underpricing,although they do not find evidence in favor of this model.Therefore,it is natural to examine the impact of the quality of financial information.Rock’s(1986)theoretical model shows that information asymmetry between informed and uninformed investors necessitates that underwriters use underpricing to compensate uninformed investors to offset the losses they incur due to the ‘winner’s curse” that results in the uninformed investors’disproportionate allocation of shares issued by low-quality firms.In Benveniste and Spindt’s(1989)model,informed investors use bids to communicate to underwriters the intrinsic values of issuers;underwriters use underpricing to reward these informed investors for accurately revealing the ‘true” value of issuers.Thus,we can infer that underpricing is merely compensation to investors for the costs of becoming informed and that the lower the fundamental uncertainty about a bond issue,the lower the required compensation to investors for becoming informed.Therefore,we document that the level of corporate bond underpricing can be reduced for firms with a high accruals quality.

The vast literature offers several insights into the influence of financial reporting quality on underpricing.Willenborg and McKeown(2000) find that audit opinion can reduce information asymmetry and thereby induce less underpricing,and Schrand and Verrecchia(2005)conclude that more disclosures before the IPO are associated with lower underpricing.Similarly,using credit ratings as proxies for information risk,Cai et al.(2007) find that bond issuers with unfavorable credit ratings experience greater underpricing than issuers with favorable credit ratings.Other studies investigate this relationship from the perspective of earnings management(Ball and Shivakumar,2008)and accounting conservatism(Lin and Tian,2012).Boulton et al.(2011)reach a similar conclusion in an international setting.In contrast,Allen and Faulhaber(1989)suggest a signaling explanation in which,to mitigate the effect of the adverse selection problem,good firms distinguish themselves from bad firms through underpricing.However,we do not find much evidence in support of signaling theory in the accounting literature.Overall,a high accruals quality gives outside investors better knowledge of the value of issuing firms,and the information asymmetry between issuers and investors and between informed investors and uninformed investors can be lessened.Thus,the level of corporate bond underpricing can be reduced.These arguments lead to the following hypothesis.

H1.Accruals quality is negatively associated with the underpricing of corporate bonds.

3.2.Underwriter reputation moderation effect

Our second hypothesis addresses how underwriter reputation affects the association of accruals quality with bond underpricing.The larger context of the securities-issuing literature suggests that investors face greater information asymmetry in the evaluation of issuing firms when accruals quality is low.One way to alleviate information asymmetry in the offering process is via third-party certifiers,such as auditors,underwriters and attorneys,who can certify a firm’s financial reporting quality.Here,we focus on underwriters.

There are two rational explanations for the presence of reputable underwriters.First,reputable underwriters are used to mitigate information asymmetry(Brau and Fawcett,2006;Kim et al.,2010;Chang et al.,2010).Reputable underwriters keep their valuable reputation by mitigating the issuer’s earnings management(Lee and Masulis,2011).Jo et al.(2007)study a related issue in the seasoned equity offering market and document an inverse association between underwriter quality and issuer earnings management.Second,Titman and Trueman(1986) find that an issuer with favorable information about firm value is more likely than an issuer with less favorable information to choose a high-quality underwriter.In other words,issuers that are confident of their financial reporting quality are more likely to hire high-quality underwriters,providing a signal to the market.4The signaling effect will be further discussed in the later section.The preceding discussion leads to our second hypothesis.

H2.The negative relation between accruals quality and bond underpricing is moderated when the borrower hires reputable underwriters.

4.Data and variables

This section explains the sample and data sources.We then describe the measures of the key variables used in this study.

4.1.Sample and data sources

Our sample period ranges from 2007,when Chinese firms issued their first corporate bond,to 2013.The relevant data are extracted from the Wind database.5The Wind database was developed according to the international standards for databases to meet the requirements of academic research,and it has been used in several recent studies.See,for example,Chen et al.(2013),Chen and Zhu(2013)and Gong et al.(2017).specifically,this database provides data on the year of the bond issuing,its underwriters,the issuing amounts,maturity and pre-issuing financial data.All of the financial statement data are measured at the end of the fiscal year before the bond issuance.6As suggested by Ge and Kim(2014),we use the lagged accounting variables which has two advantages.First,bond underpricing is more affected by past accounting information than by current accounting information,as past accounting information is already available to bondholders at the time of bond trading.Second,the regression of bond underpricing on lagged accounting information alleviates a potential endogeneity concern.To measure underwriter reputation,we hand-collect data from the website of the Securities Association of China(SAC).We consider only public bonds issued by China’s industrial companies.We exclude bond issues by financial institutions,as they are subject to different accounting rules and regulations.We then exclude bond issues for which data on underwriters are not available.We also exclude all of the bond issues that are missing coupon rate,offering date,maturity date or accounting data.In short,we are careful to ensure that the sample includes only corporate bonds with valid information about underwriters and other bond characteristics.This procedure results in a sample of 381 bonds.

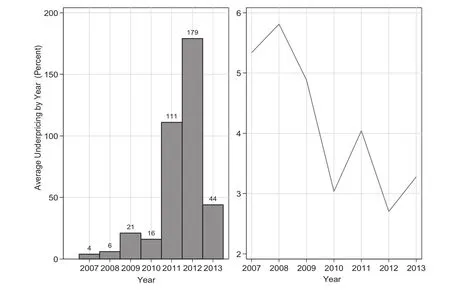

Fig.1.Yearly distribution of bond issuance(left graph)and average underpricing(right graph)over the sample period.

Fig.1 displays the distribution of bond issuance and the average underpricing over the 2007–2013 sample period.The number of bond issuances in each year is plotted in the left graph of Fig.1,which demonstrates considerable time-series volatility in the Chinese market.For example,bond issuance activity peaked in 2012 with a record of 179 firms issuing public debt,but only 4 bonds were issued in 2007.The right graph shows that bond underpricing in the Chinese market can be divided into two stages.There is a decreasing trend in bond underpricing from 5.34%in 2007 to 3.04%in 2010.In the second stage,the average level of bond underpricing fluctuates within the range of 2.5–4.0%.

4.2.Measure of accruals quality

To measure accruals quality,we use proxies that have been used extensively in research(Francis et al.,2005;Bharath et al.,2008;Lu et al.,2010).7The implicit assumption is that the measures of accruals quality are appropriate measures of information asymmetry in the bond market.Regular equity IPO firms are likely to be young with significant growth opportunities that drive a large part of the information asymmetry.For these firms,accounting numbers may capture a small part of what the firm is worth and may not be an adequate proxy for information asymmetry.Although bond issuance firms are not the same as equity IPOs and are likely to be made by older firms,it is appropriate to use an accrual-based metric to measure information asymmetry.Similar to these studies,we focus on the accuracy with which accruals convey information about cash flows to stakeholders,particularly bond investors.We use three measures of accruals quality:(1)the measure proposed by Dechow and Dichev(2002);(2)the measure developed by Dechow and Dichev(2002)as implemented by Francis et al.(2005);and(3)the measure developed by Ball and Shivakumar(2006).We measure all of the proxies at the end of the fiscal year before bond issuance.

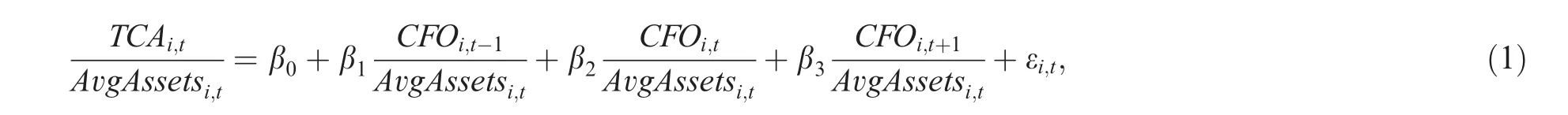

(1)Dechow and Dichev(2002)model.In this model,accruals quality is measured by the extent to which current working capital accruals map onto the operating cash flows of the prior,current and future periods.Thus,Dechow and Dichev(2002)regress current working capital accruals(TCAt)on operating cash flows in the previous year(CFOt-1),current year(CFOt)and subsequent year(CFOt+1),all deflated by average total assets.

whereTCAi,tis the working capital accruals of firmiin yeart,calculated as the change in current assets(ΔCA),minus the change in cash and cash equivalents(ΔCash),minus the change in current liabilities(ΔCL),plus the change in short-term bank debt(ΔDebt).CFOt,CFOt-1andCFOt+1signify cash flow from the operations of firmiin yearst,t-1 andt+1,respectively.Average total assets are calculated for firmiin yeartas the mean of the firm’s total assets in yearst-1 andt.

The8On 4April 2001,the CSRC issued the Index of Listed Companies’Industry classification,which serves as the industry classification standard.They include 13 industry categories.In this study,we drop the financial industry because of its different operating characteristics and debt financing activities.model is estimated for each year for each of the industry groups identified in the 2001 CSRC classification.The residual vector reflects the variation in working capital accruals unexplained by the cash flows of the previous,current and subsequent periods.Thus,the absolute value of the residual for each firm-year observation is an inverse measure of accruals quality(IAQ ddi,t=|εi,t|;the higher the residual,the lower the accruals quality).To facilitate the interpretation of this variable,we use the negative value ofIAQ_dd,which we define asAQ_dd.

(2)Francis et al.(2005)model.This model adds two variables to those in the Dechow and Dichev(2002)model:

where ΔSaleis the change in revenues and PPE is the net value of fixed assets.The model is estimated in its cross-sectional version for each industry-year combination.The absolute value of the residual for each firm-year observation is an inverse measure of accruals quality(IAQ francisi,t=|εi,t|).We use the negative value ofIAQ_francis,defined asAQ_francis.

(3)Ball and Shivakumar’s(2006)model.This model adds three variables to those in the Dechow and Dichev(2002)model:

where ΔCFO is the change in the cash flow from operations,D is a dummy variable that takes the value 1 if ΔCFOis negative and 0 otherwise and DΔCFOis the interaction between these two variables.This model tries to incorporate the asymmetry that can be recognized between gains and losses into the conventional linear accruals model.As in the previous model,this model is estimated in its cross-sectional version for each industry year combination,and the absolute value of the residual for each firm-year observation is an inverse measure of accruals quality(IAQ bsi,t=|εi,t|).We also use the negative value ofIAQ_bs,defined asAQ_bs.

4.3.Measure of underwriter reputation

Previous studies measure underwriter reputation based on either(1)underwriter ranking in the IPO tombstone or(2)the underwriter’s market share,where a larger market share indicates a higher underwriter reputation(Chen et al.,2013).As data on underwriter rankings from authoritative organizations are not available in China,we estimate underwriter reputation based on the second measure.To effectively capture the effect of underwriter reputation,we define the dummy variable,Top_underwriter,as equal to 1 if the underwriters’ranks in the top 25%in terms of their number of bond deals in the year prior to a bond issuance and 0 otherwise.9Note that underwriter reputation is measured by the number of IPO deals one year prior to the IPO year,instead of the IPO year,as underwriter reputation is established before the occurrence of a particular underwriting task.In the robustness test,we use alternative measures of underwriter reputation and the results are statistically similar.

4.4.Measure of bond underpricing

Consistent with previous studies,we measure the market-adjusted abnormal returns for the first trading day to proxy for corporate bond underpricing(Lin and Tian,2012).The measurement is described as follows.

The return of bond ‘i” at the end of the first trading day is calculated as

where Pi1is the closing price of bond ‘i” on the first trading day,Pi0is the offering price and Ri1is the total first-day return on the issuing bond.10Notably,the CSRC requires that all Chinese corporate bonds be issued at their par value(RMB100 for each bond),which means discount or premium issuing is forbidden.The return on market index for the corresponding period is

where Pm1is the closing value of the corresponding corporate bond market index on the first trading day,Pm0is the opening value for the index and Rm1is the first day’s comparable market return.

Using these two returns,the market-adjusted abnormal return for each bond on the first trading day,which we use to measure bond underpricing,is computed as

5.Empirical tests

5.1.Descriptive statistics

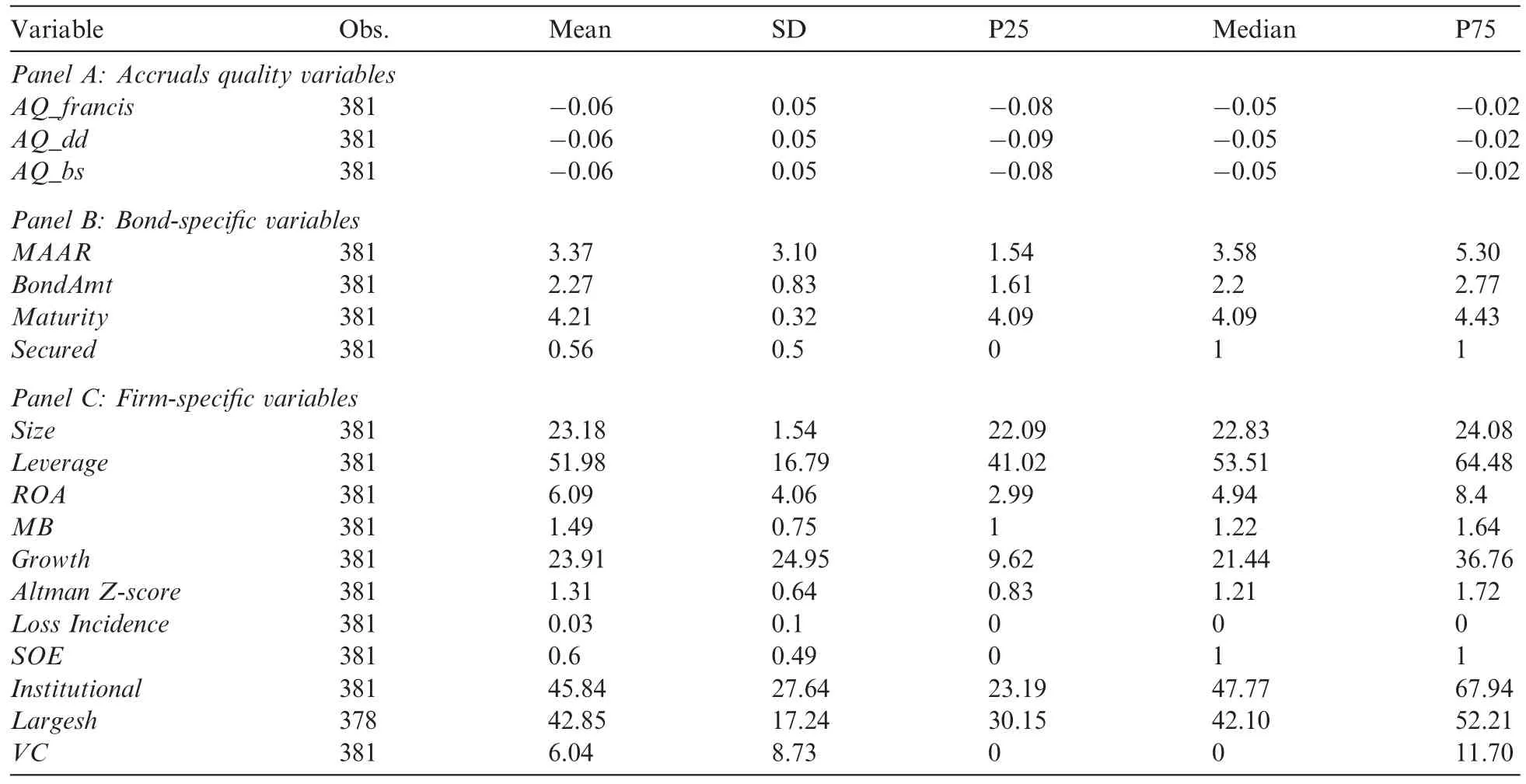

Table 1 summarizes the descriptive statistics of the variables.All of the variables are winsorized at the extreme 1%and 99%to mitigate the possible effect of outliers.The average magnitude of bond underpricing is 3.37%for the entire period.In our sample,the average offering amount is approximately RMB1.46 billion,with an average maturity of 5.89 years.11Table 1 Panel A reports the natural logarithm values of the offering amount(in hundred million),and natural logarithm of maturity(in month).On average,56%of bonds are secured.For the accruals quality proxies,the average accruals quality is-0.06.Turning to firm characteristics,the average market-to-book ratio(MB)is 1.49 and the average sales growth ratio(Growth)is 23.91.The mean value ofLeverageshows that,on average,52%of total assets are financed from debt.SOEs comprise 60%of the sample.Various performance and risk measures indicate that on average our sample firms are financially healthy.

Table 2 provides the Pearson correlations of the variables.As expected,the proxies for accruals quality show negative and significant correlations with bond underpricing(MAAR).Thus,these results present preliminary evidence of a negative association between accruals quality and bond underpricing.In addition,most of the correlation coefficients are generally within a normal range,suggesting that our variables are free of multicollinearity problems.Furthermore,we check the variance inflation factors(VIFs)of our regression.Our test indicates that the mean VIFs are less than 2,indicating that multicollinearity does not appear to be a concern.12For independent variables,we only detect a high correlation between Size and BondAmt(0.79);the analysis in the robustness section shows that this does not affect our results.

Table 1Descriptive statistics.The sample period is from 2007 to 2013.The variables are defined as follows.AQ_francis reports the negative value of the|εi,t|according to the Francis et al.(2005)model,AQ_dd according to Dechow and Dichev(2002)model and AQ_bs according to the Ball and Shivakumar(2006)model.The higher the value of AQ_francis,AQ_dd or AQ_bs,the higher the accruals quality.MAAR is a measure of underpricing with market-adjusted initial returns on the first trading day of a bond.BondAmt is the natural logarithm of the bond offering amount measured in RMB hundred million.Maturity is the natural logarithm of the maturity period of the bond in months.Secured is an indicator variable that equals 1 if the bond is secured with collateral,and 0 otherwise.Size is the natural logarithm of total assets.Leverage is a firm’s financial leverage ratio,calculated as the total debts divided by total assets.ROA is return on assets.MB is market-to-book ratio.Growth is growth in sales,measured as ending sales revenue divided by one-year lagged sales revenue.*Altman Z-score is the borrower’s Alt*man’s Z-score,which proxies for borro*wer’s default risk.Altman’*s Z-score is computed as Z=1.2(working capital/total asse*ts)+1.4(retained earnings/total assets)+3.3(EBIT/total assets)+0.6(public value of equity/book value of total liabilities)+1.0(sales/total assets).Loss Incidence is loss incidence,defined as the proportion of income losses over the past eight quarters.SOE is a dummy variable that equals 1 if its ultimate shareholder is the government,and 0 if it is an NSOE.Institutional is the percentage of shares held by institutional owners.Largesh is the percentage of shares owned by the largest shareholder.VC is the separation degree of ownership and controlling right.This table presents the description of the variables for the entire sample of 381 bond IPOs.All of the variables are winsorized at the extreme 1%and 99%levels.

5.2.Relation between accruals quality and bond underpricing

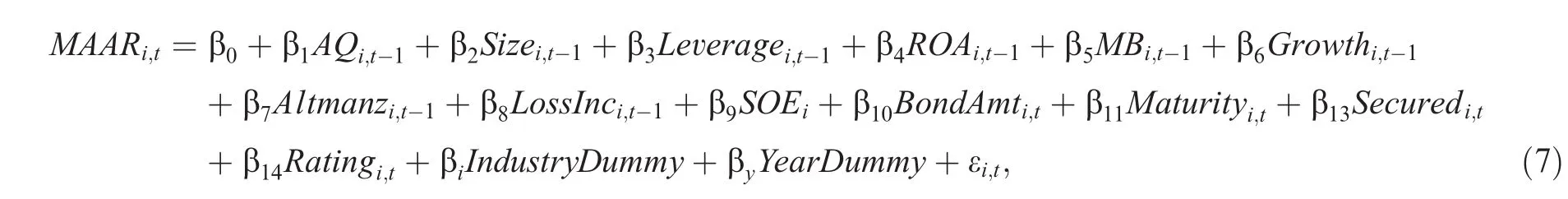

This section uses multivariate analysis to empirically test our hypothesis.Bond underpricing is the dependent variable and the proxy of accruals quality is the key explanatory variable.We use the following model to estimate the relation between accruals quality and bond underpricing:

Table 2Pearson correlations.This table reports the correlation of the variables.AQ_francis reports the negative value of the|εi,t|according to the Francis et al.(2005)model,AQ_dd according to the Dechow and Dichev(2002)model,and AQ_bs according to the Ball and Shivakumar(2006)model.A higher value of AQ_francis,AQ_dd or AQ_bs,indicates a higher accruals quality.MAAR is a measure of underpricing with market-adjusted initial returns on the first trading day of bond.Size is the natural logarithm of total assets.Leverage is a firm’s financial leverage ratio,calculated as the total debts divided by total assets.ROA is return on assets.MB is market-to-book ratio.Growth is growth in sales,measured as ending sales revenue divided by one-year lagged sales revenue.Alt*man Z-score is the borrower’s Altman*’s Z-score,which proxies for borrowe*r’s default risk.Altman’s *Z-score is computed as Z=1.2(working capital/total as*sets)+1.4(retained earnings/total assets)+3.3(EBIT/total assets)+0.6(public value of equity/book value of total liabilities)+1.0(sales/total assets).Loss Incidence is loss incidence,defined as the proportion of income losses over the past eight quarters.SOE is a dummy variable that equals 1 if its ultimate shareholder is the government,and 0 if it is an NSOE.Bond Amt is the natural logarithm of bond offering amount measured in RMB hundred million.Maturity is the natural logarithm of the maturity period of the bond in months.Secured is an indicator variable that equals 1 if the bond is secured with collateral,and 0 otherwise.All of the variables are winsorized at the extreme 1%and 99%levels.Correlations that are significant at the 5%level or less are in bold-faced.

where all of the variables are as defined in Table 1.

Following prior studies of the determinants of underpricing(Cai et al.,2007;Lin and Tian,2012),we include a number of firm-and bond-specific control variables in model(7).As new bonds issued by large firms are less risky than those of small firms,we expect the coefficient ofSizeto be negative.A higher leverage ratio implies a higher default risk,so we predict that the coefficient ofLeverageis positive.We include the market-to-book ratio(MB)and sales growth ratio(Growth)to control for the firm’s growth potential.However,the accounting literature suggests that this ratio is also a proxy for risk,so its effect on bond underpricing is unclear.We expect thatROAandAltman Z-scoreare negatively associated with risk premiums,as higher ratios indicate a lower default risk for bonds.Loss Incidenceis the incidence of loss;thus,we predict that the coefficient ofLoss Incidenceis positive.Additionally,we include theSOEvariable.SOEis a dummy variable that equals 1 if the firm is an SOE and 0 if it is an NSOE.We classify borrowers as SOEs and NSOEs based on the ownership type of their ultimate controlling shareholders.13

The bond-specific variables in model(7)includeBondAmt,Maturity,SecuredandRating.To the extent that bond issue size(BondAmt)is a measure of marketability,we expect this variable to be inversely correlated with risk premiums.The more years to maturity,the higher the interest risk exposure.Thus,we expect the coeffi-cient ofMaturityto be positive.A secured bond exposes bondholders to less default risk than an unsecured bond.Thus,the impact ofSecuredis negative.Furthermore,credit ratings may contain information about firm performance beyond those provided by publicly available financial ratios(Dichev and Piotroski,2001).Thus,we run our regressions with credit ratings.We also include year and industry indicators.In our study,we estimate the regression models with the pooled sample and reporttstatistics based ontwo-way,cluster-robust standard errors to control for both cross-sectional and time-series dependence(Petersen,2009).

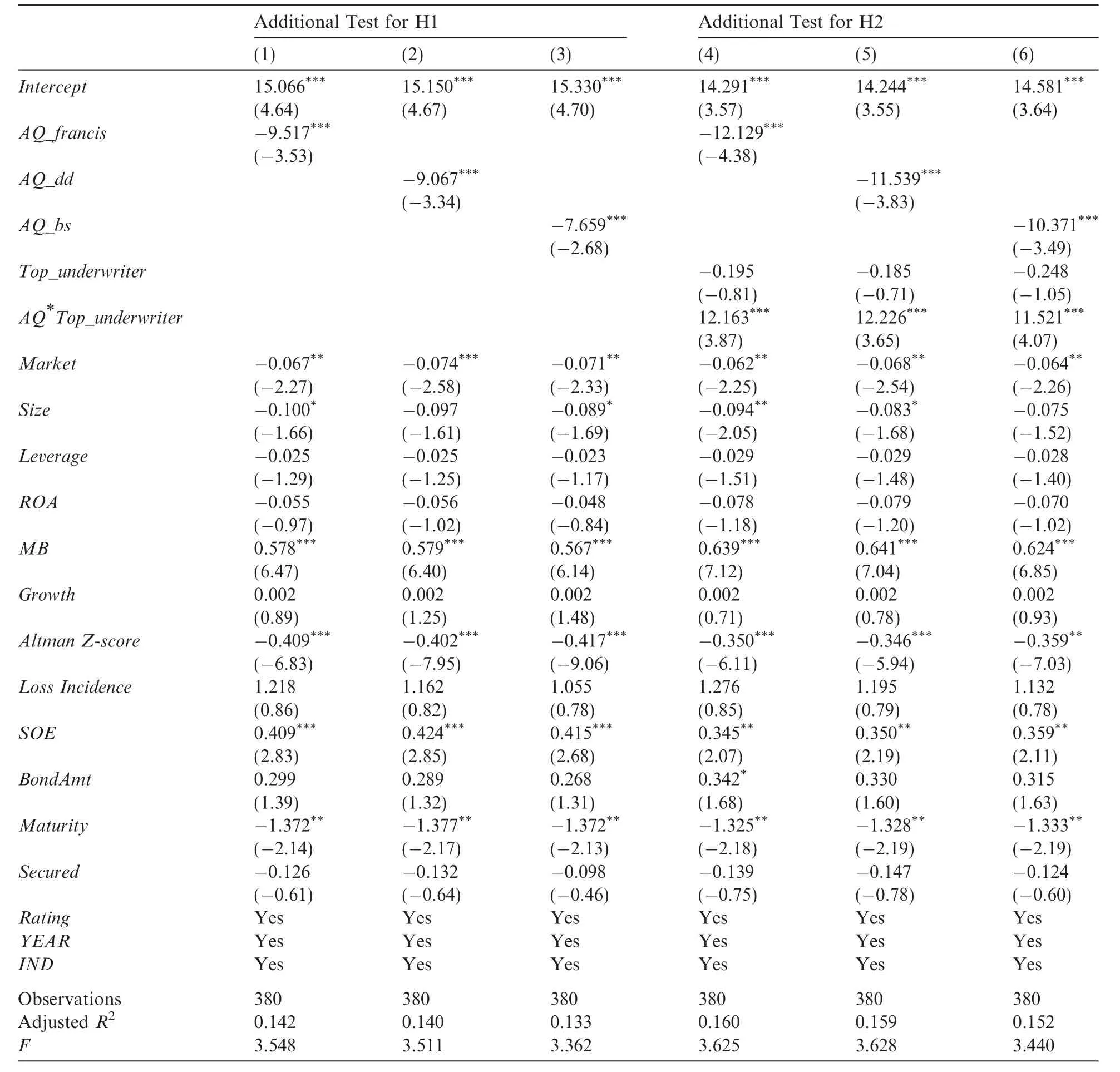

Table 3Impact of accruals quality on bond underpricing.Columns(1)–(3)report the results of estimating the relation between accruals quality and bond underpricing.Columns(4)–(6)present the OLS regression of bond underpricing on different accruals quality measures and the interaction of underwriter reputation and accruals quality.The dependent variable is MAAR,a measure of underpricing with market-adjusted initial returns on the first trading day of the bond.AQ_francis reports the negative value of the|εi,t|according to the Francis et al.(2005)model,AQ_dd according to the Dechow and Dichev(2002)model,and AQ_bs according to the Ball and Shivakumar(2006)model.A higher value of AQ_francis,AQ_dd or AQ_bs indicates higher accruals quality.Top_underwriter,a dummy variable,equals 1 if the underwriter is ranked in the top 25%in terms of the number of their bond issuing deals in the year prior to a bond issuance,and 0 otherwise.Size is the natural logarithm of total assets.Leverage is firm’s financial leverage ratio,calculated as the total debts divided by total assets.ROA is return on assets.MB is market-to-book ratio.Growth is growth in sales,measured as ending sales revenue divided by one-year lagged sales revenue.Altman Z-score is the borrower’s Altman’s Z-score,which proxies for the borrower’s default risk.Altman’s Z-score is computed as Z=1.2*(working capital/total assets)+1.4*(retained earnings/total assets)+3.3*(EBIT/total assets)+0.6*(public value of equity/book value of total liabilities)+1.0*(sales/total assets).Loss Incidence is loss incidence,defined as the proportion of income losses over the past eight quarters.SOE is a dummy variable that equals 1 if its ultimate shareholder is the government,and 0 if it is an NSOE.BondAmt is the natural logarithm of bond offering amount measured in RMB hundred million.Maturity is the natural logarithm of the maturity period of the bond in months.Secured is an indicator variable that equals 1 if the bond is secured with collateral,and 0 otherwise;All of the bond credit ratings include AA-,AA,AA+and AAA.YEAR and IND are year and industry dummies,respectively.t values are based on two-way,cluster-robust standard errors adjusting for cross-sectional and time-series dependence.***,**and*indicate that the coefficient is statistically significant different from zero at the 1%,5%and 10%level of significance,respectively.

Fig.2.Effect of accruals quality on conditional quantiles of bond underpricing.This figure plots the size of the effect of accruals quality on various conditional quantiles of bond underpricing.The first quantile(0.10)refers to a firm with one of the lowest bond underpricing in the sample firms,and the last quantile(0.90)refers to a firm with one of the highest bond underpricing in the sample.We measure accruals quality according to the Francis et al.(2005)model.

Fig.3.Basic path diagram showing the posited direct and indirect paths between accruals quality,reputable underwriters and bond underpricing.

Regarding the effect of accruals quality on bond underpricing,β1is predicted to be negative for H1;thus,higher accruals quality should reduce bond underpricing.Columns(1)–(3)in Table 3 present the results of the cross-sectional analyses of the impact of accruals quality on underpricing in the Chinese corporate bond market based on Eq.(7).The main independent variables areAQ_francis,AQ_ddandAQ_bs,respectively.The model is reasonably well specified with an adjustedR2of 13–14%at the significance level of 1%.As we predict,the coefficients on accruals quality measures are-9.625,-9.129 and-7.720 at the 1%significance level,suggesting that accruals quality is negatively and significantly related to bond underpricing in the Chinese market.These findings support H1.

Turning to control variables,we find that larger firms and firms with higherAltman Z-scoreratios receive a lower underpricing.Market-to-book ratio(MB)is strongly positively associated with underpricing,implying that borrowers with a high growth opportunity incur higher underpricing.In addition,the underpricing is higher for bonds issued by SOEs.This result is consistent with those of Chaney et al.(2011)who argue that politically connected firms have a large degree of information asymmetry,which causes a large IPO underpricing.14As for theMaturityvariable,the relationship betweenMaturityand underpricing is negative,which is inconsistent with Cai et al.(2007).Interestingly,the positive(and significant)coefficient for the size of bond offering(BondAmt)is inconsistent with the notion that this variable is a good measure of after market liquidity,which should be negatively associated with underpricing(Ellul and Pagano,2006).This result does conform to those reported by Cai et al.(2007),who also find thatBondAmtis not actually a proxy for liquidity,but is correlated with information problems.These results suggest that the larger the bond offerings,the more difficult it is for investors to understand issuing firms;hence,larger bond offerings incur higher underpricing.For the other control variables,although they do not show a statistically significant link to underpricing,the variables generally have the expected sign.

Table 4Path analysis with reputable underwriters as a mediator.The table presents path coefficient estimates using the mediation procedures in Baron and Kenny(1986).We use three measures,AQ_francis,AQ_dd and AQ_bs,of accruals quality as the source variables,MAAR as the outcome variable and Top_underwriter as the primary mediating variable.For each source variable,we report the Goodman and Sobel test of the significance of mediation,and calculate the percentage of the total effect that is mediated.aWe also calculate the ratio of the indirect effect to the direct effect.***,**and*indicate that the coefficient is statistically significant different from 0 at the 1%,5%and 10%level of significance,respectively.

As shown in Table 3,the regression model can answer the question,‘Does accruals quality reduce the bond underpricing?” However,it cannot answer another important question: ‘Does accruals quality affect bond underpricing differently for firms with already low underpricing compared to those with high underpricing?”By using quantile regression,we can obtain a more comprehensive picture of the effect of accruals quality on the corporate bond underpricing.Fig.2 reports the quantile regression estimates of accruals quality at various conditional quantiles of the bond underpricing distribution.It shows that there is no clear trend in the accrualsquality coefficients.We also test whether the coefficients are the same for various conditional quantiles of underpricing;the results support the findings presented in Fig.2.That is,the underpricing reduction benefit from the firm’s accruals quality is symmetric,which provides support for the results of the OLS regression.

Table 5Reverse causality test using treatment effects model.This table reports the results for correcting the self-selection bias using the treatment effects model.The first column presents the first-stage probit analysis of firms’decision to use high accruals quality.The dependent variable is an indicator variable that takes the value of 1 if a firm’s accruals quality measure(AQ_francis)at one year before bond issuance is above the sample median,and 0 otherwise.The other two measures have similar results.The explanatory variables include firm size(Size),leverage(Leverage),return on assets(ROA),market-to-book(MB),sales growth(Growth),Altman-Z score(Altman Z-score),the loss incidence(Loss Incidence),SOE,institutional ownership(Institutional)and the percentage of shares owned by the largest shareholder(Largesh).The second column presents the results of the effects of accruals quality on bond underpricing.The dependent variable is MAAR,a measure of underpricing with market-adjusted initial returns on the first trading day of the bond.All of the other variables are defined in Table 1.All of the bond credit ratings include AA-,AA,AA+and AAA.YEAR and IND are year and industry dummies,respectively.***,**and*indicate that the coefficient is statistically significantly different from 0 at the 1%,5%and 10%level of significance,respectively.

5.3.Moderation effect of underwriter reputation

We also examine the moderating effect of underwriter reputation on the relationship between accruals quality and bond underpricing.To test H2,we include theTop_underwritervariable and interactions between theTop_underwritervariable and accruals quality measures.If reputable underwriters(Top_underwriter)certify firms’earnings and thereby reduce the uncertainty faced by investors,we expect that the interaction terms will have the opposite sign of the relevant accruals quality measures.

We test our second hypothesis,which examines the impact of reputable underwriters on the relationship between accruals quality and bond underpricing,using the results presented in columns(4)–(6)of Table 3.As expected,we find that the coefficients onAQare consistently negative,and that the interactions betweenAQand the reputable underwriter measure are always positive and significant.The results reveal that the less transparent a firm’s accounting information,the more issuers benefit from underwriter quality.We obtain similar results when examining the interactions between the other proxies for accruals quality and reputable underwriters.These results are consistent with the hypothesis that the presence of a reputable underwriter acts as a certification for new issues,particularly for firms with lower accruals quality.

5.4.Path analysis:mediation effects of underwriter reputation

We next examine how effectively reputable underwriters alleviate the information problem and in turn reduce the adverse impact of poor accruals quality on bond underpricing.Based on the model proposed by Bhattacharya et al.(2012),we posit an indirect link between accruals quality,for which we use accruals quality(AQ)as the primary proxy,and bond underpricing(see Fig.3).

The indirect link is mediated by reputable underwriters.Using path analysis,we then test the existence of this indirect path and weight the relative importance of the direct and indirect links from accruals quality to bond underpricing.

Path analysis provides persuasive explanations of correlation structures,by decomposing a correlation between the source(causal)variable—accruals quality and the outcome variable—underpricing into a simple or direct path and a compound or indirect path that includes a mediating variable(in our case,reputable underwriters).The decomposition provides evidence for the existence and relative importance of the direct and indirect paths between accruals quality and underpricing.

We first use the reputable underwriter variable(Top_underwriter)as the mediating variable and focus onMAARas the proxy for bond underpricing in our path model.As shown in Table 4,the overall correlation betweenAQ_francisandMAARis-9.058.The direct and mediated paths decompose this correlation into the portions attributable to the direct link betweenAQ_francisandMAARand the indirect link,mediated byTop_underwriter.The path coefficients for the two segments(the path fromAQ_francistoTop_underwriterand the path fromTop_underwritertoMAAR)of the indirect path are both strongly significant at 5%,implying a strong mediated effect ofTop_underwriteron the relation betweenAQ_francisandMAAR.Sobel and Goodman(I,II)mediation statistics con firm the strong mediation effect(p< 0.10)ofTop_underwriter.Therefore,the indirect path through reputable underwriters exists.

The positive path coefficient betweenAQ_francisandTop_underwritersuggests that lenders tend to hire reputable underwriters to signal their accruals quality.Therefore,with the signaling hypothesis,we find a positive relation between accruals quality and underwriter reputation,consistent with the finding of Chen et al.(2013).The path coefficient betweenTop_underwriterandMAARis negative,implying that the presence of a reputable underwriter can mitigate the uncertainty regarding the values of IPO firms,which,in effect,certifies the earnings of IPO firms and thus reduces the level of underpricing.Carter and Manaster(1990)report results consistent with a certification effect(i.e.,lower underpricing)when firms go public with the assistance of reputable underwriters.Thus,reputable underwriters can mitigate a portion of the information risk the lenders may face.The results further show that about 89.8%of the correlation betweenAQ_francisandMAARis attributable to a direct path betweenAQ_francisandMAAR,but only about 10.2%is attributable to the indirect path through reputable underwriters,suggesting that the indirect influence of accruals quality mediated byTop_underwriteronMAARis much less important than the direct influence.Thus,consistent with Bhattacharya et al.(2012),who show the nature of the association between information risk and the cost of capital in the equity market,we provide evidence for the nature of the association between information risk and underpricing in the bond market.

We then useAQ_ddandAQ_bsas alternative source variables in our path model,and the results are similar.Taken together,the empirical results presented in Table 4 con firm that lenders hire reputable underwriters to mitigate the information risk confronting them,and that reputable underwriters can serve as a possible channel through which accruals quality influences the level of underpricing.However,our evidence that the mediated effect of reputable underwriters is much less important than the direct effect of accruals quality on bond underpricing suggests that reputable underwriters mitigate only a limited portion of information risk,and that the relationship between accruals quality and bond underpricing is fundamental.

6.Robustness

6.1.Reverse causality test

In the previous sections,we do not address the potential endogeneity problem of accruals quality.An alternative explanation of the negative relationship between accruals quality and underpricing is that firms withhigher levels of underpricing are more likely to have lower accruals quality.Firms with stronger corporate governance better align the interests of all of their stakeholders,which mitigates agency problems and results in less information asymmetry,leading to less underpricing(Watts,2003).We deal with this reverse causality issue in the following two ways.First,we add an institutional ownership variable(Institutional),a shareholding variable(Largesh)and a separation degree variable(VC)to the set of control variables.15Second,we apply the treatment effect model to purge the endogenous component of accruals quality.In the first stage,we estimate a selection model(probit model)to explain firms’decisions to choose high accruals quality.The dependent variable is an indicator variable that gets the value of 1 if a firm’s accruals quality measure is above the sample median and 0 otherwise.The explanatory variables include firm size,leverage,return on assets,market-to-book,sales growth,Altman Z-score,the loss incidence,SOE,the institutional ownership and the largest shareholder ownership.Conditional on this first-stage analysis,we analyze in the second stage the relationship between accruals quality and bonds underpricing.

Table 6Summary of robustness checks.This table reports the results of accruals quality(AQ_francis)on bond underpricing across robustness checks discussed in the text.specification 1 controls for firms’governance variables.specification 2 uses alternative measures of reputable underwriters.specification 3 controls for issuers’market risk.specification 4 controls for bond characteristics,such as coupon rate.specification 5 removes either the firm size or bond offering amount variable to mitigate the multicollinearity issue.t values are based on two-way,cluster-robust standard errors adjusted for cross-sectional and time-series dependence.***,**and*indicate that the coefficient is statistically significantly different from 0 at the 1%,5%and 10%level of significance,respectively.

We report the results of the treatment effects model in Table 5.We find that larger firms and firms with low financial leverage are more likely to have higher accruals quality.High return on assets and high sales growth are associated with lower accruals quality.The second column reports the endogeneity-adjusted estimate of accruals quality on underpricing.The coefficient onTop_AQis-4.315(significant at the 1%level),consistent with the interpretation that firms with higher accruals quality tend to have lower underpricing.16We also examine the estimated correlation between the error terms in the two equations,ρ,which equals 0.722,and is positive and significant at the 1%level,thus providing support for the treatment effect model.Therefore,we conclude that our results are robust to the correction of potential self-selection bias due to the tendency of higher underpricing firms to choose lower accruals quality.

6.2.Further robustness checks

Our results remain qualitatively similar in the following robustness tests(See Table 6).

(1)Alternative measures of reputable underwriters.In addition to ranking underwriters according to the number of their bond issuance deals in the main test,we conduct robustness tests that rank underwriters in terms of their total underwriting amounts and total assets.

Table 7Relation between accruals quality and bond underpricing after controlling for the level of marketization.Columns(1)–(3)report the results of estimating the relation between accruals quality and bond underpricing.Columns(4)–(6)present the OLS regression of bond underpricing on different accruals quality measures and the interaction of underwriter reputation and accruals quality.The dependent variable is MAAR,a measure of underpricing with market-adjusted initial returns on the first trading day of bond.AQ_francis reports the negative value of the|εi,t|according to the Francis et al.(2005)model,AQ_dd according to the Dechow and Dichev(2002)model and AQ_bs according to the Ball and Shivakumar(2006)model.A higher value of AQ_francis,AQ_dd or AQ_bs indicates higher accruals quality.All of the other variables are defined as in Table 1.All of the bond credit ratings include AA-,AA,AA+and AAA.YEAR and IND are year and industry dummies,respectively.t values are based on two-way,cluster-robust standard errors adjusted for crosssectional and time-series dependence.***,**and*indicate that the coefficient is statistically significantly different from 0 at the 1%,5%and 10%levels of significance,respectively.

Table 8Accruals quality and the non-price contract terms.This table shows estimates of the effects of accruals quality on various non-price bond contract terms.BondAmt is the natural logarithm of the bond offering amount measured in RMB hundred million.Secured is an indicator variable that equals 1 if the bond is secured with collateral,and 0 otherwise.Covenants is a count variable obtained by counting the number of financing-related and asset-sale covenants included in a bond contract.AQ_francis reports the negative value of the|εi,t|according to the Francis et al.(2005)model,AQ_dd according to the Dechow and Dichev(2002)model and AQ_bs according to the Ball and Shivakumar(2006)model.A higher value of AQ_francis,AQ_dd or AQ_bs indicates a higher accruals quality.Firm and bond characteristics are defined as in Table 3.All of the bond credit ratings include AA-,AA,AA+and AAA.YEAR and IND are year and industry dummies,respectively.t values are based on two-way,cluster-robust standard errors adjusted for cross-sectional and time-series dependence.***,**and*indicate that the coefficient is statistically significantly different from 0 at the 1%,5%and 10%level of significance,respectively.

(2)Control for issuer market risk.Ge and Kim(2014)suggest that bondholders may consider issuer market risk when pricing bonds.We calculate the standard deviation of daily stock returns as a proxy for the issuer’s market risk and include it in our regression.The results remain unaltered.

(3)Control for coupon rate.We also examine whether our results are sensitive to the inclusion of bond characteristics such as coupon rate.A higher coupon rate may affect after-market liquidity,which affects bond underpricing.

(4)As previously noted,there is a strong correlation between firm size and bond offering amount(0.79).To address this issue,we remove the control for one of these variables.The conclusions are the same as those presented previously.

7.Additional test

7.1.Does accruals quality matter in the SBO subsample?

The previous section presented evidence that lower accruals quality is associated with high underpricing in general.Here,we further investigate if there is any difference in the effects of accruals quality on the underpricing of IBO and SBO issuances.In the additional tests,we analyze Hypothesis 1–2 using IBO and SBO subsamples.

The results for the IBO subsample are qualitative similar to the main conclusion;however,inconsistent with prior evidence,we find that neither accruals quality nor the presence of a reputable underwriter affect the SBO sample(untabulated).17For brevity,we do not report these results,but they are available upon request from the authors.This implies that if a firm taps the bond market more frequently,issuersare less likely to benefit from improved accruals quality or the hiring of a reputable underwriter,perhaps for the following reasons.First,as China issued the first corporate bond in 2007,we know that in every case the time gap between the IBO and SBO must be short.In our sample,there is on average only 13.6 months between an IBO and an SBO.Within such short time gaps,there may be very little change in the issuers’conditions,so investors can make decisions based on the information generated from the IBO book-building process.Given the little change in accruals quality and lower requirements for the guarantee of underwriters,it is reasonable to infer that the effect of accruals quality and underwriters’reputation on bond underpricing in these circumstances maybe limited.Second,as the main investors in Chinese corporate bond market are institutional investors,who have the ability to effectively collect and make use of information,it is more difficult for underwriters to collect or generate material private information within such short time intervals.This further constrains the influence of underwriters.

Table 9Event study of corporate bonds default cases.This table shows the event study of how corporate bond default affects the issuer’s stock price.The event date(t=0)is the day when the corporate bond was declared to default.The estimation window is[-150,-60],the event windows are[-t,t](t=2,5,10,20,30),the CAR[-t,t]values are calculated based on original data from CSMAR.The t values are presented in parentheses.***,**and*indicate that the coefficient is statistically significantly different from 0 at the 1%,5%and 10%level of significance,respectively.

7.2.Controlling for the level of marketization18 We are very grateful to one of our referees for the suggestion that we should control for the level of marketization in the firms’localities.

A survey by Fan et al.(2007)and the World Bank(2006)concludes that due to regional differences in history,natural environment,regional development and social culture,there are large institutional gaps across Chinese provinces,including in the process of marketization and the investment climate.Wei et al.(2011)also indicate that research on China-related issues cannot simply ignore these differences in institutional environment across provinces.Therefore,we repeat our main tests after controlling for the level of institutional environment.

Following Xia and Fang(2005),we use the marketization index(Market)as a proxy of institutional environment.The marketization index is taken from the NERI Index of the Marketization of China’s Provinces:2011 Report(Fan et al.,2011).Marketis a comprehensive index that proxies for the institutional quality of each province in China.A higher value ofMarketindicates a faster process of regional marketization and a better regional institutional environment.19We measure the institutional environment using the lagged marketization index at the end of the fiscal year before the bond issuance.However,as Fan et al.(2011)provide data for the marketization index across various regions in China for only the 2001 to 2009 period,we use the regional marketization index measured in 2009 for bonds issued after 2010.We expect that companies in better regional institutional environments face lower underpricing as they are supervised by relatively sound legal systems and monitored by more professional government agencies,which can ensure a better information environment and higher levels of investor protection.

The results of the re-testing of our two hypotheses are presented in Table 7.Consistent with our main results,we find a significantly negative association between accruals quality and underpricing after controlling for the level of marketization.This reinforces H1,which predicts that bondholders,on average,value accounting quality and reduce underpricing for firms with higher accruals quality.The significantly positive coeffi-cients onAQ*Top_underwriterare consistent with H2,suggesting that the relation between accruals quality and underpricing(after controlling for the regional marketization)is moderated when the borrower hires reputable underwriters.Turning to the market variable,we find thatMarketis negatively related to bond underpricing(significant at the 5%level).

7.3.Accruals quality and the non-price bond contract terms

To gain a comprehensive understanding of the role of the issuer’s accruals quality in the corporate bond market,in this section we focus on some non-price contract terms,i.e.,bond amount,secured and covenants,which are the most widely used non-price terms in the literature(Graham et al.,2008;Bharath et al.,2011;Gong et al.,2016).Table 8 reports our regression estimates.Panel A shows the effects of various measures of accruals quality on bond issuing amount.The dependent variable in the regression is the natural logarithm of the bond offering amount measured in RMB hundred million.The results show that the coefficients of accruals quality are not statistically significant,which suggests there is no systematic difference in the bond amounts issued by firms with high and low accruals quality.

Panel B of Table 8 presents the regression results estimating the effect of accruals quality on the likelihood of using security for the bond.The dependent variable is a dummy variable that is equal to 1 if the bond is secured and 0 otherwise.The regression is estimated using a probit model.The results show that accruals quality is negatively related to the collateral requirement of the bond in columns(5)and(6).This suggests that firms with high accruals quality are subject to fewer security requirements,implying yet another advantage of a better information environment.

Panel C of Table 8 presents the regression results for the determinants of covenant intensity.Following Gong et al.(2017),we measure the dependent variable,covenant intensity,b20Bond prospectuses also include event-related covenants and accounting-related covenants.However,event-related covenants are often written loosely by lawyers,using boilerplate language.They are designed to protect bondholders upon default by increasing the recovery amount and decreasing the possible losses,which usually serves a minor role in settling the coming default.Accounting-related covenants are seldom used in public bond contracts;only 3.09%of bond contracts include them(Gong et al.,2017).Therefore,we only consider financing-related and asset-sale covenants in this study.y counting the total number of financing-related and asset-sale covenants included in the bond prospectus.Thus,the dependent variable in Panel C is the total number of covenants associated with a bond.As the number of covenants is a positive integer,we estimate the equation using a Poisson regression.In Panel D,we also use the OLS procedure to examine the association between accruals quality and covenants.The estimated coefficient of accruals quality is significantly negative at the 5%level,suggesting that firms with higher accruals quality are less subject to covenant restrictions than those with lower accruals quality.

7.4.Impact of corporate bond default on issuer’s stock price21 We thank our referee for this valuable suggestion.

Although there is no default observation in our sample,we try to check the market reaction to corporate bond defaults with an event study.As a corporate bond default is certainly a passive signal,we predict that the market reaction is negative.

We first try to collect the trading data of the stock ofChaoriCo.,Ltd.(Code 002506),22We also try to conduct an event study based on the price of those default bonds in the bond market.However,we find that there was no trading on all of those bonds around the event date due to the suspension order from the exchange.Therefore,we only focus on the stock market reaction to the issuers’corporate bonds default.which is the issuer of the first default corporate bond in China.However,Chaori’s stock was suspended from trade in the exchanges seven months before the default date due to its huge losses in 2012 and 2013.Therefore,we cannot conduct an event study using this default case.We further check another four corporate bonds default cases,and find that only two issuers’data are suitable for an event study.These two companies areZhuhai ZhongfuCo.,Ltd.(Code 000659)andBeijing XiangeqingCo.,Ltd.(Code 002306),and their stocks have not been suspended from trading on the exchange.We use 28 May 2015 and 7 April 2015,the respective dates on which the corporate bonds issued by these two companies were declared to default,as the event days.We choose[-150,-60]as the estimation window and compute CAR[-t,t](t=2,5,10,20,30)based on original data from CSMAR.

Table 9 reports the results.It shows that most of the cumulative abnormal returns are negative,except for the CAR[-10,10]ofZhuhai ZhongfuCo.,Ltd.and the CAR[-2,2]ofBeijing XiangeqingCo.,Ltd.However,not all of these cumulative abnormal returns are statistically significant.From these results,we cannot con-clude that the bond default events have significant effects on the issuers’stock price.There are two possible explanations for this result.As we know,the stock market in China experienced a great irrational boom from November 2014 to June 2015 when the stock index doubled over a six-month period.Stock investors blindly trusted that the bull market would keep going for a long time.Both of the aforementioned two default events happened one or two months before the stock market crash,when investors were most overconfident.In suchcases,investors are more likely to neglect the passive information of bonds default.Therefore,our first explanation is that in these cases,the influence of the bonds default on issuers’stock price might have been offset by the irrational upward trends of the stock market.The other possible explanation is that defaults of corporate bonds indeed have little effect on the issuers’stock price in the Chinese market.As there is no precedent for a bankruptcy caused by corporate bond default,and the government always gets involved to ensure repayments,defaults of corporate bonds may have limited influence on stock price.

8.Conclusions

The purpose of this study is to investigate two hypotheses.The first hypothesis examines how firms’accruals quality impacts underpricing in the Chinese corporate bond market.Our regression analyses reveal that bond underpricing in China is inversely associated with accruals quality,after controlling for bond-and firm-specific characteristics.This evidence is consistent with the asymmetric information theory that underlies discussions of IPO underpricing in the literature.According to this theory,higher accruals quality helps to reduce information asymmetry and mitigate bond underpricing.The second hypothesis investigates whether the presence of reputable underwriters reduces the adverse effect of poor accruals quality(information risk)on bond underpricing.Our results indicate that reputable underwriters play a role in mitigating the effects of low accruals quality on bond underpricing.To examine the effectiveness of reputable underwriters in alleviating information problems,we specify the direct path and indirect path based on the model in Bhattacharya et al.(2012).Using path analysis,we test for the existence and relative importance of both paths.We then provide statistically reliable evidence of both a direct path and an indirect path,with the direct path(accruals quality)having greater(often,much greater)importance than the indirect path(reputable underwriters).However,in our additional tests,we find there is no significant association between accruals quality,underwriters and bond underpricing for secondary bond offerings.Furthermore,we find that firms with low accruals quality are associated with more restrictive non-price contract terms such as greater collateral requirements and stricter covenants.

Our results provide evidence of the nature of the association between information risk and bond underpricing and suggest the importance of accruals quality in bond financing.Security regulations,such as the Regulation on Fair Disclosure and prohibitions on insider trading,have been promulgated to improve accruals quality(Bhattacharya et al.,2013)and may be equally important in the bond market.If there is a trade-off between improving accruals quality and employing reputable underwriters,our results suggest that the former effect dominates the latter effect.

A potential limitation of our study is that we focus on information asymmetry to investigate the impact of accruals quality on bond underpricing.However,there are other theories about the causes of bond underpricing in the literature,such as signal and liquidity theory.Factors other than information asymmetry could be explored to investigate the association of bond underpricing with accruals quality in future research.

Acknowledgements

We are grateful for funding support from the Ph.D.Programs Foundation of the Ministry of Education of China(Grant no.20130161110045).We thank the scholars attending the 9th Symposium of the China Journal of Accounting Research(CJAR).We are also thankful for the comments from Prof.Oliver Rui at the China Europe International Business School and the suggestions made by one anonymous referee.We appreciate the comments and suggestions from Prof.Zhang Huai at Nanyang Technological University.We take full responsibility for this paper.

Allen,F.,Faulhaber,G.R.,1989.Signalling by underpricing in the IPO market.J.Financ.Econ.23,303–323.

Ball,R.,Shivakumar,L.,2006.The role of accruals in asymmetrically timely gain and loss recognition.J.Account.Res.44,207–242.

Ball,R.,Shivakumar,L.,2008.Earnings quality at initial public offerings.J.Account.Econ.45,324–349.

Ball,R.,Bushman,R.M.,Vasvari,F.P.,2008.The debt-contracting value of accounting information and loan syndicate structure.J.Account.Res.46,247–287.

Baron,R.,Kenny,D.,1986.The moderator-mediator variables distinction in social psychology research:conceptual,strategic,and statistical considerations.J.Pers.Soc.Psychol.51,1173–1182.

Benveniste,L.M.,Spindt,P.A.,1989.How investment bankers determine the offer price and allocation of new issues.J.Financ.Econ.24(2),343–361.

Bessembinder,H.,Maxwell,W.,2008.Markets:transparency and the corporate bond market.J.Econ.Perspect.22,217–234.

Bharath,S.T.,Sunder,J.,Sunder,S.V.,2008.Accruals quality and debt contracting.Account.Rev.83,1–28.

Bharath,S.T.,Dahiya,S.,Saunders,A.,Srinivasan,A.,2011.Lending relationships and loan contract terms.Rev.Financ.Stud.24,1141–1203.

Bhattacharya,N.,Ecker,F.,Olsson,P.M.,Schipper,K.,2012.Direct and mediated associations among accruals quality,information asymmetry,and the cost of equity.Account.Rev.87,449–482.

Bhattacharya,N.,Desai,H.,Venkataraman,K.,2013.Does accruals quality affect information asymmetry?Evidence from trading costs.Contemp.Account.Res.30,482–516.

Boulton,T.J.,Smart,S.B.,Zutter,C.J.,2011.Accruals quality and international IPO underpricing.Account.Rev.86,483–505.

Brau,J.C.,Fawcett,S.E.,2006.Initial public offerings:an analysis of theory and practice.J.Financ.61,399–436.

Cai,N.K.,Helwege,J.,Warga,A.,2007.Underpricing in the corporate bond market.Rev.Financ.Stud.20,2021–2046.

Carter,R.,Manaster,S.,1990.Initial public offerings and underwriter reputation.J.Financ.45,1045–1067.

Chaney,P.K.,Faccio,M.,Parsley,D.,2011.The quality of accounting information in politically connected firms.J.Account.Econ.51,58–76.

Chang,X.,Lin,S.H.,Tam,L.H.K.,Wong,G.,2010.Cross-sectional determinants of post-IPO stock performance:evidence from China.Account.Financ.50,581–603.

Chemmanur,T.J.,Krishnan,K.,2012.Heterogeneous beliefs,IPO valuation,and the economic role of the underwriter in IPOs.Financ.Manage.41,769–811.

Cheung,Y.,Ouyang,Z.,Tan,W.,2009.How regulatory changes affect IPO underpricing in China.China Econ.Rev.20,692–702.

Chen,C.,Zhu,S.,2013.Financial reporting quality,debt maturity,and the cost of debt:evidence from China.Emerg.Mark.Financ.Tr.49,236–253.

Chen,J.Z.,Lobo,G.J.,Wang,Y.,Yu,L.,2013.Loan collateral and financial reporting conservatism:Chinese evidence.J.Bank.Financ.37,4989–5006.

Chen,C.,Shi,H.,Xu,H.,2013.Underwriter reputation,issuer ownership,and pre-IPO earnings management:evidence from China.Financ.Manage.42,647–677.

Cohen,D.A.,Zarowin,P.,2010.Accrual-based and real earnings management activities around seasoned equity offerings.J.Account.Econ.50,2–19.

Cooney,J.W.,Singh,A.K.,Carter,R.B.,Dark,F.H.,2001.IPO Initial Returns and Underwriter Reputation:Has the Inverse Relationship Flipped in the 1990s?University of Kentucky,Working Paper.

Dichev,I.D.,Piotroski,J.D.,2001.The long-run stock returns following bond ratings changes.J.Financ.56,173–203.

Dechow,P.M.,Dichev,I.D.,2002.The quality of accruals and earnings:the role of accrual estimation errors.Account.Rev.77,35–59.

Dong,M.,Michel,J.,Pandes,J.A.,2011.Underwriter quality and long-run IPO performance.Financ.Manage.40,219–251.

Ellul,A.,Pagano,M.,2006.IPO underpricing and after-market liquidity.Rev.Financ.Stud.19,381–421.

Fan,G.,Wang,X.,Zhu,H.,2007.NERI Index of Marketization of China’s Provinces:2006 Report.Economic Science Press,Beijing(in Chinese).

Fan,G.,Wang,X.,Zhu,H.,2011.NERI Index of Marketization of China’s Provinces:2009 Report.Economic Science Press,Beijing(in Chinese).

Francis,J.,LaFond,R.,Olsson,P.,Schipper,K.,2005.The market pricing of accruals quality.J.Account.Econ.39,295–327.

Ge,W.,Kim,J.B.,2014.Real earnings management and the cost of new corporate bonds.J.Bus.Res.67,641–647.

Glushkov,D.,Khorana,A.,Rau,P.R.,2014.Why Do Firms Go Public Through Debt Instead of Equity?University of Pennsylvania,Working Paper.

Gong,G.M.,Xu,S.,Gong,X.,2017.Bond covenants and the cost of debt:evidence from China.Emerg.Mark.Financ.Tr.53(3),587–610.

Gong,G.M.,Xu,S.,Gong,X.,2016.On the value of corporate social responsibility disclosure:an empirical investigation of corporate bond issues in China.J.Bus.Ethics 5,1–32.

Graham,J.R.,Li,S.,Qiu,J.,2008.Corporate misreporting and bank loan contracting.J.Financ.Econ.89(1),44–61.

Jo,H.,Kim,Y.,Park,M.S.,2007.Underwriter choice and earnings management:evidence from seasoned equity offerings.Rev.Account.Stud.12,23–59.

Jog,V.,McConomy,B.J.,2003.Voluntary disclosure of management earnings forecasts in IPO prospectuses.J.Bus.Financ.Account.30,125–168.

Kim,D.,Palia,D.,Saunders,A.,2010.Are initial returns and underwriting spreads in equity issues complements or substitutes.Financ.Manage.39,1403–1423.

Lee,G.,Masulis,R.,2011.Do underwriters or venture capitalists restrain earnings management by IPO issuers?J.Corp.Financ.17,982–1000.

Leone,A.J.,Rock,S.,Willenborg,M.,2007.Disclosure of intended use of proceeds and underpricing in initial public offerings.J.Account.Res.45,111–153.

Lin,Z.J.,Tian,Z.,2012.Accounting conservatism and IPO underpricing:China evidence.J.Int.Account.Audit.Tax.21,127–144.

Liu,M.,Magnan,M.,2014.Conditional conservatism and underpricing in US corporate bond market.Appl.Financ.Econ.24,1323–1334.

Lu,C.W.,Chen,T.K.,Liao,H.H.,2010.Information uncertainty,information asymmetry and corporate bond yield spreads.J.Bank.Financ.34,2265–2279.

Petersen,M.A.,2009.Estimating standard errors in finance panel data sets:comparing approaches.Rev.Financ.Stud.22,435–480.

Pessarossi,P.,Weill,L.,2013.Choice of corporate debt in China:the role of state ownership.China Econ.Rev.26,1–16.

Rock,K.,1986.Why new issues are underpriced.J.Financ.Econ.15,187–212.

Schrand,C.M.,Verrecchia,R.E.,2005.Information Disclosure and Adverse Selection Explanations for IPO Underpricing.University of Pennsylvania,Working Paper.

Sherman,A.E.,Titman,S.,2002.Building the IPO order book:underpricing and participation limits with costly information.J.Financ.Econ.65,3–29.

Titman,S.,Trueman,B.,1986.Information quality and the valuation of new issues.J.Account.Econ.8,159–172.

Watts,R.L.,2003.Conservatism in accounting part II:evidence and research opportunities.Acc.Horizons 17,287–301.

Wei,Z.,Wu,S.,Li,C.,Chen,W.,2011.Family control,institutional environment and cash dividend policy:evidence from China.China J.Account.Res.1,29–46.

Willenborg,M.,McKeown,J.C.,2000.Going-concern initial public offerings.J.Account.Econ.30,279–313.

World Bank,2006.China,Governance,Investment Climate,and Harmonious Society:Competitiveness Enhancements for 120 Cities in China.World Bank Report 37759-CN.

Xia,L.,Fang,Z.,2005.Government control,institutional environment and firm value.Econ.Res.J.5,40–51(in Chinese).

Yang,S.,Gong,X.,Xu,S.,2017.Underwriting syndicates and the cost of debt:evidence from Chinese corporate bonds.Emerg.Mark.Financ.Tr.53(2),471–491.

Zheng,S.X.,Stangeland,D.A.,2007.IPO underpricing, firm quality,and analyst forecasts.Financ.Manage.36,1–20.

China Journal of Accounting Research2017年4期

China Journal of Accounting Research2017年4期

- China Journal of Accounting Research的其它文章

- How does smog affect firms’investment behavior?A natural experiment based on a sudden surge in the PM2.5 index

- The mystery of zombie enterprises – ‘stiff but deathless”

- Do independent directors play a political role?Evidence from independent directors’death events