Clarity Required on RMB Internationalization

By+JOHN+ROSS

TWO apparently contradictory trends concerning the RMBs internationalization have developed recently. First, positively, the RMB overtook the yen to become the fourth most used currency for international payments. Second, negative trends related to Chinas position in the international economy developed. Chinas foreign exchange reserves fell by almost US $500 billion, from slightly under US $4 trillion in June 2014 to US $3.5 trillion in August 2015. There is evidence of exit of capital from China unconnected to fruitful overseas investment, and a small two percent RMB devaluation in August was followed by further losses to Chinas foreign exchange reserves in an attempt to stabilize the currency.

But this contradiction is only apparent. Both trends refl ect fundamental features of Chinas and the international economy. Examining other countries experience and economic theory explains clearly the processes taking place.

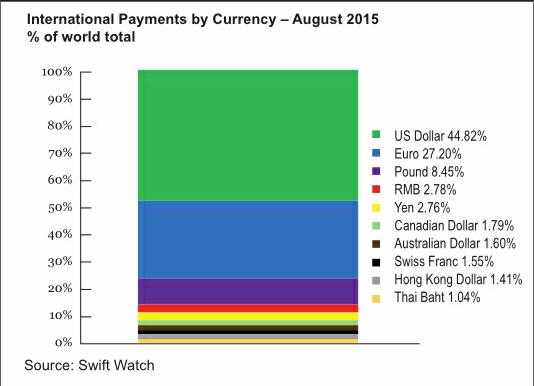

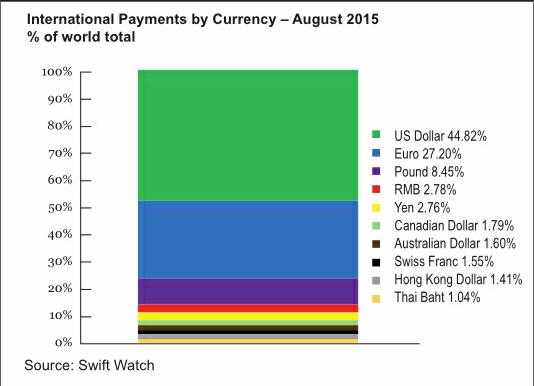

Starting with the facts, the fi gure below shows the RMBs place in global payments. The dollars dominance and RMBs peripheral position is clear. The dollar accounts for 44.82 percent of international payments. Dollar dominance is still more striking if it is understood that the euros 27.20 percent primarily reflects payments within the eurozone– without these the global dominance of the dollar is still clearer.

Turning to the RMB, global payments in dollars are 16 times greater than the RMBs 2.78 percent. Payments in dollars and euros combined are 25 times greater than in RMB. Talking of the RMB being “in fourth place” in international payments behind the dollar, without stating the gap between the two, may be correct but is misleading – there is no comparison between the dollar and RMBs positions in international payments.

This gap becomes clearer and the explanation of apparently contradictory trends referred to earlier becomes evident if it is understood that the RMB is primarily used internationally in relation to Chinas trade – functioning as a useful “hedge” against currency fl uctuations. By April 2015 31 percent of payments between China (including Hong Kong) and the Asia-Pacific region were in RMB – which primarily accounts for the RMBs 2.78 percent of global payments. Such trade operations make limited foreign accumulation of RMB necessary, and are a soundly based development refl ecting Chinas position as the worlds largest goods trading nation.

But aside from this useful function the RMBs role in international payments is still peripheral and for fundamental reasons cannot be expanded rapidly. For example, by the end of 2014, 63 percent of all countries foreign exchange reserves were in dollars, 22 percent in euros, and one percent in RMB.endprint

It is sometimes argued that the RMBs international role is small but increasing and could grow rapidly, for example, if later this year the IMF includes the RMB in the currency basket for its Special Drawing Rights (SDRs).

But this argument confuses reserves with current trade transactions and capital holdings – of which foreign exchange reserves are part. The RMB certainly should be included in the basket of currencies in SDRs because of Chinas weight in the world economy. But this will not change the fundamental situation. SDRs are neither a currency nor a claim on IMF funds – they are a claim on IMF members currencies. SDRs can essentially only be part of countries foreign exchange reserves, constituting less than three percent of these. In practical terms SDRs are essentially no more than an accounting unit, playing virtually no role in actual transactions.

Confusion over this difference between what is required for trade and establishing the RMB as an international capital unit has created destabilizing calls for too rapid liberalization of Chinas capital account.

Economic theory, confi rmed by other countries experience, shows liberalization of Chinas capital account will not lead to a balanced fl ow of funds in and out of China, but only to large-scale exit of capital from China. This would reduce Chinas economic development by simultaneously decreasing funds available for investment in China and raising interest rates, leading to further falls in Chinas foreign exchange reserves if, faced with capital outfl ows, currency interventions are made to try to prevent the RMBs exchange rate falling.

The reason why without capital controls there is only a net one-way fl ow of funds into the dollar is that any market, including the global economy, can only operate with a single price standard requiring a single price unit. This in turn determines the demand for foreign currencies including foreign exchange reserves. Relatively few individual companies seek to profi t from relative movements in currencies, but globally this is a peripheral activity. The aim of most foreign exchange holdings is to possess the unit used to price international transactions – the dollar. This is not only the goal of the central banks foreign exchange reserves but also the safest form of currency hedging by companies. Consequently if countries capital accounts are liberalized the net fl ow is always into the dollar – as global experience since international capital account liberalization seriously began in the late 1970s confi rms.endprint

China can be no exception to this fundamental economic rule. Therefore, as China moved to liberalize its capital account the data show that destabilizing movements out of the RMB into the dollar began.

Chinas foreign exchange reserves would have been increased by its trade surplus rising from US $306 billion in the year to August 2014 to US $540 billion in the year to August 2015. But instead of rising, Chinas foreign exchange reserves fell at a rate much faster than was caused by productive foreign direct investment outfl ows. In 2015 Chinas foreign exchange reserves have fallen by an average US $36.5 billion a month and the decline has deepened –Augusts fall was US $94 billion. This demonstrates large scale capital outflows are taking place with negative economic consequences.

The positive effects of the RMBs use in relation to international trade, therefore, led to it organically becoming the fourth largest currency for international transactions– a healthy process which should be allowed to continue. Failure to recognize the nature of the international capital system, which can only create fl ow into the dollar, has led to over hasty relaxation of capital controls with negative effects on Chinas economy.endprint