让思想在文书中闪光

谷约

留学文书要切忌假、大、空,一定要有实质内容和入木三分的思想。所谓“思想”就是在描写个人经历的基础上,加入自己对于某个问题的分析或思考,从而让文书闪耀出思想的光芒。很多申请者急于表达自己学习成绩好、实习经历丰富、道德高尚,但往往忽略考虑以下问题:自己对社会上某个现象或问题有没有独到的见解?在看似平常的人、事、物背后,自己能不能悟出一些不平常的道理?对自己遇到的挫折和曾犯过的错,是否有深刻的反省能力?为什么对某个专业感兴趣,是否了解其历史和现状?例如,当遇到“你如何展现领导风范?”这个题目时,很多申请者会不厌其烦地罗列甚至编造自己当过课代表、班长、学生会主席等。在中国官本位文化中,这些头衔也许会吸引某些人。但在美国,招生官们并不重视你有何种头衔,他们更想了解申请者头脑里有没有领导意识,崇尚的是什么领导品质,这些品质是如何具体落实到申请者的言行中,或者申请者从具体的事例中有没有悟出一些比领导头衔更重要的东西。他们希望看到的是申请者对问题的思考和分析,而不只是对某些事件的简单罗列。

案例分析

下面我们通过案例来具体谈谈在文书写作中该如何做到对问题进行深刻的思考。

申请者X想赴美国攻读金融工程硕士学位。他在文书原稿中机械地罗列个人事迹,写作方式是典型的中国学生思路。申请者提供了文书的中文初稿,大致内容如下:

我从小下象棋,棋艺高超。我对数字敏感,注重细节。父母认识很多金融工作者。通过家人介绍,我出资参股一家网络游戏公司私募股权项目,帮助合伙人分析公司的前景。大学实习,帮助客户开通创业板业务,做行业分析。在国内,衍生品定价、期权交易策略还不成熟。我对衍生品交易这方面感兴趣,模拟炒股比赛得第三名。

全文读下来就是一篇流水账,没有一个鲜明的主题,每部分之间缺乏逻辑关联。申请者的目的是希望通过此种貌似面面俱到的事迹罗列,让招生官看到一个“全面发展”的自己。但这种没有主题、缺乏逻辑的文书只能让招生官觉得你是一个没有深度、不爱思考的人。

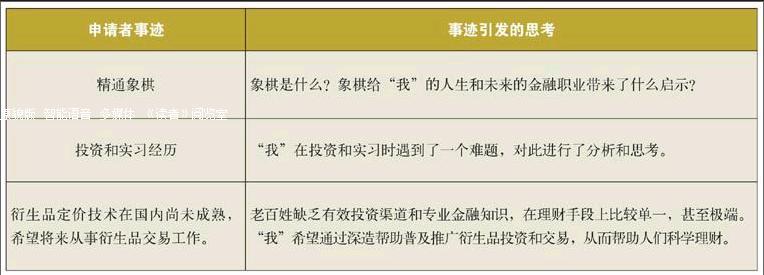

为了“拯救”X,我们从他提供的纷繁芜杂的原始素材中选出几件重点事迹,建议他淡化对个人事迹的描写,突出自己对事件的思索(见下表)。

除了让申请者突出其对事迹的思考外,我们还建议他合理组织安排文章结构。申请者按照建议对文书进行了改写,之后文书质量大大提高。参考范文如下。

I love xiangqi, also known as Chinese chess. I play competitively at the university league level. Xiangqi is a two-player board game (棋盘游戏) similar to international chess. The game originated in China and is widely popular in Chinese-speaking communities all over the world. It is also gaining popularity among non-Chinese speakers in the West, where players compete at a very high level. Compared to international chess, while the underlying structures are the same, the Chinese version is more fast-moving and combative. The moves and rules are different; the “maneuverability (操控性) ratio” of xiangqi is higher and thus somewhat more difficult. Many of Chinas world-class international chess masters are said to have started with Chinese chess before switching to international chess.

评析:外国读者一般不懂什么是“中国象棋”,所以申请者有必要先对其做一番介绍,并由此引出文章主题。

Xiangqi has taught me many lessons about economics, financial decision making, winning and losing, and about life itself. First, xiangqi teaches about thinking before acting; planning before execution. Sometimes one has to sacrifice a pawn (called “soldier”) for positional advantage. Self-discipline and patience are vital because long term gain is almost always the result of short term denial of instant gratification. The same is true with investment. Xiangqi is as much a game about what I want to do to attack as it is about what the reaction of the opponent is going to be: and if the opponent is going to take action A, then how do I protect my own asset, or if the opponent is going to take action B, then what do I do to prevent the opponents move; and if it is unavoidable what can I do to reduce the possible damage to a minimum? There should always be backup plans. Flexibility, the willingness and readiness to change a game plan, i.e., to make adjustments, is crucial. Finally, xiangqi is all about positive thinking: very often a bad decision or a bad move can spell disaster. I can keep on thinking what I could have done or what I shouldnt have done, but it is bad time management to dwell on mistakes. There is always time, usually after the game, to revisit the problem and to draw lessons, but the focus should be forward thinking; namely, what I can do to fix the problem now or how I can turn the disadvantage into advantage.

评析:本段把象棋和“我”的专业进行类比,得出三个启示:谋定而后动;知己知彼;正面思维。写“我”是象棋高手,远不如写象棋给“我”带来的思考和启示好,前者是简单的表扬,后者是“悟性”的表现。

I am a financial engineering major at XXX University of Finance and Economics, arguably one of the best institutions in China in this particular field. My four-year education there has taught me the basics of computational models, programming and theoretical frameworks to investigate and evaluate derivative products (衍生产品), and fixed asset investments. I have also studied global trading markets and practices. I won 3rd place in a campus-wide trade simulation contest during my sophomore year. Outside the school environment, I have invested in the private equity (股权) of XX, a mobile game publisher that helps Western companies enter China. In addition to being a shareholder in the company, I have played consultative roles in forming foreign contracts and other legal documents and in capital operation. Interestingly, when I interned at the Bank of China during my junior year, I met a couple of Americans who asked me why many Chinese were obsessed with gambling. They were not referring to speculative activities in the financial world, but rather gambling in casinos (赌场) in Las Vegas and in Macau. This was a tough question because there simply was no easy answer to it. The irony is that statistics show China enjoys the highest saving rate in the world. Chinese people just hate to live on borrowed money; they hate to pay high interest on credit cards; historically they do not trust that the government, somehow, will take care of them when they age. The only way they can expect to be able to pay their bills when they retire is if they have sufficient savings in the bank and if their children will chip in (共同支付). And yet, it is also true that the Chinese, some of them anyway, do gamble and gamble big; sometimes losing their lifes saving. I told my American friends the possible reasons were 1) Chinese people believe in luck and luck is something that is based purely on intuition, superstition, and personal wish; it is not based on science or logic or facts; 2) my fellow countrymen have little access to professional trading and risk management guidance and have inadequate knowledge of the numerous financial investment products available; 3) if they do have information about certain products being offered in the market, they do not have enough trust in the information or the products themselves. These reasons, plus many others, work to push them to casinos in droves. Too bad for them, but good for Las Vegas and Macau.

评析:本段主要描写了申请者在专业学习上的几段经历,叙述详略得当,从校内到校外,逻辑合理,语言流畅。申请者在写银行实习经历时,通过老外的问题(为什么许多中国人喜欢到赌城去赌博?)巧妙地引出自己深刻的思考和独到的见解。这段描写既有观察(一方面中国人的储蓄率是全球最高的;另一方面中国人确实有通过赌博来实现一夜暴富的投机心理),又有分析(三个可能的理由,且每个都和专业有关)。最后一句“Too bad for them, but good for Las Vegas and Macau.”反映出申请者的幽默感和对社会不良风气的批判,同时为最后一段“我”的留学动机做好了铺垫。

My design for my future career is one that is intricately tied with the development of comprehensive trading strategies and risk management techniques which can help my clients and customers better balance their profit and risk. I fully believe New York Universitys program in financial engineering matches my professional aspirations. After graduation, I can start with derivatives trading or a structuring position providing individual investors with strategies involving elementary and structured derivatives to manage their risk exposures in various markets. In the long run, Im interested in developing more comprehensive cross asset portfolio (投资组合) management techniques to further optimize strategies provided to clients. I am committed to helping turn gambling on the part of many into a deliberate investment.

评析:本段写“我”的留学动机和职业目标,经过之前三段的铺垫,“我”已经非常明确自己读研究生的方向,学成之后的职业设计也就顺理成章了。