Herbal Tea Dispute

State-owned enterprises should learn to work together w ith their market-oriented partners By Lan Xinzhen

Herbal Tea Dispute

State-owned enterprises should learn to work together w ith their market-oriented partners By Lan Xinzhen

W hen Yao Bo went to work one morning, he didn’t expect to be stabbed in the face.At a hospital in Suzhou, Jiangsu Province,Yao (not his real name), a sales representative for Guangzhou Wanglaoji Pharmaceutical Co.Ltd., recounted the dramatic incident to reporters.The sutured cut looked like a long centipede on the left side of his face. The person who slashed Yao’s face was a worker surnamed Hao from the JDB Group, a competitor.

Rep resen tatives from Guangzhou Pharmaceutical and JDB that day w ere promoting their own tea brands in the same vicinity when events spiraled out of control and got violent.

Com ing from a village in north Jiangsu Province, Yao had worked at Wanglaoji for only two months before he was attacked.Yao said he doesn’t know the person who wounded him and holds no grudge. But he is cognizant of the reason he was stabbed: the resentment between JDB and Wanglaoji.

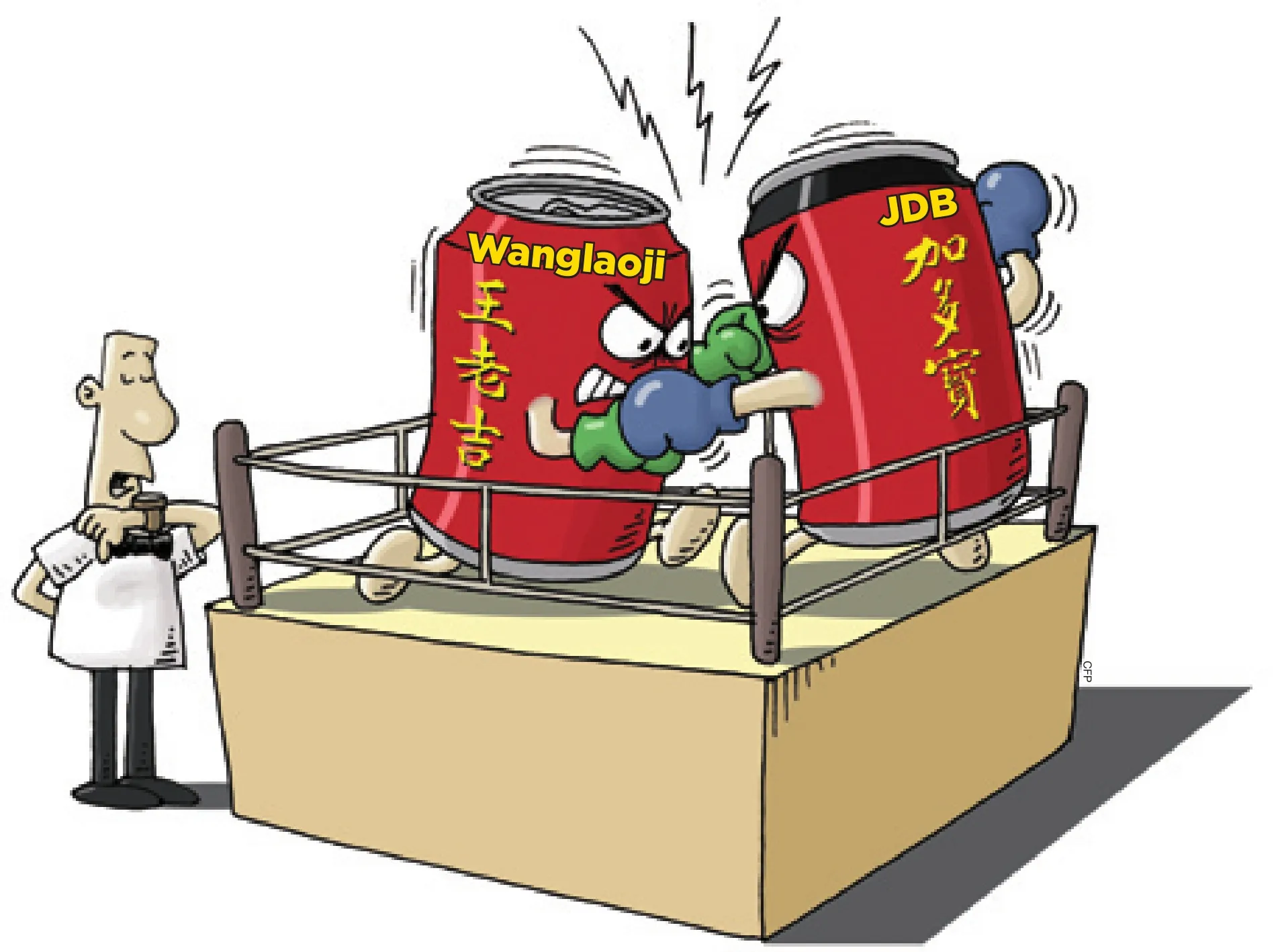

Fist figh t fo r the m a rke t

An herbal teashop called W ong Lo Kat(or W anglao ji) opened in Guangzhou,Guangdong Province, in 1828 and w as named after its founder Wong Chat Bong.In the ensuing decades the herbal tea was sold throughout south China, as w ell as Hong Kong, Macao and Taiwan, and then in Southeast Asia, the United States, Canada and France.

A fter the People’s Republic of China was founded in 1949, Wanglaoji’s herbal teashops in Guangzhou were incorporated into a staterun enterprise affiliated w ith Guangzhou Pharmaceutical Holdings Ltd. The Hong Kong part of the business, Hong Kong Wong Lo Kat (International) Ltd., is still owned and operated by Wong’s descendants.

In 1992, Guangzhou W ang lao ji Pharmaceutical Co. Ltd. developed innovative herbal tea products using a century-old formula and packaged the products in paper packets and cans. This is the earliest example of packaged herbal tea in China.

In 1995, Guangzhou Pharmaceutical Holdings Ltd. leased the right to produce its red canned herbal tea to the Hong Kong Hung To Group. The JDB Group, affiliated w ith Hong Kong Hongdao Group, then started to use Wanglaoji’s trademark for its red canned herbal tea, while Guangzhou Pharmaceutical Holdings Ltd. continued to sell Wanglaoji herbal tea in green paper packages. In 2000, Guangzhou Pharmaceutical Holdings Ltd. and Hong Kong Hung To Group signed another contract, stipulating that Hung To was allowed to use Wanglaoji’s trademark until May 2, 2010.

In 2009, the sales volume of Wanglaoji herbal tea in the country reached 16 billion yuan ($2.52 billion), surpassing that of Coca Cola. Evaluated by Beijing Famous Brand Asset Evaluation Co.Ltd. in 2010, Wanglaoji had a value of 108 billion yuan ($17.03 billion), becoming the topranked beverage in China.

In April 2011 Guangzhou Pharmaceutical Holdings Ltd. filed an application w ith the China International Econom ic and Trade Arbitration Comm ission (CIETAC) to take back the right to use the Wanglaoji trademark.The CIETAC ruled on M ay 9, 2012, that Hung To Group must stop using Wanglaoji’s trademark.

Guangzhou Pharmaceutical Holdings Ltd. held a press conference on June 4 and launched its own herbal tea in red cans, similar in look to the red-canned JDB herbal tea.The advertising slogan is almost identical to JDB and simply replaces the product name to Wanglaoji.

Such “im itation” soon came under attack by JDB, w hich sued Guangzhou Pharmaceutical in the court for “infringing upon the design of the red cans.” JDB holds that the red cans were designed by Chan Hung To, founder of Hong Kong Hung To Group, who once owned the design patent.JDB argues that it had invested several billion yuan in nurturing the Wanglaoji brand and therefore should own the design rights of the iconic red cans. JDB argues that Guangzhou Pharmaceutical has never produced any herbal tea in red cans and hasn’t invested in its development but has launched its own herbal tea w ith the same look.

Guangzhou Pharmaceutical claims that the red can is an inherent characteristic of the Wanglaoji brand. Therefore, JDB is the one infringing upon Wanglaoji’s package design by using the red cans for its own tea.

The court has made no decision in the case, but JDB is clearly unw illing to surrender its hold on the herbal tea market after years of dom ination. It has increased its ad presence on television, on subways across the country and on the Internet, and is even blocking Wanglaoji from accessing its sales channels.

JDB salesmen work six days a week. Part of their job description includes spying on Wanglaoji employees. Whenever Wanglaoji holds any promotional event, JDB’s people appear on the scene, offering up their own herbal tea for free.

A cco rd ing to a p ress re lease by Guangzhou Pharmaceutical, JDB salesmen interrupted its 23 promotional events across the country in the last three months.On August 15, JDB employees brutally beat Wanglaoji salesmen in Nanchang, Jiangxi Province, during a promotional event. That incident was followed by other attacks against Wanglaoji workers.

These scuffles led to a more serious encounter on August 28. Yao and some other Wanglaoji salesmen were holding a promotional event at the Mudu Shopping Center in Suzhou. According to police, at about 9 a.m. some JDB employees appeared on the scene and covered Wanglaoji’s advertisement banners. Later that afternoon, JDB employees began slashing their rivals’ advertising material w ith knives. Wanglaoji employees

W ang lao ji

JDB stepped in to stop the defilement, leading to Yao’s stabbing.

W ill W ang lao ji d ec line?

In 2006, Wanglaoji was deemed a part of China’s intangible cultural heritage. The brand has a reach beyond business and has become a symbol of the national culture. But the feud between Wanglaoji and JDB risks becoming a detriment to both companies and even the entire herbal tea industry, said industry watchers, citing another feud in the beverage-making world.

In 1984, Li Jingwei, head of Sanshui Brewery Factory in Guangdong Province,got hold of a formula for a sports drink and launched the beverage Jianlibao. The drink was a massive sales hit and was even called Chinese “magic water” by the Japanese media. When Jianlibao celebrated its 10th anniversary in 1994, it had sales of 1.8 billion yuan ($283.91 million) and was the top revenue-generating beverage in the industry.

In 1997, the local government of Sanshui started eyeing for shares of Jianlibao. On January 15, 2002, Sanshui transferred 75 percent of Jianlibao’s shares to Zhejiang International Trust and Investment Corp. at a price of 338 million yuan ($53.31 million). A 28-year-old, Zhang Hai,was appointed chairman of Guangdong Jianlibao Group Co. Ltd. Tension over stock ownership plagued the company’s development and its stock plunged. Production was suspended. On December 7, 2004, Jianlibao resumed production but was unable to revive the brand. Today,Jianlibao’s market share is paltry, and many of the country’s young people are unaware of the brand.

With escalating tension between Guangzhou Pharmaceutical and JDB, Wanglaoji could follow in Jianlibao’s footsteps. In June, Guangzhou Pharmaceutical launched Wanglaoji herbal tea in red cans, with sales expected to reach 2 billion-3 billion yuan ($315.46 million-473.19 million)this year. Together w ith its green paper packaged herbal tea, Guangzhou Pharmaceutical expects to sell 4 billioin-5 billion yuan ($630.91 million-788.64 million) worth of herbal tea, much lower than JDB’s annual sales performance of 16 billion yuan ($2.52 billion) in the last two years.Industry insiders believe that without JDB’s sales acumen, Wanglaoji is unlikely to mimic its past sales performance.

Gove rnm en t’s ro le

Some attribute government interference to Jianlibao’s downfall. A hint of government presence is also evident in the feud over Wanglaoji.

Guangzhou Pharmaceutical is a stateowned enterprise under the State-Owned Assets Supervision and Adm inistration Comm ission o f the State Coun c il.As a big shareho lder, the Guangzhou M unicipal Government hopes Guangzhou Pharmaceutical develops into a bigger player in the herbal tea market.

According to a report by Shenyin and Wanguo Securities Co. Ltd., the confl ict over Wanglaoji raises a key question: How should China develop a national brand using state capital?

Historically, Chinese brands have been infused with state capital and usually cooperate w ith market-oriented companies to develop operations. The Shenyin and Wanguo report concludes that in these cases, success depends on both parties strengthening trust and cooperation.