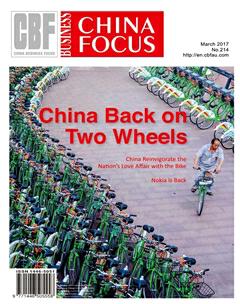

China Back on Two Wheels

From Shanghai to Sichuan province, bike-sharing schemes are being rolled out on an unprecedented scale in an effort to slash congestion and air pollution by putting a country once known as the “Kingdom of Bicycles” back on two wheels.

Even through Beijings nicotinetinged smog you can make out the multi-coloured frames, gliding through the pea soup towards a greener future. In recent months an unmissable fleet of fluorescent orange, canary yellow and ocean blue bicycles has hit the streets of urban China as part of a hi-tech bikesharing boom that entrepreneurs hope will make them rich while simultaneously transforming the countrys traffic-clogged cities.

“We want to solve problems by getting bikes back on to the streets of our cities,” said Li Zekun, the 25-year-old marketing director of Ofo, one of the startups spearheading this 21st-century transport revolution. From Shanghai to Sichuan province, bike-sharing schemes are being rolled out on an unprecedented scale in an effort to slash congestion and air pollution by putting a country once known as the “Kingdom of Bicycles” back on two wheels.

Ofo, so named because of the words resemblance to a bicycle, has put about 250,000 of its bright yellow bikes to work since late 2015, of which around 40,000-50,000 are in the capital, according to Li. The Peking University biology graduate said his company, which was founded by five students looking to improve transport options on university campuses, had attracted about 3 million users in cities such as Beijing, Shanghai, Xiamen and Guangzhou.

Its bicycles make about 1.5m trips each day between them. “For short journeys, bikes are the best form of transport,” Li enthused at Ofos headquarters in the Internet Finance Centre, a 26-floor building in western Beijing.“You never know when a bus might come. It might not be easy to find a taxi. Walking might take you too long and tire you out.” Other startups, such as Mobike andBluegogo, are seeking to get in on the act, depositing truckloads of bicycles on sidewalks and street corners across China.

Li Gang, Bluegogos 28-year-old chief executive, said he believed bike sharing would bring “mental joy” to millions of Chinese citizens as well as boosting their health and fitness levels.

It was his mission “to enable everyone to enjoy the happiness of bike riding”, he said. “I predict that by next year millions of people will be riding bikes in Beijing every day,” said the entrepreneur, whose firm has 50,000 bikes spread across three cities – Chengdu, Guangzhou and Shenzhen – and plans to expand to a new city every fortnight. “More people will choose this healthy way to get around so the number of cars on the roads will decrease dramatically and this will really help the climate and the environment,” he said.

In the years following Mao Zedongs 1949 communist takeover, bikes ruled supreme in China and the Flying Pigeon – the eastern equivalent of the Raleigh Roadster – became one of the countrys most recognisable symbols. But two-wheeled travel began to go out of fashion as China became more open to the world, ushering in decades of economic boom and a high demand for cars. In 1980, almost 63% of commuters cycled to work, the Beijing Morning Post reported last year, citing government data. But by 2000 that number had plummeted to 38% and today it stands at less than 12%.

Car use, meanwhile, has rocketed. In 2010 China overtook the US to become the worlds largest car market, with 13.5m vehicles sold in just 12 months. This year, manufacturers expect to sell almost 23m passenger cars. That jump from two to four wheels has been music to the ears of international car manufacturers, but it has resulted in gridlock and contributed to a pollution crisisexperts blame for hundreds of thousands of premature deaths every year.

According to state media, Beijing has 5.65m registered vehicles which annually pump 500,000 tonnes of pollutants into the atmosphere. And with China now waging a highprofile “war on pollution”, cities hope a return to the era of the bicycle can help them clean up at least some of the smog. Transport officials in Beijing are aiming to get 18% of commuters riding to work by 2020.

Public bike-sharing schemes, of which there are more than 500 around the world,have existed in China for about a decade but the scale on which these private initiatives are being rolled out is unprecedented.

Reports in the Chinese media suggest hundreds of thousands of shared bikes have been put into action. That compares with 11,500 operating in the British capital, according to Transport for London. The other factor making Chinas bike-sharing boom stand out is the technology.

While those sharing bikes in cities such as London must pick them up and park them at docking stations, tracking technology means Chinese users can collect and park their bikes wherever they please. Mobikes orangewheeled bikes have a GPS system that allows users to locate them using a map on the companys smartphone app. Users of Ofos yellow bikes, which cost about 10p to use, unlock them using a combination code sent through its app, and the company keeps tabs on its bikes by monitoring the location of the users smartphones. “It is very convenient,” said Li, who claims an Ofo bike can be ready to ride in about 10 seconds.

Chinese investors, including the tech giants Didi Chuxing and Tencent, are throwing their weight behind the bike-sharing startups, pumping tens of millions of pounds into their operationssince the autumn.A recent story about the budding industry in the China Daily warned of “grave maintenance and management challenges” and the existence of unscrupulous users who damaged or disappeared with the bikes. Recent weeks have seen reports of stolen bicycles, which are worth up to 3,000 yuan (£350),being sold online. But the China Daily urged commuters and city officials to embrace the attempt to “reinvigorate the nations love affair with the bike”. Li said his company believed so strongly in a global cycling renaissance that it planned to export its bike-sharing revolution to London, Singapore and Los Angeles.“In the future, we hope people all over the world will be using Ofos app to unlock its bikes, anywhere and at anytime,” he said.

Investors Ride Bike-Sharing Wave

China has turned the business of bike sharing, traditionally a money-losing proposition sponsored by municipal governments, into the latest hot investment trend. Hundreds of millions of dollars have poured into the sector over the last two years, turbocharging an industry that has flooded the streets and sidewalks of major Chinese cities with legions of bikes in yellow, orange, blue, neongreen and other colors, each representing a different startup.

Unlike older city-sponsored service, the new generation of bike-sharing companies uses smartphone-based apps and location-based technology to let subscribers find and unlock the closest bike parked anywhere on the street. When riders reach their destination, they can park and lock their bikes anywhere, paying a small fee based on ride distance of time of use.

Leading the startup pack if ofo, known for its bright yellow bikes, and Mobike, whose stylish two-wheelers are know for their modern look and orange-and-gray coloring.Ofo became the latest recipient of investor largesse earlier the week , when it announced it had raised a fresh $450 million in new funding.

The two have been regular fixtures in the headlines for their frenzied growth over the last year, including hundreds of millions of dollars in fundraising. They now boast a pedigree of Alist investors, including the likes of Chinese internet giant Tencent, global private equity major Warburg Pincus, venture giant Sequoia Capital, and Singaporean sovereign wealth fund Temasek.

Just weeks after landing a $215 million Series D funding round, Chinese bike-sharing service Mobike has scooped up a strategic investment from manufacturing giant Foxconn, the firm that helps Apple and others produce electronic devices. Mobike isnt disclosing the size of the Foxconn deal, but a company spokesperson did confirm that it is separate to the Series D, which was led by Tencent. The one-year-old company is targeting an international expansion this year, as we wrote after this months earlier funding was announced, and it said that this alliance with Foxconn will help it scale up its fleet of bikes accordingly.

The Mobike service deploys GPS-enabled bikes across cities which can be picked up and rented by users who have the companys mobile app. For that reason, it needs a large fleet of bikes on the streets, and thus it is bulking up on its production. It believes that, working with Foxconn, it can more than double its output to reach 10 million new bikes per year. It also said the union can reduce its overall production cost, and lower the distribution costs of placing bikes worldwide by locating production hubs in strategic areas.

“In 2017, we aim to enable residents in a hundred cities in China and internationally to enjoy our unique and convenient solution to the global challenge of last-mile travel, and Foxconn is the ideal partner to support these ambitious expansion plans,” Davis Wang, co-founder and CEO of Mobike, said in a statement. “Foxconn is actively seeking to maximize the potential of internet-driven smart manufacturing. This partnership with Mobike is a great example of how we can use this expertise to address the challenges of urban transportation and deliver greater convenience to consumers,” added Foxconn Senior Vice Presi-dent James Du.

Foxconns other tech investments include high-end audio maker Devialet, SoftBank robot Pepper, AR display firm DigiLens, and France-based IOT company Actility. Mobike began offering its service in Shanghai in April 2016 and today it is present in 13 cities across China. The company hasnt said exactly how many bikes it has deployed, but it claims to have over 100,000 bikes in each of its top cities: Beijing, Shanghai, Guangzhou and Shenzhen. Beyond Tencent and Foxconn, its investors include Warburg Pincus, travel firm Ctrip, Huazhu Hotels Group, Sequoia China and Hillhouse Capital.

Chinese bike-sharing start-up ofo said it has raised $450 million in a fresh round of funding, as the firm faces up against deep-pocketed rival Mobike in one of the hottest sectors to attract tech investors. Investment group DST Global, ride-hailing giant Didi Chuxing and CITICs private equity arm were among investors, the company said in a statement.

Ofo and Mobike are two of a growing number of bike-sharing services in China that allow users to find, unlock and pay to rent the bicycles through a smartphone app, targeting younger consumers tired of congested roads and public transport. Strong growth in the sector saw Mobike close a $215 million funding round last month, led by Tencent Holdings and Warburg Pincus LLC. Ofo has previously raised funds from investors including Chinese smartphone maker Xiaomi and Didi. Since mid-2015 ofo has accumulated over 20 million registered users.

Chinas “Uber for bikes” startups are being taken for a ride by thieves, vandals, and cheapskates

First it was the taxi-hailing wars. Then it was the ondemand service wars. Now, Chinas internet industry is watching another money-burning battle unfold between rival startups. Within the past year venture capital firms have poured hundreds of millions of dollars into rival companies, all competing to become Chinas “Uber for bikes.” Their premise is simple: Pedestrians looking for a lift can open their smartphones, unlock a bike parked nearby, hop on for a ride, and pay a fee once they arrive at their destination. Its difficult to overstate how popular these services have become. On almost every street corner in Chinas major cities, bikes of different shapes, sizes, and colors are lined up next to one another.

But widespread customer negligence and razorthin margins could make it hard for these businesses to stay afloat. The very factors that make Chinas bikeshare services so convenient—low prices and ease-of-use, namely—are the same factors that could spell their death.

“What theyve got is a very interesting technology, but a basic business model that makes no sense,” says Paul Gillis, who teaches accounting at Peking University in Beijing.

Bike-sharing is not new, but Chinese startups have reinvented the concept to make it even more efficient.

Most bike-sharing schemes, like those in New York or Taipei, require bikes to be parked into designated docks when not in use. Theres often no way to know where these locations are, so riders have to plan out their routes in advance. Or there might be a clunky app, perhaps from the same government agency that funded the program. Chinas bike-sharing startups, on the other hand, allow their vehicles to be placed anywhere in the city. Best-inclass engineers have developed GPS-based apps that allow people to find nearby bikes, and charge based on how much time riders spend on them.

Bullish venture capitalists funded rapid expansion, ensuring companies have plenty of cash to buy bikes and put them on the streets. Prices are dirt-cheap. After paying a small deposit through WeChat or Alipay, two Chinese online payment services, 30 minutes on a bike will cost between 0.5 and 1 yuan ($0.07 and $0.14), depending on the brand.

As a result, many Chinese have taken up bikesharing as a replacement for the subway, or even walking. Judy Zhao, a 25-year-old marketing executive, tells Quartz that she takes the bus every day to work, but as soon as she gets off at 5:30pm, she hops on a Mobike to cycle back home.

“I ts a b o u t 2 0 minutes to ride [from my office to home], so I only need to pay 0.5 yuan (about$0.07),” she tells Quartz.“Its cheaper than public transportation.” Numerous companies have climbed onto the bike-sharing bandwagon, but two startups lead the pack in terms of venture capital funding: Mobike and Ofo.

Mobike, which was founded in late 2015 by a former Uber China employee, first grew popular in Shanghai and is now in 23 cities across China. Investors have funded it at lightning speed: It secured two venture capital rounds this year alone that jointly totaled about $300 million. Its backers include Singapore sovereign wealth fund Temasek, along with Foxconn, the manufacturing giant best known for making the iPhone. Chief rival Ofo was founded in late 2014. It grew popular on college campuses in Beijing before raising $130 million last October from nine investors including Xiaomi and Didi Chuxing, the ride-hailing giant that acquired Ubers China division. On March 1, it announced it closed an additional round totalling $450 million (link in Chinese).

Inspired by Ofo and Mobikes swift uptake in early 2016, rival companies followed suit and a mini-bubble surfaced. About 30 bike-sharing companies (link in Chinese) exist in China right now, with many founded in 2016. Five of those companies went on to raise doubledigit funding by years end, according to Chinese tech database IT Juzi.

Mobike spokesman Xue Huang says that several factors have helped make China ripe for a bike-sharing boom. For one thing, most of the worlds bikes are made in China, which means they can go directly from the factory warehouse to the streets. Roads in Chinas major cities tend to be flat and wide, and populations are dense. Most important, unlike in other parts of the world, riding bikes around in China never really went out of fashion. Until only recently, it was the predominant mode of urban transportation. “China used to be a kingdom of bicycles. When I was young in the 90s, there were bikes everywhere,” says Huang. “And given the population is already well-trained [to ride them], theyre just looking for something more convenient.”

While Mobike, Ofo, and their many rivals are easy to use, theyre equally easy to abuse. The companies basically rest on the “honor system,” and consumer negligence poses a serious threat to their long-term viability. The “park anywhere” policy is a blessing and a curse. On the one hand it increases the likelihood that bikes will be found in ones immediate vicinity. But it also allows riders to park their bikes in remote locations with no nearby foot-traffic. As a result, bikes parked along freeways are now a common sight in China.

Property managers, meanwhile have started to complain about bikes taking up space besides private buildings, or blocking pedestrians on the sidewalk. News reports of bike-share vehicles piling up in dumpsters, ditches, rivers, and even trees (link in Chinese) make regular appearances on Chinese social media. To manage this problem, Mobike and other companies rely on volunteer users to spot and report discarded bikes. But they have also hired in-house teams specifically for rounding up these dispersed bikes, and taking them to high-traffic hubs or repair centers. That costs money. Uber and Didi dont have to deal with this problem, since those companies generally dont own the cars connected 8to their apps.

Then theres the problem of theft and vandalism. Mobike vehicles lock and unlock when a rider scans the QR code attached to a bike. But many people—perhaps employees at competing companies—will deface these QR codes, rendering the bikes unusable.

Ofo bikes, meanwhile, unlock when a user scans the bike plate, receives a four-digit password via smartphone, and then inputs the code into an old-fashioned mechanical lock. But these mechanical locks have permanent passwords. Users can simply memorize the password of a particular bike, unlock the mechanical lock, and re-secure it using their own personal lock. This lets users effectively steal the bike after first use, and ride it without being bound to the apps timer. Recently, two nurses in Beijing spent five days in jail after they were caught using this trick on Ofos bikes—though most such riders probably go about unnoticed. All of these factors merely compound the stress placed on an already shaky business model. Mobike and its rivals wont reveal how much their bikes cost to produce, but an old estimate (which Mobike says has since decreased) places the cost of a standard Mobike at 3,000 yuan (about $437). Professor Gillis says that fares alone will hardly recoup these costs in a timely manner—let alone cover labor and R&D expenses.

“They rent for one yuan every half hour, and they expect that they might be rented four times a day for a half hour, which amounts to four yuan per day,” he tells Quartz. “If you take four yuan per day and you take that into the 3,000 yuan, youve got a long time before youve recovered the cost of a bike.”

Profit-challenged Chinese internet companies have a habit of living long lives once they get big, especially if a larger internet company like Alibaba or Tencent acquires them. Mobike and Ofo have a lot going for them. Like Uber and Didi, they collect lots of data about traffic. More important, they align well with the central governments commitment to reducing pollution nationwide, as well as its ambition to promote itself as a global innovator in technology.

The government wont necessarily stay a friend for long. Its already begun to turn its back on Didi Chuxing, for instance, by issuing new restrictions on driver eligibility, cutting the supply and making it harder for customers to hail a ride. If Mobike and its rivals can find a suitor quickly, they can perhaps live on comfortably as a loss leader for a deep-pocketed parent company. But if not, or if the government decides their popularity is chipping away at buses and subways, many of the bikes lining Chinas street corners might soon end up in the junkyard—or wherever.