Current Status of Pharmaceutical Retail Market: Problems and Countermeasures

WANG Jiao-nan, CHEN Yu-wen

Current Status of Pharmaceutical Retail Market: Problems and Countermeasures

WANG Jiao-nan, CHEN Yu-wen

ObjectiveTo provide

for management and supervision of pharmaceutical retail market. Methods Current status of pharmaceutical retail market was analyzed and suggestions were raised to promote a healthy development of pharmaceutical retail market. Results and Conclusion Suggestions for the development of China’s pharmaceutical retail market are put forward from the two aspects of pharmaceutical retail enterprises and government supervision, including promoting rational distribution of chain pharmacies, encouraging the development of chain pharmacies, strengthening the licensed pharmacist system, implementing strictly the GSP certification system,

pharmaceutical retail market; pharmacy; supervision; measure

Since 2011, under the guidance of “National Drug Distribution Development Plan (2011-2015)”, China’s pharmaceutical retail market has developed significantly. Retail pharmacy business continues to grow and the market concentration, circulation efficiency and the level of modern management are enhanced. A number of national pharmaceutical retail chain enterprises and regional leading enterprises are growing quickly. Pharmaceutical retail industry has entered a new stage.

Medicines are special commodity for disease prevention and treatment. Therefore, the quality of drugs is directly related to people’s lives. To ensure the safety of pharmaceutical drug quality is not only the corporate responsibility, but also the fundamental principle for the corporate to have the market share. In China, most people buy drugs from retail market. However, there are still many problems in the pharmaceutical retail market. This article studies the present situation of pharmaceutical retail market and provides some strategies for its further development.

1 China’s pharmaceutical retail market development situation

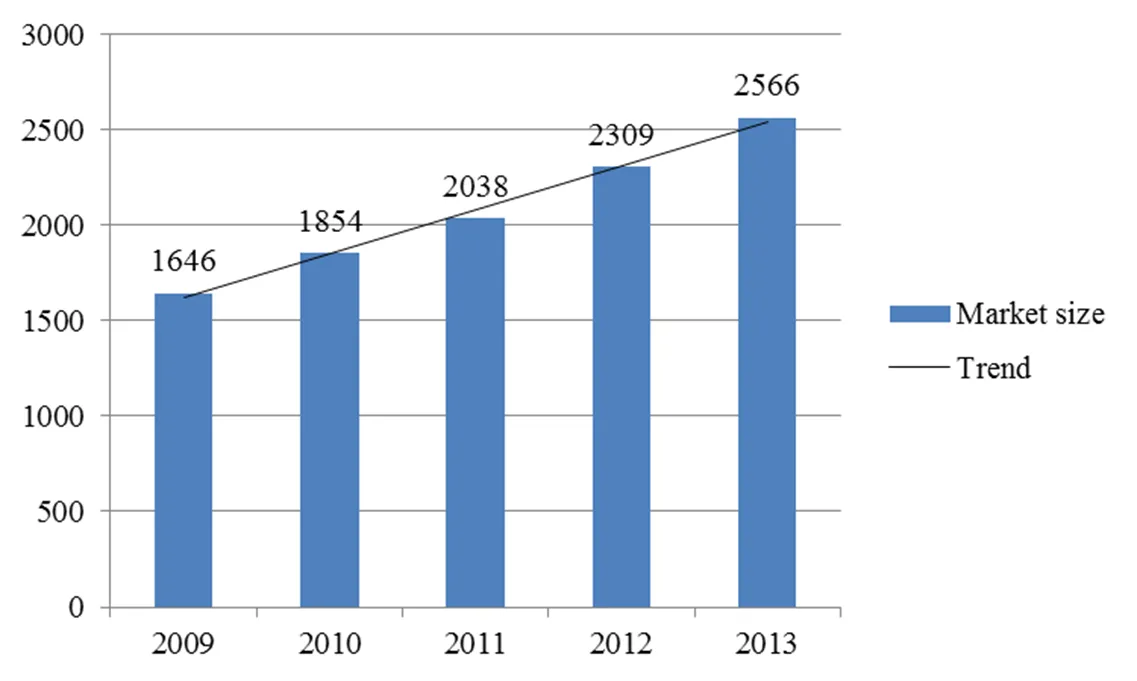

The data released by Health Advisory showed that[1]the overall size of China’s drug retail industry was about 230.8 billion Yuan in 2012 (including all commodities), an increase of 13%; According to different categories, pharmaceuticals grew 16%, non-drug health products grew 4.7% and other non-health products increased 0.9%. It was expected the pharmacy market scale could reach 256.6 billion Yuan and drugs accounted for 77.7%, while non-drug accounted for 22.3% in 2013. (Figure 1)

Figure 1 2009-2013 changes in drug retail market trends

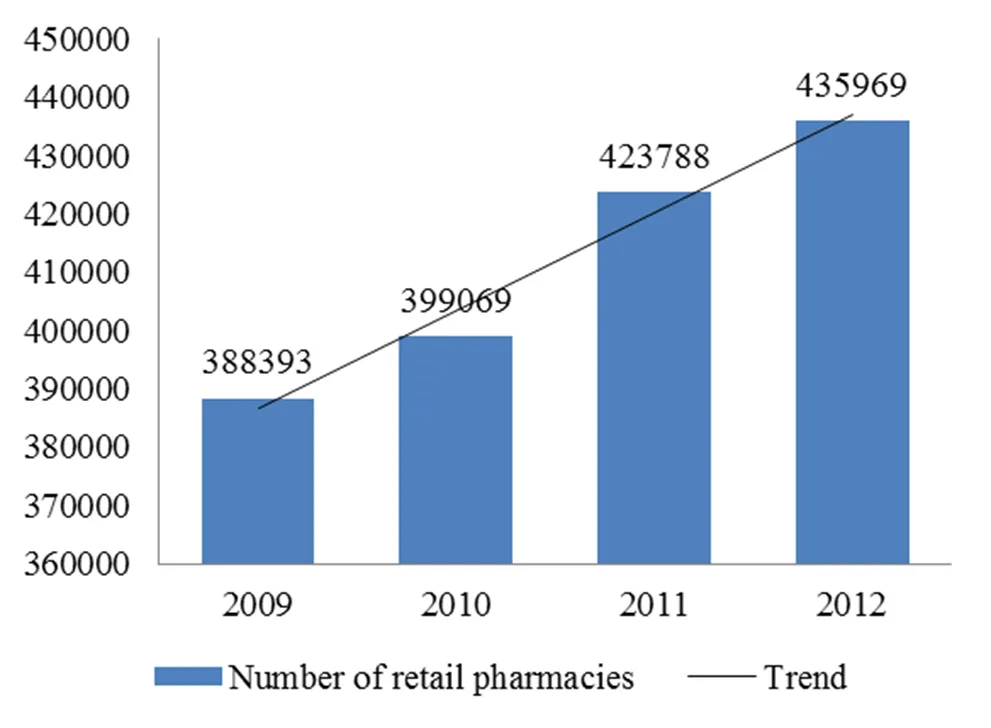

According to statistics[1], there were 435,969 pharmacies nationwide in 2012, an increase of 3.5%.

Figure 2 2009-2013 Number of retail pharmacies

From Figure 2, we can see that the number of retail pharmacies was in a growing trend, and it grew fast in 2011 and 2010, the growth in the rest years was slow.

By the end of 2012, the total number of retail pharmacies was nearly 430,000. China's population was 1.339 billion (the 6th national census result). Every 3,000 people owned a pharmacy, much higher than the international level in developed countries which have a pharmacy for every 6,000 people[2]. This international standard was mentioned in the Blue Book of China’s Pharmaceutical Market in 2010.

Figure 3 The retail pharmacies distribution of some cities

Figure 3 showed that Shanghai had one retail pharmacy for every 7000 people which were the highest number, while Changsha had one retail pharmacy for every 1527 people with the lowest number. Shanghai was four times the number of people in Changsha. The distribution of retail pharmacies is uneven.

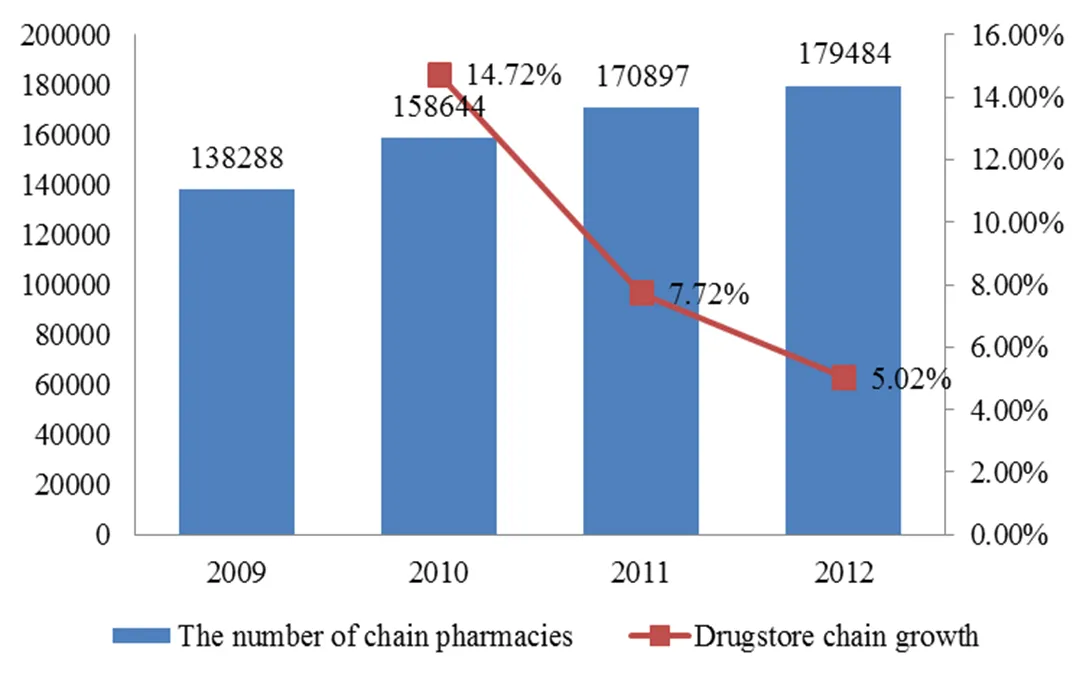

According to Figure 4[1], there were 179,484 pharmacy chains, an increase of 5.0%.

Figure 4 2009-2012 the growth in the number of retail pharmacy chain in China

As shown in Figure 4, China’s chain stores were growing slowly. Based on the drugstore chain growth trend, the growth rate was decreasing, showing that the number of chain pharmacies slowed down.

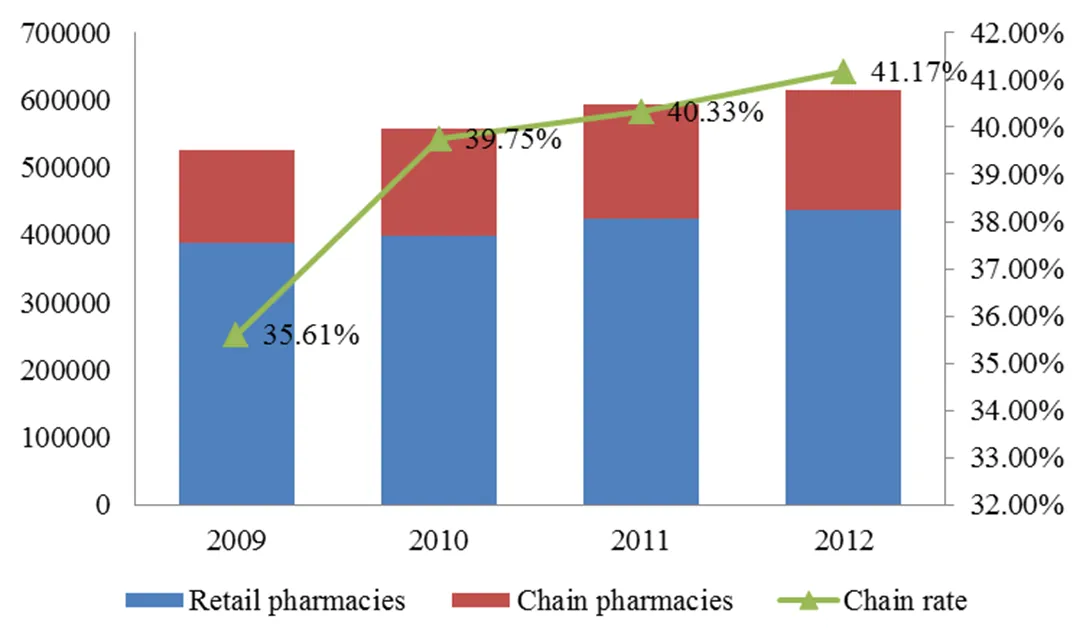

The monomer drugstores accounted for more than 60% in China’s pharmaceutical retail pharmacies. The huge number showed that the rate of chain drugstore chain was in the lower stage. As shown in Figure 5.

Figure 5 The chain rate of retail drugstore from 2009 to 2012

As can be seen from Figure 5, the proportion of the monomer drugstore was big. The chain rate of drugstore was about 30%-40% which was relatively low. However, from the line chart of the chain rate, the chain rate was slowly going up, indicating that the proportions of chain pharmacies were increasing, too.

Now the total number of registered pharmacists in China is 231,488[3].

Table 1 Number of registered pharmacists in 31 provinces

RankProvinceNumber of peopleRankProvinceNumber of people 1Shandong1829817Shanxi5848 2Jiangsu1702618Guangxi5630 3Zhejiang1541019Heilongjiang5445 4Henan1469020Tianjin4815 5Guangdong1460221Jilin4561 6Sichuan1005322Shanxi4442 7Hubei931123Yunnan4014 8Shanghai924424Gansu3092 9Hunan912125Xinjiang2621 10Beijing819326Chongqing2147 11Anhui810227Guizhou1724 12Fujian781028Ningxia1021 13Hebei756129Hainan1001 14Liaoning681830Qinghai566 15Jiangxi649531Xizang151 16Inner Mongolia6292

Source: State Food and Drug Administration Web site, as of December 2013

The total number of drugstores in China is about 430,000, while the number of licensed pharmacists is 230,000. Drug wholesalers, hospitals and other medical units need licensed pharmacists. Meanwhile, there are about 13,000 pharmaceutical wholesale enterprises and more than 20,000 hospitals which mean a serious shortage of licensed pharmacists. After the release of the new GSP, what the total of 430,000 drugstores worries most is the shortage of licensed pharmacists. According to statistics, every 1,500 people in the United States have a pharmacist and very 820 people in Japan have a pharmacist. Meanwhile, China has a pharmacist for every 7,500 people. LAOBAIXING Pharmacy’s research shows that, in addition to the shortage of pharmacists, the unreasonable distribution of licensed pharmacists is another problem. There are about 2 pharmacists per 10 thousands people in Shanghai while in Heilongjiang province, every 10 thousands people have less than one pharmacist[4].

2 Problems in the development of drug retail market

According to the present situation of pharmaceutical retail market, we can sum up the following problems:

According to the “2012 China Pharmaceutical Market Development Blue Book” from CFDA Southern Medicine Economic Research Institute, the developed country has a pharmacy for every 6,000 people, but China has a pharmacy for every 3146 people. We can see that China has too many pharmacies.

Based on the above histogram, we can see that the highest number of people per retail pharmacy is 4 times than the minimum number. Therefore, the distribution of China’s retail pharmacies is uneven[2].

The number of chain pharmacies is big in China, but few retail pharmacies have national chains and the majority of them are small scale. This can not be called chain operations in a sense. The largest US CVS has a total of 4,200 drug chain stores, while China’s largest chain operator NEPSTAR drugstore only has 2,758 branches. LaoBaiXing pharmacy, the second largest only has more than 600 stores.

As the chain pharmacies, they should unite the separate, decentralized pharmacies together to form a wide coverage of large-scale marketing system. The advantage of chain pharmacy is to integrate the resources to improve the competitiveness of enterprises. In 2012, the rate of China's chain pharmacy was 41.17%, which indicated that the proportion of single pharmacy accounted more in the market and the rate of chain pharmacy was low.

The number of registered pharmacists is only about 1/2 of the total number of pharmacies nationwide which cannot meet the needs of pharmacies. The new GSP requires that each enterprise must have at least one licensed pharmacist. The biggest problem is the shortage of licensed pharmacists now.

3 Suggestions for promoting healthy development of China’s pharmaceutical retail market

As to the regulation of pharmaceutical retail market, the government should focus on market supply in the first place; otherwise it will affect market stability. Second, drug safety issues must be attached to great importance. Thirdly, the allocation of resources should be rational. Last but not least, the government should work in accordance with the law[8]. The government should establish a unified, open, competitive and orderly modern market system so that it can play a fundamental role in the market allocation of resources[9]. To promote the healthy development of the pharmaceutical retail market, it is necessary to establish the long-term supervision mechanism for enhancing the level of medication safety and strengthening the supply capacity.

It is necessary for the government to regulate pharmacies by adjusting the distance, population density and market. The supervision from drug regulatory authority is poor. Market regulation and the supervision from pharmaceutical authority is not enough to control the development of pharmaceutical retail market. Therefore, drug retail market should be controlled moderately so that the numbers of pharmacies, pharmacy scale and demand will be balanced relatively.

Based on rational distribution plan, restrictive means should be applied to the over-saturated regions to contribute to the proliferation of pharmacy layout from the city to the countryside. Pharmaceutical department can take regional units (such as administrative village as a unit) as a boundary, based on the total resident population to allocate the number of pharmacies in the region[2].

The governments at all levels should actively introduce relevant policies to encourage the development of chain pharmacy. Relevant laws about drugstore chain management system should be formulated to improve the legal management system. Retail pharmacies can develop fast in the competition with the implementation of cluster chains[6].

The new medical reform plan proposed to “encourage the development of chain retail pharmacy”, which meant to expand the number of chain stores and market coverage, but also to create immortal soul for enterprises to win in the market. In order to survive and develop, the small chain pharmacies must increase the bargaining power with manufacturers, and joining the alliance will be the best choice.

China’s pharmacist system was established 18 years ago. It played an important role in strengthening pharmacy technician team, promoting the pharmaceutical market management and ensuring people's medication safety. With the development of national economy and the improvement of people's living standards, the public need licensed pharmacists to provide high-quality services to ensure their safe medication[5].

China should increase the number of practicing pharmacists to enhance the development of China’s medical and health level, the legislative process should be accelerated to promote pharmacist system. The legal profession of practicing pharmacists’ exclusiveness must be determined from the national level. It should be stipulated that licensed pharmacists can engage in drug dispensing and prescription in retail pharmacies and hospital pharmacies. It is the best way to attract pharmacy technicians to join the team and provide high quality pharmaceutical services for the public[5].

In order to survive, it is a good choice for pharmaceutical retail enterprises to join the chain drugstore. Because various policies were proposed to regulate drug distribution channels[6].

The chain has the following advantages:

(1) It is conducive to the application of modern management techniques to achieve scale.

Compared with single-store operators, chain operators can reduce distribution costs, management costs and financial costs. When the three major costs are reduced, the total cost will certainly be reduced.

(2) It is conducive to build corporate brand.

The scale of chain drugstore is bound to give people the visual impact, and then people will have evaluation of the enterprise through the experience and cognition. Therefore, the enterprise’s brand is built. Corporate brand is the most important core competitiveness.

Chain drugstore does not mean to increase the number of stores and market coverage, or to unify store furnishings and other exterior. The true sense of the chain is the fundamental unity of the internal, such as the corporate philosophy, culture, marketing strategies and personnel management. Such drugstore chains can have sustainable and healthy development in the market.

The introduction of GSP in 2013 specified the standards for drug retail enterprises. Drug retail enterprises should develop a series of standards based on the new version of GSP, including quality management and responsibilities, personnel management, documents management, facilities and equipment, procurement and acceptance, display and storage, sales management and after-sales management.

Article 128 in the 2013 version of GSP clearly stated “Enterprise shall be equipped with licensed pharmacists in accordance with the relevant provisions of the State. Licensed pharmacists are responsible for guiding prescription and rational drug use”. The licensed pharmacists in drug retail enterprises must should have professional knowledge and master the regulations of the pharmacy administration so as to ensure the medication safety for consumers[7].

[1] HU Yong-zhong. A model-driven Development, Panoramic Aerial Hundred [EB/OL]. http://cpeo2013.sinohealth.cn/showmsharehou?id=83, 2013-09-02.

[2] WU Jin. Research on Distribution and Development Strategy of Retail Drugstores in China [J]. China Pharmacy, 2013, 24 (17): 1627-1629.

[3] CFDA. List of Qualified Personnel Practicing Pharmacists [EB/OL]. http://app1.sfda.gov.cn/datasearch/face3/base.jsp?tableId=70&tableName=TABLE70&title=Lists of licensed pharmacists &bcId=124384865891143630110373736798.

[4] MA Fei. Call for Legislation for Pharmacist Shortage [N]. Medicine Economic News, 2013, 3 (27): 5.

[5] LI Zhao-hui, DING Jin-huan, CAO Li-ya. Analysis of the Distribution of Licensed Pharmacists in 2011 [J]. China Pharmacist, 2012, 15 (6): 881-883.

[6] LI Bin. How to Change the Pharmacy under the New Health Care Reform [J]. China Pharmacy, 2009, (8): 22-23.

[7] BIAN Ming, CHEN Hong-zhi. The Analysis of Influencing Factors in Equipping with Licensed Pharmacist in Retail Pharmacies [J]. Capital Medicine, 2011, (11): 10-12.

[8] Anonymous. Analysis of the Development Situation of China’s Pharmaceutical Retail [EB/OL]. http://www.chemdrug.com/databases/detail/3-33065.html, 2014-01-13

[9] GAO Xing, CHEN Rong-qiu. Conception of Supervision System of Chinese Pharmaceutical Market [J]. Chinese Journal of New Drugs, 2007, 16 (19): 1547-1552.

Author’s information: CHEN Yu-wen, Professor. Major research area: Pharmacy administration. Tel: 15940448000, E-mail: cywwyc@163.com

- 亚洲社会药学杂志的其它文章

- E-commerce Marketing Models of Fisher Scientific Company in Canada: Analysis and Its Enlightenment

- The Development of Chinese Medicinal Materials and Decoction Pieces Industry: Problems and Countermeasures

- Online Pharmacy ModelChoice of Pharmaceutical Retail Chain Enterprises

- An Research on Establishing the System of Drug Safety Mandatory Liability Insurance

- On Digital Drug Management in One Hospital Pharmacy

- An Evaluation Study of Brand Competitiveness of Chain Pharmacies Based on the Analytic Hierarchy Process