Bye Bye, TPP

By Antonio Acunzo

Bye Bye, TPP

By Antonio Acunzo

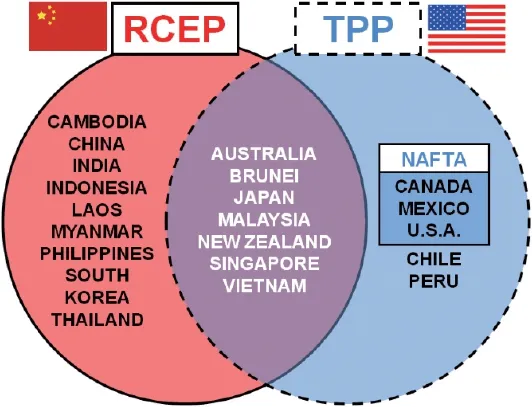

With the new US President-elect, Mr. Donald J. Trump, it is now almost official that the Trans-Pacific Partnership (TPP) is over and will not be signed by the US Congress, putting the word end to what was envisioned as the largest free-trade agreement between the USA and 11 countries along the Pacifi c rim, namely Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam, representing 40% of global economy and 30% of global trade.

Conceived as a highly sophisticated deal that started negotiations back in 2006, the complex TPP now fades away and it is going to be quite challenging to explain the reasons for this failure at the coming APEC CEO Summit Peru 2016, which takes place in Lima, Peru, from 17-19 November 2016, where US President Mr. Barrack Obama is expected to deliver a speech in front of presidents and prime ministers of the 12 TPP countries, and where the President of the People’s Republic of China, Mr. Xi Jinping, will take this strategic opportunity, served on a silver plate, to sponsor the RCEP, or Regional Comprehensive Economic Partnership, the free-trade agreement between China and 15 Asia-Pacifi c countries as the best alternative to the now defunct TPP. For the record, RCEP is the extensive FTA program covering the 10 ASEAN markets (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam) and the six markets with which ASEAN has FTAs already in place (Australia, China, India, Japan, New Zealand, and South Korea), representing 27% of global economy and 30% of global trade.

US President-elect Mr. Trump had already defi ned the TPP during the Republican Presidential Debate IV in November 2015, “It is a deal that is going to lead to nothing but trouble. It’s a deal that was designed for China to come in, as they always do, through the back door and totally take advantage of everyone.” And he also added, “If you look at the way China and India and almost everybody takes advantage of the United States, China in particular, because they’re so good. It’s the No. 1 abuser of this country” ... “And if you look at the way they take advantage, it’s through currency manipulation. It’s not even discussed in the almost 6,000-page agreement.”

The point is that China was not even part of the TPP; as we all know, the TPP was meant to lower trade barriers betweenthe 12 countries by lowering tariffs on goods, coordinating regulations, copyright protections, and much more.

And an effective TPP would have meant a negative impact on China because the zero or close to zero tariffs on goods coming to the USA from markets that competes with China was not expected to provide an advantage or help to China, if not and only in the case of a China investment in one of the TPP countries.

To be fair, even former Secretary of State and Democratic party presidential candidate, Mrs. Hillary Clinton, was no longer supporting the TPP, although in her book Hard Choices she wrote about the TPP saying “it won’t be perfect, but it should benefi t American businesses and workers” but justified her reversed position by saying that she did not believe that TPP “would meet the high bar I have set”.

So from an ASEAN perspective, the big loser here seems to be the USA as ASEAN countries remain well covered by existing FTAs, and will pursue additional FTAs, while the US companies will not enjoy this kind of market access and continue to deal with existing trade barriers and tariffs.

And always, for the record, the only ASEAN country holding an FTA with the USA is and remains Singapore, dating back to 2004 and still effective, making Singapore ranking 13thin the list of largest export markets for the USA, and 17thas trading partner.

On a different scenario, for instance, two TPP countries, Japan and Australia, made effective the JAEPA, Japan Australia Economic Partnership Agreement, which entered into force on 15 January 2015, and cemented a relation where Japan is the fourth largest investor in Australia and Australia ranks 4th as top investor in Japan.

As an example, if we consider beef, which is Australia’s largest agricultural export to Japan, Australian exporters command a price advantage over competing US producers who are subject to the Japanese tariffs which would have been removed under the TPP, but since TPP is well over, US beef will no longer be an attractive product for the Japan market, an aspect that may result in US$ 400,000 a day of lost sales for American beef according to the National Cattlemen’s Beef Association.

For Singapore alone, the disappearance of the TPP will not provide much harm as the Lion state has already in place FTAs with the USA and 10 of the 12 TPP countries, leaving Canada and Mexico outside the bilateral free trade which may be negotiated at a later date.

While for the USA the situation sees FTAs in place today with 20 countries, seven of which are TPP countries (Australia, Canada, Chile, Mexico, Peru, Singapore, South Korea), although two of them, Canada and Mexico, are part of the NAFTA, North American Free Trade Agreement, an FTA now totally opposed by US President-elect Donald J. Trump who defi ned NAFTA as “the worst trade deal the US ever signed”.

Indeed China has already in place FTAs with the ASEAN marketplace in addition to FTAs with eight TPP countries, leaving outside Japan plus the three NAFTA members of Canada, Mexico, and the USA.

In 2015 China ranked third (after Canada and Mexico) as US trade partner, with exports set at US$ 116 billion (supporting approximately 12 million jobs in the USA), while from the imports side China ranked fi rst (before Mexico and Canada) recording a value of US$ 483 billion, with a trade surplus of US$ 367 billion in favor of China.

And, for the record, China is the largest foreign holder of the US debt, owning about 10%, or US$ 1.2 trillion, of the publicly held US debt, and China is also the third largest holder of the US debt right after the Social Security Trust Fund (US$ 3 trillion) and the Federal Reserve (US$ 2 trillion).

The TPP had been favored by many trade organizations representing the US business, from the US Chamber of Commerce to the National Association of Manufacturers, from the National Small Business Association to the American Farm Bureau Federation, and so on including e-commerce giants like FedEx and DHL.

Recognizing the fact that we live in a globalized world, with 95% of world consumer outside the USA, it is essential, and strategic, to negotiate smart free trade deals, hence TPP or not TPP, we all expect that the USA will design an innovative trade architecture with the Asia-Pacifi c marketplace with newly-designed one-to-one FTAs or with a broader program enlarged to a wider target of markets.

Antonio Acunzo

Antonio Acunzo is the Chief Executive Officer at MTW Group-Marketing, a market-entry strategy and brand marketing advisory firm founded in Florida, and with Asia-Pacific office in Singapore. He brings with him over 15 years of experience in international business in the US and Asian markets focused on the Luxury and THL industries, and is a regular speaker at marketing and international business events.

Source:Singapore Business Review