Why China’s Economy Continues to Outdo the U.S.’s

By JOHN ROSS

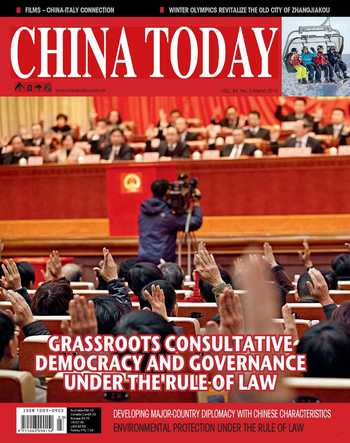

EACH year China sets formal economic targets– these are announced at the National Peoples Congress which this year will be held in March. A review of Chinas record, recently and as a whole, is useful when assessing whether or not it can achieve these targets.

During the last period, sections of the international media suggested that Chinas economy was in “severe slowdown,” while the U.S. was undergoing “strong growth.” As these are the worlds two largest economies this is evidently a major issue of global significance. When China and the U.S. published their 2014 GDP results this allowed a comparison of their respective growth which showed that serious misanalyses had been presented in parts of the media of Chinas economic development.

Taking first the objective data:

In 2014 Chinas economy grew by 7.4 percent and the U.S.s by 2.4 percent – see Figure 1. Chinas economy grew more than three times as fast as the U.S.s.

Chinas GDP increased from RMB 58.8 trillion in 2013 to RMB 63.6 trillion in 2014 – i.e. by RMB 4.8 trillion. In dollar terms this was US $780 billion measured at the exchange rate of December 31, 2014. The U.S. added US $653 billion to GDP. China therefore added approximately US$130 billion more to world output, at market prices, than the U.S. This is shown in Figure 2.

If measured at World Bank Parity Purchasing Powers(PPPs) China added approximately US $1,300 billion to GDP compared to US $653 billion by the U.S.

China therefore not only continued to be the worlds most rapidly growing major economy but continued to significantly outgrow the U.S.

A selection of headlines gives the flavor of what facts now show to have been unjustified “scare stories” about Chinas economy. Taking a few in chronological order, in January 2014 the Financial Times ran an article headlined “Chinas debt-fuelled boom is in danger of turning to bust.” In April a Financial Times headline declared “Chinas crisis is coming – the only question is how big it will be.” In October the American Enterprise Institute announced: “An economic mess in China.” The contrast between such headlines and the actual economic results was therefore striking.

But such inaccurate materials recycled a decades old genre of what may be termed “fictional economics” regarding the coming “crisis” or “drastic slowdown” in China. This was not confined to fringe publications but involved persistently inaccurate projections by major Western media. For example in 2002 Gordon Chang wrote a book entitled The Coming Collapse of China – whose thesis is selfexplanatory. This argued: “A half-decade ago the leaders of the Peoples Republic had real choices. Today they do not. They have no exit. They have run out of time.” Over a decade later, as time had not run out, one might expect such an authors analysis to be disregarded. Instead Chang was featured by Forbes and Bloomberg TV as a “China expert.”

Another example may be taken from The Economist. In June 2002, it produced a special China supplement “A Dragon out of Puff.” Its analysis of China: “The economy still relies primarily on domestic engines of growth, which are sputtering. Growth over the last five years has relied heavily on massive government spending. As a result, the governments debt is rising fast. Coupled with the banks bad loans and the states huge pension liabilities, this is a financial crisis in the making.” The Economists conclusion in 2002 was: “In the coming decade, therefore, China seems set to become more unstable.”In reality, far from entering a crisis, China was about to enter the decade of fastest growth ever experienced by a major economy in human history.

Why does such repeated inaccurate analysis of Chinas economy continue to appear in the Western media? For it is striking that China, during its economic reform, has not underperformed but consistently outperformed its own ambitious projections. To graphically illustrate this, Figure 3 compares the projections made by Deng Xiaoping for Chinas economic growth, towards the beginning of the reform process, with Chinas actual results.

Deng Xiaopings first stated target was to increase the size of Chinas economy by 400 percent between 1981 and 2000 – the actual increase was 623 percent. The second goal was to increase Chinas GDP by a further 400 percent between 2000 and 2050 – a 1,600 percent increase between 1981 and 2050. In reality, by 2014 Chinas economy had already grown by over 2,200 percent compared to 1981. Deng Xiaopings target was reached 38 years ahead of schedule! As regards Chinas latest stated goal, to double GDP between 2010 and 2020, China is also ahead of its growth target for this.

Given such a reliable record, over three and a half decades, China is clearly continuing to develop in line with the key goals officially reiterated by President Xi Jinping:“We have set the goal of completing the building of a moderately prosperous society in all respects by the centenary of the Communist Party of China in 2021 and building China into a modern socialist country... by the centenary of the Peoples Republic of China in 2049.”

Outside China, understandably, there is less understanding of the framework of “socialism with Chinese characteristics” in which Chinese economic policy is stated. So it may be useful to use the recent explanation of why Chinas extremely rapid growth rate, by international standards, will continue made by one of Chinas leading economists, Justin Yifu Lin.

Analyzing first Chinas domestic factors Lin noted: “In 2008, Chinas per capita income was just over one-fifth that of the United States. This gap is roughly equal to the gap between the U.S. and Japan in 1951, after which Japan grew at an average annual rate of 9.2 percent for the next 20 years, or between the U.S. and South Korea in 1977, after which South Korea grew at 7.6 percent per year for two decades…By extension, in the 20 years after 2008, China should have a potential growth rate of roughly eight percent.”

While Lin analyzed Chinas average long-term growth rate as at around eight percent, shorter-term projections must take into account external economic factors. Lin argued: “The external scenario, however, is gloomier… As a result, Chinese growth is likely to fall below its potential of eight percent a year. As policymakers plan for the next five years, they should set Chinas growth targets at 7-7.5 percent, adjusting them within that range as changes in the international climate dictate. Such a growth target can…achieve the countrys goal of doubling income by 2020.” Indeed, a seven percent annual growth rate from 2015 would result in China somewhat exceeding its target of doubling the size of its economy in 2010-2020.

The reason Lin notes China can meet such targets also goes to the core of an elementary economic error which leads to much erroneous media analysis of China. Lin notes: “China has the potential to maintain robust growth by relying on domestic demand – and not only household consumption.” Economically, in any country, domestic“demand” is not equal to consumption, as writers such as Pettis erroneously state, but is equal to consumption plus investment.

China, in reality, has the worlds largest investment resources. As Lin noted: “Chinas investment resources are abundant… private savings in China amount to nearly 50 percent of GDP… Even under comparatively unfavorable external conditions, China can rely on investment to create jobs in the short term; as the number of jobs grows, so will consumption.” In a developing economy, on average investment accounts for 50 percent of economic growth, and in an advanced economy 57 percent. It is therefore no surprise that Chinas much greater investment resources than the U.S. leads to its economy continuing to grow much faster than the U.S.

But why is China able to successfully carry out such investment programs, whereas in the U.S. numerous calls for increased investment, for example in infrastructure, have not been implemented even when publicly supported by such leading figures as former Treasury Secretary Lawrence Summers?

The reason lies in the fact China is a “socialist market economy” not a “capitalist market economy.” China possesses a state sector which does not aim to encompass the whole economy, nor to administer it, but which is strong enough to set, and if require, maintain Chinas overall investment level. As the Wall Street Journal accurately summarized: “Most economies can pull two levers to bolster growth: fiscal and monetary. China has a third option. The National Development and Reform Commission can accelerate the flow of investment projects.”

No capitalist market economy, including the U.S., possesses such a powerful structure as Chinas “socialist market economy.” This is why Chinas economy has continued to persistently outperform the U.S. and why all media predictions of disaster over several decades, and again recently, invariably turned out to be false.

However, another statistic casts a light on the situation. While sections of the media were running inaccurate stories on Chinas economy, foreign companies increased their investment in China from US $123.9 billion in 2013 to US$127.6 billion in 2014. As usual companies, which have to deal with money and not propaganda, were more in contact with economic reality than sections of the press.

In light both of the record and the data outlined by Lin and others, there is, therefore, no reason to doubt that China will achieve its target of doubling the size of its economy between 2010 and 2020. No other major economy will even come close to this. The factual record shows clearly that those seeking more accurate predictions for what will happen in Chinas economy will find them in Chinas media, from Chinas top economists, and in Chinas own growth projections.