An Empirical Study of Economic Growth,Human Capital and Financial Development in Qingdao City

Liping KE

School of Economics,Ocean University of China,Qingdao 266100,China

1 Introduction

There are many factors influencing economic growth,and human capital and financial level are publicly known to play a long-term role in promoting economic growth.Human capital is an important source for scientific and technological progress,and it can exert a long-term impact on economic development.Many regions have taken positive incentives in order to attract the best talents,such as providing housing subsidies for many years to graduating students.At the same time,the level of financial development can promote the development of new industries,thus raising the employment rate.According to Okun's Law,for each additional 2%of employment rate,GDP will increase by an average of1%,so it can accelerate economic development to some extent.In this paper,through the empirical study of the influence of human capital and financial development on economy,we analyze the quantitative relationship between human capital and financial development.Since the regional coordination problems are affected by many factors and there is a certain degree of diversity,we build the indicator system to evaluate the coordination between human capital and economic growth,between financial development and economic growth at present in Qingdao City,respectively,and propose realistic improvement measures.

2 Current development of economy,finance and human capital in Qingdao City

2.1 EconomyJudging from the economic aggregate,in recent years,there has been a steady increase in economic level of Qingdao City,and noticeably the proportion of output value of tertiary industry to GDP has increased continuously.From 2009 to 2011,the city's GDP was 485.387 billion yuan,566.619 billion yuan and 661.56 billion yuan,respectively,with the annual growth rate of 16.74%,16.76%and 16.75%,respectively.In 2009,the total output value of primary industry was23.025 billion yuan,accounting for 4.7%of GDP;the total output value of secondary industry was242.014 billion yuan,accounting for 49.9%of GDP;the total output value of tertiary industry was 220.348 billion yuan,accounting for 45.4%of GDP.In 2010,the total output value of primary industry was27.699 billion yuan,accounting for 4.9%of GDP;the total output value of secondary industry was 275.862 billion yuan,accounting for 48.7%of GDP;the total output value of tertiary industry was 263.058 billion yuan,accounting for 46.4%of GDP.In 2011,the total output value of primary industry was30.638 billion yuan,accounting for4.6%of GDP;the total output value of secondary industry was 315.072 billion yuan,accounting for47.6%of GDP;the total output value of tertiary industry was 315.072 billion yuan,accounting for 47.8%of GDP.As can be seen from Fig.1,the primary industry basically grew,the secondary industry was basically stable and the tertiary industry abnormally grew.The average growth rate of tertiary industry in the three years in Qingdao City was 19.72%,while the average growth rate of tertiary industry in China in the same period was 16.92%,showing that the economic growth in Qingdao City was higher than the national average.

2.2 FinanceThe financial industry continues to grow in Qingdao.During 2009-2011,the average annual growth rate of deposits was11.08%,and the average annual growth rate of loans was 12.55%.At the end of 2011,the balance of savings was 863.85 billion yuan,an increase of12.79%,while the balance of loans was 694.775 billion yuan,an increase of 18.03%.The number of practitioners in financial institutions increased from 41000 in 2009 to 51000 in 2011,with the average annual growth rate of 7.55%.However,the organizational system continues to improve,initially forming the modern financial organization system with complete functions.As of the end of2011,there were a total of 38 banking institutions above the level of branches in Qingdao City,including3 policy banks,5 state-owned joint-stock banks,9 joint-stock commercial banks,9 foreign banks;there were 39 insurance companies,including 19 property insurance companies,1 export credit company,17 life insurance companies,1 health insurance company,and 1 pension insurance company.However,the finance is still facing the shortage of professionals,especially the technical and management personnel.

2.3 Human capitalIn recent years,the employment scale in Qingdao City has continuously expanded.As of 2011,1810000 million people were employed in the city,730000million rural labor forces were transferred,and the registered urban unemployment rate was less than 2.92%,lower than the national average.The total regional population increased from 7629161 in 2009 to 7663612 in 2011,with the average annual growth rate of0.15%.The number of students in colleges and universities was275157 in 2009 and 291453 in 2011,with the average growth rate of 1.94%.The number of labor of the right age was5138000 in 2008 and 5511800 in 2011,with the average annual growth rate of 2.37%.The number of environmental protection employees increased from 21000 in 2008 to 25000 in 2011,with the average annual growth rate of5.98%.The number of resource exploration employees increased from 24000 in 2008 to 30000 in 2011,with the average annual growth rate of7.72%.The number of labor in primary,secondary and tertiary industries was 1024000,2208000 and 1906000 in 2008,respectively;1060200,2270800 and 2180800 in 2011,respectively,with the average annual growth rates of1.16%,0.94%and 4.59%,respectively.The number of labor in three industries and the growth rate trend during 2000-2010 can be shown in Fig.2.

3 Empirical study of influence of financial development and human capital on economic grow th

3.1 Data sourcesThis paper selects the time series data during 1988-2011 in Qingdao City,uses the number of college students for every 10000 people as the human capital,uses the balance of loans as the level of financial development,and uses the GDP converted by comparable prices to measure the level of economic development.In order to study the elasticity of human capital and financial development to economic growth,respectively,we take logarithm of the above indicators,respectively.The data are fromQingdao Statistical Yearbook(2012).

3.2 Unit root testFor time-series data,in order to avoid spurious regression problem,we need to first check the stationarity of the series data,namely whether there is a unit root in the series.In this paper,we use ADF test method to test economy(LNGDP),financial Development(LNJR)and human capital(LNRL).Test results are shown in the following table.According to the test results,the original series LNGDP,LNJR and LNRL are all non-stationary series,and after the first order difference,the derived DLNGDP,DLNJR and DLNRL are all stationary series,so we can call economic growth,financial development and human capital the first order integrated series,denoted as GDP~I(1),JR~I(1)and RL~I(1),respectively.In order to verify whether there is a long-term stable equilibrium relationship between human capital or financial development and economic growth,there is a need to perform the cointegration test.

3.3 Cointegration testWe use the classic EG two-step method to test LNGDP,LNJR and LNRL,and we first use the least square method to perform the linear regression of LNGDP,LNJR and LNRL.The results are shown in Table 2.

In the above table,R2=0.9949,correctedR2=0.9944 andFstatistic=1957.04.The test parameters are significant,and the regression results are quite good.The regression equation is as follows:

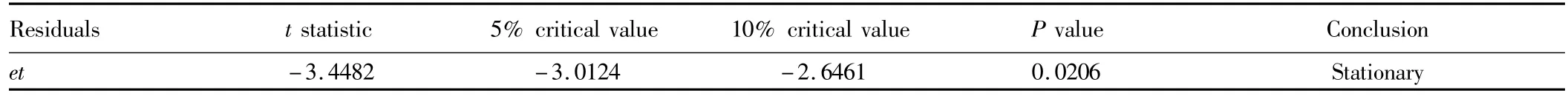

Then we use ADF method to carry out the stationary test on the residual series,and the test results can be shown in Table 3.From the stationary test results on the residual series in Table3,it is found that P value of residual series is less than 0.05,so at the 5%significance level,it rejects the null hypothesis with one unit root,that is,the residual series is stationary,namely et~I(0).Therefore,there is a long-term dynamic equilibrium relationship between LNGDP and LNJR or LNRL.

Table 1 Unit root test

Table 2 Regression results

Table 3 Unit root test results of residual series

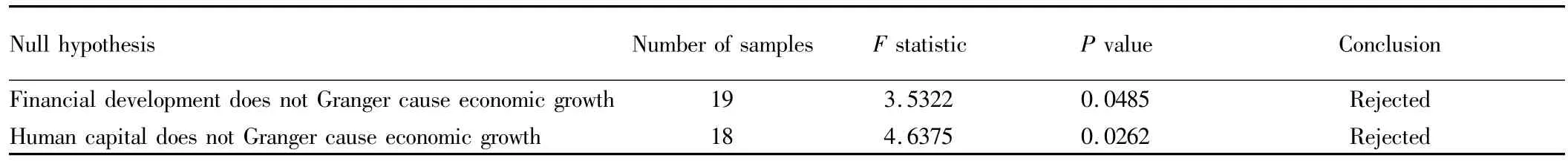

3.4 Granger causality testAlthough there is a long-term dynamic equilibrium relationship between economic growth and human capital or financial development,we can not identify which causeswhich.The Granger causality test results are shown in Table 4.Through the Granger test,when the lag is 3,it is found that in the case of the null hypothesis"financial developmentdoes not Granger cause economic growth",Pvalue is 0.0485,less than the critical value(0.05)at the5%significance level,so the null hypothesis is rejected,and it is believed that financial development Granger causes economic growth.Similarly,when the lag is4,it is found that in the case of the null hypothesis"human capital does not Granger cause economic growth",P value is 0.0262,less than the critical value(0.05)at the 5%significance level,so the null hypothesis is rejected,and human capital is believed to Granger cause economic growth.According to the regression results,it can be concluded that for each additional1%of financial level,GDPwill increase by an average of 0.8987%;for each additional1%of human capital,GDPwill increase by an average of 0.0665%.So promoting the financial development and increasing human resources can accelerate economic development to some extent.

Table 4 Granger causality test on economic grow th and financial development or human capital

4 Coordination between financial development and human capital

From Granger causality test and multiple regression analysis,we can find that both finance and human capital are important factors influencing economic growth,so it is necessary to study the coordination between human capital and finance.In this paper,on the basis of synergetics,financial development and human capital,we introduce the coordinated development model to objectively assess the coordination between financial development and human capital in Qingdao City.

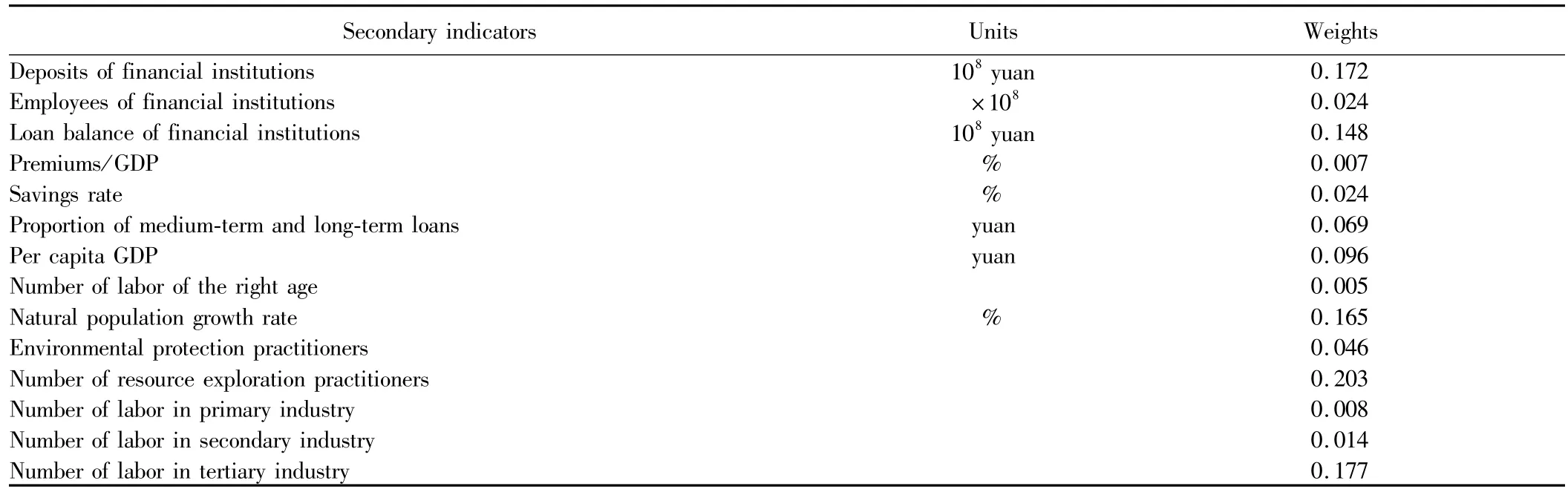

4.1 Building of indicator systemThe financial sub-system is divided into two primary indicators(financial scale and financial efficiency).The financial scale is divided into three secondary indicators(deposits of financial institutions,employees of financial institutions,and loan balance of financial institutions),and the financial efficiency is divided into four secondary indicators(premiums/GDP,savings rate,proportion of medium-term and longterm loans and per capita GDP).The human capital sub-system is divided into four primary indicators(population system structure,population-environment system structure,population-resource system structure,and population-society-economy system structure).The population system structure includes three secondary indicators(number of labor of the right age,natural population growth rate and number of environmental protection practitioners).The population-resource system structure includes one secondary indicator(number of resource exploration practitioners).The popula-tion-environment system structure contains one secondary indicator(environmental protection practitioners).The population-societyeconomy structure includes three secondary indicators(number of labor in primary industry,number of labor in secondary industry and number of labor in tertiary industry).

Table 5 Units of and weights of secondary indicators

4.2 Data processingThe data selected for the coordination study are the time-series data during 2000-2011.We need to first normalize the raw data and perform the dimensionless processing on the indicators.The specific steps are as follows:

(i)Assuming the original series hasmrows andncolumns,the original data can form a matrixX=(x)m×n,wheremis the time axis andnis the number of indicators.

The coordination degree is an important concept in the synergistic theory.In this paper,we choose the coordination degree calculation formula developed by Yang Shihong inUrban Ecological and Environmental Science(2011)to reflect the coordination between human capital and level of financial development.It is calculated as follows:

Cv=,wherexandyrepresent the comprehensive level of financial development and comprehensive level of human capital,respectively;Cvis the coefficient of variation(the smaller the value,the higher the level of coordination).According to the above formula,it is found that ifCvis smaller,Cwill be bigger and better,so we can build the coordination degree model as follows:This coordination degree can reflect the status of coordination between financial development and human capital,but it does not interrelate the overall level of the two,so it is necessary to introduce the integrated development model of coordination degree.The specific form is as follows:D=,whereax+byis the linear combination of financial development and human capital;aandbare called the additional factors of influence of financial development and human capitalon economy,respectively,and the greater the value,the higher the degree of influence,but the value is not equal to elasticity.Both the financial development and human capital have a great impact on economy,but the degree of impact is different.From the previous regression equation,it can be found that financial development has a great impact on economy,so let the weighta=0.6,b=0.4.The greater the value ofD,the higher the degree of coordination.

4.3 Analysis of the coordination between financial development and human capitalAccording to the entropy calculation steps,based on the weights of various indicators,we use the weighted average method to calculate the comprehensive level of financial development and human capital,respectively.The calculation results are as follows:

Table 6 Comprehensive level of financial development and human capital in Qingdao City

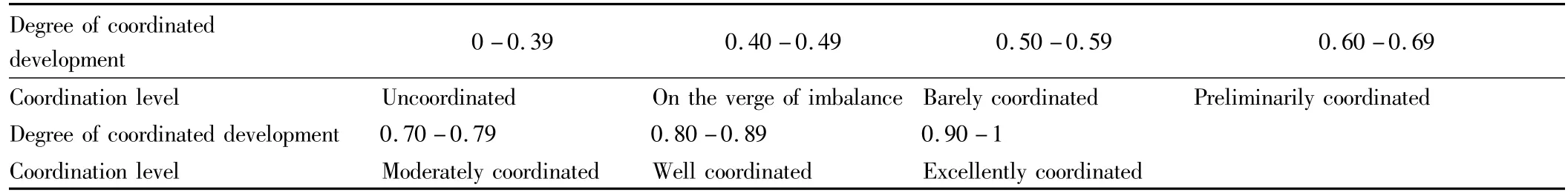

The grading of degree of coordinated development is as follows:

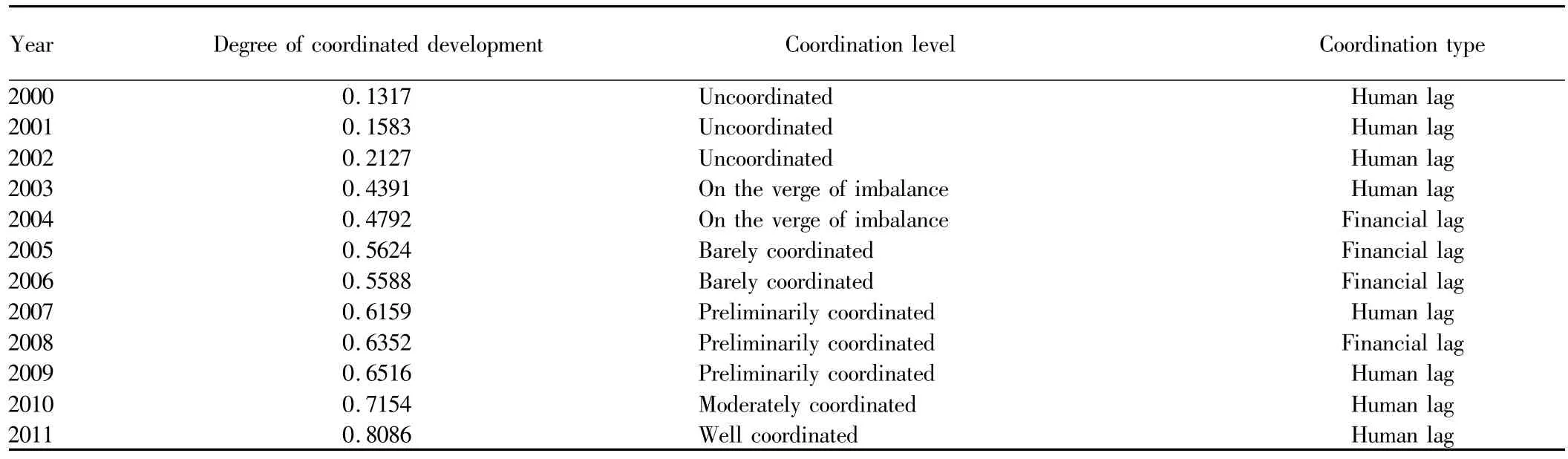

According to the degree of coordination between the level of financial development and human capital in Qingdao City and the grading of coordination,we get the coordination between financial development and human capital during2000-2011,and the lag is compared according to the comprehensive level of development.The specific results are shown in Table8.According to the coordination level,the coordination between the level of financial development and human capital in Qingdao City is divided into six stages:2000-2002(uncoordinated);2003-2004(on the verge of imbalance);2005-2006(barely coordinated);2007-2009(preliminarily coordinated);2010(moderately coordinated);from 2011(well coordinated).During 2000-2002,the pace of coordinated development was common;during 2003-2009,the pace of coordinated development was good;during 2010-2011,the pace of coordinated development was the best.Through the study on the coordination between the level of financial development and human capital in Qingdao City,it is found that the coordination went through five stages(human lag-financial lag-human lag-financial lag-human lag).During 2000-2003,the human capital development always lagged behind the financial development,and went through the process of"uncoordinated-on the verge of imbalance";during 2005-2009,the coordinated development shifted from barely coordinated to preliminarily coordinated,and the human capital started to have the trend of exceeding financial development;during 2009-2011,the financial development was accelerated,from preliminarily coordinated to well coordinated,indicating that the financial development was healthy and rapid.

Table 7 The grading of degree of coordinated development

Table 8 The level of coordination between financial development and human capital in Qingdao City

5 Conclusions and recommendations

Financial development and human capital have a significant impact on the economic growth,and the elasticity of impact factors is 0.8987(financial development)and 0.0665(human capital),respectively.Improving the level of financial development and human capital will play a role in boosting the economy.Through the cointegration test,it is found that there is a long-term stable dynamic equilibrium relationship among the level of financial development,human capital and economic level.Through the Granger causality test,it is found that both financial development and human capital Granger cause economic growth.The coordination between financial development and human capital in Qingdao City is going good,however,the human lag is still serious,indicating that the quantity and quality of excellent talents to some extent affect the human capital,and thus affect the economic growth.To further enhance the level of coordination between finance and human capital,the relevant departments of Qingdao City need to strengthen the talent training,increase funding for education and technology,offer housing and living subsidies for excellent talents,and increase the number of research institutions,which can improve the level of coordination between finance and human capital,thus speeding up economic development.

[1]SUIYH.Theory of coordinated development[M].Qingdao:Qingdao Ocean Press,1990.(in Chinese).

[2]YANG SH.Urban ecological environment[M].Beijing:Science Press,2001.(in Chinese).

[3]MA XH.The evaluation index system research of sustainable development[J].Theoretical Exploration,2006(2):10-13.(in Chinese).

[4]LIU Y.Study on comprehensive coordination degree assessment of regional PRED system[J].Statistics and Decision,2009.(in Chinese).

[5]HUANG Y.Study on coordination between technology progress and economic development in railway[D].Beijing Jiaotong University,2009.(in Chinese).

[6]XU S,JIANG CW.Inquiry into Qingdao financial industrial development[J].Finance Economy,2009(8):63-64.(in Chinese).

[7]YOU HJ.Analysis on the coordination of industrial structure and employment structure——Taking Shanxi Province asan example[J].Sci-Tech Information Development&Economy,2010(15):123-125.(in Chinese).

[8]LU J,YANG JJ.The analysis of coordinated development evaluation of economy and ecological environment in Baoying County[J].Inner Mongolia Environmental Protection,2010(3):46-49.(in Chinese).

[9]GAO Y,DING YS.Study on national spatial comprehensive evaluation based on entropy evaluation method[J].Academic Forum,2010(1):122-125.(in Chinese).

[10]SUN PJ.Analysis of the coordination of population-economy-space in Beijing[J].City Planning Review,2012(5):38-45.(in Chinese).

Asian Agricultural Research2015年3期

Asian Agricultural Research2015年3期

- Asian Agricultural Research的其它文章

- Empirical Analysis of the Role of Urbanization in Driving the Grow th of Rural Residents'Consumption

- Study on the Export Competitiveness of China's Flower Seed lings

- Comparative Analysis of Food Price Policies in the Developed Countries

- Impact of Agricultural Modernization,Economic Grow th and Industrialization on the International Competitiveness of Agricultural Products:Based on the Empirical Analysis of Cointegration and VEC Model

- Evolution of Family Enterprises of Feed and Veterinary Drugs and Introduction of Professional Manager System

- Analysis of the Factors Influencing Breeding Record Establishment of Sheep-raising Households or Farm s Based on Logit-ISM:Based on 849 Questionnaires from 17 Cities in Shandong Province