世界经济主要指标

国家统计局国际统计信息中心

·国际统计数据·

世界经济主要指标

国家统计局国际统计信息中心

一、世界经济

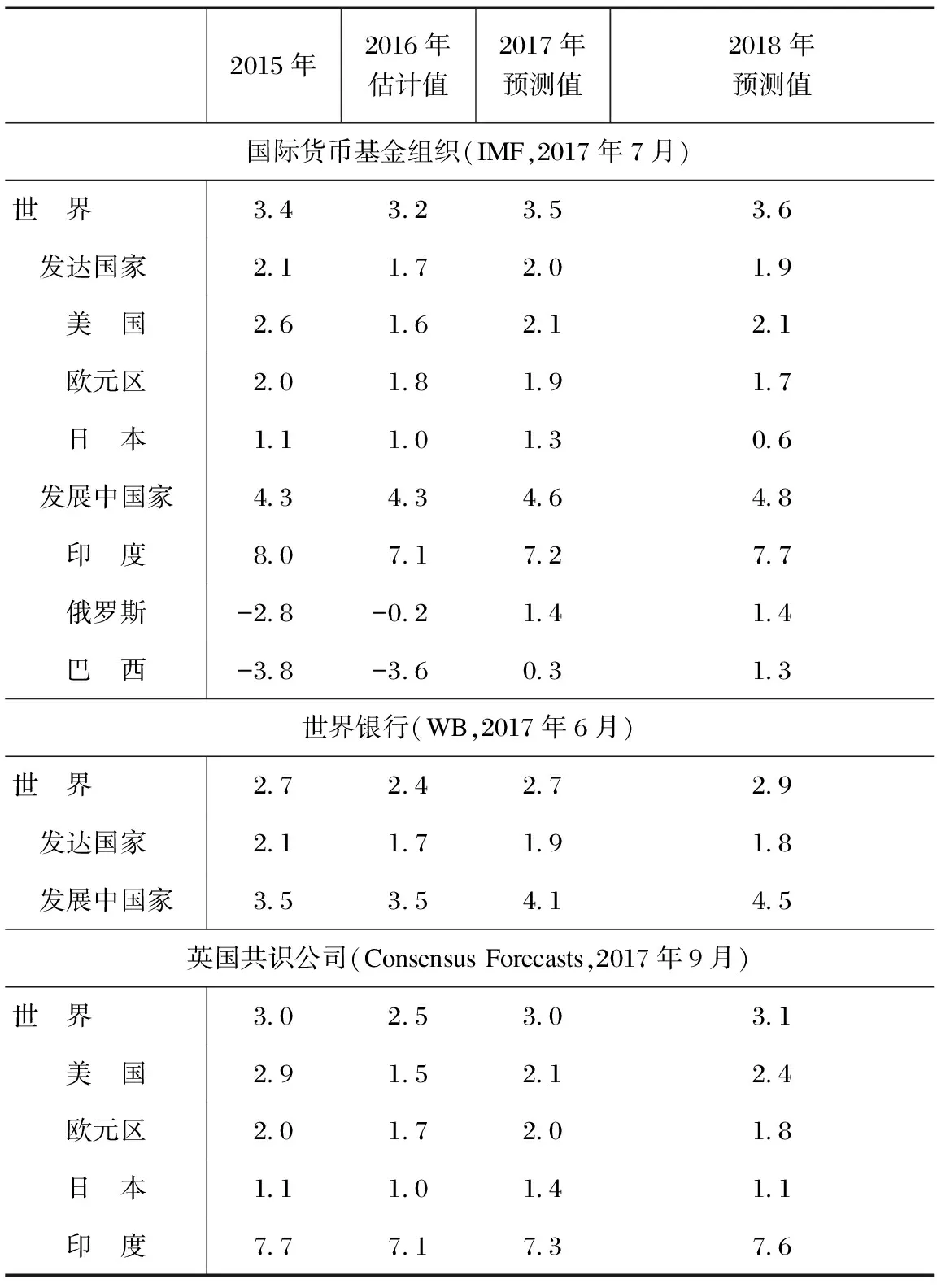

表1 世界经济增长率(上年=100) 单位:%

注:(1)国际货币基金组织公布的世界及分类数据按照购买力平价方法进行汇总,世界银行和英国共识公司按汇率法进行汇总。 (2)印度数据指财政年度。(3)各经济体2015年数据已据其官方发布结果做了调整。

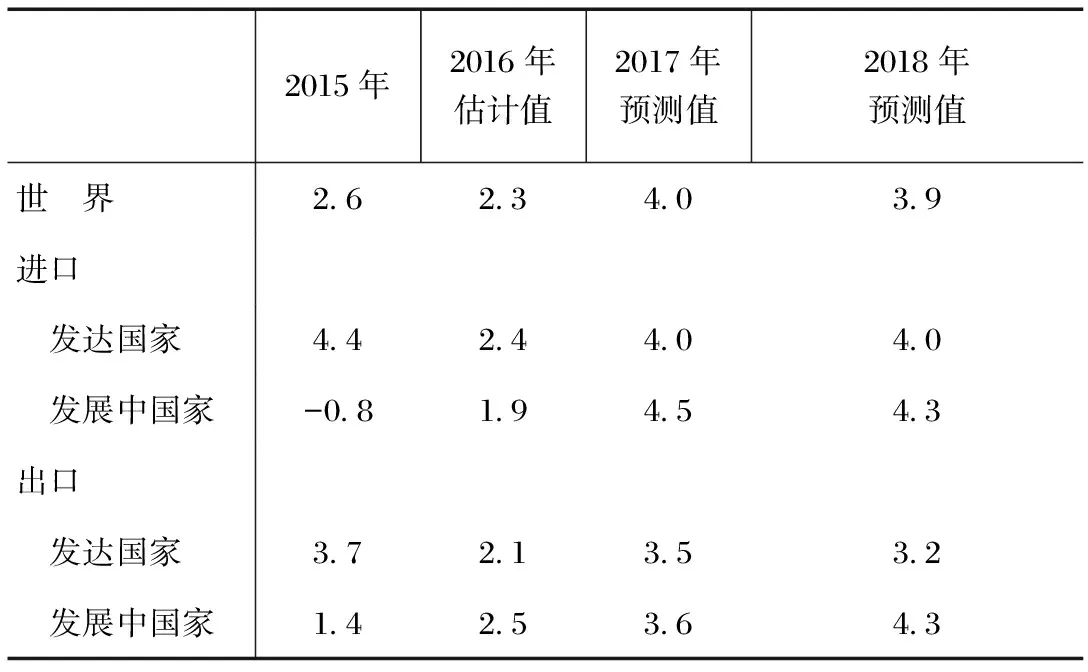

表2 世界贸易量增长率(上年=100) 单位:%

注: 包括货物贸易和服务贸易,进、出口为2017年4月预测。

资料来源:国际货币基金组织2017年7月预测。

表3 消费者价格涨跌率(上年=100) 单位:%

注: (1)印度来源于英国共识公司的数据指财政年度。(2)各经济体2015年数据已据其官方发布结果做了调整。

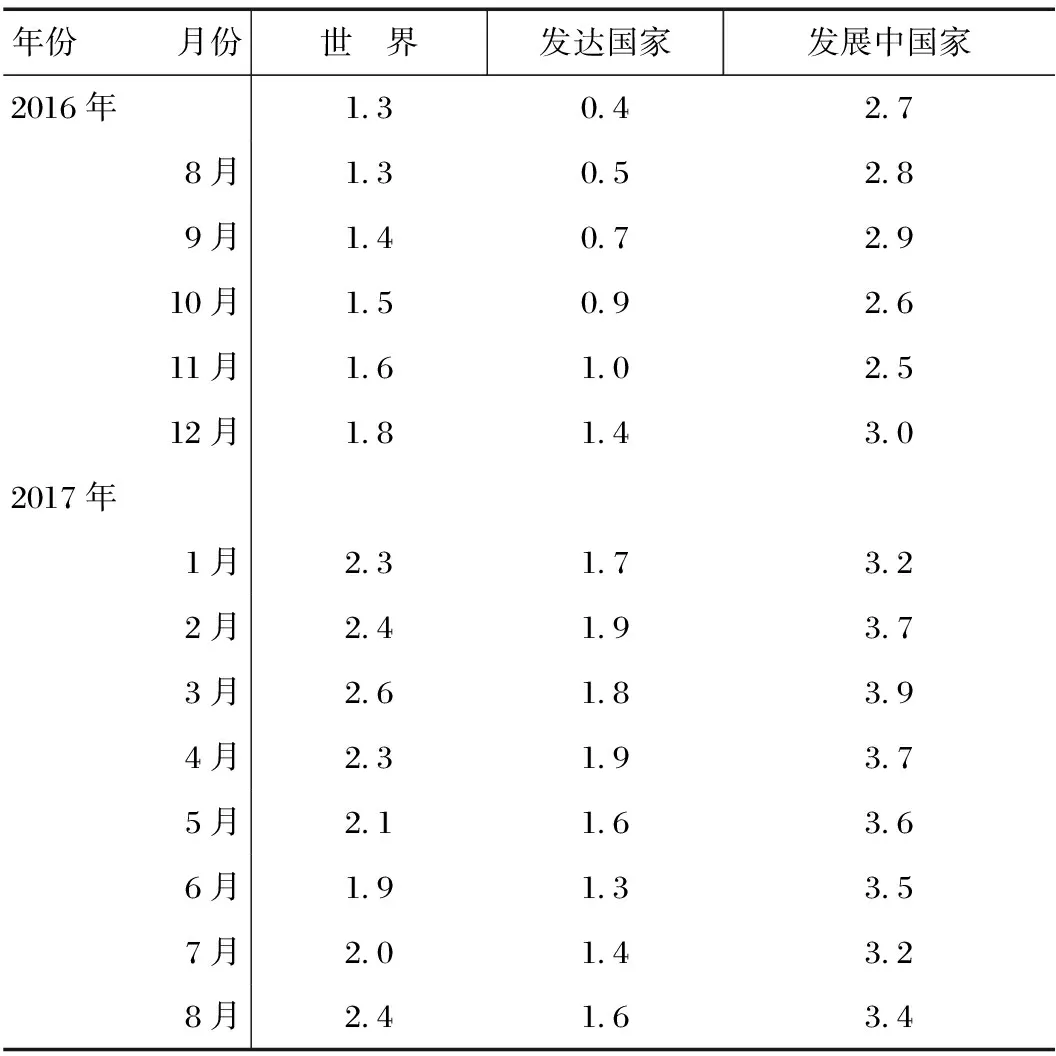

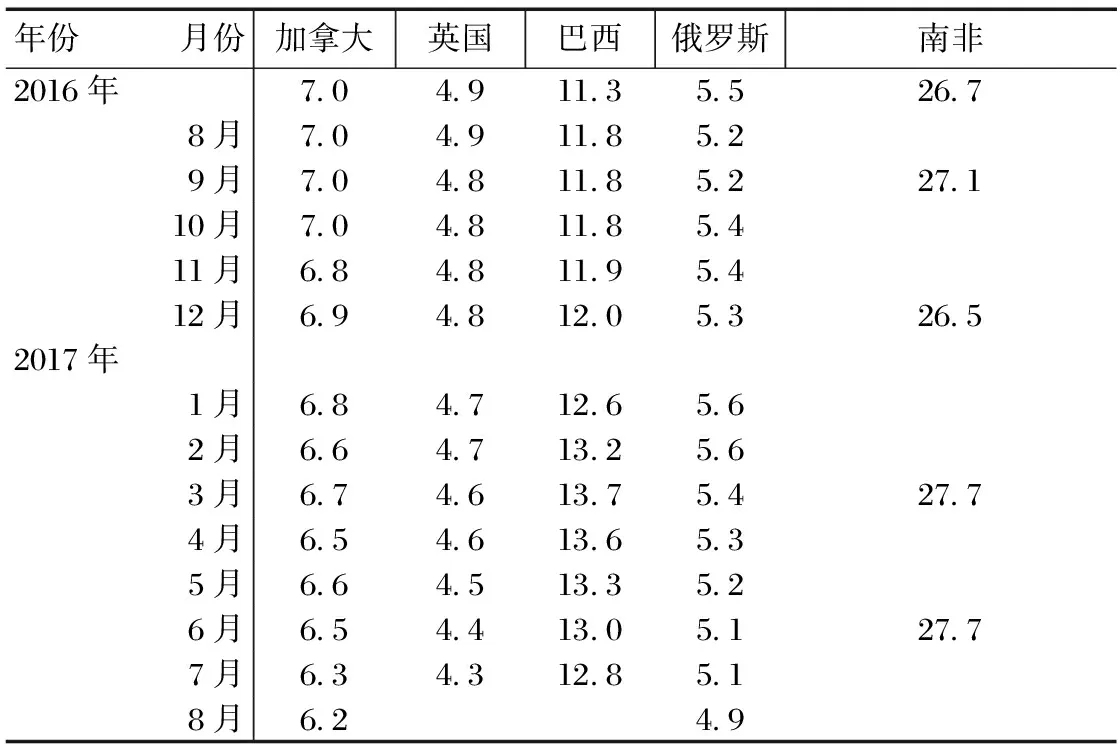

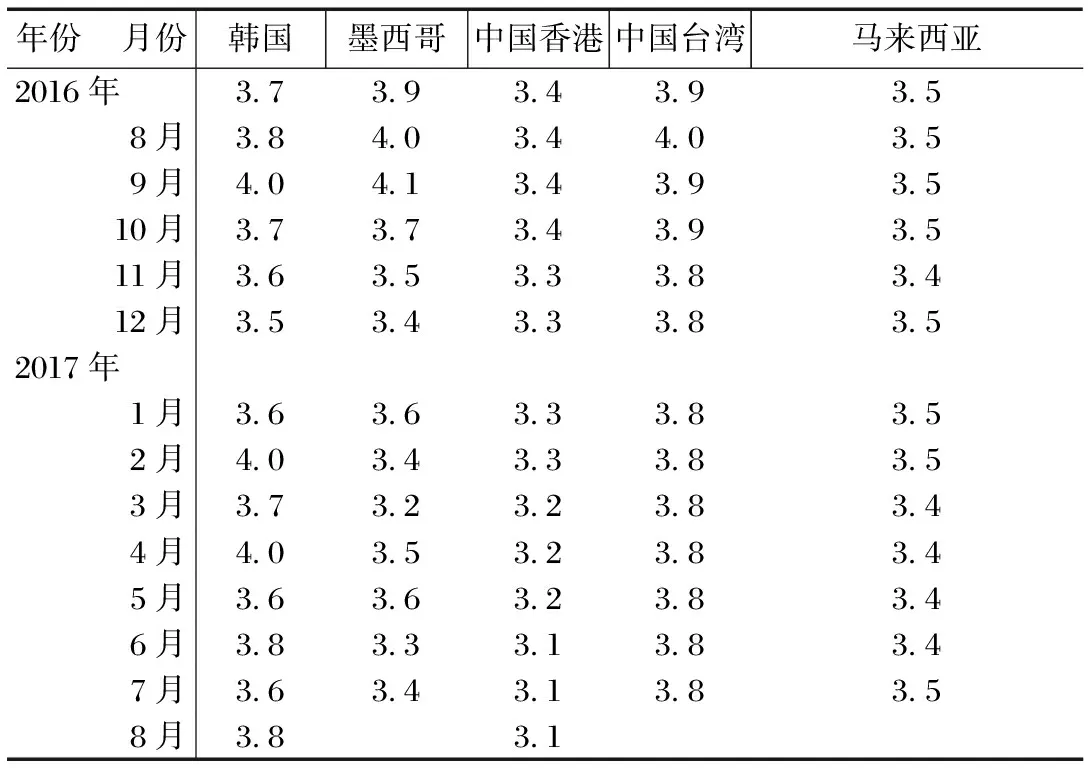

表4 消费者价格同比上涨率 单位:%

资料来源:世界银行数据库。

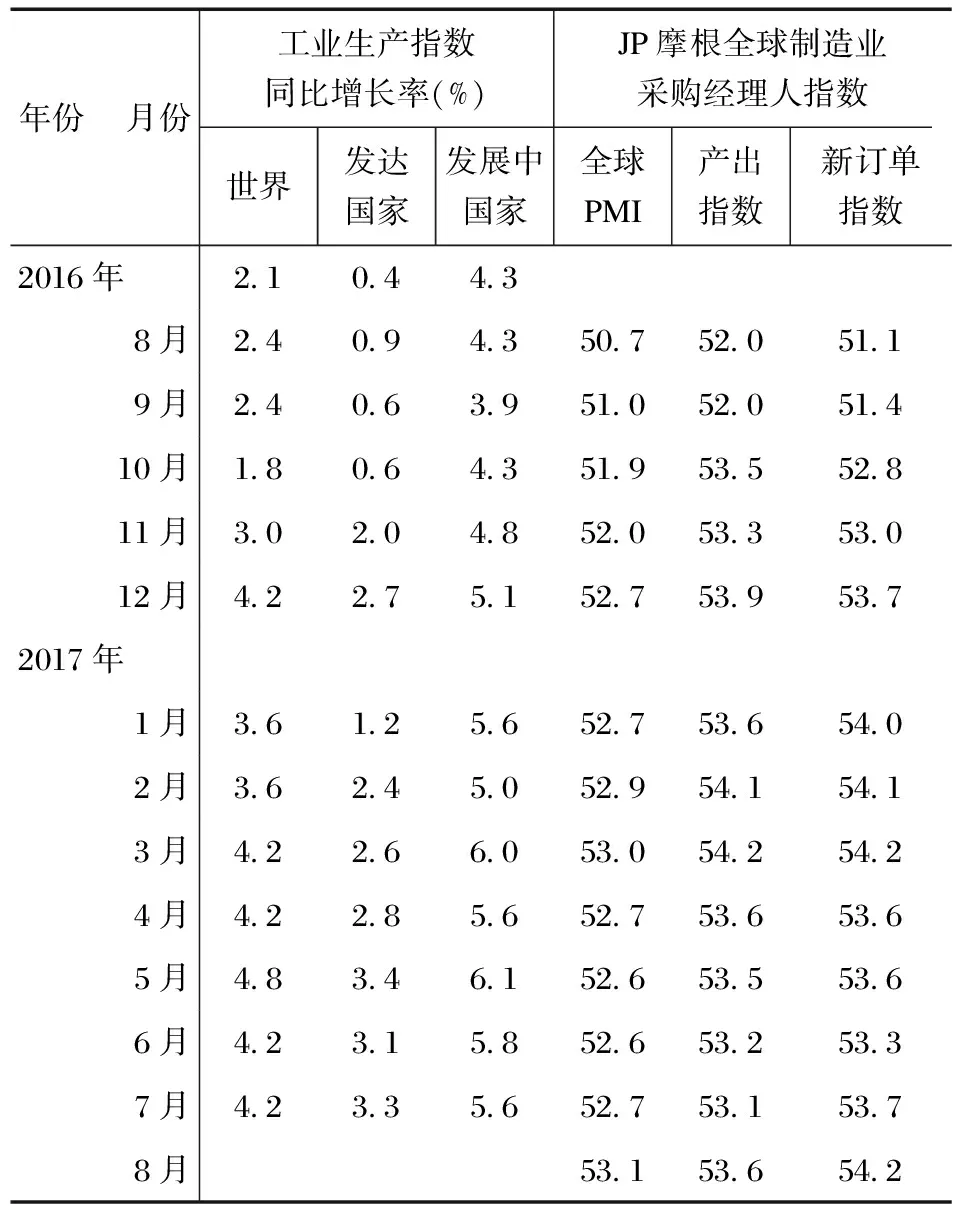

表5 工业生产

注:(1)工业生产指数同比增长率为经季节调整的数据。(2)采购经理人指数超过50预示着经济扩张期。

资料来源:世界银行数据库、美国供应管理协会。

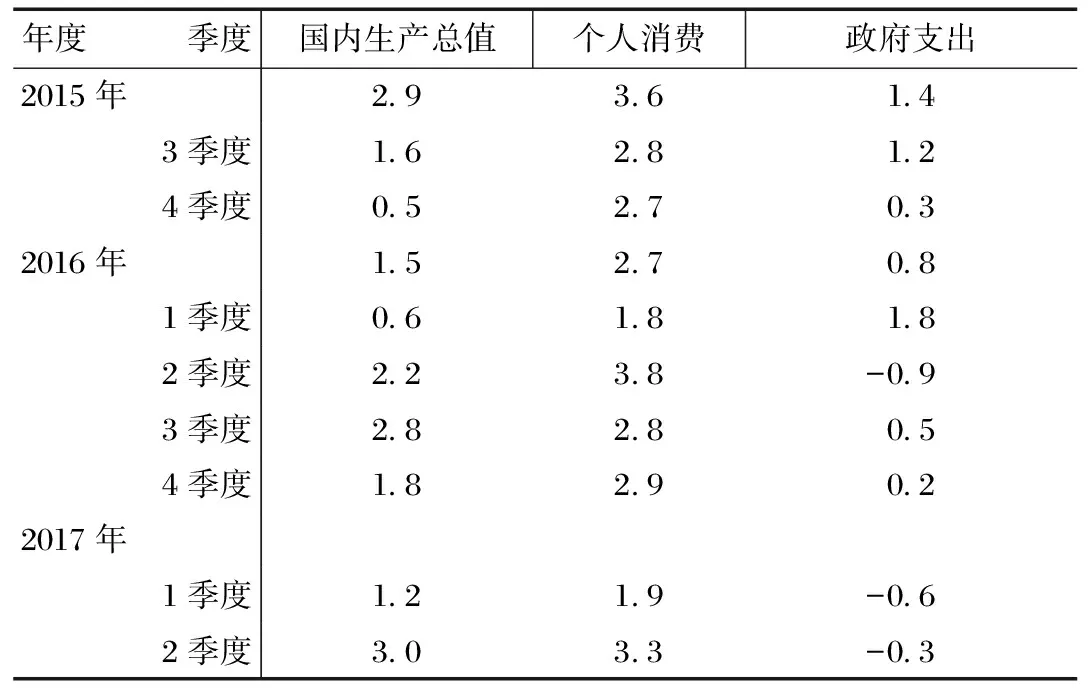

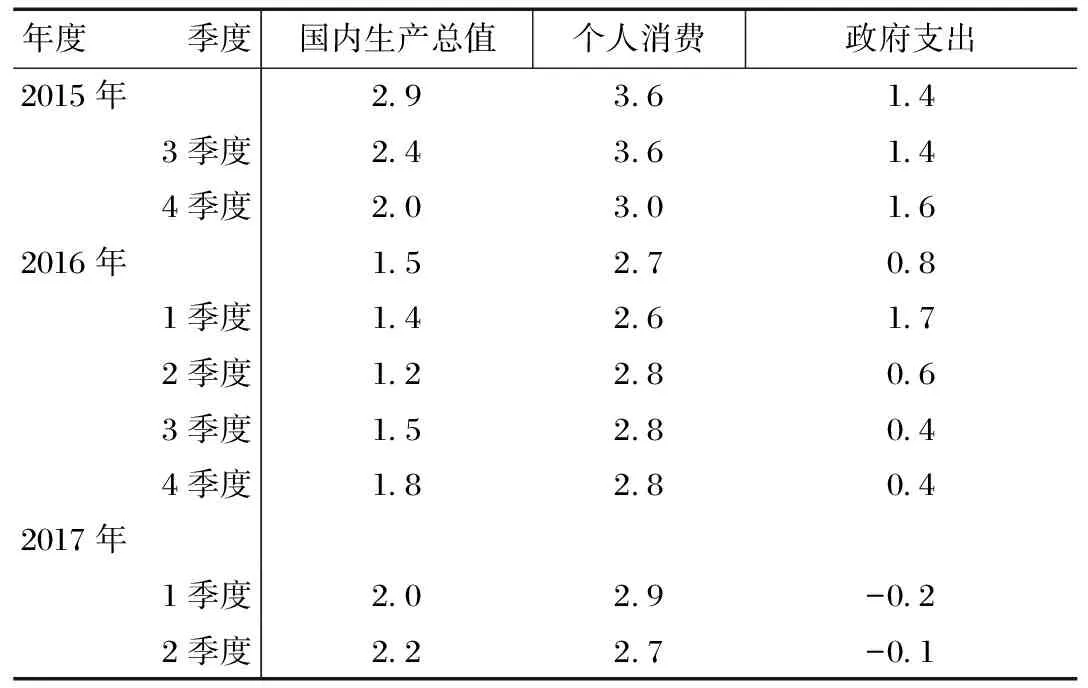

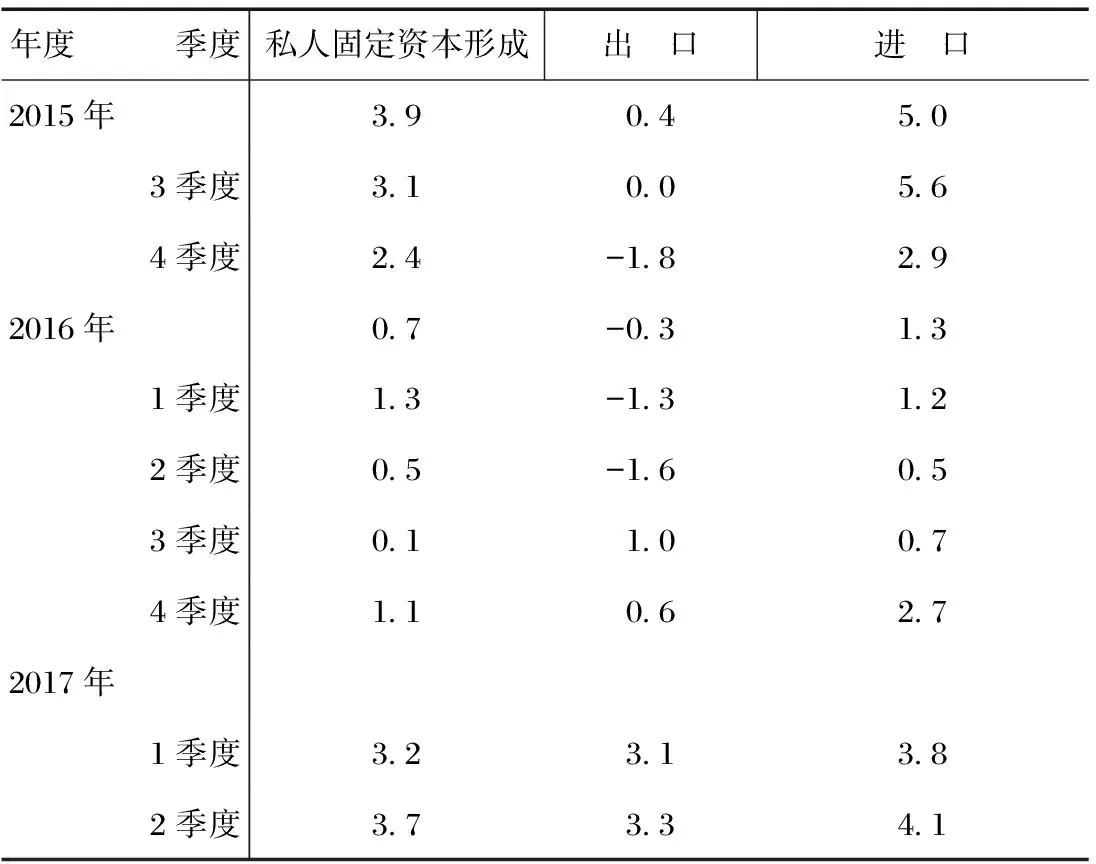

二、美国经济

表6 国内生产总值及其构成增长率(环比) 单位:%

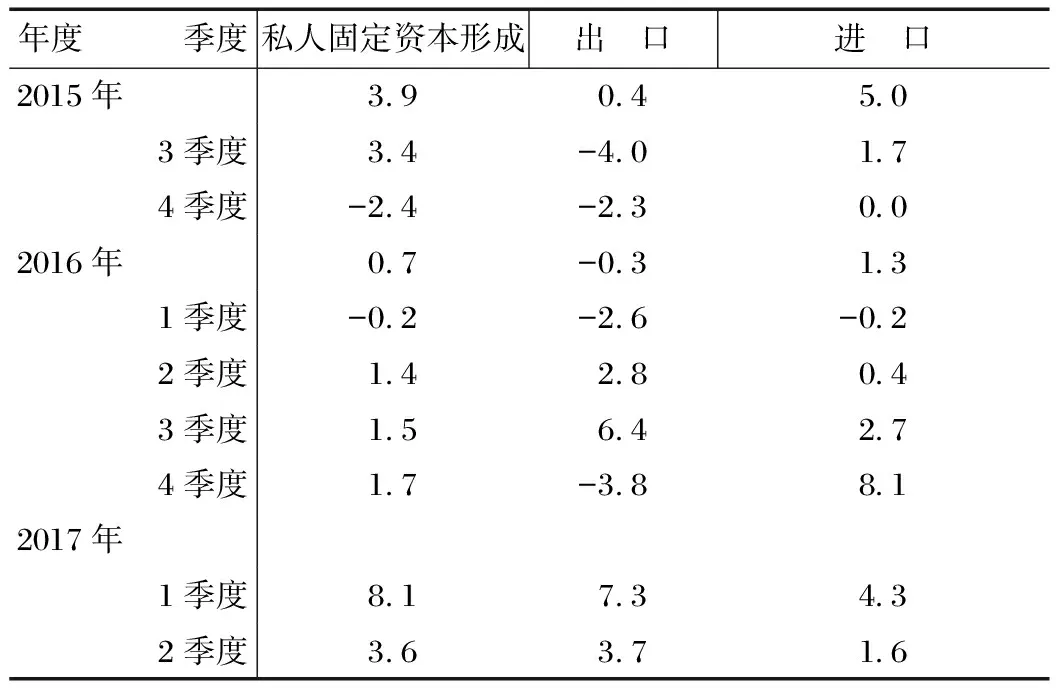

表7 国内生产总值及其构成增长率(环比) 单位:%

注:季度数据按季节因素调整、折年率计算(表6、表7)。

资料来源:美国商务部经济分析局(表6、表7)。

表8 国内生产总值及其构成增长率(同比) 单位:%

表9 国内生产总值及其构成增长率(同比) 单位:%

注:季度数据按季节因素调整(表8、表9)。

资料来源:美国商务部经济分析局(表8、表9)。

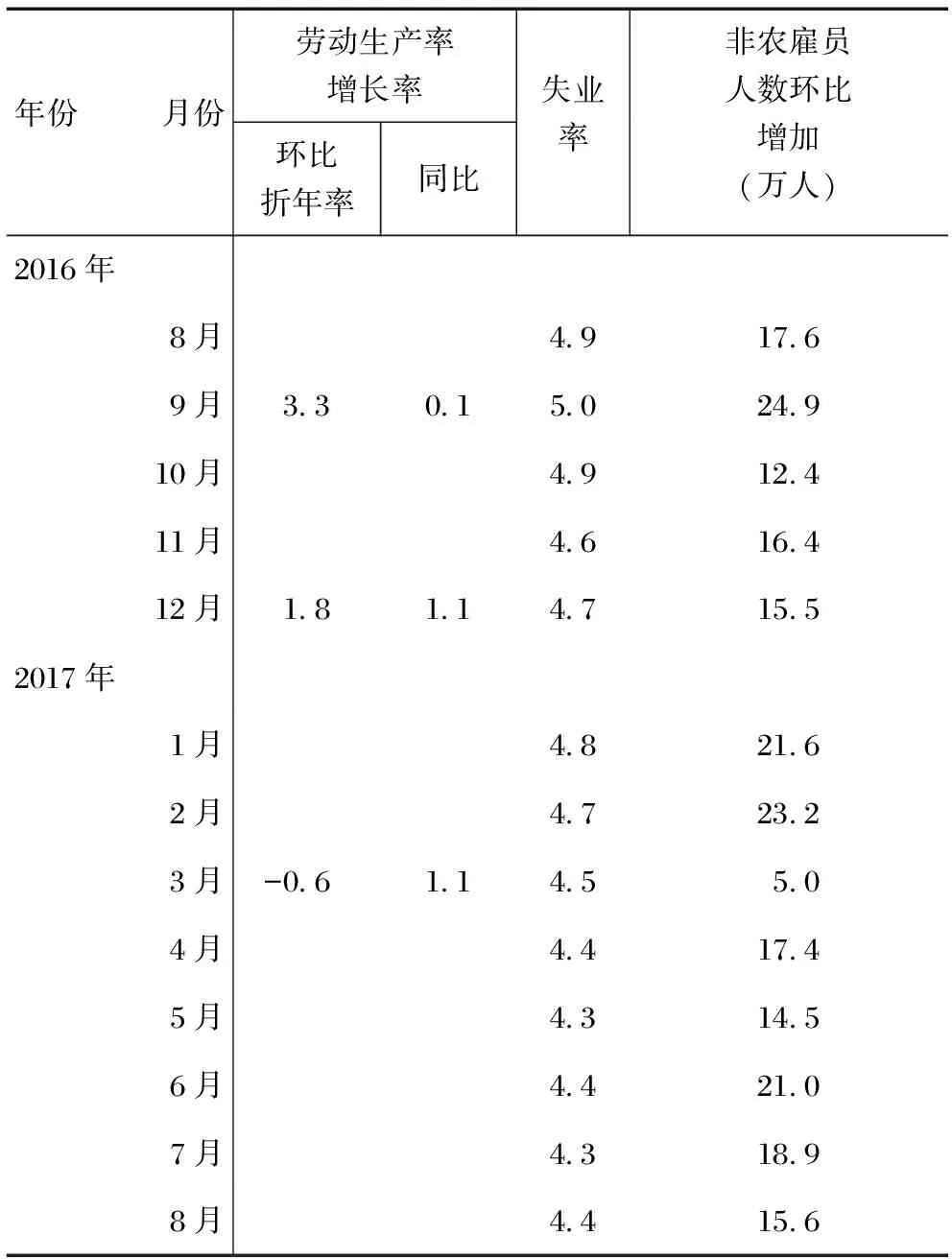

表10 劳动力市场 单位:%

注:除年度数据以外,劳动生产率增长率为该月份所在季度的增长率。

资料来源:美国劳工统计局。

表11 进出口贸易 单位:亿美元

注:包括货物和服务贸易。因季节调整,各月合计数据不等于全年总计数据。

资料来源:美国商务部普查局。

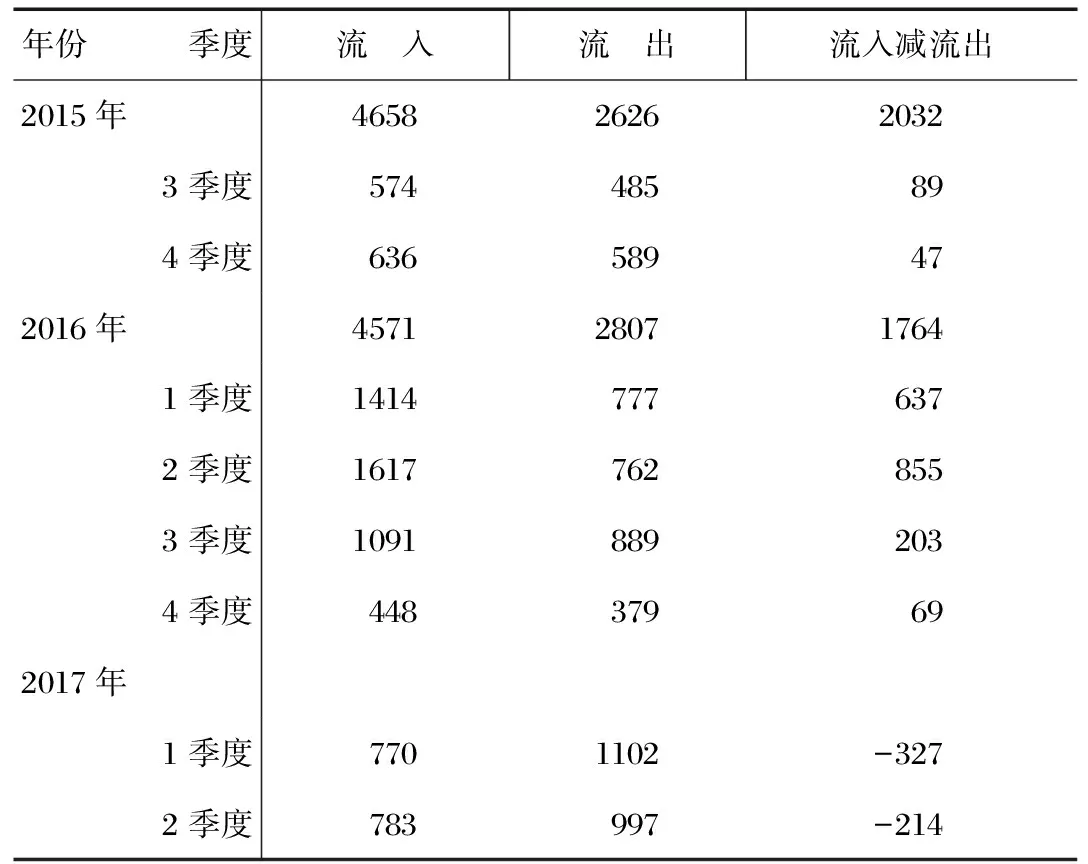

表12 外国直接投资 单位:亿美元

资料来源:美国商务部经济分析局。

三、欧元区经济

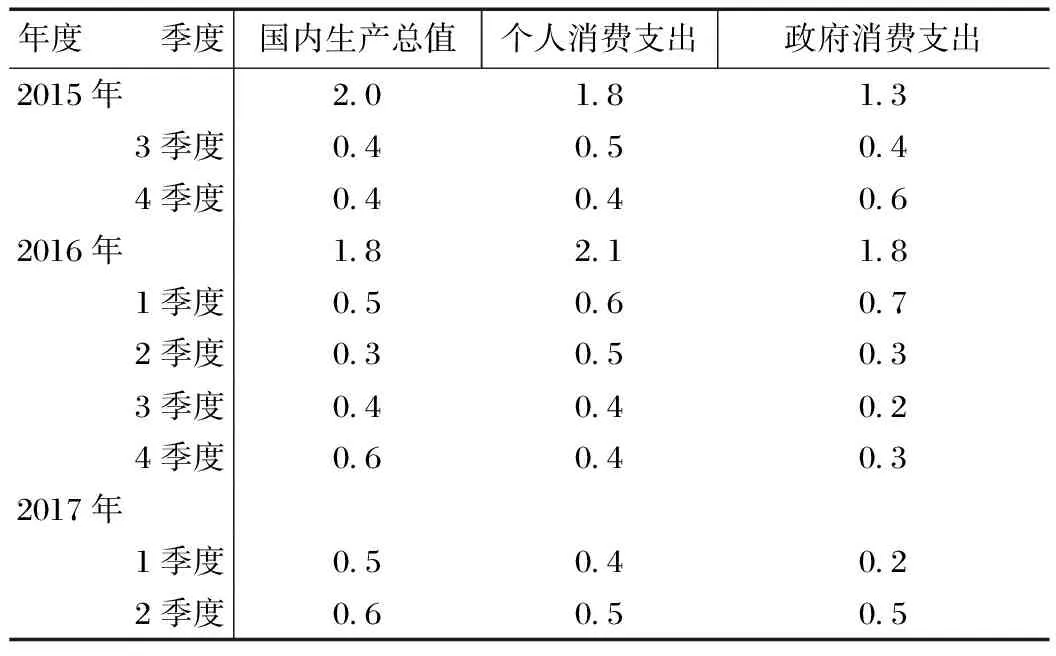

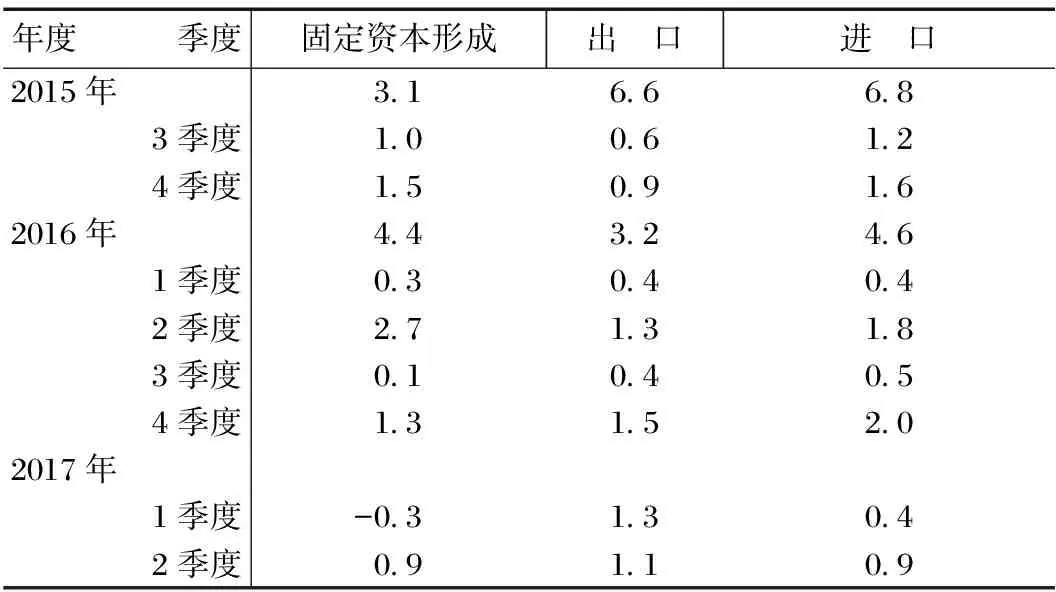

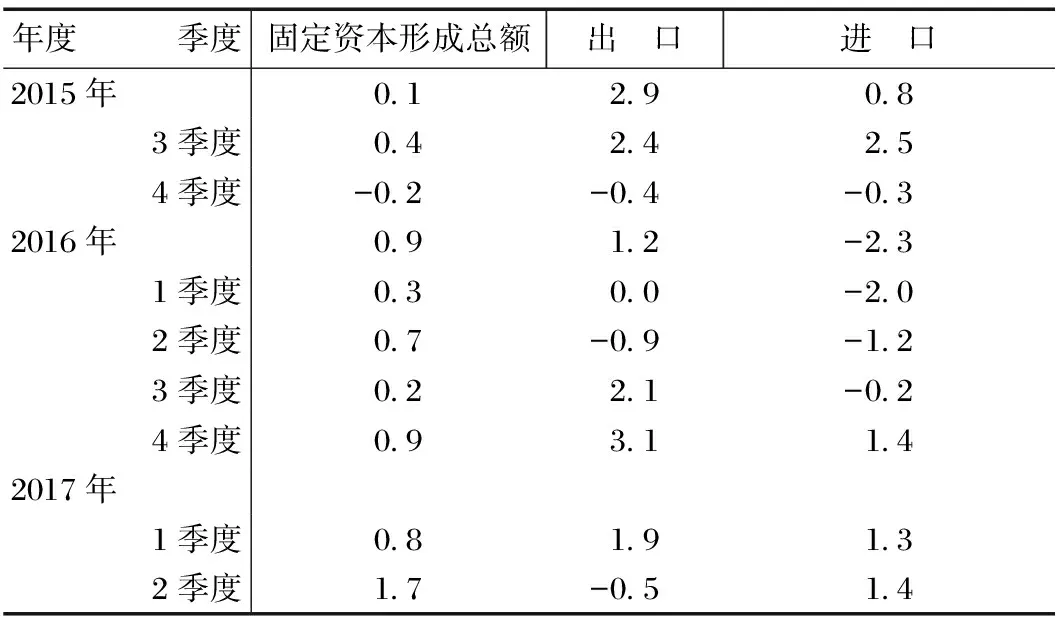

表13 国内生产总值及其构成增长率(环比) 单位:%

表14 国内生产总值及其构成增长率(环比) 单位:%

资料来源:欧盟统计局数据库(表13、表14)。

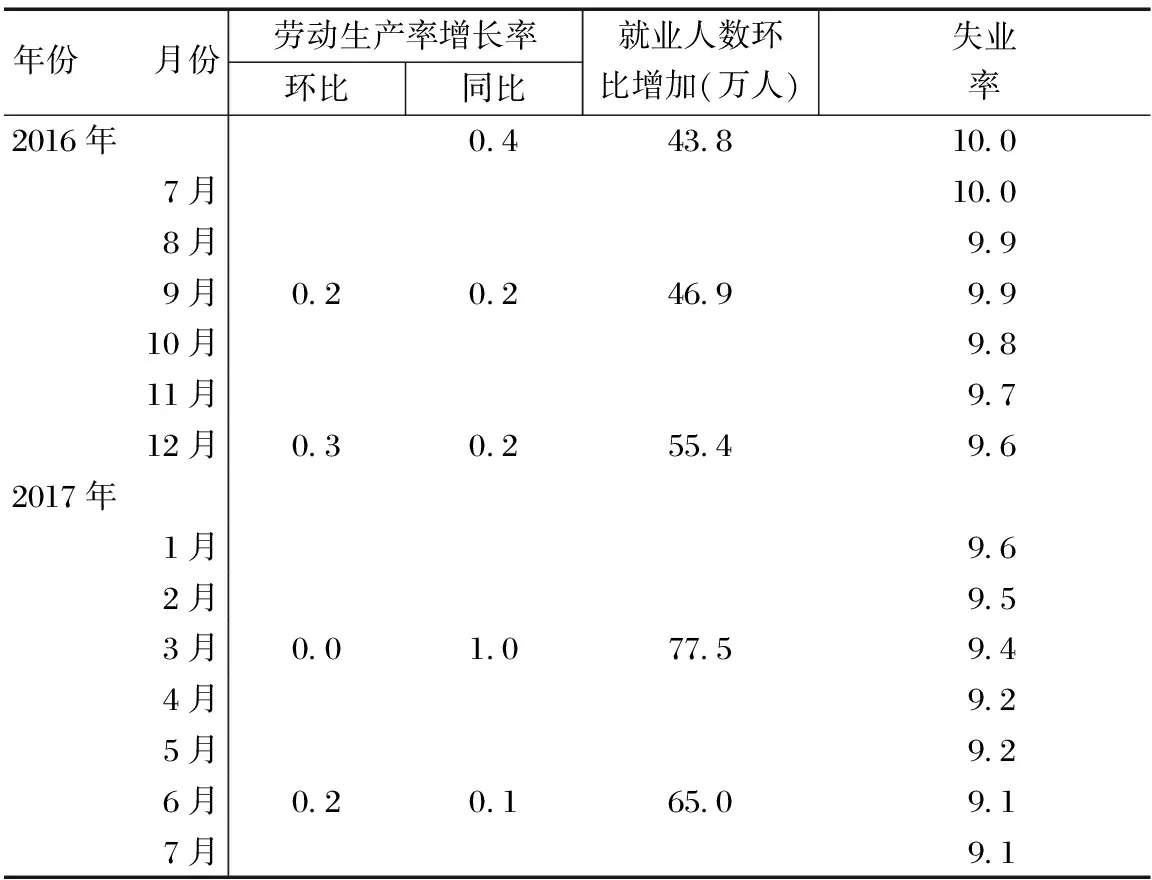

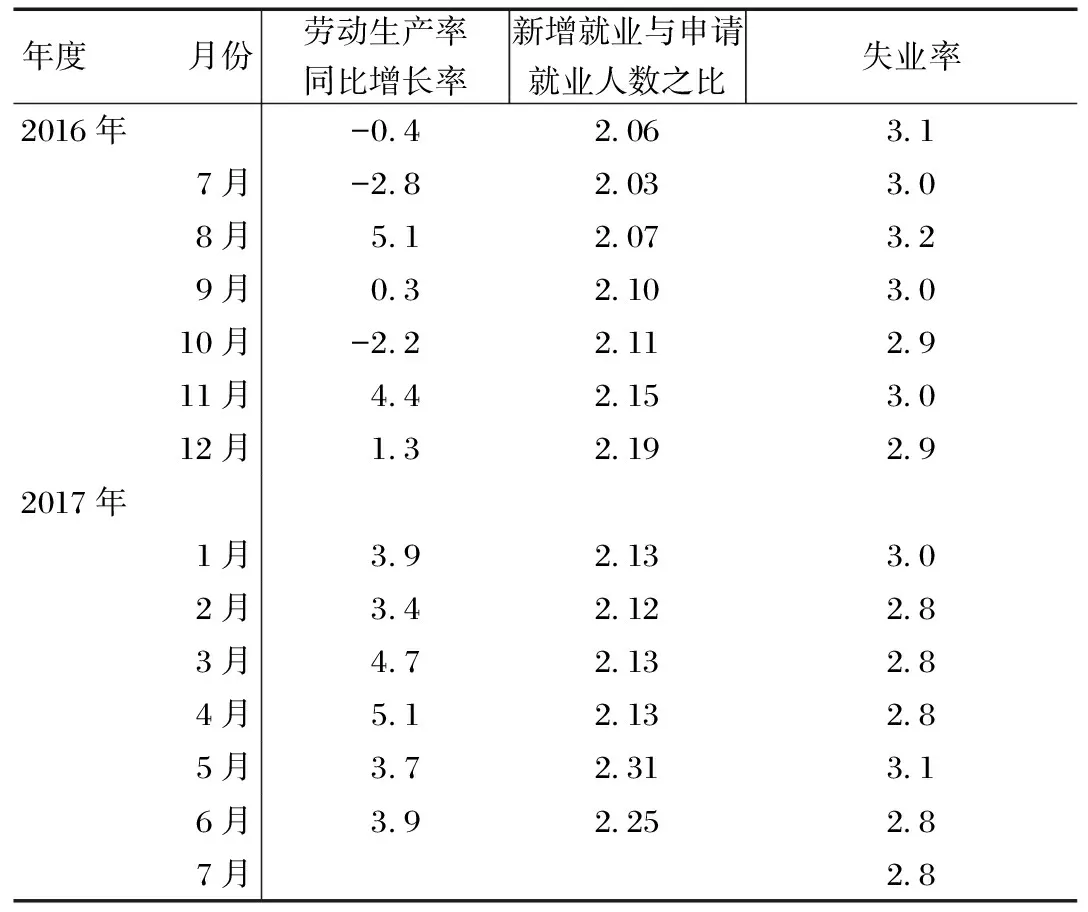

表15 劳动力市场 单位:%

注:除年度数据以外,劳动生产率增长率为该月份所在季度增长率;就业人数为该月份所在季度的环比变化。

资料来源:欧洲央行统计月报、欧盟统计局数据库。

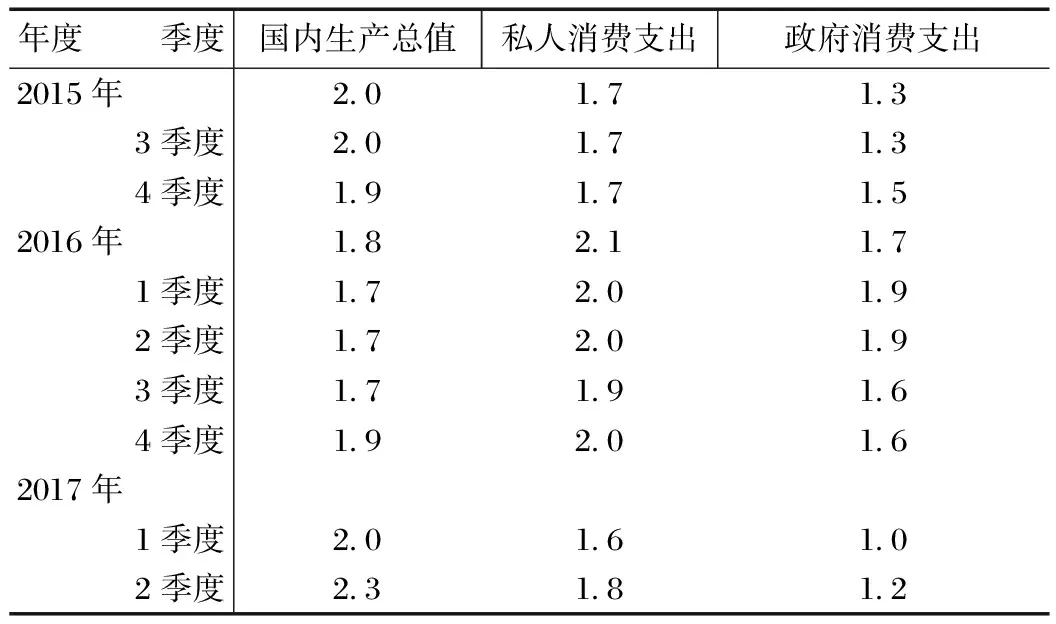

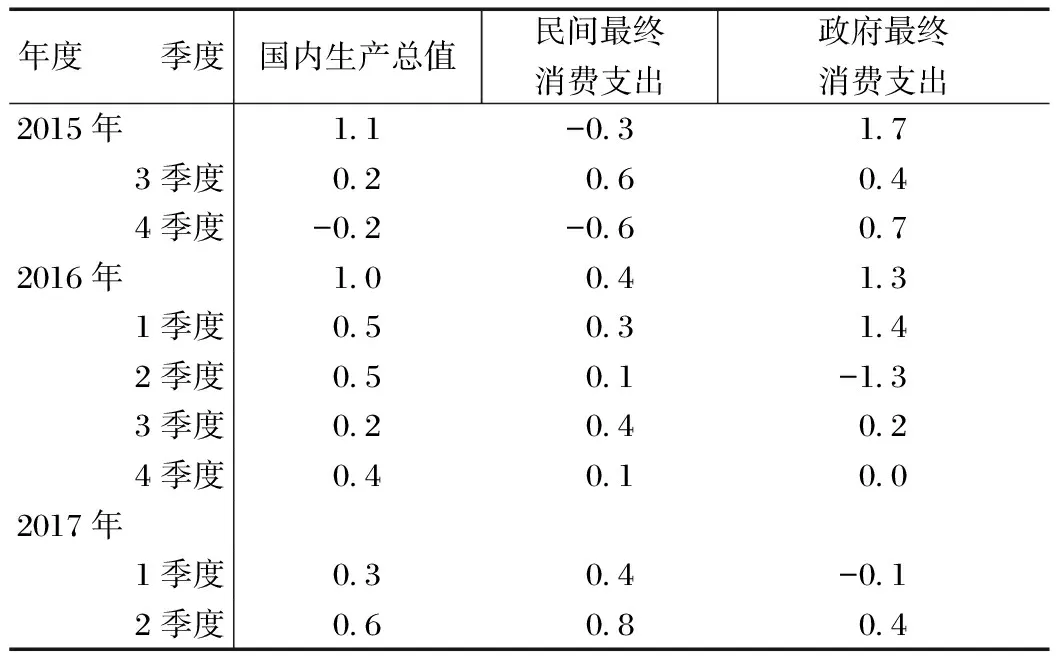

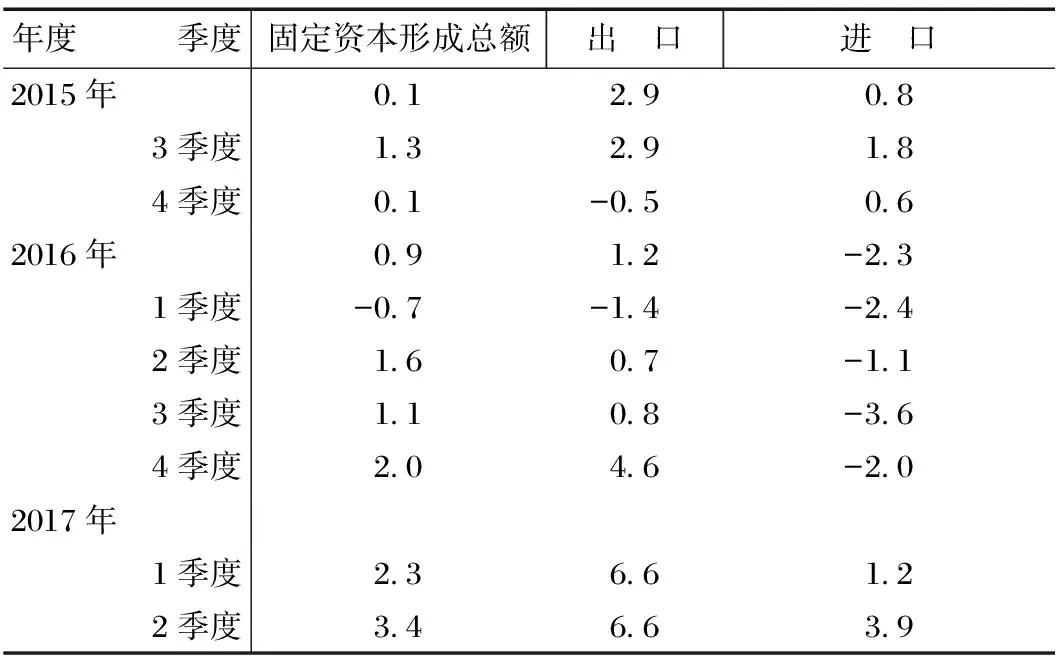

表16 国内生产总值及其构成增长率(同比) 单位:%

表17 国内生产总值及其构成增长率(同比) 单位:%

资料来源:欧盟统计局数据库(表16、表17)。

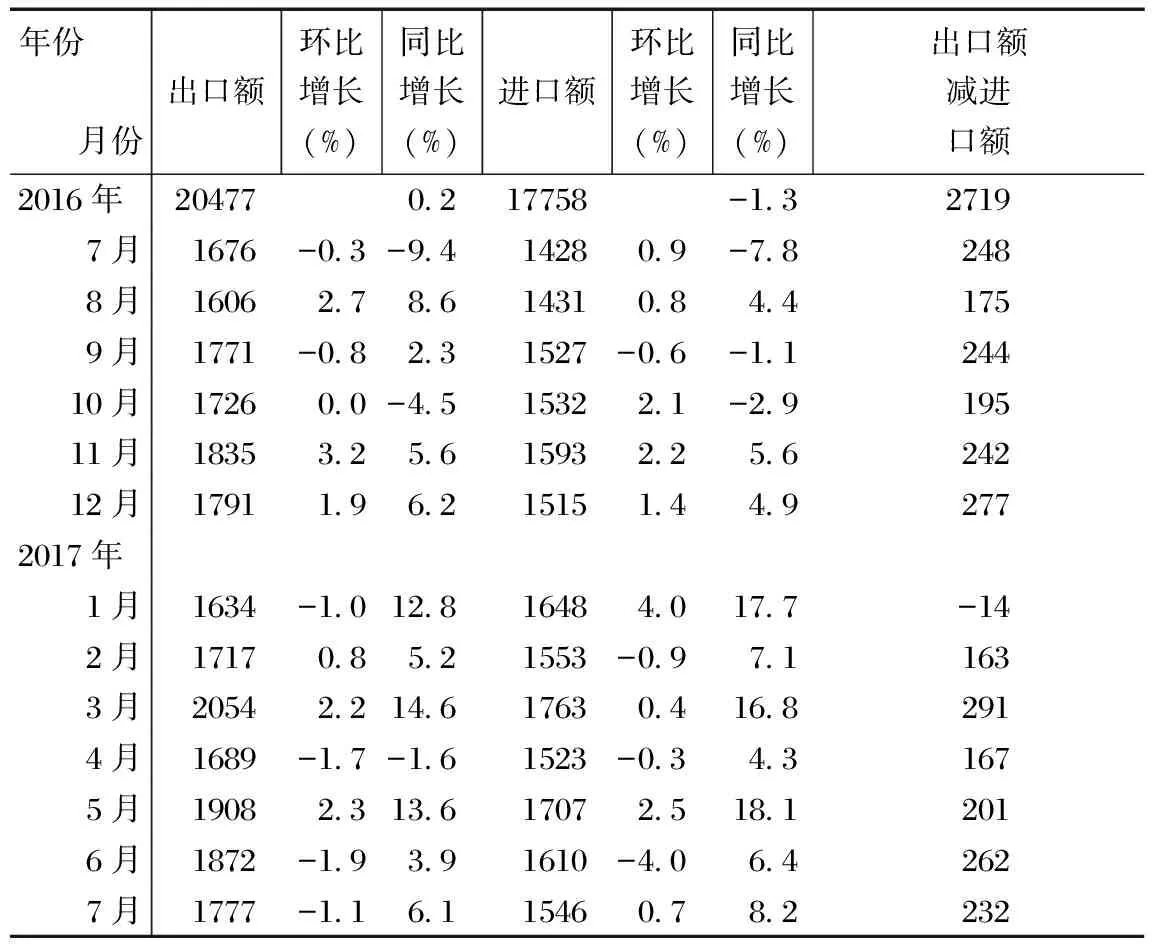

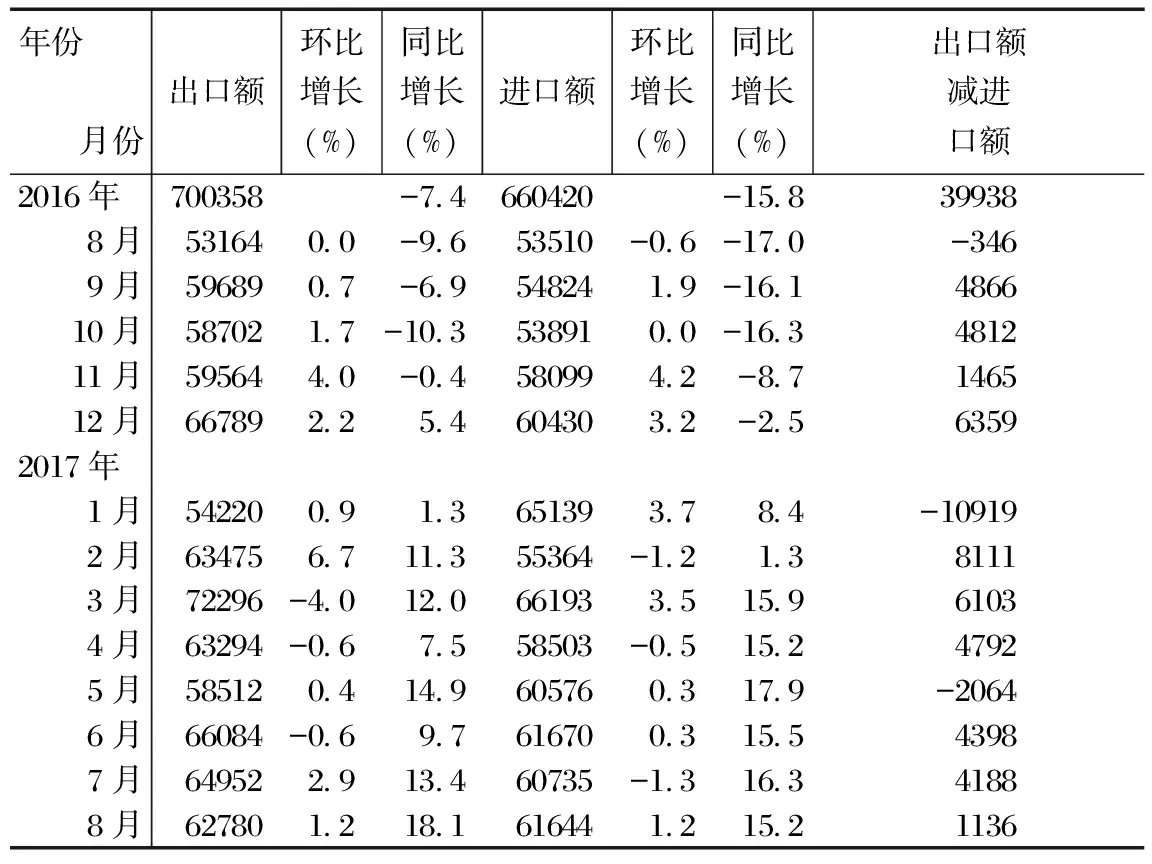

表18 进出口贸易 单位:亿欧元

注:欧元区绝对数指欧元区现有范围,即19个成员国。贸易额不包括欧元区各成员国相互之间的贸易额,为经季节调整后的数据。

资料来源:欧盟统计局数据库。

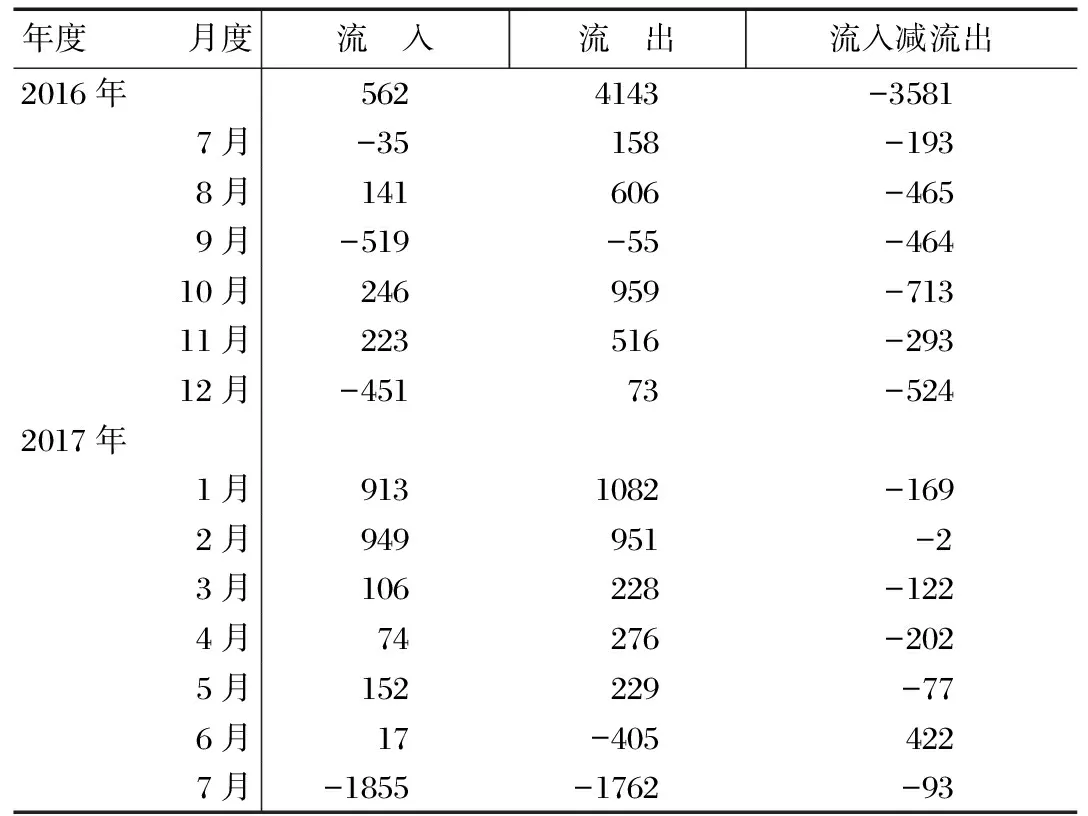

表19 外国直接投资 单位:亿欧元

注:欧元区绝对数指欧元区现有范围,即19个成员国。欧元区外国直接投资额不包括欧元区各成员国相互之间的直接投资额。

资料来源:欧洲央行统计月报。

四、日本经济

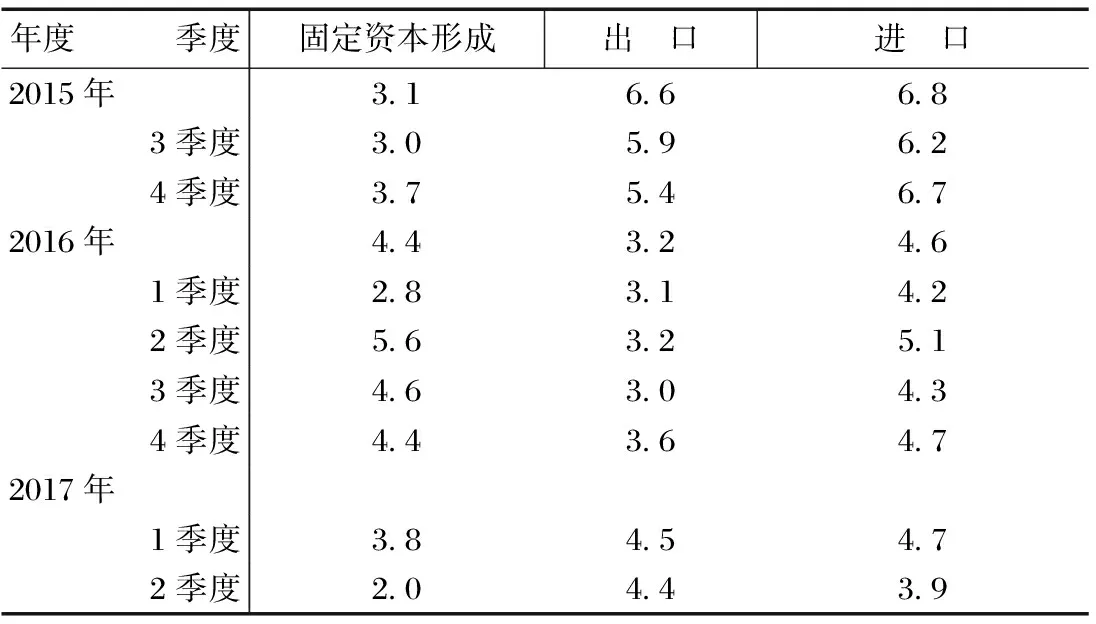

表20 国内生产总值及其构成增长率(环比) 单位:%

表21 国内生产总值及其构成增长率(环比) 单位:%

表22 国内生产总值及其构成增长率(同比) 单位:%

表23 国内生产总值及其构成增长率(同比) 单位:%

资料来源:日本内阁府(表20~表23)。

表24 劳动力市场 单位:%

资料来源:日本统计局和日本央行统计月报。

表25 进出口贸易 单位:亿日元

注:月度贸易额为季节调整后数据。

资料来源:日本财务省。

表26 外国直接投资 单位:亿日元

资料来源:日本财务省。

五、其他主要国家和地区经济

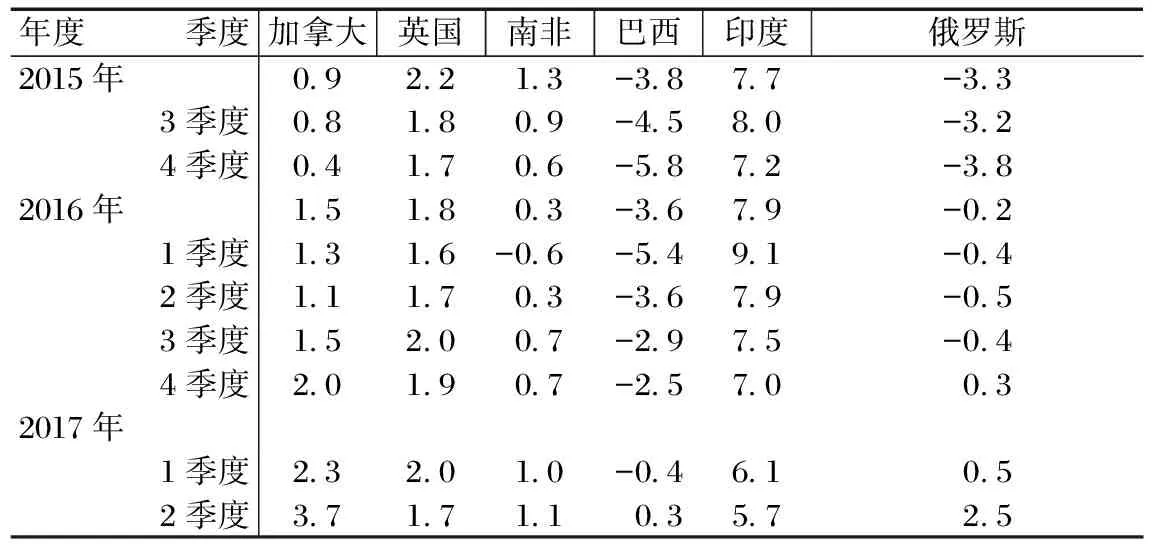

表27 国内生产总值增长率(同比) 单位:%

注:印度年度GDP增长率为财年增长率。

表28 国内生产总值增长率(同比) 单位:%

资料来源:各经济体官方统计网站。

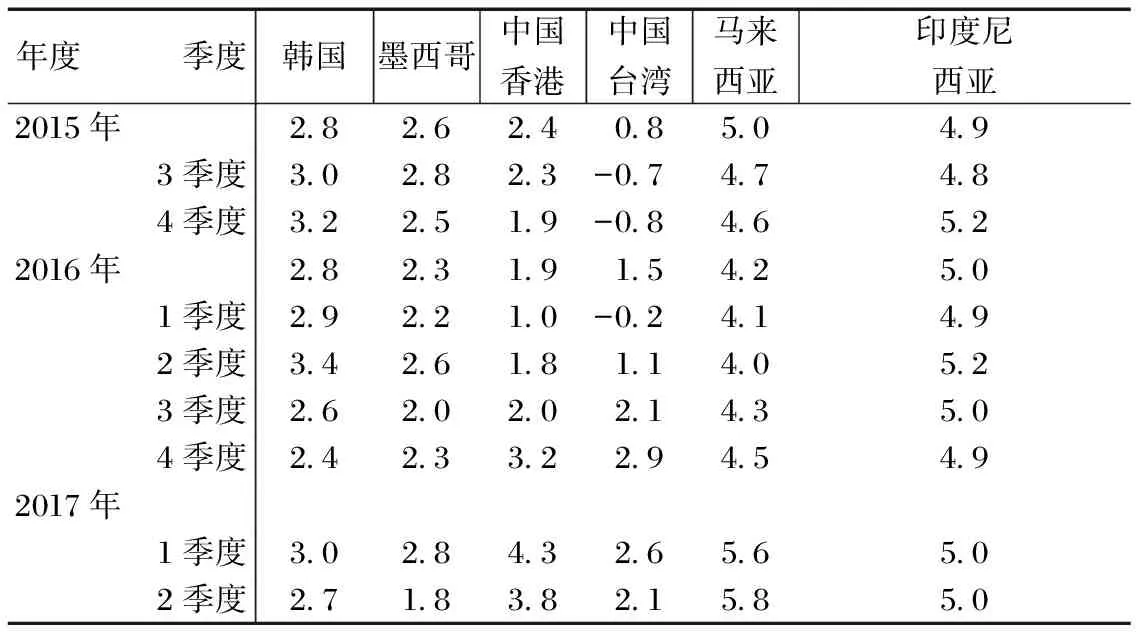

表29 劳动力市场失业率 单位:%

表30 劳动力市场失业率 单位:%

注:(1)英国和中国香港月度数据为截至当月的3个月移动平均失业率。(2)加拿大、英国、韩国和中国香港为经季节因素调整后的失业率。

资料来源:各经济体官方统计网站。

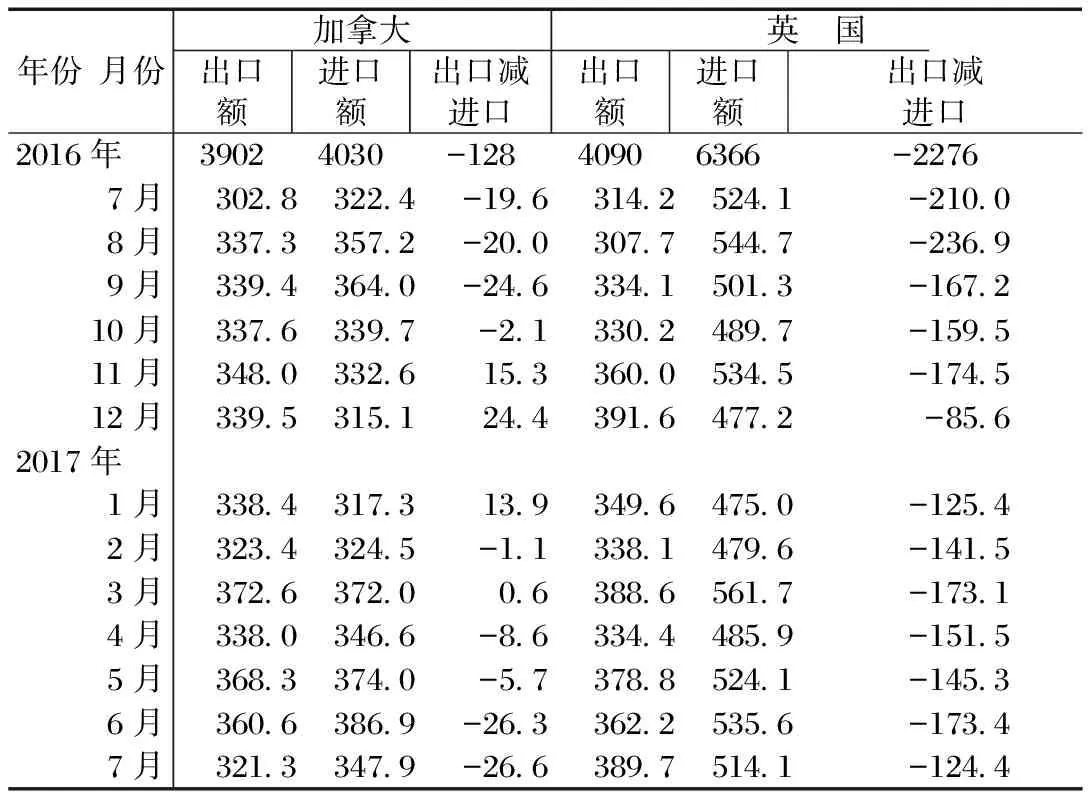

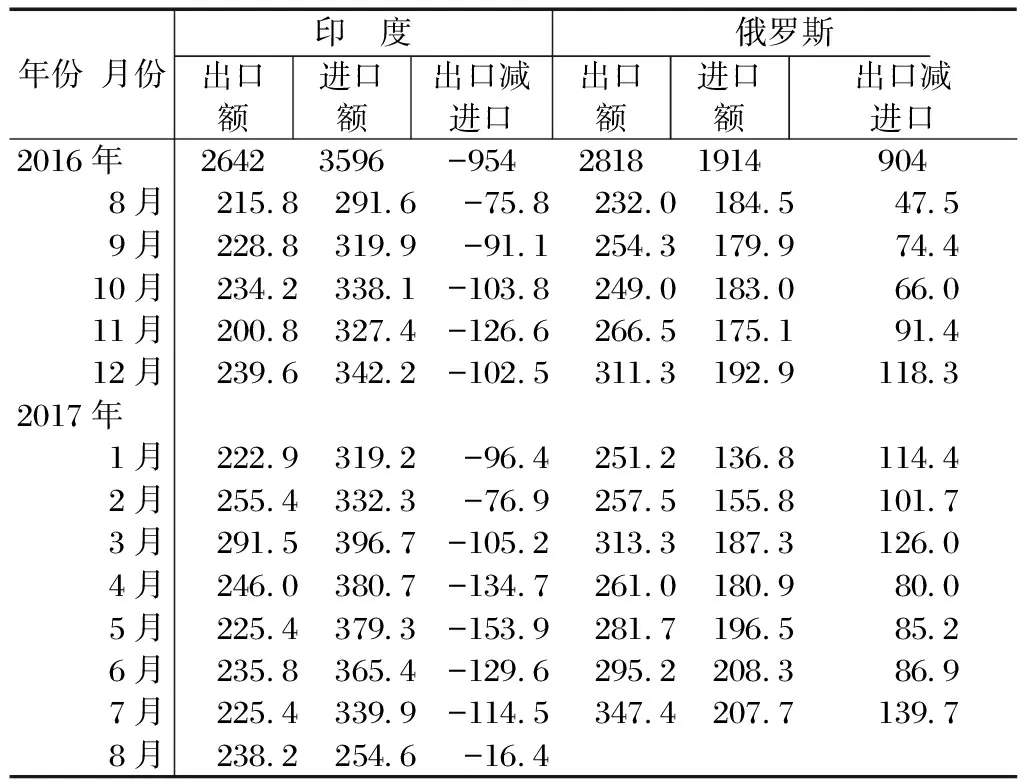

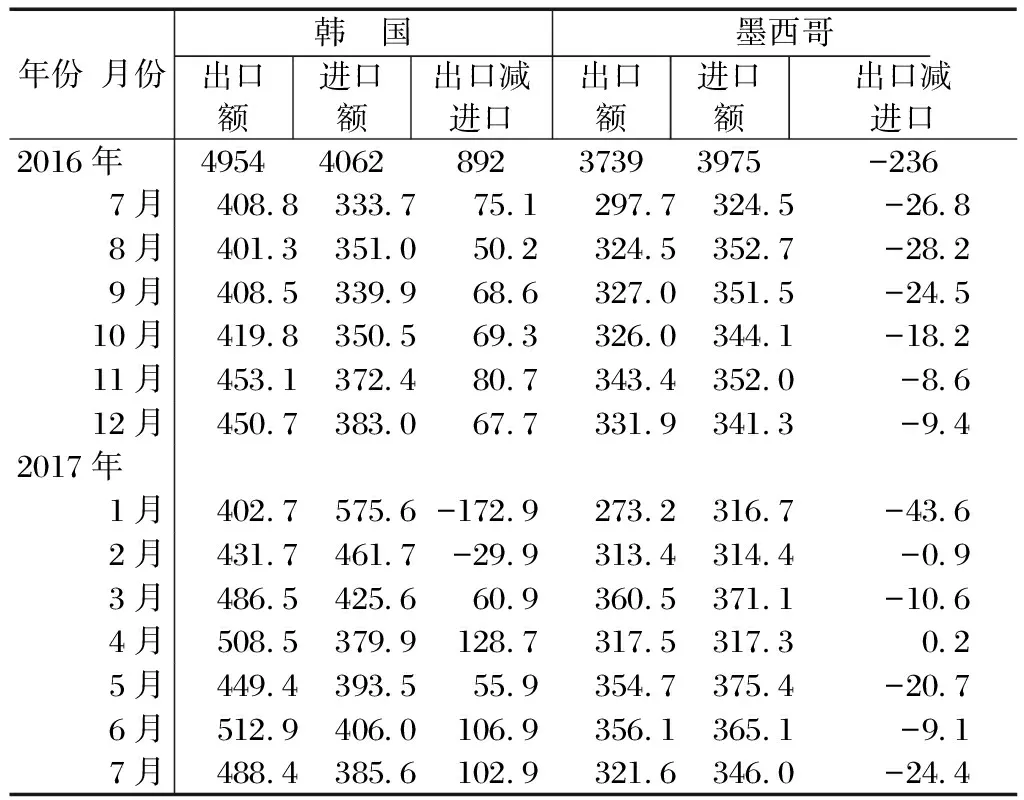

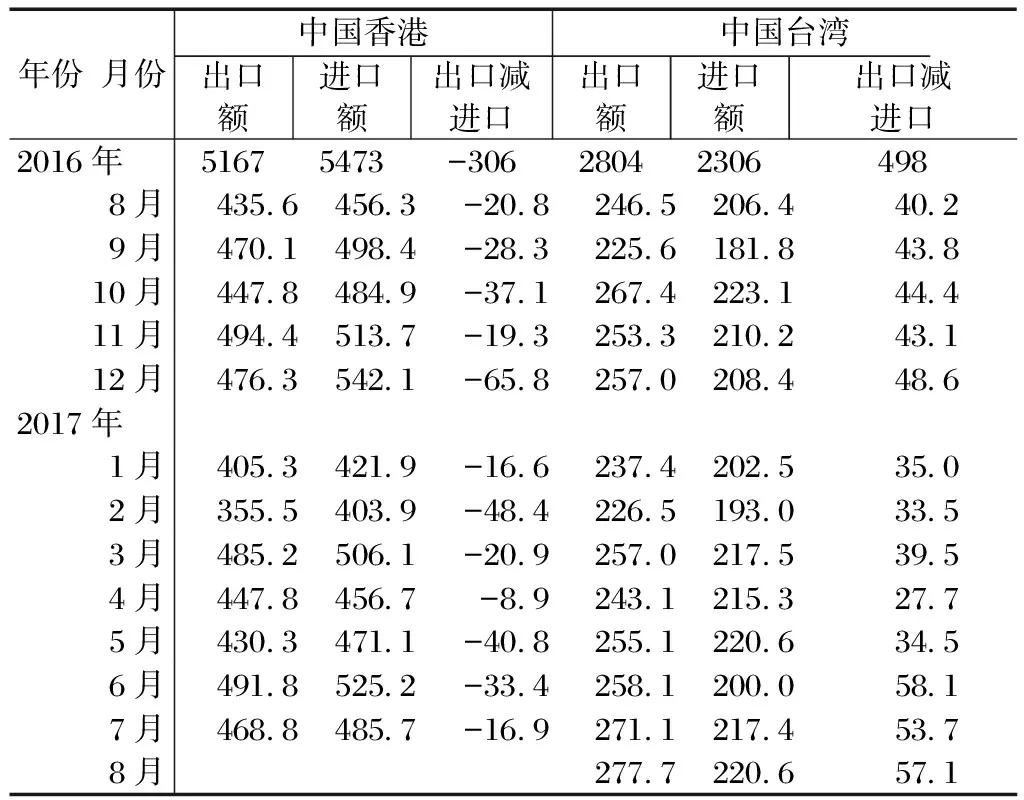

表31 进出口贸易 单位:亿美元

注:加拿大和英国数据经过季节因素调整。

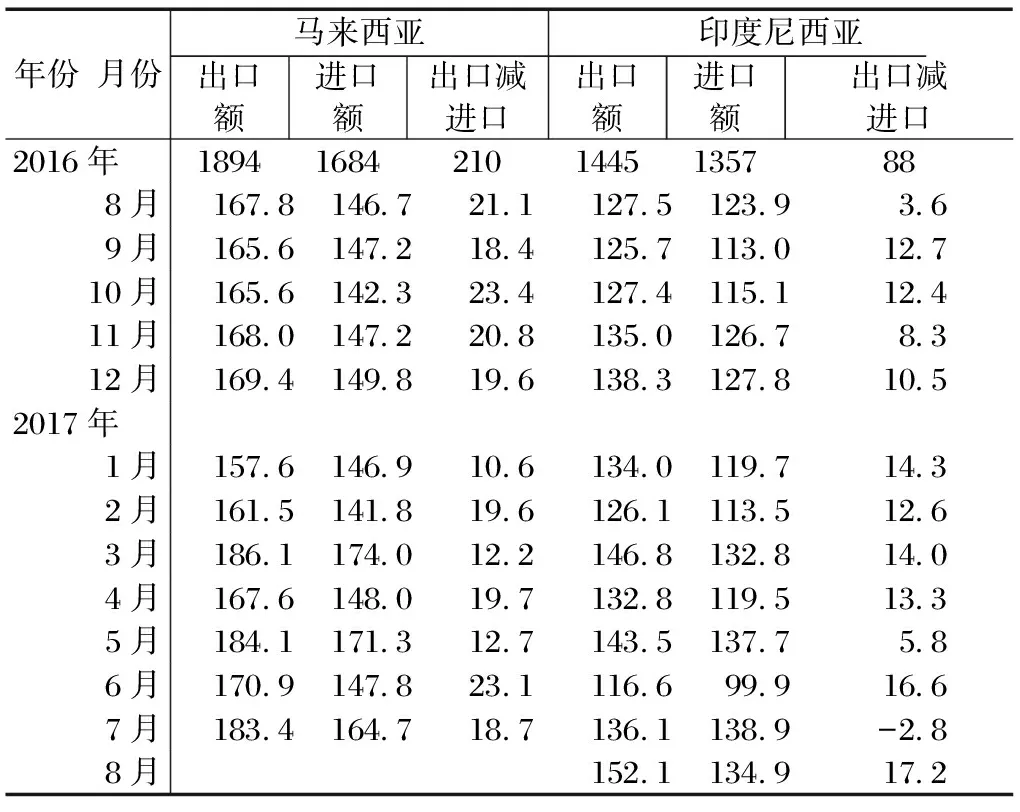

表33 进出口贸易 单位:亿美元

表34 进出口贸易 单位:亿美元

表35 进出口贸易 单位:亿美元

表36 进出口贸易 单位:亿美元

资料来源:各经济体官方统计网站(表27~表36)。

六、三大经济体指标对比图

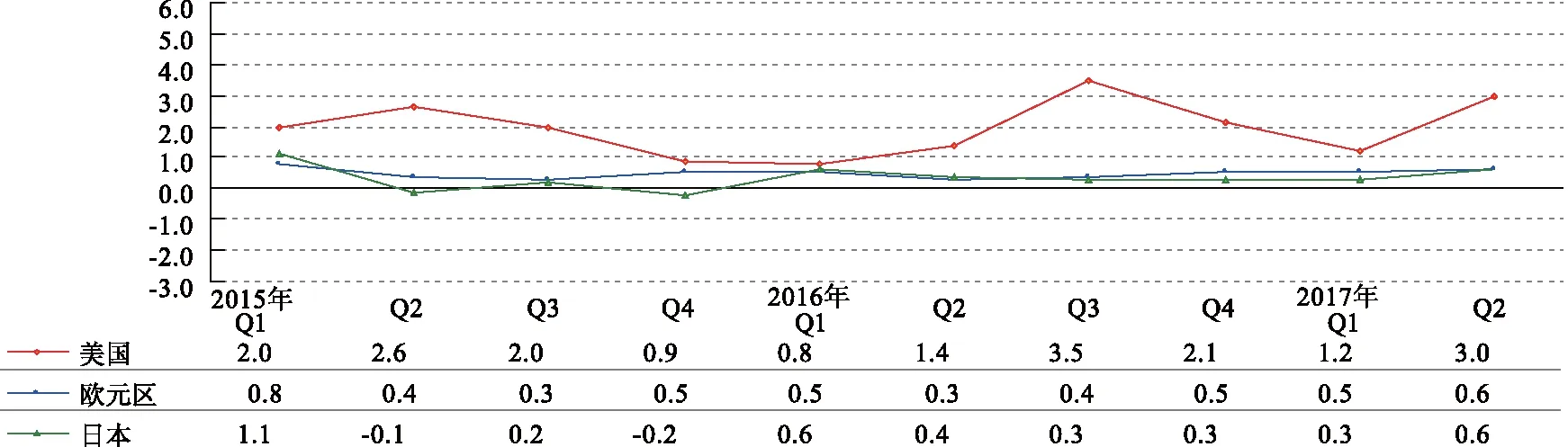

图1 三大经济体GDP环比增长率(%) 注:美国为环比折年率增长率。

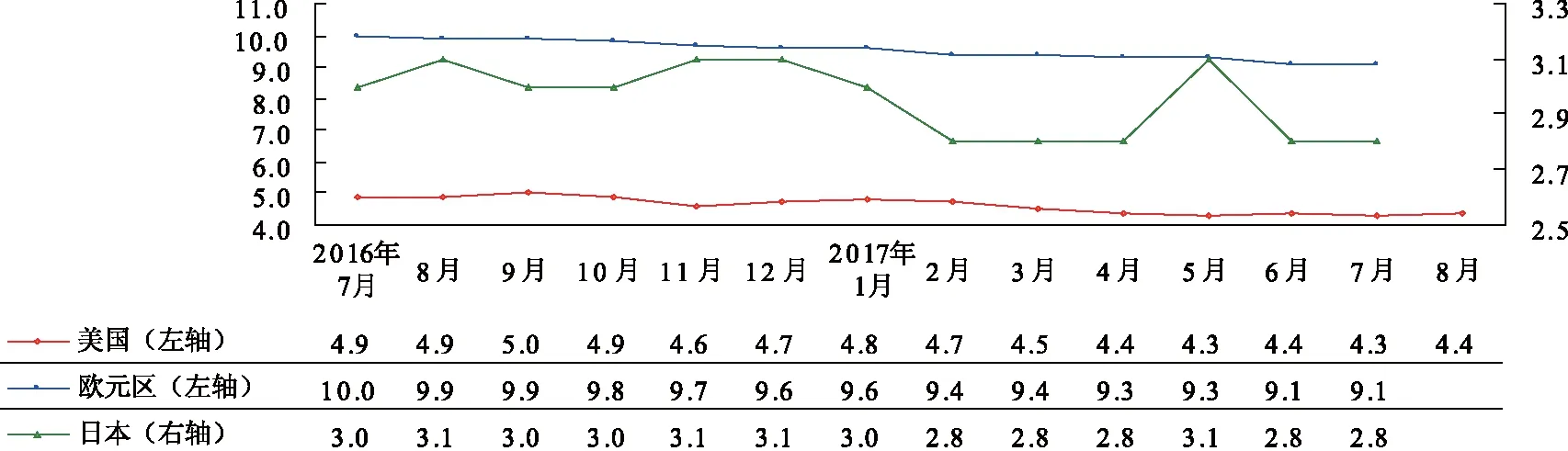

图2 三大经济体失业率变动(%)

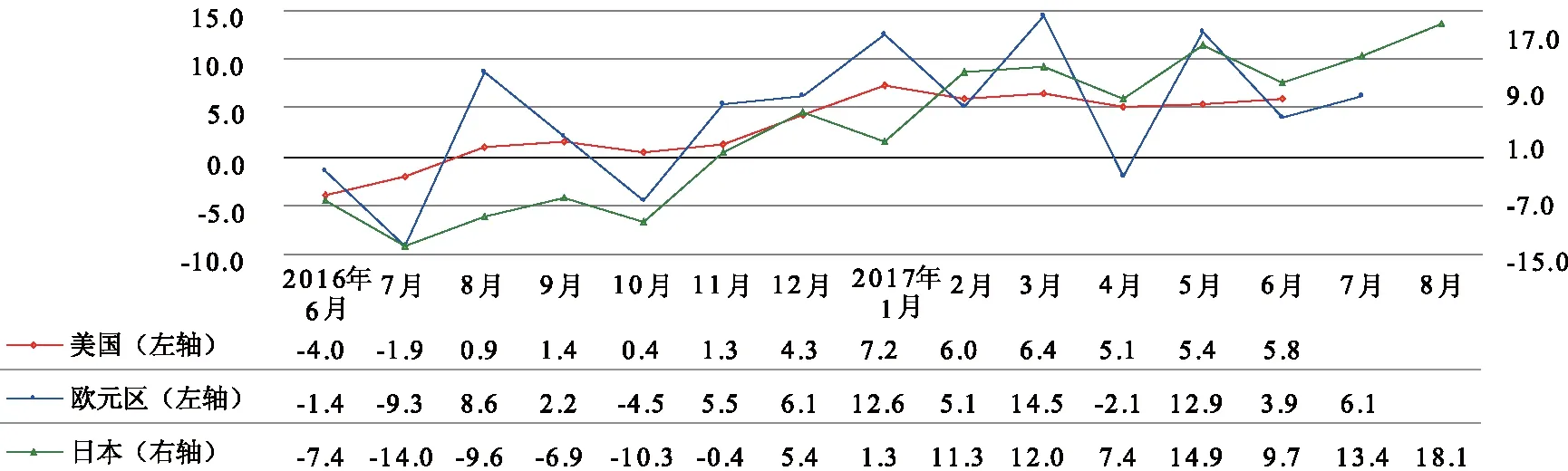

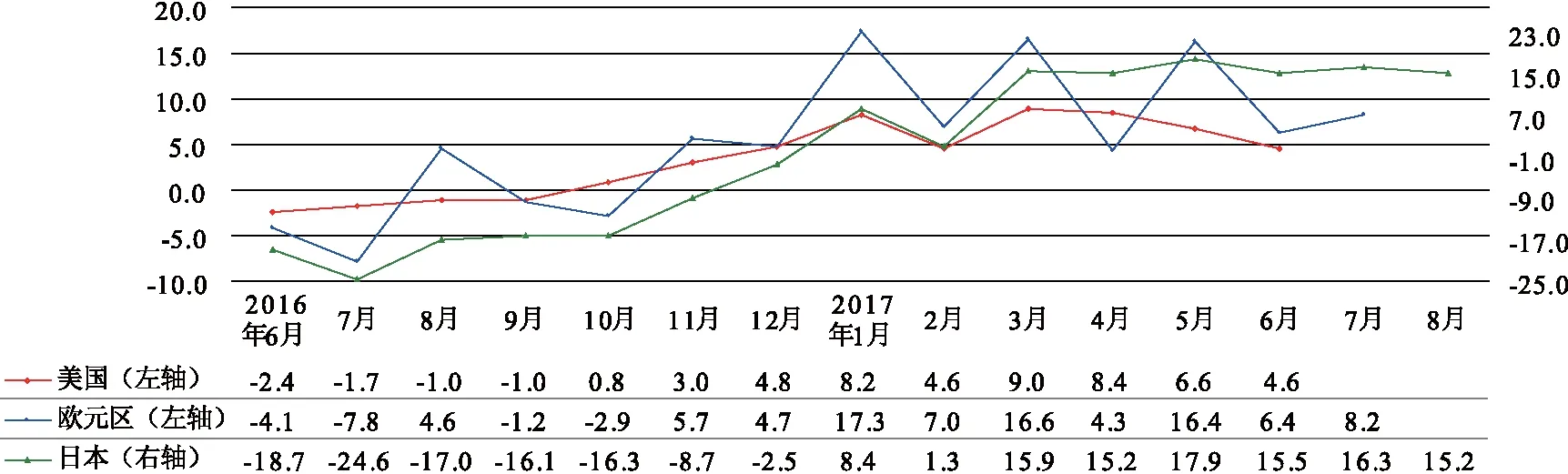

图3 三大经济体出口额同比增长率(%)

图4 三大经济体进口额同比增长率(%) 数据来源:各经济体官方统计网站(图1~图4)。

责任编辑:陈璇璇

S

(1)Toconstructalong-termmechanisminwhichsupplystructureanddemandstructurearedynamicallyaccommodatingtoeachother

Han Yongwen

In theory, the supply side structural reform in the short term is to promote “three to drop, one to fall and one to fill”, reversing the problem on the surface where the supply structure cannot adapt to the demand structural requirements; in the long-term and fundamentally, it is to perfect mechanism system where market plays a decisive role in resource allocation, improve the total factor productivity, further strengthen total factor market, enhance the internal power of microcosmic body, really form a unified, open and competitive market, and establish a long-term mechanism for supply and demand which are dynamically adaptive, and structure changes of supply and demand which are adapting to each other.

(2)Tocarryoutthegreatcausesofmodernizationofreformandopeninguptotheend——Commemoratethe40thanniversaryofthereformandopeningup

Jia Kang

The reform and opening up will usher in the 40th anniversary. A comprehensive and profound understanding and continued substantive advances of reform and opening up concern the future of the country, the destiny of the nation and the well-being of the people. The reform and opening up has brought about great progress to China economy and society, which shows clearly, but not limited to, from the aspects of the total economy and per capita income, and is closely related to innovation and reconstruction in material, spiritual, political, cultural, ecological and other dimensions of civilization. China’s reform has entered the “deep water zone”, where the resistance is unprecedented, which requires us to further emancipate our minds, rush through the “Three Gorges of history” with a comprehensive reform, and meet the great rejuvenation of modernization.

(3)Thecrossroadsofglobal“broadmoney”and“tightmoney”

Gu Yuanyang

Since the second half of 2016, the sound of global monetary easing moving to the inflection point of gradual tightening has become lauder, the main reasons for which are the emergence of new factors for the global monetary policy shift, tightening convergence changes in global monetary policy differentiation, and the Fed’s acceleration of the pace for the monetary policy normalization. Because of their macroeconomic situations are less sound than that in the United States, the European Central Bank and the Bank of Japan did not follow the change of the Fed’s monetary policy to alter their quantitative easing monetary policy, but considering the loosing monetary policy has come to an end, they began to release the preliminary tightening signal. In 2017, caused by the increased factors for monetary policy tightening, the global monetary policy adjustments moved to the crossroads. However, the road for the global monetary easing to exit has never been flat, the global loosen monetary policy and low interest rate environment are difficult to fundamentally change, it is less likely to see the turning point of global re-inflation and monetary policy moving from loose to tight, thus causing a shortage of liquidity in the world.

(4)Sustainedeconomicrecoveryandweakexpansionbase——Analysisoftheworldeconomicsituationinthefirsthalfof2017

National Bureau of Statistics Interpretation Group

In the first half of 2017, the major economies recovered to varying degrees, the main economic areas continued to improve, and the world economy grew steadily with increased vitality, and overall maintained a sustained recovery trend. However, the unstable factors still exist, the foundation of recovery is not firm, and the external environment facing our country is still complicated. It is expected that the world economy will continue to recover in the second half of the year, but the pace will not be too fast. The external economic environment of our country is grim, so we should pay close attention to it and deal with it properly.

(5)TheenlightenmentofcurrencyinternationalizationexperienceforpromotingtheinternationalizationofRMBalongThe“BeltandRoad”

Meng Gang

The pound, the dollar, the yen and the euro are the world’s major international currencies. From the aspects of trade, investment, finance, government and others, studying the internationalization experience of the currencies above is significant. To promote the internationalization of the RMB during the “Belt and Road” construction, China should enhance the foundation for the domestic economy, while maintaining stability, China should jointly negotiate, construct and share with countries along the line, strengthen economic and financial cooperation, optimize the environment for investment and trade, and intensify the functions of RMB for denominated settlement, trading and reserve.

(6)ResearchonthesystemmechanismofpromotingecologicalcivilizationconstructioninChina

CCIEE Research Group

China is the first country to put forward the concept of “ecological civilization” at the United Nations’ conference, therefore, how to build ecological civilization well is a question worthy of in-depth study. From the basic theory of ecological civilization, This paper analyzes the present situation and experience of ecological environmental protection at home and abroad, put forward the general idea, goal and main task of ecological civilization construction in our country, on the basis of which it gives the major policy suggestions for the administration and supervision system, laws and regulations system, economic policy and market mechanism and so on.

(7)Stablerealestateprices,wealthexpectationsandeconomicgrowth

He Jingtong, Na Yi and Zhao Zimu

It is urgent and significant to curb the continued “overheat” of the real estate market and promote the stable and healthy development of the real estate market. However, the market effects of various regulatory policies in China are not satisfactory. We need to further analyze and recognize the support mechanism for prices behind the back, set out countermeasures starting from the root. The price formation mechanism based on the short-term “supply - demand” analysis seems logical, but ignores the important characteristics of the real estate market, that is, real estate is a special commodity with investment goods and consumer goods, so the market subjects are easy to form the expected bullish wealth. Therefore, how to correctly guide the real estate market is the key to stabilizing prices and inducing the property market moving to the stability at the moment. In the long term, we should construct stable legal system based on legal system as the core, with the precise regulation from the supply side to guide and stabilize expectations; in the short term, we should promote the reform of the system of land leasing in time, prevent local governments in the rounds of land transaction to push up the prices that increase the expected real estate wealth. Stable expectations will bring about stable prices, guide the flow of excessive capital in the housing market to other industries, which help to improve the efficiency of resource allocation, balance the differences in the industrial profit rates, promote the adjustment of industrial structure and technological innovation, and thus stimulate the endogenous power doe stable economic growth.

(8)TheforecastofthetotallaborsupplyandstructureofChinainthefuture

Tian Fan

Economic development cannot be separated from the support of the labor force, and the supply of labor force will directly affect the normal operation of a country’s economy. This article uses the population shift algorithm to predict the Chinese total working age population and age structure, and then using regression analysis it determines the correlation coefficients between labor supply and the working age population, which were used to predict the total labor supply, labor force supply structure, future labor force sex structure and quality structure; according to the empirical analysis the results of the study, it puts forward some policy enlightenments.

(9)Fromtheperspectivesofculturalideasandinstitutionalarrangementstofindout“shortslabs”andfillthem

Huang Yong, Fu Jinlong, Pan Yigang and Dong Bo

The “short slabs” is the prominent problem and contradiction affecting the overall development. Finding and filling “short slabs” are very important for realizing sustainable development. Against the development goals during the “13th Five-Year” period to build a comprehensive and high level well-off society, the “short slabs” in the development of Zhejiang province are mainly from the fields which are not meeting the high level requirements in accordance with the standards, not balanced in accordance with the requirement of equilibrium imbalance, and not adaptive in accordance with the increased advantages. Through comparative analyses, it has become clear that the short slabs in six aspects of the current development of Zhejiang in innovation, opening up, integrated transportation, urban integration, public services, ecological civilization and others are more prominent. This article attempts to analyze the reasons from the perspective of cultural ideas and institutional arrangements, and put forward the direction for innovating and filling the short slabs.

Editor:Huang Yongfu

欢迎订阅《全球化》杂志

《全球化》杂志由中国国际经济交流中心主管/主办,是集研究性、学术性、政策性、应用性于一体,以国际经济、宏观经济、企业国际化经营为主要内容的经济类理论月刊(国内统一刊号:CN11-6008/F;国际标准刊号:ISSN2095-0675)。刊物按照曾培炎理事长的办刊宗旨,依托“中国智库”平台优势,秉承“同享人类智慧,共谋全球发展”的核心理念,本着兼容并蓄、百花齐放的原则,着力打造“全球经济思想库”,构建一个智库交流的平台,成为广大读者观察国际问题的重要窗口和共享思想盛宴的便捷之门。刊物致力于探讨全球化带来的机遇与挑战,积极反映国际社会特别是新兴经济体和广大发展中国家的诉求,研究如何改善全球经济治理,建立公正合理的国际经济新秩序;对中国经济社会发展的重大问题进行理论研究,关注宏观经济运行、产业发展、区域发展中的重点和难点问题,提高经济形势分析预测的科学性、及时性和权威性;积极推动中国经济对外开放进程,关注中国企业国际化经营与发展中的趋势与问题,为中国企业“走出去”提供政策和资讯服务,同时为跨国公司进入中国提供引领和支持。刊物力争具有全球视野,服务宏观决策,推动企业发展,集聚各类人才,成为政府、科研院所、企业从事国际经济研究、把握中国经济动向的重要平台。

全国各地邮局均可订阅,国内邮发代号:82-572;也可填好“征订单回执”,直接汇款向我部订阅。地址:北京市西城区永定门内大街5号232室《全球化》编辑部;邮编:100050;电话:010-83362183/83366113。

本刊定价:每期人民币35元,美元20元,港币50元,每月25日出版(国内免费邮寄)。

2018年《全球化》杂志(月刊)征订单回执