2016.05

by Cotton Incorporated

Recent price movement

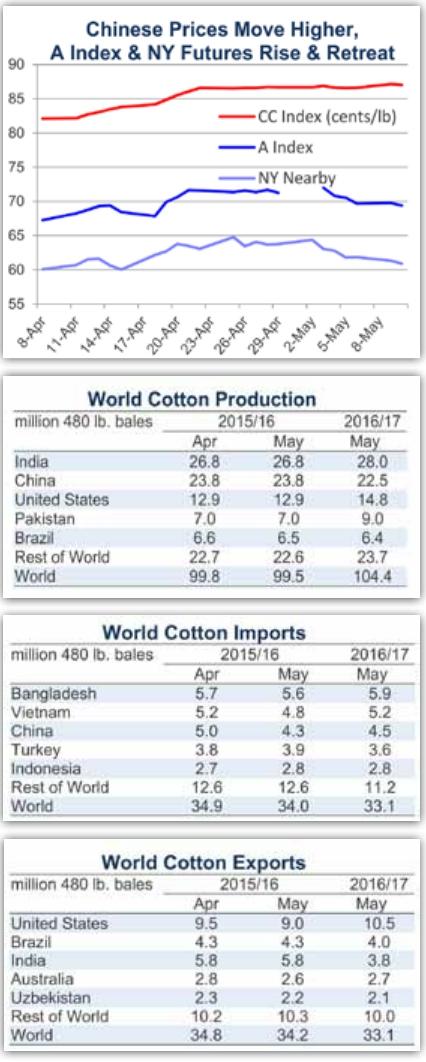

The A Index and NY Nearby rose and then retreated over the past month. Despite recent declines, current levels remain above those a month ago. Prices in China, India, and Pakistan increased last month.

Values for the July NY futures contract rose from 60 cents/lb in early April to nearly 65 cents/lb in late April and early May. More recently, values have retreated, with current levels near 61 cents/lb.

The A Index increased from levels near 67 cents/lb a month ago to those 72 cents/lb in early May. The most recent values have been below 70 cents/lb.

In contrast to the movement in the A Index and NY Futures, the China Cotton(CC) Index has only increased in recent weeks. In international terms, the CC Index rose from 82 cents/lb one month ago to near 87 cents/lb recently. In domestic terms, the CC Index increased from 11,700 RMB/ton to 12,500 RMB/ton.

Prices for the Indian Shankar-6 variety moved generally higher over the past month, rising from 63 to 67 cents/ lb. In local terms, values also increased slightly, climbing from 33,200 to 34,800 INR/candy.

Pakistani spot prices also rose, climbing from 61 to 65 cents/lb in international terms and from 5,250 to 5,550 PKR/maund in domestic terms.

Supply, demand, & trade

In May, the USDA releases their first complete set of estimates for an upcoming crop year. These forecasts call for an important increase in global cotton production, a slight increase in global mill-use, a slight contraction in trade, and a reduction in world ending stocks in 2016/17.

Next crop years cotton harvest is projected to be 104.4 million bales. If realized, this would represent a 4.8 million bale (4.8%) increase relative to 2015/16. However, the current crop is the smallest since 2003/04, and the volume predicted for the coming season is not large by recent standards (10-year average is 116.3 million bales). At the country-level, the largest changes are predicted for Pakistan(+2.0 million bales, from 7.0 to 9.0 million), the U.S. (+1.9 million, from 12.9 to 14.8 million), India (+1.2 million, from 26.8 to 28.0 million), and China (-1.3 million, from 23.8 to 22.5 million). After adverse growing conditions negatively affected production in Pakistan, India, and the U.S. in the current crop year, the global increase in production can be seen primarily as a result of expectations for a return to normal growing conditions in 2016/17.

World mill-use is expected to increase 1.8 million bales next crop year(+1.6%, from 109.0 to 110.8 million). After six consecutive years of decline, consumption is forecast to rise in China (+1.0 million bales, from 32.5 to 33.5 million). The assumption of growth in China is likely related to the reductions in Chinese cotton prices over the past year. Mill-use is also expected to rise in a range of other countries, including Vietnam (+400,000, from 4.7 to 5.1 million), Bangladesh(+300,000, from 5.7 to 6.0 million), and Pakistan (+250,000, from 10.3 to 10.5 million).

Global trade is projected to contract slightly in 2016/17 (from 34.0 million bales to 33.1 million). The largest countrylevel reduction in imports is anticipated for Pakistan (-1.4 million, from 3.1 to 1.7 million), where a return to normal growing conditions would imply a reduced need for imports. This should have a pronounced impact on Indian exports next crop year (-2.0 million, from 5.8 to 3.0 million) since India has been the dominant source of Pakistani imports this season. Another factor affecting global import demand is the continued absence of China. China is projected to bring in only 4.5 million bales in 2016/17. While this would represent an improvement relative to the current crop year (+250,000 bales versus the 4.3 million bales estimated for 2015/16), the volume forecast is only about one third of the average over the past ten years (12.4 million).

With consumption expected to exceed production, global ending stocks are predicted to decrease for a second consecutive crop year (-9.6 million bales in 2015/16, -6.4 million bales in 2016/17). In 2016/17, virtually all of the reduction in global stocks is expected to occur in China, where the decrease can be seen as part of the process of drawing down the massive supplies held in the Chinese reserve system.

Price outlook

In mid-April, the Chinese government announced price-related details concerning the current release of cotton from reserves. Sales began May 3rd and are scheduled to continue through the end of August. The total amount of cotton eligible for auction during this time period has been established at two million tons with the initial daily volume set at 30,000 tons. Foreign cotton held by the reserve system is to be sold first, followed by the oldest domestic stocks. Quality determinations will be made by the State Fiber Inspection Bureau. Quality-related price differentials from the China Cotton Association will be implemented.

Base grade prices are derived as a 50/50 average of international and domestic prices from the previous week. The international component will come from the A Index(plus a one percent duty and 13% VAT) converted into RMB using the official customs exchange rate. The domestic component of the 50/50 international/domestic average is itself derived as a 50/50 average of the CC Index and the Chinese National Development and Reform Commission(NDRC) CN cotton ‘B price.

Thus far, mill uptake has been strong, with virtually all of the cotton offered for sale being purchased by mills. The strong pace of sales contrasts with the low rate of purchases made in the preceding round of auctions (July- August, 2015), when only 6% of the total amount of cotton offered was purchased by mills. Reasons for more aggressive purchasing by Chinese mills could be due to the narrowing of the separation between auction prices and international prices since the summer, the quality of the foreign cotton being offered for sale, as well as the drawdown in mill inventory that likely occurred ahead of the current auction as mills were waiting for price-related details to be released and for the auction process to begin. As increasing proportions of domestic supplies are put up for sale, a stronger test of the ability to move reserve stocks will begin.

- China Textile的其它文章

- ICAC:World Cotton Consumption Drops

- Wool:A highlight at China Graduate Fashion Week 2016

- Oeko—Tex presents its new brand strategy

- Quanzhou:Textile and garment export growth rate was over 2% in the first 4 months

- Show Town·China Graduate Fashion Week 2016

- Cotton Incorporated 2017/18 A/W Trends