To review 2014 well,to prospect 2015 better

Review 2014 with six representative areas in textile industry

Cotton textile: healing + expectation

For the three-year temporary cotton reserve policy, the whole cotton industry has weathered several bitter winters, though its period came to the end in 2014, the industry still needs a while to heal.

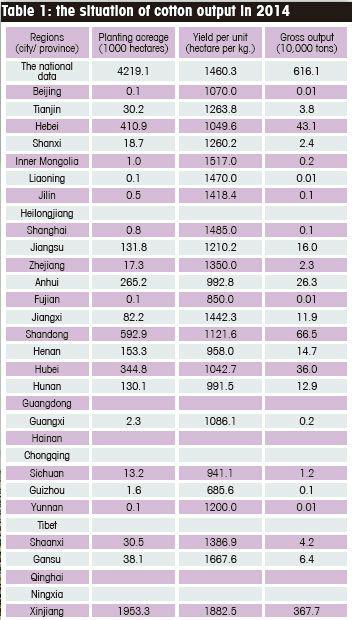

According to National Bureau of Statistics of the Peoples Republic of China, the total production reached 6.161 million tons, decreasing 138,000 tons than 2013, down by 2.2 percent year on year. (Table 1)

Facing the situation, the reporter gets the reasons why it happened in last year from National Bureau Statistics, which are listed as follows:

The reduction of growing areas is the main factor. The total growing areas completed 4.2191 million hectares, decreasing 0.1265 million hectares, down by 2.9 percent year on year, and therewith decreased 183,000 tons of the production.

Though the total cotton acreage decreased, the unit yield increased thanks to Xinjiang. In the last whole year, the growing areas in Xinjiang accounted for 46.3 percent from 39.5 percent in 2013, and it brought 0.7 percent higher of unit yield than 2013.

In terms of different areas, Xinjiang, as the largest cotton production region in China, got yield improvement, while other parts saw the opposite direction in general. In 2014, Xinjiang accounted for 59.7 percent of national gross output, and reached 3.677 million tons, up by 4.5 percent than 2013; while in other regions in China, the gross output added up to 2.484 million tons, down by 10.7 percent comparing 2013.

What new normal brings the biggest problem to the industry is weak demand. And from the recent report of China Cotton Textile Association that the indicators of Boom Index (BI) declined for supply exceeding demand, continually downward prices, and wait-and-see pessimism.

However, some voices insist that with loose monetary policy in an all-round way, the domestic demand for cotton will heat up and the price will rebound.

Home textile: e-commerce + merger & regroup

“It was the best of times. It was the worst of times.” In the year of 2014, Though the brick and motar suffered tough times, e-commerce of home textiles saw rapid development.

On “Double 11”, three listed home textile companies broke daily sales of 0.38 billion yuan, and among which, LUOLAI achieved 0.188 billion yuan, FUANNA did 0.13 billion yuan, and Mendale did 70 million yuan. Above those, there is no doubt that e-commerce has become an important field for home textile realizing transformation. And regard to 2015, Ms. An Zhi, the director of Tmall home textile department, emphasized that the way of e-commerce combines sellers and consumers. And also balances supply and demand. In addition, it is the way with significant advantages to near consumers better.

When the strategy of e-commerce is fast marching, the tide of industrial merger and regroup has appeared on the scene. According to the survey given by China Home Textile Association (CHTA), in 2014, the related enterprises were put in a tight spot in sale except corporate champions which behaved excellently. For the obvious polarization, Mr. Yang Zhaohua, the president of CHTA, pointed that as long as the leading enterprises research market in real earnest and make full use of market leverage effect, they will achieve fast development and increasing market share. In other words, the merger and regroup is on.

Technical textile: rapid development + fast growth+ better expectation

As Chinas economy entered the “new normal”environment featured with slowdown of growth, textile industry continued further adjustment, however, technical textiles industry remained in rapid development because of its close relation with infrastructure, urbanization, environmental protection and new energy: production maintained a certain level of growth, enterprises had high enthusiasm in investment, stable increase happened in export, and economic benefit was also in good situation. Overall, the whole industry enjoyed strong development momentum.

Technical Textiles, as a significant field for industrial restructuring of textile industry, has a brighter future. Currently, domestic market still serves as the greatest force to promote technical textiles development, for investment of the state is increasing in infrastructure, environmental management, health care, security and protection and national defense, etc., which provides more opportunities and possibilities for rapid development of the industry and growth of backbone enterprises.

According to statistical data, industrys major economic indicators were still in fast-growing range in the first three quarters of 2014, although the growth went down slightly over the same period of last year, with main business income growing by 13.15%, total profit rising by 25.62%, fixed investment increasing by 24.63% and exports going up by 7.13%. According to regular questionnaire survey of member companies, the business index of the first three quarters was 81, almost remaining the same with 2013, which indicates that entrepreneurs were satisfied with the overall business condition; while market demand index was 63, suggesting that the market maintained in certain growth.

Double-digit growth happened in fixed invest-ment, higher than the average of whole industry, indicating that companies have better expectation in future development, for new investment and technological innovation are driven by prosperity of industry development. The fixed investment and new projects of nonwovens even reached up to 50%, which demonstrates the confidence of enterprises fully.

As 2015 is the last year of “12th Five-Year Plan”, drawing-up of “13th Five-Year Plan” is already on the schedule, therefore, the preparation has become a priority of China Nonwovens & Industrial Textiles Association in 2015, which contains a lot of industrial investigations, demonstrations, and researches of technology roadmap and trends in next five years, potential users and downstream markets demands, as well as development of international technical textiles.

Experiencing the production capacity expansion of past two years, technical textiles industry will step into a new phase of orderly development with further improvement of industrial structure, in order to produce more high-end products to replace imported ones, then enhancing industrial competitiveness continuously.

Chemical Fiber: adjustment + small price volatility+ asset circulating and restructuring

2014 is the third year for China chemical fiber industry to enter the phase of adjustment.

During the “12th Five-Year” period, especially from the beginning of 2012, the whole industry had gone to a downhill road, with demand in the doldrums, cost unceasingly rising and profit continuously falling, which called for adjustment to be the main topic of the industry gradually. The later adjustment of three years from 2012 to 2014 brought directional changes to the industry development and corporations also turned their attitudes from initial suspicion and even denial into acceptance and facing positively. Under the national background of “new normal”, adjustment has now become a widespread issue of each enterprise.

Compared with the previous years, some subtle changes came to the overall operation of chemical fiber industry in 2014. The first change was in “market operation”: in the market, price volatility was in relatively large range in previous years, but it became smaller in 2014, which indicates that the companies were more rational — they organized the production in accordance with plan, rather than the previous “around the market”. Another change was that asset circulating and restructuring happened to capital market between different enterprises in the same industry, which was rare in chemical fiber industry. In addition, 2014 also met sharp decline in investment.

Chemical fiber industry will remain the same in 2015, and may be slightly better than 2014. But at the same time, further deepening of reformation, change of financial policy, adjustment of RMB exchange rate, reduction of foreign market share will also bring many challenges to the development of industry.

Dyeing & printing: environmental protection + sustainable development

In 2014, the whole dyeing and printing industry was facing the situation of unprecedently high requirements on the environmental protection and innovation.

·Water pollutant discharge standard enhanced.

·Making of air pollutant discharge standards launched.

·More outdated productivity to be eliminated.

·The environmental management guidelines for textile printing and dyeing companies issued.

These standards and policies signify that companies of the industry need to adjust to the increasingly stricter environmental standards as soon as possible. Therefore, they need not only to increase improved environmental investment and improved environmental protection management, but also to explore long-term plans to balance sustainable development and core business, e.g. research and development of low-impact or environment-friendly production equipments, technology and products, and promoting stakeholders preference of sustainable production and products in supply chains and value chains.

Under these circumstances, the related enterprises have already begun to take actions to road to sustainable development.

In the production showroom of Zhejiang Shengfa Textile Printing & Dyeing Co., Ltd., some special military fabric, which is widely used in military-looking clothes and military equipments with its characteristics of strong intensity, high resistance, and good permeability is displayed in a prominent location attracting every audience. And only by this innovative fabric can the company bring in about 100 million yuan a year, accounting for a quarter of the companys annual output. In the eyes of the president Yang Wenlong,“Innovation is a way to solve the problem of today; while creation is the goal for tomorrows sustainable developing.”

As with Shengfa, lots of dyeing and printing companies have been going into “the battle of defending green”, for they believe only through the power of technology as well as innovation would their future be changed, and the industrys development be saved.

Since 2014, Chinas textile industry has been faced with great pressure in economic operation, due to slowdown of domestic economic growth and weakness in downstream market demand. In the second half year, Chinas filament industry were exposed to more severe ordeals — operational rate (the number of machines in operation) of enterprises slowed down, inventory kept up, and SMEs had difficulties in capital turnover.

According to statistics of various industry clusters in filament industry, the production of chemical filament fabrics in five regions (Shengze, Changxing, Xiuzhou, Longhu and Siyang) accumulated to 16.529 billion meters in the first three quarters, with an increase of 2.55%; total industrial output value fell by 2.23% over the same period of previous year, with decrease rate declining by 2.53 percentage points than the second quarter; the total profit margin of the five regions filament amounted to 2.5%, down by 1.44 percentage points over the same period of 2013, with decline rate increasing by 0.73 percentage point than the second quarter. According to National Bureau of Statistics, from January to September, Chinas chemical filament fiber industry reached profit margin of 4.29%, with a year-on-year increase of 0.36 percentage point; compared with the low growth of major economic indicators, the tax grew by 18.25% over the same period of 2013, which added great pressure to enterprises; by the end of September in 2014, Chinas chemical filament fiber industry has created product inventory up to 6.819 billion yuan, with year-on-year increase of 12.87%. And sluggish in sales also raised the risk of inventory backlog.

Under “new normal”, in which the overall development of Chinas economy showed slow growth, filament industry also experienced the problems of growth rate declining, market demand going down, a lack of outstanding product, management quality decreasing, environmental pressure rising and irrational capacity structure, and the problems were severe particular in increased production and management difficulties, continuously growing environmental pressures, as well as contradictions caused by irrational capacity structure.

After development of nearly 30 years, it is not enough for Chinas filament industry to rely on invested capital solely now. Instead, technological progress and innovation are the means to achieve sustainable development of the industry. In spite of complicated domestic and international macroeconomic environment, the market will be gradually transferred to new development channel with self-regulation. In 2015, the industry will experience further adjustment, under which the industry and companies will assume greater pressure from transformation.

Macro-economy in 2015 with nine areas in focus

GDP geared down

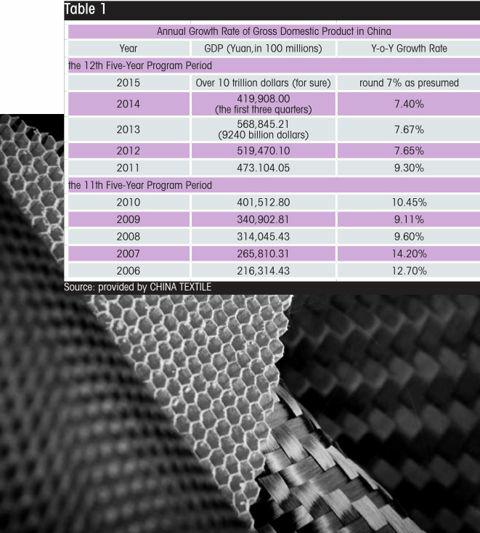

What comes into the year-end spotlight is the Central Economic Work Conference (CEWC)in China, which takes place sometime in the second or third week of December every year. Beijing griped the public attention from Dec.9th to 11th when the top echelon of the Communist Party of China (CPC) had a tone-setting meeting known as “the Central Economic Work Conference” to chart the course and direction of economic growth in the coming new year. After over 30 years of rapid growth, the high speed system itself is shunted onto the mid-high track which was already the case of the first three quarters in 2014, registering 7.4%, 7.5% and 7.3% respectively instead of the double-digit growth over the past years. The year of 2014 will come short of the goal predetermined rate at 7.5% while the analysts are of the opinion that Chinas GDP in 2015 will be scaled down to somewhere around 7%, believing this level suffices to provide over 10 million new jobs without any impact on important economic indicators, good enough to keep social stability and consumption drive.

It is quite an impressive picture that China started to enter a period of slower growth, hovering around 7 percent at GDP rate, just as the official press put it, a “New Normal” status quo in domestic economic performance. Many explanations were found to expound the context of the expression-“new normal”, but diverted to a narrow sense of “gearing down speed”. That is not what the real meaning of the official terminology was supposed to reach. The report of the Central Economic Work Conference has, in a clear-cut term, given a broad range of areas characterizing the New Normal in the new year of 2015.

Nine areas in focus on the New Normal

Although the new status of economic growth at slowdown rate is frequently reported in public press, named as “new normal” to draw attention to deepening reform in comprehensive fashion for driving the innovative growth with an optimized structure, it is the first time for the rhetoric “new normal” to be made public in such an itemized details featuring nine points of focus as a guide to economic route-map in the new year and in the years to follow.

The consumption will continue to play fundamental role in pushing economic development driven by innovating supply to galvanize market demand that is predicated on quality-and-safety basis. Consumers were subject to waves of emulative spending, a bandwagon effect of consumption in the past, but not at the present, when individuality and diversity come on mainstream. To follow the suit, correct policy for new consumption must be adopted to lead the purchasing potentials to proper outlets.

Investment: The investment opportunity of technology, product, business concepts and commerce model in their new advancements respectively calls for an innovative avenue of investment and financing, which also applies to the projects for connectivity in infrastructure. It is the direction of investment that China must head for, especially when the traditional industries are growing into relative saturation with excessive capacities over 30 years of large-scale construction backed up by highly-intensified investment stimulus.

Export and Trade Balance: The global demand is anemic in sharp contrast to the hematose expansion of market space before international financial crisis. The export was an important kinetic energy to drive Chinas economy on a rapid move as China took the advantage of the pre-crisis market opportunities, but the situation is not what it used to be, with the comparative advantage of low labor cost fading away. China still stays competitive in export to such an extent that the large-scale “going out” takes place in synchronization with the high-level “coming in”. The government encourages the export to shore up economic growth in continuity, provided that a new advantage of comparability will be established as a must, quickly.

Production Capacity and Industrial Structure: China was short of supplies in the past, which had posed mainstay problem for quite a long time in the course of economic development. Over the years, the shortfall was solved in an excessive manner, resulting in oversupply in traditional production capacities. To tackle the contradiction, the industrial organization must be restructured at an optimized and upgraded level by virtue of merging and re-consolidation into a relatively concentrated paradigm. More significantly, the emerging sector, service sector and SMEs will play more protuberant role, with the industrial organization composed of such new features as being small-sized, smart-driven and professional.

Relative Advantage in Factor of Production: China is the world-largest populous country with demographic structure to show an ageing trend and a reduced surplus of labor force. When the relative advantage in factor of production took effect in the past, labor cost at low level was the edge of success. With this, the imported technology and management was able to be turned into productivity. But this driving force from the large-scale effect in factor of production is being debilitated. Instead, economic growth will rely largely on the quality of labor force and the progress of technology, driven by new engines of innovative growth.

Market Competition: Fair-play market regulations and rules must be practiced across the board inside the country, and the resources must be allocated and deployed at an elevated efficiency, which are the endogenous requirements for economic development, quite different from the traditional growth model that is built on quantitative expansion and price contraction. Now the model is being shifted to quality escalation and product differentiation.

Resources and Environment: A good ecological environment must be provided to sustain economic growth in a new model buttressed with green, lowcarbon and recycling process. Environmental pressure is going up to the point of upper limit for its bearing capacity, because too fast development loaded with excessive production exhausted resources and prized away much room on ecology and environment in the past decades.

Risks and Solutions: The risks certainly loom large as economic growth slowed down, and solutions to the mass risks must be found in case these risks in various forms might stack up to a dangerous level in the course of development. Even though the existing risks are under control to a greater extent, de-leveraging and debubbling will be spearheaded in a series of measures to fight risks by addressing both symptoms and root causes with the right cure.

Macro-control and Resources Allocation: When marginal gains start to decrease in steps, the stimulus policy with surging investment or other incentives will not work. The macro-control must be conducted in a way that dovetails supply with demand in new changes, which means that the market forces will steer industrial growth in the future, including macro-control steering mechanism actuated to ease overcapacity problems.

- China Textile的其它文章

- Responsible cotton leads the way towards sustainable progress

- Calendar

- The kids have it:Parents will pay more for unique, quality kids clothesn

- CINC unites Japan-funded dyeing and finishing company to conclude supply chain alliance

- INVISTA’S new LYCRA brand focuses on the China market and increases investment

- Market