Financial Support for Rural Cooperative Economy in China Based on Grey Correlation Analysis

Fuchang XU,Chuandong WANG

College of Economics and Management,Shandong Agricultural University,Taian 271018,China

1 Introduction

China is a large agricultural country.Withoutagricultural development,national economy will not achieve considerable development.As a core of rural economy,rural finance plays an irreplaceable role in developmentof ruraleconomy.Since the promulgation and implementation of Law of the People'sRepublic of China on Farmers'Specialized Cooperatives in July 2007,rural cooperative economic organizations have been developing rapidly and become an essential part and future development direction of rural economic development.In the Decision of the Central Committeeof the Communist Party of China on Some Major Issues Concerning Comprehensively Deepening the Reform made at the Third Plenary Session of the 18th Central Committee of the Communist Party of China in 2013,it clearly stated that it is required to encourage rural areas to develop cooperative economy and support the largeamount,specialized and modernized operation[1].Financial support for rural cooperative economy determines development prospect of rural cooperative economy.In this study,we tested correlation between rural finance and rural cooperative economy.Finally,we came up with some recommendations for improving financial support of rural cooperative economy.

2 Current situations of financial support for rural cooperative economy

2.1 Prelim inary establishment of rural financial systemWithmany yearsof sustained effort,China is establishing amultilevel,wide-coverage and moderately competitive rural financial service system composed of banking financial institutions,nonbanking financial institutions,and othermicro financial organizations.Complementary function andmutual cooperation of policy finance,commercial finance and cooperative finance promote convenience and availability of rural financial services.Since comprehensive launching of pilot project of rural credit cooperative reform in 2003,a new round of rural financial reform and innovation are advancing in an all around way.By the end of 2014,there were 2350 rural credit cooperatives(including rural commercial banks and rural cooperative banks)and 78246 business offices,agriculture-related loan and farmer loan up to 7069.5 billion yuan and 3388.9 billion yuan,accounting for 30%and 63.2%of all financial institutions,and the function of financial support for three rural issues is constantly giving play.The reform of Three Rural Issues Financial Division of the Agricultural Bank gives certain independence in administration mechanism,financial accounting,and risk management.After expansion of pilot scope,business volume and profit amount of branches of pilot county account for 40%and 80%of total business volume and profit amount respectively,showing effective improvement of rural financial service level.Overall plan for reform of agricultural development bank was formally completed in November,2014.In future,itwill further strengthen policy function,to practically bring backbone function of rural financial system into full play.Postal Savings Bank should bring into play advantages of nationwide network and constantly enhance county-wide financial services.State Development Bank should bring into play financial support role in promoting rural and county-wide social construction,and actively support go-out strategy of agriculture.New rural financial institutions play an important role in enriching county-wide financial system,and solving the problems of low coverage,insufficient financial services,and incomplete competition of financial institutions in rural areas[2].

Besides,with deepening and popularization of Internet technology,Internet based finance develops rapidly.Various Internet based financial types appear,such as crowd funding,online sales of financial products,mobile phone bank,mobile payment,etc.Some Internet financial organizations alsomake some valuable exploration in supporting three rural issues concerning agriculture,farmers and countryside.

2.2 Loan lim it of rural cooperative econom ic organizations is constantly increasingIn recent years,with introduction of three rural issues and extensive appearance of rural cooperative economic organizations,under policy support ofmany departments and joint effort of financial institutions,the effort of financial support for rural cooperative economic organizations is constantly strengthening.By the end of2014,the balance of rural loan in financial institutions was 19438.3 billion yuan,with year-on-year growth up to 12.4%;the loan balance of farmerswas5358.7 billion yuan,with year-on-year growth up to 19%;loan balance of rural enterprises and various economic organizations was 14079.6 billion yuan,with year-on-year growth of 10%.

3 Variable selection and model specification

3.1 Selection of variablesIn this study,we selected rural finance amount(RFA),rural finance structure(RFS),and rural finance efficiency(RFE)to reflect development situations of China's rural finance,and use amount of rural cooperative economy(RCE)to manifest development level of rural cooperative economy.Definitions of these four indicators are as follows.

(i)Rural finance amount(RFA).Rural finance amount is usuallymeasured by FIR and M2/GDP.FIR is Financial Interrelations Ratio.Money and quasimoney comprise the sum of currency outside banks,demand deposits other than those of the central government,and the time,savings,and foreign currency deposits of resident sectors other than the central government.This definition ofmoney supply is frequently called M2.Since China's rural financial system is typical bank leading financial system,we used the ratio of loan balance of rural cooperative economic organizations to rural GDP tomeasure China's rural finance amount.

(ii)Rural finance structure(RFS).With great support of government for rural cooperative economy,the function of rural cooperative economy in rural economy will become more and more important.Therefore,we selected the ratio of loan balance of various rural cooperative organizations to rural loan balance to represent rural finance structure.

(iii)Rural finance efficiency(RFE).The rural finance efficiency level reflects the ratio of loan balance to deposit balance.In this study,we used the ratio of loan balance of rural cooperative economy to rural cooperative economy depositbalance to represent the rural finance efficiency.(iv)Amount of rural cooperative economy(RCE).In order to ensure quantization and availability of the study,we selected the GDP of primary industry as amount of rural cooperative economy.Compared with total GDP,the GDP per capita can better reflect actual situation of rural economic growth,sowe selected rural GDP per capita tomeasure rural economic development level.

3.2 Model specificationModel specification refers to the description of the process by which the dependent variable is generated by the independent variables.Thus,it encompasses the choice of independent and dependent variables,aswell as the functional form connecting the independent variables to the dependent variable.Specification can also include any assumptions about the stochastic component of the model.In this sense,specification should bemade before estimation.Considering China's rural cooperative economy develops rapidly in recent years,there are relatively few data available,small sample data reflect incomplete and unclear information,we adopted grey correlation analysismethod to discuss the relationship between rural finance and rural cooperative economy.For size of sample data and whether conforming to typical probability distribution,there isno requirement in the grey correlation analysismethod.Besides,it does not need much calculation,so it is very convenient,and therewill not inconsistency between quantitative results and qualitative analysis results[3].The basic idea is using similarity level of geometric shape of data curves for time series tomeasurewhether they are closely connected with each other.If curves are closer to each other,the correlation between corresponding series is higher;otherwise,the correlation will be lower[4].

4 Em pirical analysis

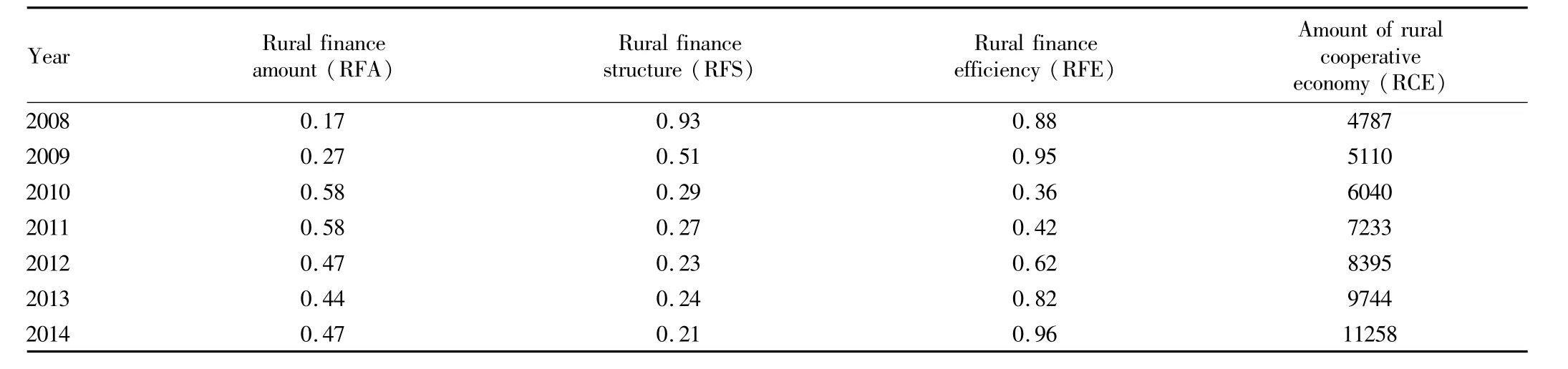

4.1 Data source and processingOriginal data of this study were selected from websites of State Statistical Bureau,The People's Bank of China,China Statistical Yearbook,and Almanac of China's Finance and Banking.According to above-mentioned definitions of variables,wemade processing of these original data and obtained following indicator assignments for rural finance and rural cooperative economy,as listed in Table 1.

Table 1 Indicator assignments of rural finance and rural cooperative economy

4.2 Grey correlation analysisGrey correlation analysis adopts a specific concept of information,and it defines situations with no information asblack,and thosewith perfect information as white.However,neither of these idealized situations ever occurs in realworld problems.In fact,situations between these extremes are described as being grey,hazy or fuzzy.Therefore,a grey system means that a system in which partof information is known and part of information is unknown.With this definition,information quantity and quality form a continuum from a total lack of information to complete information-from black through grey to white.Since uncertainty always exists,one is always somewhere in the middle,somewhere between the extremes,somewhere in the grey area.Steps for data processing of grey correlation analysis are as follows:

Step one:select reference series X0=(x01,x02,x03,x04,x05,x06,x07),and comparison series Xi=(xi1,xi2,…,xi7),where i=1,2,3.In this study,we took the amountof rural cooperative economy(RCE)as the reference series,and took rural finance amount(RFA),rural finance structure(RFS)and rural finance efficiency(RFE)as comparison series.

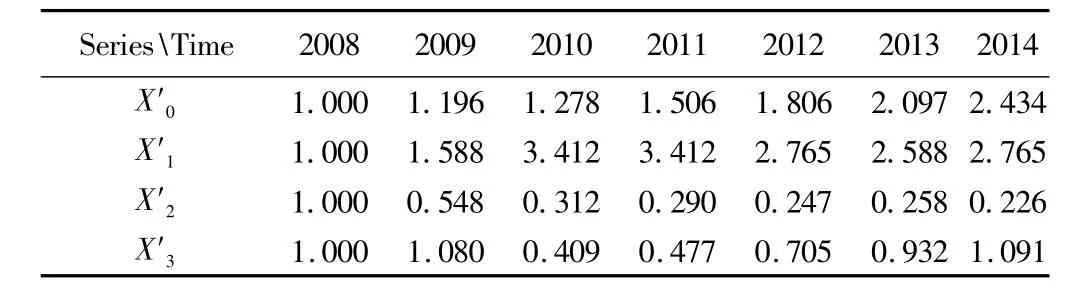

Step two:take dimensionless(standardized)processing of variables.Because data of serieshave differentunits,to eliminate incommensurability generated from dimensionless processing,we generallymake dimensionless processingwhen making grey correlation analysis.Commonmethods include initial valuemethod and mean valuemethod.We adopted initial valuemethod.The equation is X′i=Xi/xi1=(x′i1,x′i2,…,x′i7),where i=0,1,2,3.Table 2 lists initial values of series obtained from dimensionless processing.

Table 2 Initial values of series

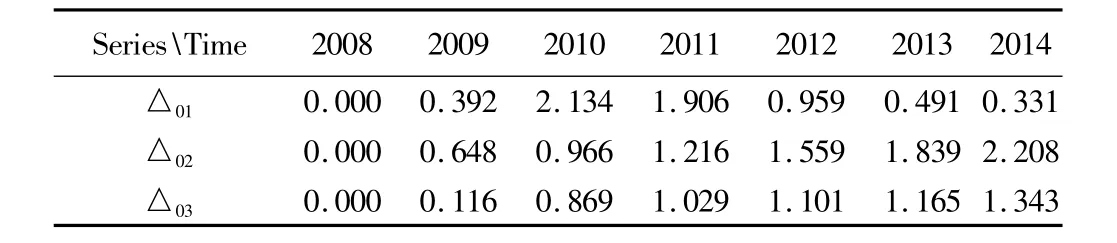

Step three:calculate absolute difference between comparison series and reference series in the same period,written as△0i=|x0(k)-xi(k)|,i=1,2,3;k=1,2,…,7.

Table 3 Absolute difference of series

Step four:select themaximum value and minimum value from absolute difference of series.The maximum difference is M =MaxiMaxk△i(k),while theminimum difference is m=MiniMink△i(k).From Table3,we could find thatM =2.208,andm =0.000.

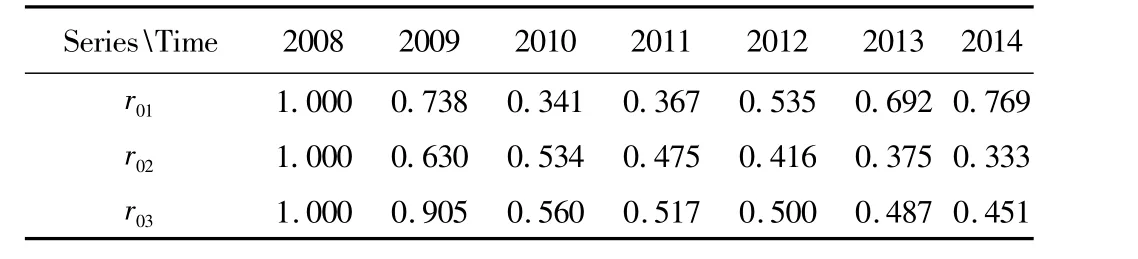

Step five:calculate the grey correlation coefficient.r0i(x0(k),xi(k))=(Δmin+ρΔmax)/(Δi(k)+ρΔmax),whereρ denotes identification coefficient.Generally,0≤ ρ≤1.In this study,ρ=0.5.Calculation results are listed in Table 4.

Table 4 Grey correlation coefficient

Step six:calculate the grey correlation.

Using the above equation,we can calculate the grey correlation of the amount of rural cooperative economy(RCE),rural finance amount(RFA),rural finance structure(RFS),and rural finance efficiency(RFE),R01=0.635,R02=0.538,and R03=0.632.

Through above empirical analysis,it can be seen that the correlation between rural finance amount,rural finance structure,and rural finance efficiency and rural cooperative economy is greater than 0.5.It indicates that the influence of these three indicators is significant on growth of rural cooperative economy,and rural financial development effectively promotes rural cooperative economic development.From further comparison of the grey correlation between these three rural finance indicators and rural cooperative economy,we found that the sequence is R01>R03>R02.It reflects that rural finance amount plays the greatest role in rural cooperative economic development,followed by rural finance structure,and the least is rural finance efficiency.

5 Policy recommendations

Based on the above conclusions,we came up with following recommendations for improving financial support of development of rural cooperative economy.

5.1 Improving existing rural finance system and innovating on rural financial service productsAs entities of rural production development,rural cooperative economic organizations take on different characteristics of types,and agricultural cooperative organizations also have diversified fund demand.Thus,only in diversified condition,financial institutionsmay realize complementary advantages and greatly satisfymulti-level financial demands of agricultural cooperative organizations[5].According to international experience,it is recommended to establish rural policy financial system,rural cooperative financial system and agricultural insurance system,make them complementwith each other and promote each other,to jointly support development of rural cooperative economic organizations.Besides,it is recommended to improve financial services,innovate on financial products,and increase credit input according to characteristics of fund demands of rural cooperative economic organizations.Main points should be focused on guaranteemanner,credit limit,and loan rate,tomanifest convenient,individuality,and flexibility,and develop suitable credit products of specialized cooperative organizations[6].

5.2 Further improving credit security mechanism for rural cooperative econom ic organizationsFirstly,it is recommended to actively implement credit cultivation of rural cooperative economic organizations,gradually realize participation of whole members of rural cooperative economic organizations,and link the credit of each member with the corresponding rural cooperative economic organizations.Secondly,it is recommended to set up specialized farmer cooperative credit security fund composed of local government,related financial institutions,agricultural insurance companies,and leading enterprises,to provide security services for promising rural cooperative economic organizations[7].Thirdly,it is recommended to establish risk compensationmechanism.Since agriculture,farmers and rural areas are weak,agriculture-related security risk is relatively high,it is recommended to introduce agricultural insurance,to provide insurance support for development of rural cooperative economic organizations,decentralize credit risk of financial institutions,and improve enthusiasm of financial institutions for granting credits.

5.3 Further improving financial,taxation,and monetary policy combined positive incentivemechanismAs tomonetary and creditpolicies,it is recommended to comprehensively use variousmonetary policy tools,to extend fund sources of rural financial institutions.In the first place,it is recommended to implement lower rate of reserves for rural financial institutions and enhance fund strength of rural financial institutions.In the second place,it is recommended to raise support for re-lending and rediscount,to bring into full play positive incentive function of agricultural support,small-sum re-lending and re-discountsupport.In financial policies,it is recommended to follow the principle of"government guidance and market operation",comprehensively take advantage of preferential tools such as reward,subsidy,and tax,and mainly support financial institutions to launch small-sum loan for farmer households,new agricultural operation entity loan,insurance for staple agricultural products,bank card withdrawal support,remittance,and transfer of account,etc.

[1]Decision onmajor issues concerning comprehensively deepening reforms issued by Central Committee of Communist Party of China[M].Beijing:Beijing People's Publishing House,2013.(in Chinese).

[2]Rural Financial Service Research Group of People's Bank of China.China Rural Finance Service Report2014[M].Beijing:China Financial Publishing House,2015.(in Chinese).

[3]LIU SF,DANG YG,GAO ZG,etal.Grey system theory and its application[M].Beijing:Science Press,2004.(in Chinese).

[4]LIX,ZHU YC.Gray correlation analysis about the income and consumption patterns of rural residents[J].Statistical Research,2013(1):76-78.(in Chinese).

[5]WANG LX.The innovation of finance supportmode in the development of agricultural cooperative organization[J].Academic Journal of Zhongzhou,2013(7):36-41.(in Chinese).

[6]HU ZH.On financial services for frmers specialized co-op(FSC)[J].Journal of Central University of Finance&Economics,2010(8):34-38.(in Chinese).

[7]QIN YL.Study on the development of rural cooperative economic organization supported by finance[J].South China Finance,2011(12):79-81.(in Chinese).

Asian Agricultural Research2015年7期

Asian Agricultural Research2015年7期

- Asian Agricultural Research的其它文章

- Em pirical Study on Online Political Participation of Young Migrant Workers

- Strategic Analysis on Objectives of National Grain Security

- Further Understanding of the Food Safety Problem

- Land Circulation and Increase of Farmers'Income:A Case Study of Dazhou City

- Reform of Rural Land System from the Perspective of New Urbanization

- How to Develop the Tea Industry in Leiyang City?