WORK SMARTER, NOT HARDER

By+Zhou+Xiaoyan

SUMEC Group Corp. is one of the largest exporters of machinery products based in east Chinas Jiangsu Province, an economic powerhouse in the yangtze River delta. Founded in 1978, the company used to be a mere original equipment manufacturer for foreign big names. Facing faltering demand and decreasing profit margins after the financial crisis since 2008, the company made a tough decision to change its business model, which later enabled it to transform to an original design manufacturer and finally an original brand manufacturer.

By integrating resources with domestic research institutions and universities, SUMEC has developed many hi-tech products and greatly increased its profitability.

For instance, gasoline engine generators under the companys brand Firman have oc- cupied the No.1 market share in Africa. Highpressure washers under the brand name of Cleanforce are the top seller in the North American market. To date, exports of products under the companys own brands have accounted for 30 percent of the total.

Cai Hongbo, Chairman of SUMEC, said industrial upgrade is the only way out for exporters. “Our core competitiveness should be based on technological innovation and better branding, instead of cheap prices.”

Economic data released earlier this year showed that China had surpassed the United States as the biggest goods trading nation.

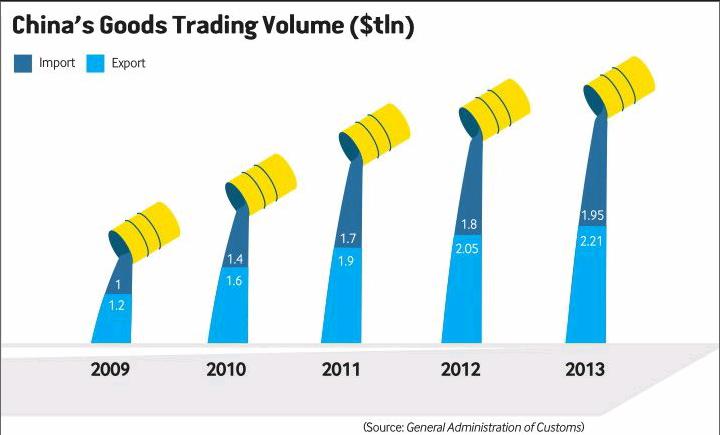

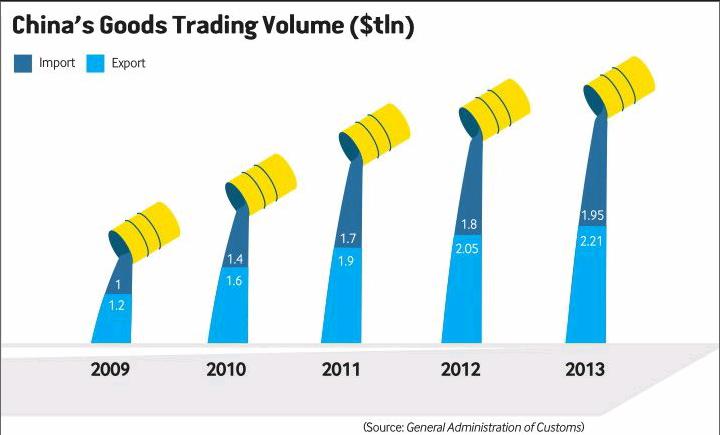

Chinas total goods trade volume in 2013 stood at a record high of $4.16 trillion. Exports reached $2.21 trillion and imports, $1.95 trillion. The World Trade Organization confirmed that Chinas goods trade in 2013 was $250 billion more than the United States.

As big as it is, China is far from a strong trading nation, experts and government officials argue. More needs to be done to improve the countrys trade structure by adding value to exported goods and fostering trade in services.

A rising force

Chinas rise to dominance in world trade happened over a very short period, with the value of Chinese trade roughly doubling every four years over the past three decades.

Since the reform and opening-up policy was adopted in 1978, Chinas trade volume has surged from $20.6 billion to $4.16 trillion, representing a compound annual growth of 16.4 percent.

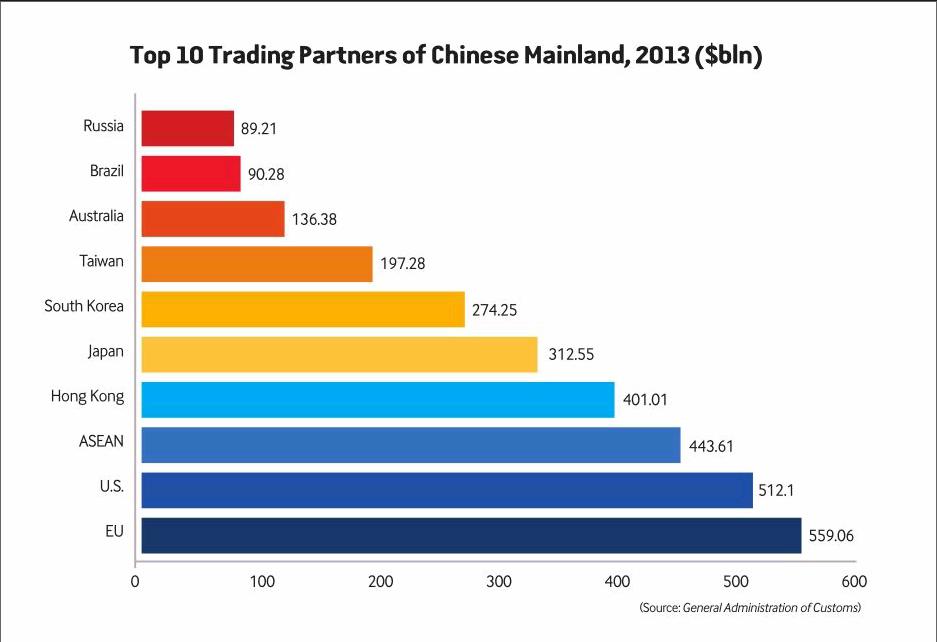

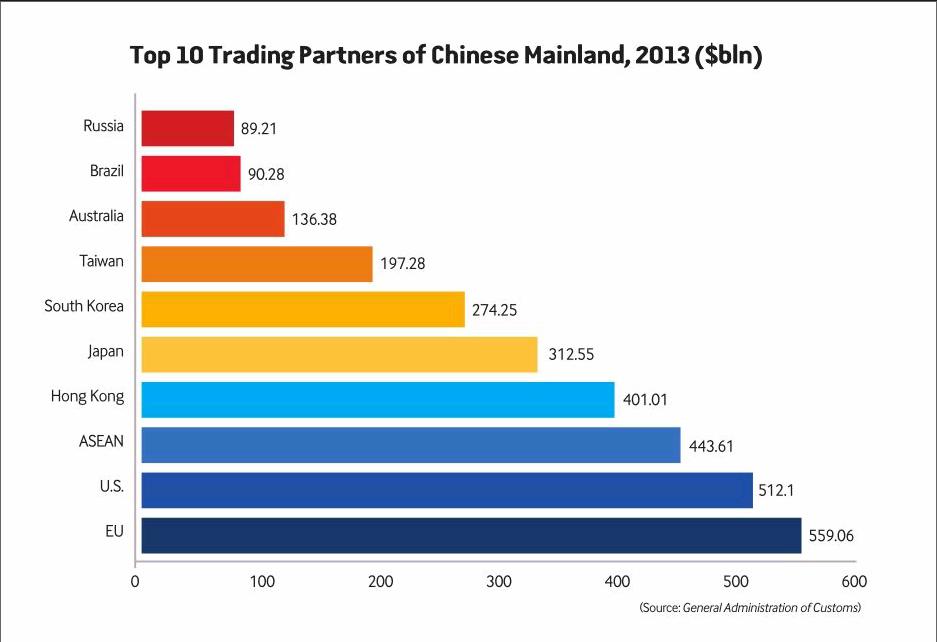

China accounts for 12 percent of global trade volume and is now the largest trading partner of 120 countries and regions. Foreign trade adds 180 million jobs to the country each year and contributing 18 percent of Chinas tax revenues. One out of every four employees in the country works in foreign trade-related businesses, according to the Ministry of Commerce (MOFCOM).endprint

“Foreign trade has become the most dynamic driving force for social and economic development,”said Gao Hucheng, Chinas Commerce Minister.

Bai Ming, a research fellow with the Chinese Academy of International Trade and Economic Cooperation, attributed the leapfrog development of Chinas foreign trade to the reform and opening-up strategy, a global industrial shift and Chinas low cost advantage.

“Since World War II, the global industrial shift has been accelerated. Many industries were transferred from the United States to Japan, and then to the Four Asian Tigers (Hong Kong, Singapore, South Korea, and Taiwan) and later to the Chinese mainland. After that, China became the worlds factory,” Bai told Beijing Review.

Weak links

Analysts, however, said the top trader spot is no reason for gloating as China is far from being a strong trading nation due to a lack of hi-tech exports and the lackluster service-trade data.

“Among our exported goods, most of them have an economically low added value and we have few of our own brands. We still lag behind in global marketing networks and models,” said Gao.

In 2013, Chinas exports of hi-tech products accounted for 29.9 percent of its total exports, but 73 percent of those products were made by foreign-invested companies, according to data from the MOFCOM.

Processing trade still occupies the bulk of Chinas foreign trade, said Liu yuanchun, Deputy Dean of School of Economics at the Renmin University of China. A large amount of components are brought to China to be assembled and then re-exported. MOFCOM figures show the processing trade made up 32.6 percent of total imports and exports in 2013.

“The core technologies are in the hands of foreign companies or joint ventures while Chinese manufacturers are still at the lower end of the industrial chain, living off very thin profits,”said Liu.

“For a long time, Chinese products haves relied on quantity and price advantages for international competitiveness, while lacking core competitiveness and added value,” said Bai.“China is making products that other countries are not willing to. Although it is the top trader of goods, profits belonging to China are definitely not in line with that status.”

Besides the structural problem in Chinas trade of goods, another piece of evidence for China not being strong enough in trade is that its service trade still lags far behind the United States. International trade, however, is now edging away from commodities to services and intellectual property, which happen to be Chinas weaknesses.endprint

Chinas shortcoming in service trade represents a stumbling block on the countrys path to becoming a stronger trading nation. According to the MOFCOM, Chinas service trade reached $539.64 billion in 2013, accounting for 11.5 percent of its total trade volume, far below the world average of 20 percent. The amount is also less than half of that for the United States.

The country also saw a widening deficit of$118.46 billion in service trade in 2013, surg- ing 32.1 percent from the $89.7 billion deficit in 2012. Overall, the country has witnessed a deficit in service trade for 12 consecutive years, according to the MOFCOM.

Zhang Monan, an associate research fellow at the China Center for International Economic Exchanges, said a structural upgrading is also happening in global service trade.

In recent years, service trade has become more dependent on the development of knowledge-, technology- and capital-intensive industries, such as telecommunications and finance, computer software and data processing, rather than on traditional labor- or resourcesintensive service industries such as tourism and sales services.

In China, traditional industries like tourism and transportation still make up the bulk of its service trade, while knowledge- and capitalintensive sectors are relatively weak compared to developed countries. Despite the fact that high value-added industries like insurance and finance have registered robust growth in the past few years, they are far from being capable of playing a leading role, said Zhang.

“Compared with trade of goods, growth in Chinas service trade is much slower. Improving competitiveness in that regard is a must for China at a time when the country is marching toward being a stronger trading nation,”Bai said.

“To support exportoriented service companies, the government should, under the rules of the WTO, grant preferential policies, such as more convenient registration procedures for businesses, introducing clients to them, holding exhibitions to enable them to meet with potential clients and helping to solve disputes between them and their foreign counterparts,”Bai suggested.

Zhang Xiaoyu, a researcher with the Chinese Academy of International Trade and Economic Cooperation, said a “strong trading nation” is not something that a country should deliberately pursue, but should be a natural outcome after having adjusted their domestic economic structure.endprint

“A countrys trade structure is in line with its domestic economic structure. Only when China carries out domestic industrial upgrades and economic rebalancing can it improve its overall trade structure,” Zhang told Beijing Review. “Its bound to be a long process.”

“High-end service exports, such as financial services, cultural products and technology transfer, are Chinas weakest links. Also, Chinas service sector is not as opened up as the manufacturing sector. This problem should be addressed.”

A frequent target

Chinas foray into the global trade market has not always gone smoothly. It has been the most targeted nation in anti-dumping investigations for 18 consecutive years and countervailing investigations for eight consecutive years.

Bai said its inevitable for a big trading na- tion to become a frequent target of trade disputes.

“Its not just an issue for China. When Japan and the Four Asian Tigers emerged as big trading nations, they were faced with the same problem. Till today, trade disputes between the United States and Japan or South Korea still occur frequently.”

“The tallest tree is the one most swayed by the wind,” Bai said. “Since the financial crisis, trade protectionism has become increasingly severe. Restrictions on import quotas from China imposed by other countries are aimed at saving their own economy.”

Zhang said China should treat trade protectionism rationally.

“Chinas peaceful development has broken up the previously established balance. How to increase trading strength while getting along with trading partners is a tough issue China has to face.”

“China does lag behind developed countries in terms of advanced trading concepts, environmental protection and labor protection standards. We should constantly learn from them and shoulder our responsibilities,” Zhang said.

“As painful as it is, it will bring about a better outcome. Chinas trade development should be based on structural adjustment and should be healthy and sustainable. Only when we are willing to give up some current interests can future gains be secured,” Zhang said.endprint