Status Quo of China’s Chemical Fiber Industry (2014)

By+Zhao+Zihan

According to Chinas Chemical Fibers Association, Chinas chemical fi ber industry in 2014 presented such operating characteristics:

Production: The production load of the industry reflected the seasonal regularity with declined overall output.

Price: Synthetic fi ber prices fell sharply in the second half of 2014 owing to the plummeted crude oil prices.

Performance: Chemical fi ber products enjoyed expanded profi t margins thanks to the smaller range of price dropping of products than that of raw materials which fell sharply.

Businesses: The enterprises preferred more rational production and operation to control the market load with declined investment willingness.

Industry: The industry has been gradually accepting and adapting to the “new normal” to further deepen structural adjustments.

Status quo of the industry in 2014 Output

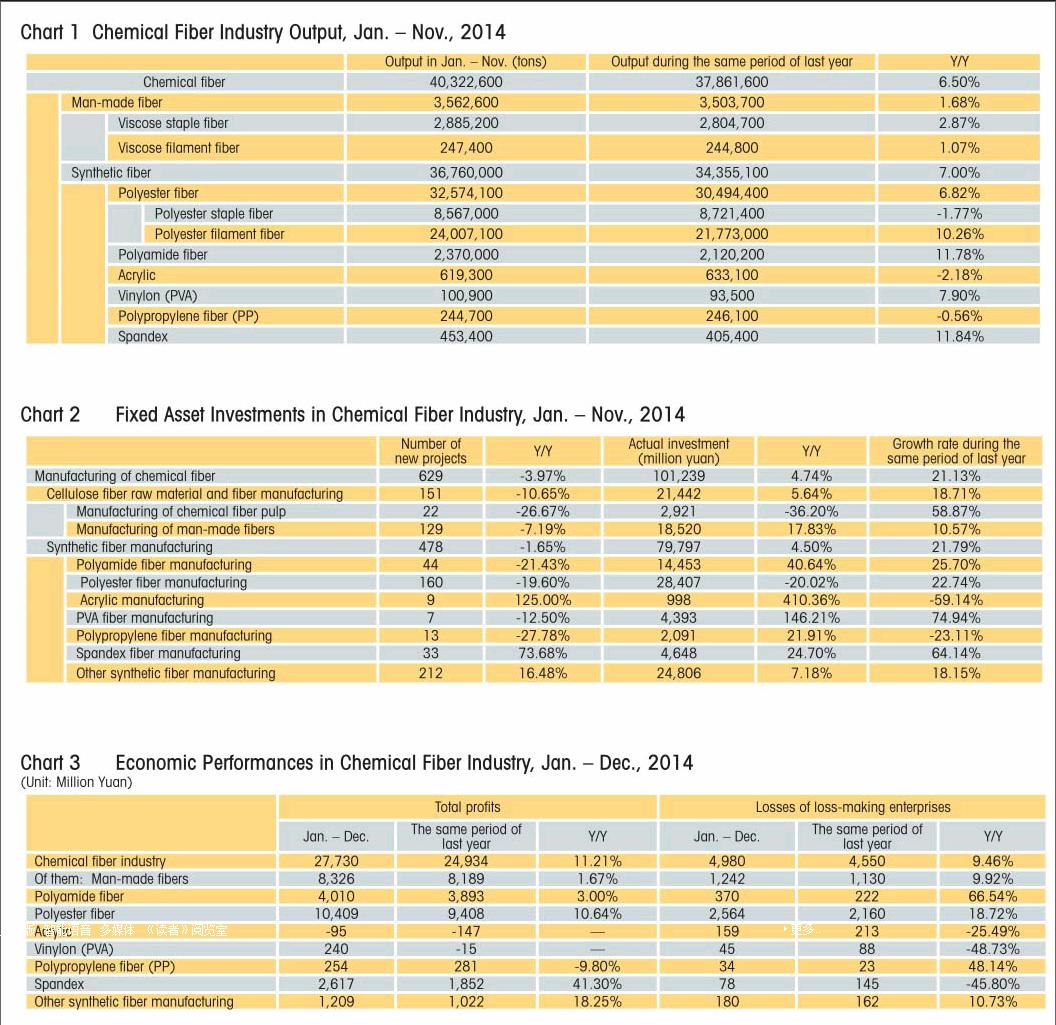

From January to November, 2014, the chemical fiber output reached 40.32 million tons with an increase of 6.5% year on year; the growth rate continued falling compared to the previous years. This is the normal performance of the industry through an adjustment period, as well as an inevitable result of transformation and upgrade .

The production growth increased month by month in the fi rst half of 2014, and presented a downward trend in the second half, especially obvious in the off-season July and August.

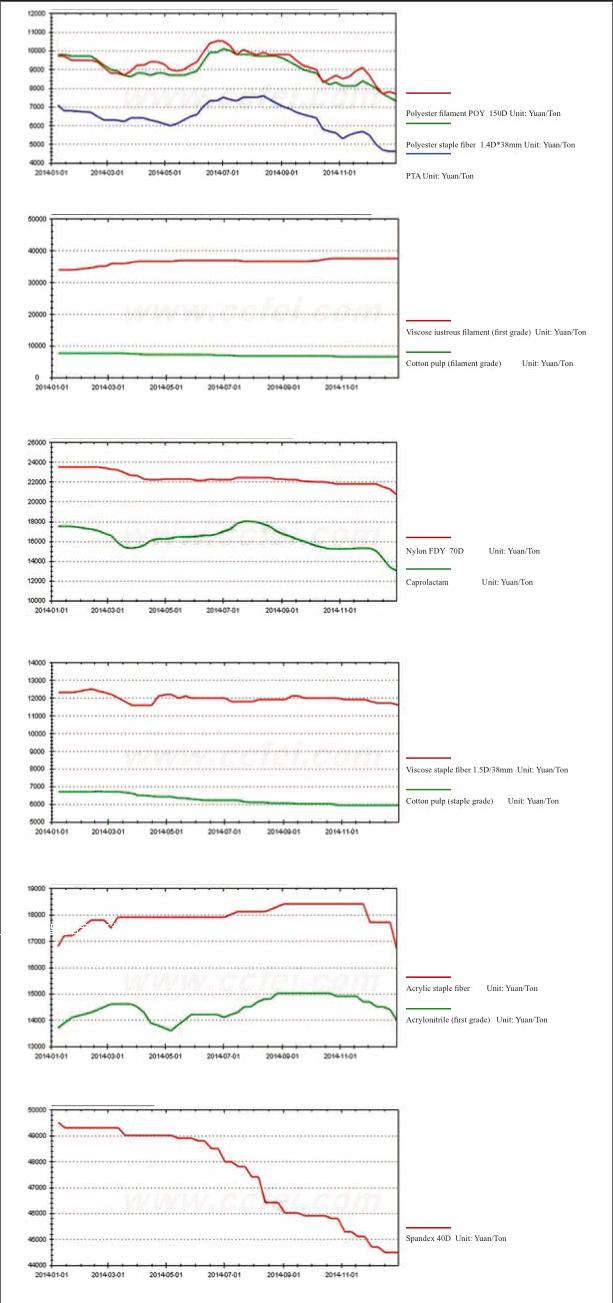

Market quotation (See the fi gures on the right side)Inventory

During 2014, polyester filament and polyester staple fi ber presented a very successful destocking in March, and the inventory was in a normal state to the end of June, however, on the low side. The off-season July and August saw a signifi cant increase while the falling came back again in September and October.

Nylon stocks continued to remain high, only a slight decline after September.

Spandex industry though had been getting along all right in its operation, inventories increased signifi -cantly because of the high operating rates.

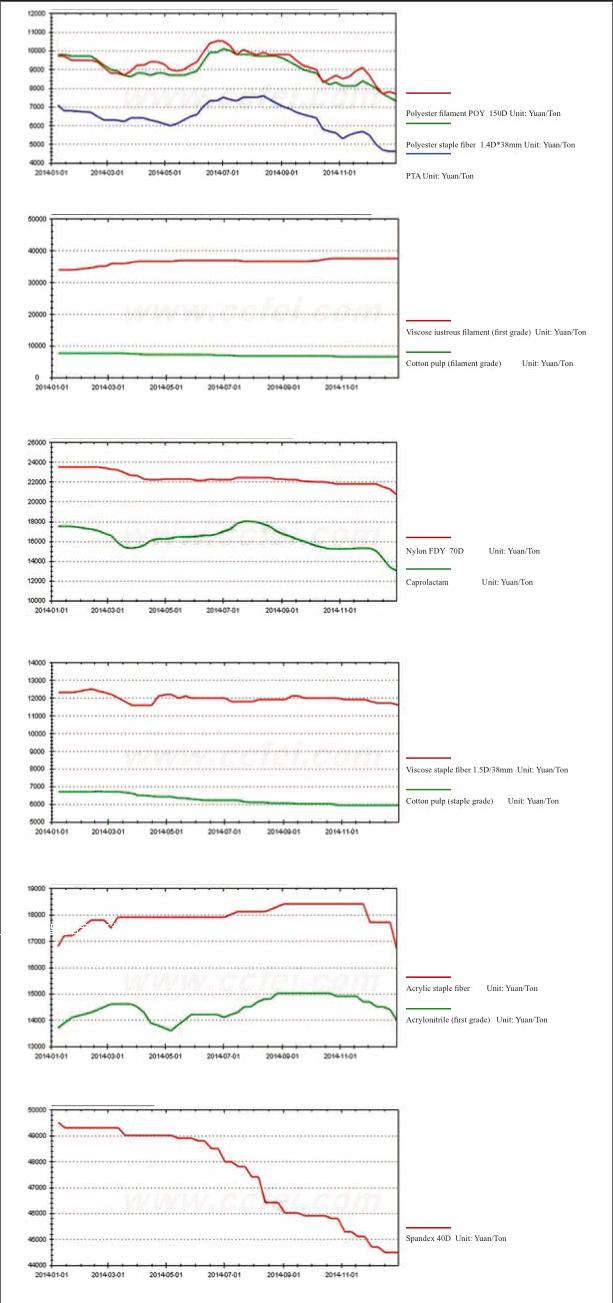

Investment

Of the industry, the number of new projects reduced 3.97% year on year, a negative growth once again after 2009. The actual investment was 101.239 billion yuan, a year on year increase of 4.74%, down by 16.39 percentage points over the same period of last year. Among them, the polyester industry witnessed a year-on-year decrease of about 20% both in its number of new projects and the actual investment, indicating that the industry investment boom is fading.

Economic Performance

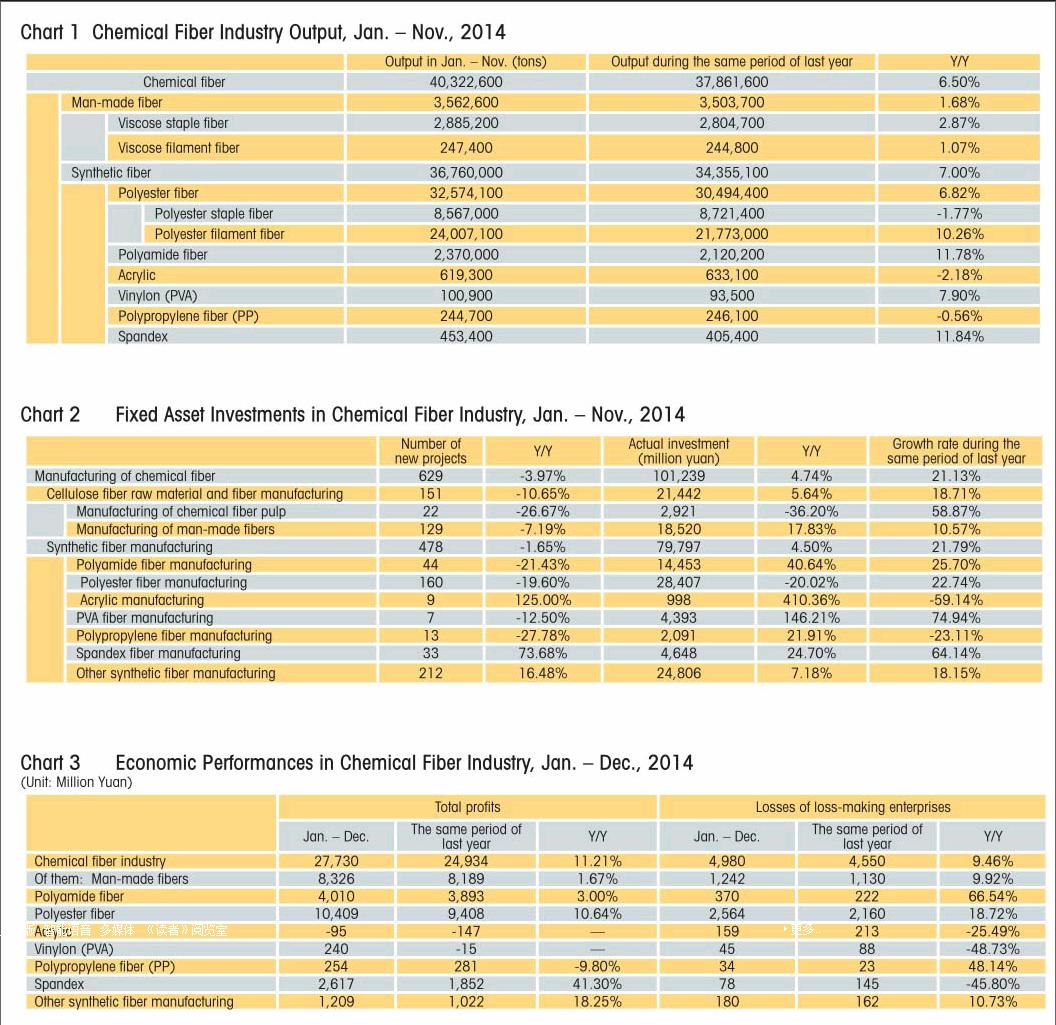

According to the data from National Bureau of Statistics, in 2014, chemical fi ber industry saw an industrial added value growth rate of 8.5%.

Market quotation

From January to December, the industry realized a total profi t of 27.73 billion yuan, an increase of 11.21% year on year. The percentage of businesses suffering losses of the industry rose 0.63 percentage point to 18.01%, while the losses of loss-making enterprises increased 9.46% year on year.

The polyester industry saw a total profi t of 10.409 billion yuan with an increase of 10.64% year on year, 13.71 percentage points higher in its growth rate.

Although the spandex industry enjoyed a continued growth in economic benefi ts, its growth rate dropped signifi cantly.

Profi t of man-made fi bers mainly referred to acetate fi ber, and the viscose fi ber industry was actually in more diffi culty to run.

Profit of the chemical fiber industry witnessed a recovery in the second quarter and reduced signifi cantly in August. In spite of the lasting declined product prices from September to December, there were somewhat increased profi ts thanks to the dropping raw material prices.

From January to November, the rate of return on sales in the industry increased 0.27 percentage point year on year to 3.85%.

Several important issues New capacity

In 2014, industry investment boom was gradually fading. Some planned projects were delayed or canceled, while some completed projects could not release full capacity according to the market situation. Preliminary statistics showed that the newly polyester production capacity was 3.48 million tons, accounting for only half of the projects planned to put into production counted in the beginning of 2014.

The projects planned to be put into production in 2015 are mainly what postponed from those planned in 2014, with total polyester production capacity of about 3.4 million tons, which according to the actual situation is estimated that about 50% of capacity can actually be accomplished.

Sharply declined crude oil prices

Oversupply of crude oil resulted in sharply declined prices, and in late 2014 WTI oil price fell to 55 USD/barrel. Synthetic fiber raw materials also saw a sharp falling in prices owing to the loss of cost support.

The factors affecting oil prices in 2015 are still concentrated in such aspects as the supply and demand fundamentals, fi nancial attributes, and geopolitics. The supply is likely to remain loose, for there is almost no possibility for OPEC to cut production, and somewhat improvement is perhaps to be seen in demand with a weak recovery in the global economy, however, still diffi cult to achieve a balance between supply and demand. The U.S. dollar may still remain its strong position. The oil price in 2015 is predicted to rise after restrain.

Narrowed price differences between staple fi bers and cotton

Affected by domestic cotton policy adjustments, the domestic cotton prices fell sharply, which is gradually shrinking its price distance with the polyester staple fi ber and viscose staple fi ber, generating a certain comparative advantage that will have some impact on the market demand for synthetic staple fi ber.

Nevertheless, the relaxation of controls over cotton is a major positive lift for our overall competitiveness of Chinas textile industry, and the chemical fi ber industry will also benefi t from the overall progress of the textile industry.

Progress in mergers and acquisitions

Relying on market regulation and industry guidance, assets fl ows and restructuring among the same trade has come up in the capital market. The chemical fiber industry has seen progress in mergers and acquisitions.

Several companies such as China Resources Jinhua Co., Ltd. and SINOSTEEL have quitted their business in chemical fi bers.

Overall forecast in 2015

The global economy will continue maintaining a weak recovery trend in 2015, while Chinas economy is to keep a steady growth in medium to high speed, creating a macro environment for the chemical fi ber industry to run smoothly. Steady growth of the textile industry contributes to the expected improvement of demand for chemical fi bers. International oil prices may rise after restrain, along with which chemical fi ber products prices may rebound, but the PTA over- capacity situation is hard to change which still need to rely on reduction of outputs to stabilize the market. Overall, the chemical fiber industry is predicted to enjoy a slightly better operation than 2014.

Chemical fi ber output is expected to 46 million tons in 2015, an increase of about 5%; total profit will see somewhat growth over the previous year, along with improved operating quality.

- China Textile的其它文章

- Textile machinery industry witnessed a substantial growth in exports

- 2014 Financial Year of Rieter:Double-digit sales growth with a strong second half

- China’s textile industry under new normal towards a powerful nation

- SPINEXPO Shanghai:Creative trend for development

- Athleisure runs up the score with ever more designers & collaborations

- Première Vision New York and Indigo New York:growing and moving full steam ahead for S/S 2016