Chinese Enterprises Achieve Win-Win with Europe

By LI GANG

Soaring Investment, Potential for Growth

According to Eurostat, the European Commissions statistics database, from 2008 to 2012, the EUs outward foreign direct investment (OFDI) stock in China was on a path of steady growth. In 2011, the OFDI stock of the EUs 27 countries in China exceeded 100 billion and the figure rose to 118.1 billion in 2012, a 1.2-fold increase compared to that of 2008 (see Table I).

In recent years, a new trend in EUChina relations has been the strong growth momentum of Chinese enterprises investment in the EU. According to the Statistical Communiqué of 2012 on China Direct Investment Overseas jointly released by the Ministry of Commerce and the National Bureau of Statistics, in 2005 Chinas OFDI stock in the EU totaled US $768 million, accounting for just 1.3 percent of its OFDI as a whole. In 2006, Chinas OFDI stock in the EU broke the billion-dollar mark to reach US $1.275 billion, a year-on-year increase of 66 percent. After the outbreak of the European debt crisis, Chinas investment in the EU bucked the trend by maintaining its growth and achieving leapfrog development. In 2009, Chinas OFDI stock in the EU hit US $6.278 billion, almost double the 2008 amount. By the end of 2012, Chinas OFDI stock in the EU stood at US $31.538 billion, a 40-fold increase over the 2005 level.

Statistics on Chinas global investment collected by the U.S.-based Heritage Foundation show that in 2005 there was only one transaction where the amount of investment from China to Europe was above US $100 million. The number of transactions on such an investment scale increased gradually in the following years and by 2013, the figure was 18 (see Table II).

Although bilateral investment between China and Europe has mushroomed, it nonetheless remains in the initial stages, both sides scoring equally low on the bilateral investment scale. There is consequently huge potential for further growth.

According to statistics from the Ministry of Commerce, in 2012, Chinas OFDI stock in the EU totaled US $31.538 billion, representing 5.9 percent of its global sum. In terms of the EUs direct investment in China, by the end of 2012, the EUs OFDI stock in China reached118.1 billion, only 2.3 percent of the regions total OFDI. During the same period, the EUs OFDI stock in the U.S. was valued at about 1.7 trillion, representing over 30 percent of the EUs total OFDI stock (see Table I). Its clear that the bilateral OFDI is not commensurate with their economic aggregates. Both sides hence have ample space to increase their mutual direct investment.

Chinese Enterprises Seek New Business in Europe

Comprised of some of the worlds most advanced economies, the EU, a highly integrated economic bloc, plays a decisive role in the global economy.

The U.K., owing to its mature capital market and good investment conditions, has attracted many Chinese enterprises. In recent years, Chinas investment in the U.K. has grown fast and entered various fields covering agriculture, energy, finance, real estate, technology and transportation, with energy, transportation and real estate absorbing the majority of the investment. So far, over 500 Chinese enterprises have established branches in the U.K., with Chinas OFDI stock there reaching US $32.3 billion. In general, most Chinese enterprises run without a hitch in the U.K.

In February 2013, Chinas automaker Geely bought the U.K.s Manganese Bronze for £11.04 million. The classic black cab manufactured by Manganese Bronze is a cultural symbol of London. Geely purchased Manganese Bronzes key assets and business to better explore the British market and also with a view to entering the local market of car rental and private cars. Meanwhile, the acquisition and operation of Manganese Bronze helped Geely better understand the laws and regulations of the international market, market demand and social con-ditions, so as to accumulate experience for future international operation.

Other examples in the transport sector include SAIC Motors cooperation with Rover to produce the MG 6, a midsize car, in a venture that explored a new cooperation model: designed in the U.K.– made in China.

Further, the China National Petroleum Corporation (CNPC) acquired part of INEOS Refining, and Huawei Technologies and ZTE expanded their manufacturing, R&D and testing centers in the U.K.

In 2014, Chinas investment in the U.K. maintained its momentum of fast growth. According to Heritage Foundation statistics, from January to June, Chinese enterprises made 16 investments in Europe, each worth over US$100 million, with total investment hitting US $12.87 billion. Among those, seven investments totaling US $4.87 billion were made to the U.K.

In 2009, the sovereign debt crisis swept the region, seriously affecting its economy as many foreign investors gradually withdrew their capital. But Chinese enterprises nonetheless stepped up European investment. Chinese enterprises, while increasing investment in key countries, also started to amplify their ventures in countries that had suffered the most under the Eurozone crisis.

Against this background, several factors enabled Chinese enterprises to enhance their investment in Europe. First of all, the debt crisis brought down the share prices of some European enterprises, lowering the cost of mergers and acquisitions. Secondly, the crisis led to a credit crunch resulting in liquidity shortages. By purchasing shares and undertaking acquisitions, Chinese enterprises could help suffering economies ride the storm. Thirdly, some heavily indebted European countries were forced to privatize state-owned property, which provided investment opportunities for Chinese enterprises. Finally, the EU provided a favorable policy environment for Chinese investment.

As the fourth largest economy in Europe, Italy is home to some very competitive brands, and before the European debt crisis, Chinese enterprises that had invested there performed well. Haier (Italy) serves as a good example of Chinas OFDI success.

In 2001, Haier purchased a refrigerator manufacturer in Campodoro in northeast Italy, launching its maiden voyage into the European market. To begin with, Haier used the existing production line to manufacture hotel mini- bar refrigerators. Two years later, based on market demand, Haier increased its investment in scientific research and development to launch a large-scale reform of the company, upgrading its products year by year. In 2008, the three-door Italian-style refrigerator developed by Haier won high praise from the market for its human-centered design. Today, Haier (Italy) mainly produces high-end products that suit the needs of European customers. Its annual production increased from 34,359 units in 2008 to 80,733 units in 2012. When European home appliance companies are forced to implement production restrictions and lay off employees, Haier (Italy) works overtime to finish the orders it receives.

Alongside the development of the China-Italy economic and trade relationship, investment from Chinese enterprises in Italy soared in 2014, as Chinese companies completed multiple largescale mergers and acquisitions: Shanghai Electric bought a 40 percent stake in Ansaldo Energia, the Italian power equipment manufacturer; Chinas State Grid bought a 35 percent stake in energy grid holding company CDP Reti for 2.1 billion; and the Shanghai-based Bright Food Group Co. acquired a majority stake in Italian olive oil maker Salov Group.

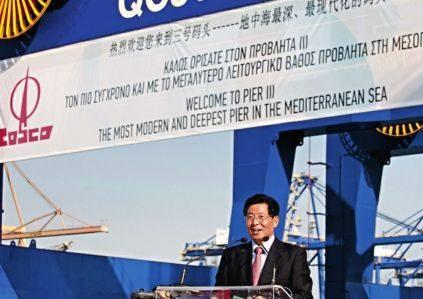

More and more Chinese enterprises have chosen to invest in another nation hit hard by the Eurozone crisis – Greece. So far there are 13 Chinese companies operating in Athens in such areas as port transportation, ship manufacturing, green energy, telecommunications and real estate.

On June 12, 2008, the China Ocean Shipping (Group) Company (COSCO) won the privatization tender for a 35-year concession to run Piers 2 and 3 at Piraeus Port, Greeces largest port, for a price of 498 million. After signing the relevant agreements with the Piraeus Port Authority on September 30, 2009, COSCO started managing the two container terminals. But the venture met with protest from some locals, who feared their jobs would be threatened by the introduction of the Chinese enterprises. As COSCO took over the management of the container terminals in October 2009, the company encountered a six-week-long strike. Yet COSCO was able to allay the workers fears: The newly built container terminals created 1,000 jobs at a higher salary than the local average level. The group also provided professional development opportunities for port workers to streamline their efficiency, enabling them to up their rate of loading and unloading from six to 22 standard containers per hour, so surpassing the European port average. In 2008, 434,000 containers were transported at Piraeus. In 2013, the number reached 3.16 million containers, a seven-fold increase. COSCO thus helped Piraeus Port get back into the black. The profits of the first half of 2014 hit 11.30 million, an increase of 22 percent compared to the same period in 2013, making COSCOs Piraeus project one of the most successful cases of asset privatization in Greece, as well as one of the most demonstrative cases of Chinese investment in Europe.

A Scramble for Europe?

As the COSCO example illustrates, things do not always go smoothly for Chinese enterprises in Europe. Prejudice from governments and local people is one of the barriers hindering Chinese investors from increasing their investment in the region. Chinas investment in Europe is equal to Venezuelas; South Africa invests much more than China; and Brazils investment in Europe is 10 times Chinas figure. No one believes these countries intend to “occupy” or “eat up” Europe, but the fear of China doing so is palpable.

As a matter of fact, it is unlikely that China will “occupy” or “eat up” the European countries receiving its investment. Rather, there are clear benefits of Chinese investment.

First, it eases a lack of liquidity. The European debt crisis resulted in inadequate economic growth. Public investment remains restricted while private investors confidence is shattered. Continued Chinese investment is expected to bring more capital to the EU, which is still tightening its belt.

Second, investment from Chinese enterprises provides plenty of job opportunities for local people. Data from Chinas Ministry of Commerce reveal that by the end of 2012, the number of companies founded by Chinese investors through direct investment reached nearly 2,000, and that those companies employ 42,000 locals.

Third, Chinese investment stimulates companies that have been merged to improve their production efficiency, which enables European trade to increase its share in the global market.

Fourth, investment from China helps raise the asset value of European com- panies. According to market rules, an increase in demand brings about a rise in price. Although some European companies share prices fell because of the debt crisis, the arrival of Chinese enterprises in Europe expands the demands on assets and, accordingly, raises asset prices.

Eliminating prejudice against Chinese enterprises requires an objective attitude from European governments and people as well as reflection on the part of Chinese enterprises.

First of all, Chinese companies should learn more about European policies and laws. Some investors from China believe that their capital is the key to everything and know little about local policies and laws. Such an attitude is doomed to hinder their development in a market based on a sound legal system.

Next, cooperation between Chinese companies and local labor unions needs to be strengthened. Chinese investors did not bank on resistance from European labor unions when they made their first forays into the European market. In recent years, many Chinese firms have encountered considerable opposition to planned mergers due to their improper ways of dealing with local labor unions. Public relations (PR) strategies should be stressed, and communication between Chinese firms and local governments and people needs to be enhanced. Most Chinese enterprises lack sound PR strategies, which creates the mistaken impression that they intend to “plunder” their European counterparts core technologies. Locals often believe Chinese companies neglect their corporate social responsibilities and are suspicious of the true aims of Chinese investors. Communication is the key to erasing such doubts and prejudices.

EU countries have always been favored investment destinations for China owing to advanced technology, skilled labor, transparent laws and fewer market access barriers. Europe,

at the same time, welcomes investment from China to revive the local economy and generate more job opportunities. Though Chinas economic aggregate takes up 10 percent of the global figure, its stock of outward direct investment only accounts for 1.5 percent of the worlds total. Therefore, the country has enormous potential for outward investment. Meanwhile, both sides have the desire and conditions to increase mutual investment. With favorable factors including the rapid development of an all-round strategic partnership between China and EU, an advance in bilateral investment agreement negotiations, and progress in RMB internationalization, the China-EU investment relationship has a bright future.