Stock index adjustments,analyst coverage and institutional holdings:Evidence from China

Song Zhu,Xioyu Jing,Xioli Ke,Xioyu Bi

aBusiness School,Beijing Normal University,China

bBank of China,China

Stock index adjustments,analyst coverage and institutional holdings:Evidence from China

Song Zhua,*,Xiaoyu Jianga,Xiaoli Kea,Xiaoyu Baib

aBusiness School,Beijing Normal University,China

bBank of China,China

A R T I C L E I N F O

Stock index adjustment Analyst coverage Institutional holding

Using 231 pairs of matched firms from 2009 to 2012 in Chinese stock market,we find that the stock index adjustment significantly affects the analyst coverage,which in addition to the stock index leads to more analyst coverage,while deletion from the stock index has no significant effect,indicating that stock index adjustment can significantly change the information environments of firms that are added to the index.An index adjustment also affects institutional holdings in consideration of new information(e.g.,changes in fundamentals and information environments).Changes in institutional holdings are partially due to changes in analyst coverage,and both index funds and other types can change their portfolios in response to changes in the target firms’informativeness.

Ⓒ2017 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

The ‘‘S&P game”is another name for the arbitrage that occurs in response to the addition of stocks in the S&P 500 index(Lee et al.,2008),which is conducted by both index fund managers and other traders.Usually,significantly positive(negative)abnormal returns around the index addition(deletion)are found(Harris and Gurel,1986).A large increase occurs in correlating the trading volume of stocks added to the index with the volume of those that remained in the index,and the opposite is true as a result of the deletions(Greenwood and Sosner,2007).Due to the arbitrage surrounding the times of index changes,investors in funds linked to the S&P 500 Index and the Russell 2000 Index lose between$1 and 2.1 billion a year for the two indices combined,and the losses can be greater if benchmarked assets are considered;the pre-reconstitution periodis lengthened or involuntary deletions are taken into account(Chen et al.,2006).However,recent research finds that a buy–hold index portfolio outperformed the annually rebalanced index in the 1979–2004 period.Although the short-term momentum and poor long-term returns of new issues partially explain these returns,index deletions were found to provide significantly higher factor-adjusted returns than index additions(Cai and Houge,2008).This suggests that changing holdings around index adjustment may not be a wise decision.

Although changes in institutional index fund holdings are responsible for the observed abnormal returns in response to S&P 500 changes(Shleifer,1986;Harris and Gurel,1986),there has been scant supporting empirical evidence(Pruitt and Wei,1989;Chen et al.,2004;Green and Jame,2011).Do changes in institutional holding only result from the portfolio management of index funds?Addition and deletion announcements also contain valuable and relevant new information that may further affect the portfolio management for both index funds and other institutional investors.Moreover,Beneish and Whaley(1996)and Shleifer(1986)suggest that analysts may also alter their attitudes regarding firms that are added to or deleted from the stock index,which is not supported by evidence.Do stock index adjustments also af f ect analysts’coverage and stock recommendations,further inf l uencing changes in institutional holdings and ultimately leading to a more volatile market reaction to index adjustment?There are no clear answers,as little work has been done in this area.

We use 231 pairs of matched Chinese firms in the same industry,during the same year and the same quarter with similar assets over the 2009–2012 period,and find that stock index adjustments significantly affect analyst coverage,which in addition to the stock index,leads to more analyst coverage(proxied by the number of analysts and stock recommendations).In contrast,deletion from the stock index has no significant effect,indicating that stock index adjustments can significantly change the information environments of firms added to the index,as Beneish and Whaley(1996)and Shleifer(1986)suggest.Index adjustments also affect institutional holdings,as Pruitt and Wei(1989)note,even in cases of new information,such as changes in fundamentals and information environments.Moreover,changes in institutional holdings can be partially due to changes in analyst coverage,such that index and other funds change their portfolios in response to changes in the informativeness of the target firms.

Our paper contributes to the literature in the following ways.First,we provide more rigorous evidence for the effects of stock index adjustments on institutional holdings in relation to the validity of the related hypotheses.We use matched samples and a multi-regression to investigate the information content of stock index changes,such as changes in firms’profitability,growth potential or the information available for decisions—any of which may coincide with stock index adjustments and lead to changes in institutional holdings.Second,we examine the influence of index adjustments on firms’information environments and show how the former affects the latter’s analyst coverage and stock recommendations,which then influence their market performance and investor holdings.Our finding provides some evidence for the information content hypothesis concerning stock index adjustment.Third,our work provides further evidence of the stock index adjustments,analyst coverage and institutional holdings in the Asian Pacific and other emerging markets.Finally,the conclusions of this paper will be useful for studies on the future of stock indices in China.In 2015,China’s stock market experienced a dramatic uprush and collapse,and the stock index future is now heavily criticized by many scholars and investors.Our work on the logic and patterns of institutional investors’reactions to stock index adjustments can provide some evidence and useful clues about the regulation of stock indices in China’s future.

The remainder of this paper is organized as follows.Section 2 reviews the relevant literature and Section 3 presents the stock index adjustments in China.Section 4 describes the research design and the empirical analysis is shown in Section 5.The final section concludes our paper and discusses future research.

2.Literature review

There are many studies on the market created in reaction to stock index adjustments,and several hypotheses are proposed.The downward-sloping demand curve hypothesis suggests that the demand of index fund managers reduces the stock’s supply for non-indexing investors,permanently increasing the market clearing price(Shleifer,1986;Chakrabarti et al.,2005).The liquidity hypothesis suggests that the addition or deletion of a stock from the index alters the stock’s liquidity,which affects its price(Shleifer,1986;Beneish and Whaley,1996).Price pressure is attributable to index trading,because index fund managers must add or delete the stock from their portfolios to avoid unfavorable tracking errors by which they may be evaluated.Reflect-ing a supply and demand imbalance,securities prices adjust to new levels in response to this buying and selling pressure exerted by the index-fund managers(Harris and Gurel,1986;Elliott et al.,2006;Platikanova,2008).The information content hypothesis proposes that addition and deletion announcements contain valuable and relevant information.Inclusion(exclusion)signals a real or perceived increase(decrease)in management quality,and the S&P’s inclusion of a stock in an index may act as a certification of quality,leading to a price and possible volume increase due to trading by index managers(Beneish and Whaley,1996;Denis et al.,2003;Cai,2007;Gygax and Otchere,2010).The investor awareness hypothesis suggests that investors cannot invest in a security of which they are unaware,and firms have a shadow cost for being unknown that decreases as the firms become better recognized.A stock’s addition to an index alerts investors of its existence,increasing the number of analysts following it,its information dissemination and its liquidity and breadth of ownership.These factors lead to a reduction in the firms’shadow costs and the investors’required rate of return,which results in an increase in the firms’stock price and expected stock returns(Chen et al.,2004;Elliott et al.,2006).

All of these hypotheses imply changes in investor trading,particularly that of institutional investors such as index funds.Shleifer(1986)and Harris and Gurel(1986)suggest that changes in institutional index fund holdings are responsible for the observed abnormal returns in response to S&P 500 changes,but they do not provide evidence.Pruitt and Wei(1989),Chen et al.(2004)and Green and Jame(2011)examine the actual changes in institutional holdings following both additions to and deletions from the S&P 500.They reveal that changes in institutional holdings in response to additions or deletions from the S&P 500 are positively correlated.However,they do not consider the informational content of the stock index change,such as changes in firms’profitability and growth potential,or the information available for decisions—all of which may coincide with stock index adjustments and ultimately lead to changes in institutional holdings.A stock’s addition to an index alerts investors of its existence,increasing the number of analysts following it and its information dissemination.Financial analysts are outsiders who generally have less access to firm-level,idiosyncratic information.As such,they can focus their efforts on obtaining and mapping industry-and market-level information into prices.Unlike institutions and insiders,analysts convey their private information through firm-specific earnings forecasts and stock recommendations(Piotroski and Roulstone,2004).Mikhail et al.(2007) find that both large and small traders react to analyst reports(analysts’recommendations).However,few studies have been conducted examining index adjustments’effects on firms’information environments,which further affect their market performance and investor holdings.

3.Stock index and index adjustment in China

Unlike the U.S.,Japan and other major security markets where most of the listed firms in a single country are traded in one stock exchange,in mainland China there are two stock exchanges—Shanghai Stock Exchange and Shenzhen Stock Exchange—that manage the trading of publicly listed firms in mainland China.Up to 31 December 2012,there have been 975 firms listed in the Shanghai Stock Exchange,with 921(54)in the A-share(B-share)market.There have been 1537 firms listed in the A-share market in the Shenzhen Stock Exchange,including 481 firms on the Main Board,701 on the Small and Medium Enterprise Market Board and 355 on the Growth Enterprises Market Board.Another distinguishing factor is that unlike the S&P 500 or Russell 2000 in the U.S.,the Nikkei 225 in Japan and the Hang Seng Index in Hong Kong,there are two major stock indices for the Shanghai and Shenzhen Stock Exchanges in mainland China:namely,the Shanghai Composite Index(Code:000001)(SHCI as the acronyms hereafter)and the Compositional Index of Shenzhen Stock Market(Code:399001)(SZCI as the acronyms hereafter),respectively.

The SHCI is the most important stock index in China in terms of presenting changes in market volatility.It started on 15 July 1991,based on 100 points,and is disclosed to global investors via Thomson Reuters,Bloomberg and other channels.The SHCI is based on all of the listed firms in the Shanghai Stock Exchange,computed as the market value of sample firms and multiplied by its weight,which is the number of stocks issued by sample firms.1Given that the index also contains the B-shares,which are priced in terms of U.S.dollars,the market value is exchanged based on the appropriate exchange rate,usually the middle rate of RMB yuan against the U.S.dollar on the last trading day of each week by China Foreign Exchange Trade Center.If a firm launches an IPO,it will be included in the index on the 11th day of its trading on the market.If a firm delists,it will be excluded from the index on the exclusion day.It is often common knowledge on the market several months in advance that a firm is going IPO,so there are already many analysts covering the IPO firms.For the delisted firms,listed firms in China delist if they suffer losses for three continuous years.Before the financial report is provided for the last year when the firm may delist,the market might already know something,but may be unsure whether the firm will delist.Thus,there are a few days for the market,institutional investors,analysts and other investors to discover whether a particular stock is being added to or deleted from the Shanghai Composite Index.

The SZCI is based on 40 typical listed firms and started on 23 January 1995 with a base of 1000 points.The SZCI is computed as the market value of sample firms multiplied by its weight,which is the circular number of stocks issued by sample firms,not the total number of stocks.To maintain objectivity and fairness,the SZCI is adjusted considering the norm of the component stocks.On each January,May and September,the SZCI may be adjusted.First,the Shenzhen Stock Exchange looks at all of the listed firms and filters out those that meet the following requirements:a listed time of more than 3 months,a market value based oncircular stocks to the total market value of all firms that is in the top 90%and a trading-to-total-market value of all firms in the top 90%.Given the circular market and trading values,representative of the industry and growth,financial position and operating performance for the past three years and compliance with regulations in the past two years,the Shenzhen Stock Exchange weights each factor and then chooses up to 40 firms as being representative of the Shenzhen Stock Exchange.Thus,it has a small window during which the market,institutional investors,analysts and other investors can determine whether particular stocks will be added to or deleted from the SZCI.

There is another important stock index,the Hushen 300 index(Code:000300)(SH300 as the acronyms hereafter),that contains 300 listed firms in either the Shanghai Stock Exchange or the Shenzhen Stock Exchange.It covers firms with 70%market value to the total value of all listed firms in both exchanges.This index is a single-stock index that represents the market,and it is recognized by both the Shanghai Stock Exchange and the Shenzhen Stock Exchange.The HS300 started on 31 December 2004 with a base of 1000 points,and is based on sample firms with daily trading volumes in the top 50%of all listed firms in China.Those with daily market values in the top 300 of the total samples are selected,and the weight of each sample stock is well balanced,with the industry distribution covering most industries.The HS300 is adjusted biannually,with enforcement in early January and July and two weeks of advanced disclosure of the adjustment list.Each time the HS300 is adjusted,the adjustment ratio(stocks adjusted to total number)is lower than 10%.Moreover,firms that have suffered a loss during the most recent year are not added to the HS300 unless they significantly affect the representativeness of the index.The only index future in China’s security market is the HS300 future,which is based on the HS300.Thus,the HS300 is more influential than the SHCI and the SZCI,especially for institutional investors.

4.Research design

4.1.Data and samples

The SHCI is based on all listed firms,such that additions to the index provide no additional information.Thus,we collect all of the stock index adjustments for the HS300 since they began to the end of 2012 from the WIND database.Analyst coverage(number of analysts and stock recommendations)is available from the third quarter of 2009 to the first quarter of 2013,and the holdings of institutional investors are available from the third quarter of 2004 to the first quarter of 2013 in the WIND database.2As analyst coverage,institutional holdings and other financial information are disclosed on a quarterly basis,we collect our data based on quarterly financial statements.Given that we need to calculate the changes in variables,our sample firms are from the fourth quarter of 2009 to the fourth quarter of 2012.To make the study more rigorous,we use matched samples.The matching is based on the same industry,the same year,the same quarter and similar size.After dropping the financial industry,our final sample is 462:231 stock index adjustment firms and 231 matched firms from 2009 to 2012,including 112 firms added to the HS300 with 112 matched firms and 119 firms dropped from the HS300 with 119 matched firms.

4.2.Model and variables

We suggest that the stock index adjustment not only affects the portfolio management for index funds,but also affects other institutional investors by influencing their information environments,namely the analyst coverage,which affects institutional decision making.

To examine whether stock index adjustments affect information environments,namely,analyst coverage,our model is based on O’Brien and Nhushan(1990)with additional controlling factors:

Our analyst coverage measure includes two variables.NumAnalyst is the number of analysts in a particular firm,and NumRating is the total number of stock recommendations(Buy,Upgrade,Hold,Downgrade and Sell)issued by analysts in a particular firm.As we want to compare the analyst coverage before and after stock index adjustment,we use the changes in the two variables.ΔNumAnalyst is the change in the number of analysts in the next quarter compared to the event quarter when the target firm is added to or dropped from the stock market index.ΔNumRating is the change in the number of total stock recommendations in the next quarter compared to the event quarter.As a robustness test,we also use the change in the number of ‘‘Buy”(ΔNumBuy),positive(Buy and Upgrade)(ΔNumPositive)and negative(Sell and Downgrade)(ΔNumNegative)recommendations.For matched firms,all of the variables listed above represent changes in the same quarter as for target firms.

Indexing refers to the stock index adjustment,with 1 indicating that the target firm is added to the stock market index,-1 indicating that it is dropped and 0 being matched firms.

NumInst is the number of institutional investors in the target firm in the event quarter,and ΔNumInst is the change in the number of institutional investors in the target firm in the event quarter compared to the previous quarter(Pruitt and Wei,1989).For the matched firms,all of the above variables are the changes in the same quarters as the target firms.

ΔROE is the change in return on equity(ROE)in the event quarter compared to the previous quarter.ΔGROW is the change in revenue growth in the event quarter compared to the previous quarter.ΔLEV is the change in leverage(total debt ratio)in the event quarter compared to the previous quarter.ΔSIZE is the change in scale(nature log form of total assets)in the event quarter compared to the previous quarter and Ret is the raw market return during the event quarter.For matched firms,all of the above variables measure the change in the same quarter as the target firms.

Inds are the industry dummy variables,namely 11 dummy variables for 12 industry categories used by the China Securities Regulatory Commission(CSRC)after dropping the financial industry.Years are the year dummy variables,namely 3 dummy variables for 4 years.Quarter is a dummy variable where 1 indicates the quarter 1,and 0 otherwise because the Hushen 300 only adjusts twice a year in January and July.

To investigate the influence of analyst coverage on the effects that stock index adjustments have on institutional holdings,we use the Baron and David(1986)method,which is popular in the management literature.Our models are set as follows:

Insthold is the institutional investor holding(in the percentage of the invested firm’s total stock)in the event quarter,and ΔInsthold is the change in institutional holding during the subsequent quarter of the event quarter in which the target firm is added to or dropped from the stock market index,compared to the event quarter(Green and Jame,2011).For matched firms,all of the above variables are the change in the same quarter as the target firms.

Indexing,ΔNumAnalyst,ΔROE,ΔGROW,ΔLEV,ΔSIZE,Inds and Years are the same as above.

According to Baron and David(1986),if α1> 0,β1> 0,γ1> 0,γ2> 0 and γ1< β1,then the analyst coverage plays a partial mediation role in the influence that stock index adjustments have on institutional holdings.If γ1> 0 is not significant while α1> 0,β1> 0 and γ2> 0 are significant,then the analyst coverage has a whole mediation effect,suggesting that the stock index adjustment affects the institutional holding total via the analyst coverage.Otherwise,the analyst coverage has no mediation effect.

5.Empirical analysis

5.1.Descriptive statistics

Table 1 shows the mean comparisons for the interested variables among different groups.Panel A shows the comparisons between firms added to the stock index and matched firms.The change in institutional holdingsfor firms added to the stock index in the next quarter,compared to the event quarter,is 2.930%,indicating that institutional investors increase their holdings in those firms by 6.002%.Meanwhile,the change in institutional holdings for matched firms is 2.930%,and the difference is significant at the 0.01 level,indicating that firms added to the index attract more institutional holdings.However,the change in the number of institutional investors shows the opposite direction,in that the number of institutional investors decreases more for firms added to the index than those for matched firms.This may be because more shares are concentrated for fewer institutional investors.

Table 1 Mean comparisons.

Both of the changes in the analyst coverage variables,ΔNumAnalyst and ΔNumRating,show the same situation in which more analysts cover firms added to the stock index,and more stock recommendations are given to those firms compared to the matched firms.This indicates that firms added to the index are more likely to be covered by analysts.Further dividing stock recommendations,we find that the changes in the number of positive recommendations—namely ‘‘Buy” and ‘‘Update”—are higher for added firms than those for matched firms,whereas only the ‘‘Buy” recommendation does not significantly differ from that of matched firms.The changes in the number of negative recommendations—namely ‘‘Sell” and ‘‘Downgrade”—also do not significantly differ from those two groups.The fundamental aspects of the two groups do not differ from each other significantly except for the change in growth.

Panel B shows the comparison between firms dropped from the stock index and matched firms.The change in institutional holdings for firms dropped from the stock index in the next quarter compared to the eventquarter is 1.845%while the change in institutional holdings for matched firms is 3.639%.The difference is significant at the 0.05 level,indicating that firms dropped from the index attract more institutional holdings.However,the change in the number of institutional investors shows the opposite direction.The analyst coverage(number of analysts and stock recommendations)does not significantly dif f er between firms dropped from the stock index and matched firms.Only the ‘‘Buy” recommendation and positive recommendation(‘‘Buy” and ‘‘Update”)are higher for matched firms than for those dropped from the stock index.

Table 2 Stock index adjustment and analyst coverage.

5.2.Stock index adjustment and analyst coverage

Table 2 shows the effects of stock index adjustments on analyst coverage,particularly the number of analysts covered.The first column shows the results for all of the sample firms(firms added to and dropped from the index,and matched firms).The coefficient for indexing,namely,the proxy for stock index adjustment,issigni fi cantly positive,suggesting that the stock index adjustment is positively related to analyst coverage(proxied by the number of analysts).The addition to the stock index alters analysts’attention and attracts their coverage,consistent with Beneish and Whaley(1996)and Shleifer(1986).

Table 3 Stock index adjustment and analyst’s stock recommendation.

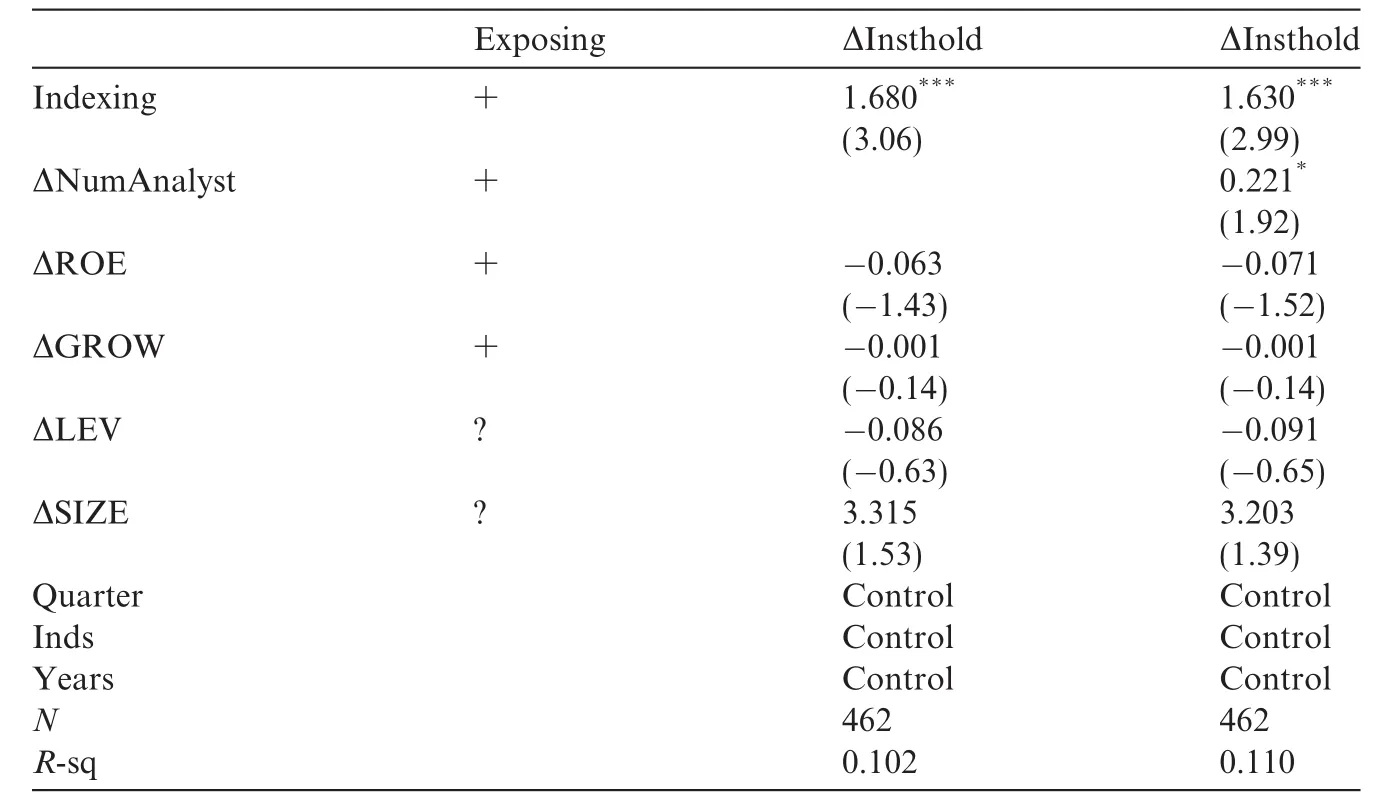

Table 4 Stock index adjustment,analyst coverage and institutional investors’holding.

Given that research notes an asymmetric reaction of the market to index adjustment,suggesting that the market is less concerned with index deletions,we separate our samples into three groups.The second column reports on the firms added to the index and their matched samples,and the results are consistent with the total samples,indicating that additions to the stock index attract more analyst coverage.The third column uses the firms dropped from the index and their matched samples,but the coefficient for indexing is not significant,indicating that an asymmetric relation between stock index adjustment and analyst coverage also exists between addition to and deletion from the index.The last column uses the firms added to and those dropped from the index.The coefficient for indexing is not significant.

Table 2 shows that the analyst coverage proxied by the number of analysts is also asymmetrically related to stock index adjustments.In other words,addition to the stock index attracts more analysts,whereas being dropped from the index does not significantly affect the analyst coverage.

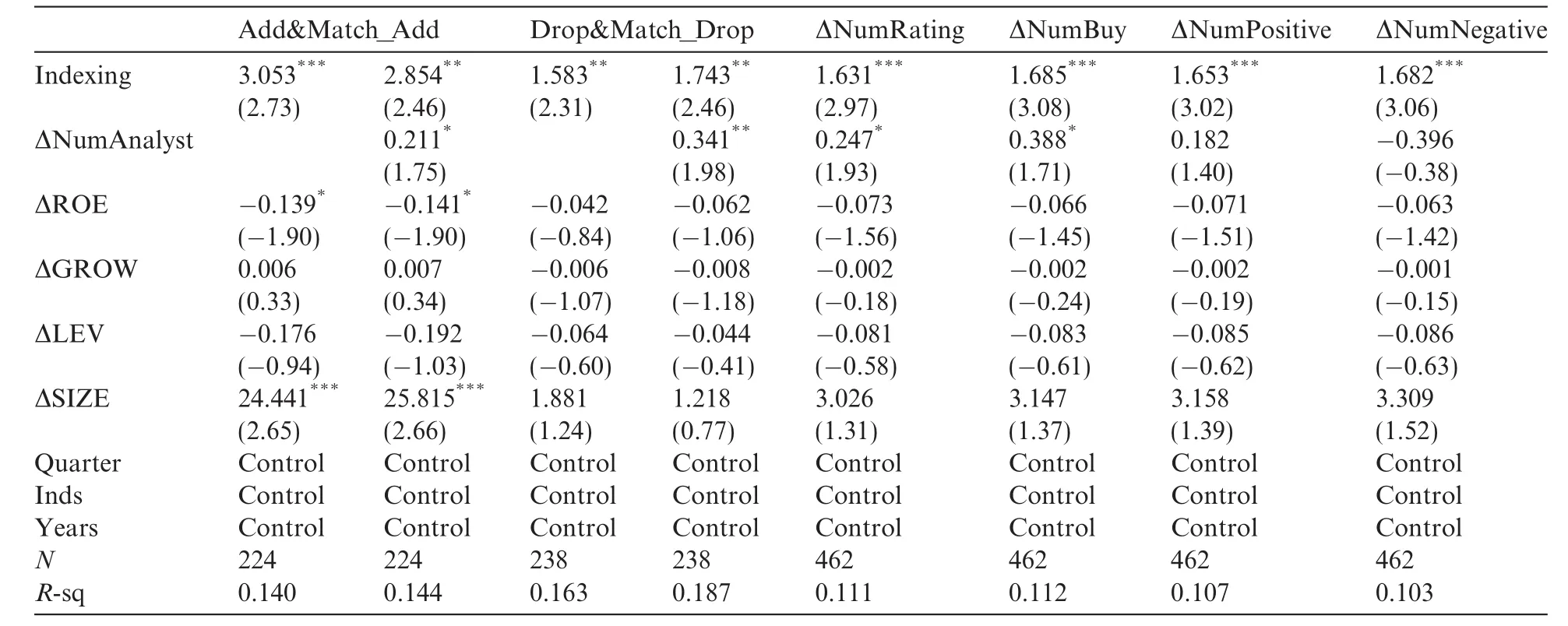

Table 5 Robust tests.

Table 3 shows the effects of stock index adjustments on analysts’stock recommendations.The first column is for the total number of stock recommendations.The coefficient for indexing is significantly positive,which means that the stock index adjustment leads to changes in stock recommendation issued by the analyst.Columns 2 and 3 regress for additional samples and deletion of samples,respectively.Added sample firms tend to have more stock recommendations issued by analysts in the next quarter than the matched firms,whereas deleted firms exhibit no significant difference compared to matched firms.The above results are consistent with Table 2;that is,that addition to the stock index leads to higher analyst coverage while deletion has little effect.The last three columns further separate the stock recommendations,but only the total‘‘Buy” and ‘‘Upgrade”recommendations(ΔNumPositive)are significantly changed if the stock index is adjusted—details that are only evident for firms added to the index.3We run the regressions for the change in the number of positive stock recommendations for Add&Match versus Drop&Match,and the coefficient for indexing is only significant for the former.

In all,Tables 2 and 3 show that stock index adjustments lead to changes in analyst coverage for the target firms,with addition making the firm more attractive to analysts and prompting more stock recommendations(especially positive,e.g.,‘‘Buy”and ‘‘Upgrade”)and deletion resulting in little change.

5.3.Stock index adjustment and institutional investor holdings

Table 4 examines the effects of stock index adjustments on institutional holdings and how analyst coverage influences this relationship.The first column presents the direct effects of stock index adjustments on institutional holdings.It shows a significant positive coefficient for indexing,namely the stock index adjustment measure,which means that a change in the stock index’s status significantly affects the holding by institutional investors,consistent with Pruitt and Wei(1989),Chen et al.(2004)and Green and Jame(2011).

When the influence of analyst coverage is added(ΔNumAnalyst)in column 2,the coefficient of ΔNumA-nalyst is significantly positive,suggesting that the change in analyst coverage leads to a change in institutional investors when the firm is added to or dropped from the stock index.This is consistent with the assertion of Mikhail et al.(2007)that institutional investors listen to analysts.The coefficient for indexing is still significantly positive;however,its magnitude drops from 1.706 to 1.648.In all,the results suggest that the change in analyst coverage has a partial mediation effect on the influence of stock index adjustment on institutional investors.In other words,the change in institutional holdings of firms added to or dropped from the stock index results not only from tracking the index portfolio strategies of index funds,but also partially from the changed information environments,which affect the portfolio management of institutional investors.Comparing the R-square value in the two regressions,it is about an 8%increase if considering the effect of analyst coverage,confirming the influence of analyst coverage on the changes in institutional holdings that surround the stock index adjustments.

Table 5 shows the results of more robustness tests.The first two columns compare the firms added to the stock index and their matched samples.Consistent with the results for all of the samples,the coefficients for indexing are significantly positive in both columns.However,the magnitude drops if the influence of analyst coverage is added,as it is also positively related to the changes in institutional holdings.This means that compared to matched sample firms,firms added to the stock index attract more analyst coverage,resulting in higher institutional holdings and increased holdings gained by tracking the index portfolio strategies of the index funds.Analyst coverage does influence the portfolio management of institutional investors.

This phenomenon is also seen in firms dropped from the stock index,the coefficients for indexing in the second two columns and the changes in the analyst coverage—all of which are significant.However,because deletion from the stock index does not significantly change the information environment(proxied by number of analysts4Shown in the third column of Table 2.and stock recommendations5Shown in the third column of Table 3.),the stock index adjustment only affects the portfolio management for index funds,and not other institutional investors,by influencing their information environments.

The last four columns show the results for stock recommendations.The coefficients for indexing are all significantly positive,which means that a change in the stock index’s status really affects firms’institutional holdings.If analyst coverage is significant under the regressions for ΔNumRating,then addition to the stock index leads to higher institutional holdings not only due to the index portfolio strategies of index funds,but also due to more stock recommendations.

In all,Tables 4 and 5 suggest that changes in the institutional holdings of firms added to the stock index partially result from tracking the index portfolio strategies of index funds,and partially from changes in analyst coverage,which affects the portfolio management of institutional investors.

5.4.Robustness tests6We also consider the stock repurchase influence on our conclusion.However,there is no stock repurchase for our sample firms during the sample period,so it has no repurchase influence.

5.4.1.Another stock index

We also collect all stock index adjustments for the SHCI and SZCI,from when they began to the end of 2012 from the WIND database.After dropping the financial industry,our final sample is 98:specifically 49 stock index adjustment firms and 49 matched firms.The regression results are better than the previous match-ing when we use 49 pairs of matched firms from 2009 to 2012.The stock index adjustments significantly affect the analyst coverage;specifically,addition to the stock index generates more analyst coverage(proxied by the number of analysts and stock recommendations)while deletion has no significant effect.Moreover,the changed institutional holdings are partially the result of the changes in analyst coverage,suggesting that index and other funds change their portfolios based on the changed informativeness of the target firms.

5.4.2.Mergers and acquisitions(M&A)

M&A events may significantly change the holdings of institutional investors,coinciding with stock index adjustments to render our conclusion biased.To avoid the M&A influence,we check our data for the M&A activities during the sample year instead of only concentrating on the sample quarter to allow for the long M&A process.Of the sample firms added to the stock index(Add),0 have M&A in the sample year,compared to 0 for matched firms(Match_Add).This result is 2.5%for firms dropped from the index(Drop)and 3.4%for their matched samples(Match_Drop).We include a dummy variable,M&A,in the regression to check the influence of stock index adjustments on analyst coverage and institutional holdings.The results are basically the same as above;that is,the coefficient for M&A is not significant.Thus,our previous conclusions are not biased on the M&A activities.

5.4.3.Punished by the regulation authority

Some firms may be punished by the regulation authority,China Securities Regulatory Commission(CSRC),for financial fraud,information disclosure,insider trading or other illegal activities.This then reflects their corporate governance and the stewardship of management that affects the valuation of institutional investors.The punishment may also coincide with a stock index adjustment.Thus,to allow for this effect,we also check our data for punishment during the sample year(not only concentrated on the sample quarter to allow for the long process of punishment).Of the sample firms,2.7%of those added to the stock index(Add)are punished by the CSRC in the sample year,compared to 0.9%for the matched firms(Match_Add).The result is 0.8%for firms dropped from the index(Drop)and 1.7 for their matched samples(Match_Drop).We include a dummy variable,Punish,in the regression to check the influence of the stock index adjustments on analyst coverage and institutional holdings.The results are basically the same as above that is the coefficient for Punish is not significant.Thus,our previous conclusions are not biased for punishment by the regulation authority.

5.4.4.Self-selection of stock index adjustment

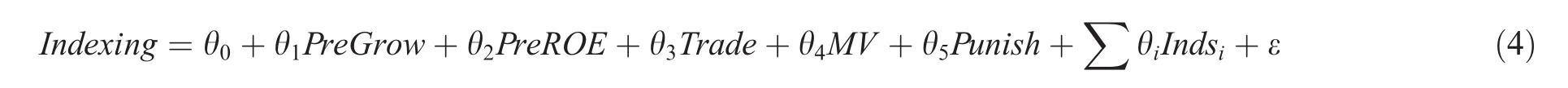

The stocks that are added to a stock index are selected based on many benchmarks,such as firm size and liquidity.Such stocks may be larger and perform better than those outside of the stock index;thus,they are more likely to be followed by analysts.7Thanks to the anonymous referee for pointing out the endogeneity problem.The relation between a stock index and the analysts following it may create a sample selection problem.We use the Heckman two-step method to address this issue,and the models are set as follows.

Model(4)is the first step(probit model)in determining whether a firm should be added or dropped from the stock index.Usually,an adjustment to the stock index considers past operating performance,past operating compliance,the industry and growth and the trade volume and market value of the circular stock.Thus,we include the following factors in the first model regression:PreGrow,the sales growth rate for the past year;PreROE,the ROE for the past year;Trade,the trade volume in log form;MV,the market value of the circular stock in log form;and Punish,a dummy variable equal to 1 if the sample firm was punished by the CSRC in the sample year,and 0 otherwise.Inds are the industry dummy variables;namely,11 dummy variables for 12 industry categories are used by the China Securities Regulatory Commission(CSRC)after dropping the financial industry.

Model(5)is the second step of the Heckman tests,where IMR is the inverse Mills ratio.The variables are defined as in model(1).

The regression result shows that the coefficient of IMR is not significant,which means the sample selection issue is not significant.In contrast,the coefficient of Indexing remains significantly positive,indicating that a stock index adjustment does affect the analysts following it for a specific stock.Our conclusion is that the sample selection problem does not have a significant effect.

6.Conclusions

Even though there are several hypotheses in the literature explaining market reactions to stock index adjustments,scant rigorous empirical evidence has been provided(Pruitt and Wei,1989;Chen et al.,2004;Green and Jame,2011).Little has been done in terms of the influence of index adjustments on firms’information environments,which further affects market performance and investor holdings.Using 231 pairs of sample firms in China,we give direct evidence of the price pressure and investor awareness hypotheses on the stock index adjustment effect.Our results suggest that changes in institutional holdings for firms added to the stock index partially result from tracking the index portfolio strategies of index funds,and partially stem from the changed analyst coverage,which affects the portfolio management of institutional investors.Deletion from an index does not reflect this phenomenon.

An important weakness of this study is that our sample period is only from 2009 to 2012,which may be too short in that it does not cover a bear and a bull market period.The results may appear to be due to a bear market sentiment that affects the investors’behavior,and thus using a longer period may improve the results and our conclusions.

Baron,R.M.,David,A.K.,1986.Moderator-mediator variables distinction in social psychological research:conceptual,strategic,and statistical considerations.J.Pers.Soc.Psychol.51,1173–1182.

Beneish,M.D.,Whaley,R.E.,1996.An anatomy of the S&P game:the effects of changing the rules.J.Finance 51(5),1909–1930.

Cai,J.,2007.What’s in the news?Information content of S&P 500 additions.Financ.Manage.36(3),113–124.

Cai,J.,Houge,T.,2008.Long-term impact of Russell 2000 index rebalancing.Financ.Anal.J.64(4),76–91.

Chakrabarti,R.,Huang,W.,Jayaraman,N.,Lee,J.,2005.Price and volume effects of changes in MSCI indices-nature and causes.J.Bank.Finance 29,1237–1264.

Chen,H.,Noronha,G.,Singal,V.,2004.The price response to S&P 500 index additions and deletions:evidence of asymmetry and a new explanation.J.Finance 59(4),1901–1930.

Chen,H.,Noronha,G.,Singal,V.,2006.Index changes and losses to index fund investors.Financ.Anal.J.62(4),31–47.

Denis,D.K.,McConnell,J.T.,Ovtchinnikov,A.V.,Yu,Y.,2003.S&P 500 index additions and earnings expectations.J.Finance 58(5),1821–1840.

Elliott,W.B.,Van Ness,B.F.,Walker,M.D.,Warr,R.S.,2006.What drives the S&P 500 inclusion effect?An analytical survey.Financ.Manage.35(4),31–48.

Green,T.C.,Jame,R.,2011.Strategic trading by index funds and liquidity provision around S&P 500 index additions.J.Financ.Market 14,605–624.

Greenwood,R.M.,Sosner,N.,2007.Trading patterns and excess comovement of stock returns.Financ.Anal.J.63(5),69–81.

Gygax,A.F.,Otchere,I.,2010.Index composition changes and the cost of incumbency.J.Bank.Finance 34,2500–2509.

Harris,L.,Gurel,E.,1986.Price and volume effects associated with changes in the S&P 500 list:New evidence for the existence of price pressures.J.Finance 41(4),815–829.

Lee,C.I.,Gleason,K.C.,Madura,J.,2008.Intraday and night index arbitrage.Q.J.Finance Account.47(2),3–16.

Mikhail,M.B.,Walther,B.R.,Willis,R.H.,2007.When security analysts talk,who listens?Account.Rev.82(5),1227–1253.

O’Brien,P.C.,Nhushan,R.,1990.Analyst following and institutional ownership.J.Account.Res.28,55–76.

Piotroski,J.D.,Roulstone,B.T.,2004.The influence of analysts,institutional investors,and insiders on the incorporation of market,industry,and firm-specific information into stocks prices.Account.Rev.79(4),1119–1151.

Platikanova,P.,2008.Long-term price effect of S&P 500 addition and earnings quality.Financ.Anal.J.64(5),62–76.

Pruitt,S.W.,Wei,K.C.,1989.Institutional ownership and changes in the S&P 500.J.Finance 44(2),509–513.

Shleifer,A.,1986.Do demand curves for stocks slope down?J.Finance 41(3),579–590.

25 February 2016 Accepted 6 December 2016 Available online 14 April 2017

*Corresponding author.

E-mail address:zhusong@bnu.edu.cn(S.Zhu).

☆This paper is sponsored by a National Natural Science Fund(71302023).

http://dx.doi.org/10.1016/j.cjar.2016.12.005

1755-3091/Ⓒ2017 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

JEL:G2 M3

China Journal of Accounting Research2017年3期

China Journal of Accounting Research2017年3期

- China Journal of Accounting Research的其它文章

- influence of Chinese entrepreneurial companies’internationalization on independent innovation:Input incentive effect and efficiency improvement effect

- How much control causes tunneling?Evidence from China

- Five-year plans,China finance and their consequences

- The significance of research—Comments on the Five-Year Plan paper