Chinese Capital Enters U.S. Commercial Property Market

By YE HUIJUE

SINCE it bounced off rock bot- tom last year, the U.S. housing market has been attracting increasing numbers of cashedup Chinese to invest in residential and commercial properties across the country.

New York, as always, tops the list of favored investment destinations for budding real estate tycoons from the Chinese mainland.

A Sign of the Times

Over spring break last March, Polly Chang was doing anything but relaxing. she instead received representatives from several Chinese companies who had come to the Big Apple with one thing in mind: property.

Ms. Chang is a real estate agent with nine years experience in the New York market. Shes currently senior vice president at Prudential Douglas Elliman, the largest real estate brokerage in the Big Apple.

Of her spring break clients, Ms. Chang said, “These consortia come to scout for commercial properties before submitting proposals to boards or shareholders back home on potential purchases.” Its a drawn-out process, but worth the time spent. In the last few years, shes found herself dealing with more and more Chinese clients.

Chinese companies favor either buying property stocks for equity investment or acquiring mismanaged buildings outright, often for self-use, Ms. Chang said. Their activities have even had a discernable impact on local property prices.“Prices have been climbing since last October. And the spread between asking price and knockdown price (a barometer of interest in the real estate market) has dropped from 20-25 percent to 5-10 percent.”

Chinese buyers became the second largest investor group in the U.S. housing market in 2011, registering US $7 billion in transaction volume for that year. In February, Vanke signed a US $20 million agreement with Tishman Speyer, the largest real estate company in the U.S., to jointly develop San Franciscos 201 Folsom Street. And in March, Zhang Xin, CEO of Soho China Ltd., bought a 40-percent stake in the New York General Motors Building, making her the biggest Chinese spender on American property in history.

“European customers used to be dominant. In 2011 Canadians and Russians started to get the upper hand, but we are now seeing an even faster Chinese surge,” Ms. Chang added.

Meanwhile, U.S. real estate funds are actively courting Chinese capital.

Christopher McNeur, managing director of Elite View International Capital(EVIC), told us that his group plans to raise over US $100 million from Chinese institutional investors by May. The fund will invest in several property projects on the U.S. mainland.

EVIC is on track to reach financing agreements with a number of Chinese Qualified Domestic Institutional Investors (QDII), including a “large Chinese bank” that is “very likely to provide half the total capital,” according to McNeur.

Some Chinese companies buy direct stakes in the U.S. housing market, while others favor diversifying into property through investment funds. Thanks to their activities, Wall Street is currently betting on Real Estate Investment Trusts (REITs) seeing big rises in net value. The net value growth rate of Penghua U.S. Real Estate Fund, for instance, stood at 8.10 percent in the third quarter last year.

New York State of Mind

In 2011, Chinese real estate web portal Soufun acquired former AIG buildings at 72 Wall Street and neighboring 50 Pine Street, making it the first Chinese company ever to buy commercial properties at the very heart of Americas financial district. In 2009, Kumho Investment Bank of South Korea purchased these two buildings from AIG, but its development plans never materialized. Assets with AIG labels were not even removed – a memorial, as it were, to the 2008 fi nancial crisis. Nonetheless, reselling the buildings to Soufun generated a US $26 million profi t for Kumho.

According to a security guard at the former AIG buildings, beginning with a visit from several Chinese businessmen to the premises in April 2012, more and more Chinese have been seen walking in and out of the buildings. Among the April visitors were Chairman of Soufun Mo Tianquan and his newly appointed New York office managing director Hou Yukui. Mo was reported as saying that he planned to transform the 16th fl oor of one of the New York buildings – on which he was standing and looking down at the whole of Wall Street as he was quoted –into Soufuns global training center.

An analyst report from Cushman & Wakefield reasoned that uncertainties and contractions in the global economy have led to retarded recovery and driven investors to major markets. Since major cities usually provide a more stable return on investment, they are favored by risk-averse investors.

Since 2007, commercial property in New York has proven highly attractive to domestic and international investors alike.

In the wake of the financial crisis, New York housing prices picked up steadily. Statistics from Chandan Economics, a real estate research company, show that office building sales reached US $12 billion in 2011. Although still below the US $40 billion of 2007, it was twice the figure of 2010. Vacancy rates in quality buildings dropped below 10 percent.

Although the number of Chinese enterprises buying New York commercial properties remains limited, it is certainly on the increase.

At 25 Broad Street, near the center of the Financial District, a 50,000 square feet building was recently acquired by a Chinese company. Before that, another building on the same street was purchased by a Chinese fi rm for US $18 million. HNA Capital, a subsidiary of HNA Group, bought a US $265 million offi ce building in downtown Manhattan.

Its safe to say that New Yorks real estate agents are feeling – and cashing in on – the vigorous demand from Chinese companies and individuals keen on buying into the market.

The Role of Private Equity

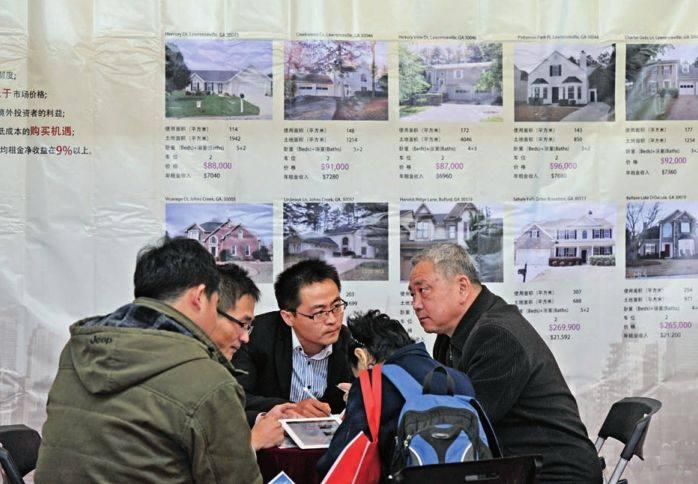

Chinese private real estate funds are now actively entering the recovering U.S. housing market.

“Our Atlanta project is almost settled. I am signing some final documents on the ground very soon, including a loan agreement,” said Zhang Mingeng in an interview at the end of last year in New York. Zhang is chairman of Grand China Real Estate Fund.

He revealed that after the current deal, worth US $24 million, another property project in Chicago was on their investment agenda.

In China, private real estate funds have made the jump from physical to equity investment in a very short time– three to five years in most cases. But some have been even quicker in shifting their attention to America, where they hope to get in on the early stages of a housing market recovery.

Wang Neng, professor of finance at Columbia Business School, said that the fundamentals of the U.S. economy were good. As long as investors realize this, he said, the housing market would remain attractive to Chinese investors. Some Chinese private equity fi rms are already exploring the North American market, and investment from Chinese in real estate fi nancial products is set to increase. But it will take time.

Zhang Mingeng has afforded himself a two-year trial period to adapt to the U.S. housing market. “Chinese used to focus solely on physical investment in the property market. Now, they are beginning to accept equity investment as a potentially lucrative option,” he said.

“Were planning to explore the market, and within two years to attract potential Chinese investors,” Zhang added. Grand China Fund, where he works, developed from its predecessor Beijing Yinxin Investment Group. Its cofounders include Sunshine 100 Real Estate Group, Shanghai Forte Group, Fuho Capital Management and Xishen Capital Management. Grand China Fund is the first Renminbi-denominated real estate fund approved by the China National Enterprise Development and Reform Commission.

Since the Law of the Peoples Republic of China on Partnership Enterprise was revised in August 2006, private real estate investment funds have become a favored investment tool for many money managers. The investment horizon is long, but returns are generally stable. Limited partnerships also allow a management company to run several funds at once in order to improve shareholder returns.

According to Zhang, most of his investors are institutional, and include manufacturers, exporters and mine owners. About a quarter to a third of their assets tend to be in foreign currency, which they used to keep in private banks for stable, low-risk returns. But now, with the financial crisis well behind them, investing in real estate projects through private funds is growing more attractive.

Zhangs current strategy is to cooper- ate with American developers and agents to invest in stable projects like condominiums with long-term tenants. He believes annual earning ratios on five-year projects can reach eight to 10 percent after tax and operation/management costs are accounted for. If asset appreciation is factored in, returns may be even higher.

In terms of financing, Grand China Fund and American partners jointly provide 30 percent of the total capital(80 percent of which comes from Grand China). The remaining 70 percent comes from American bank loans. Easy access to credit and low interest rates further reduce the costs of financing.

Wang Neng says that if Chinas economy keeps up its momentum, stronger purchasing power and abundant capital will mean more Chinese citizens are able to migrate to, or stay temporarily in, the U.S. And even if Chinas growth slows down, capital outflow is unlikely to stop. Either scenario should be good news for the U.S. housing market.

Prospects

Several years ago, many rich Chinese individuals were found “bottom fishing”in the U.S. residential property market. Many were burned in the crash. This time round, Chinese institutional investors seem to be making more long-term considerations as they enter the countrys commercial property market.

“Return on investment ratios can be higher in China, mind you,” Polly Chang pointed out, adding that the ratio for New York commercial real estate falls between six to 12 percent, while it can reach 10 to 30 percent in some Chinese cities.

So why the interest in America?

In a word, stability. “All my Chinese clients want a low-risk, stable environment – and predictable government policies,” said McNeur. When promoting real estate funds to Chinese customers, he assures them of a before-tax Internal Rate of Return (IRR) of 12 percent. If their risk profile is higher, better returns can be expected.

The signs are that there are many more potential than actual Chinese investors in the American real estate market at present. Nonetheless, the housing market recovery in the U.S. is proving to be domestic-driven. This indicates the U.S. economic resurgence has entered a general upswing.

“While increasing numbers of Chinese are set to invest in U.S. commercial properties, their current share of the market is still less than one percent,”said Zhuang Nuo, CEO of Glohouse.net, a real estate website.

Statistics from Marcus & Millichap show that in 2012 foreign investment accounted for only five percent of the value of the U.S. commercial property market. Domestic funds, institutional investors and Real Estate Investment Trusts(REITs) remain dominant.

One real estate agent who requested anonymity tells us that in the long run, the return ratio on commercial properties, especially that on office buildings, will head south as office culture in the U.S. changes. “Open offices” and the increasing prevalence of mobile workers who are not tied to a physical desk will have impact on the demand for office space in general. In short, its a changing sector, and the good times – here for the time being – will not necessarily last.