Seeking Changes and Stability

Seeking Changes and Stability

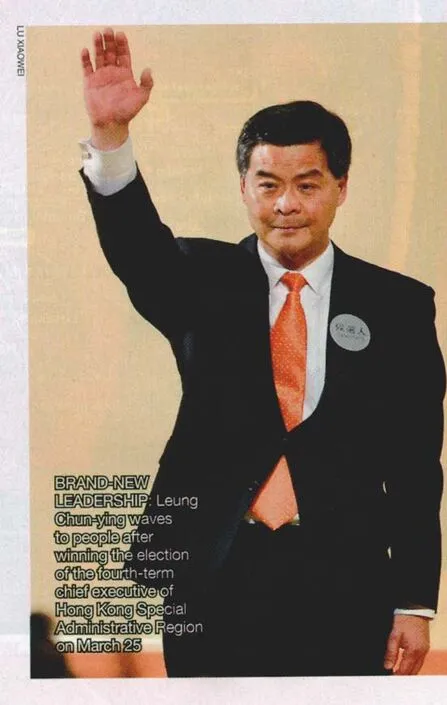

On July 1, Leung Chun-ying was sworn in as the third chief executive of Hong Kong Special Administrative Region (SAR) since its establishment on July 1, 1997. Before Leung’s assumption of the post and the end of Donald Tsang Yam-kuen’s second term as chief executive of the SAR Government, Leung and Tsang gave an interview respectively to Beijing Review special correspondent Qiao Zhenqi in Hong Kong. Excerpts follow:

Beijing Review: What brought you the victory in Hong Kong’s chief executive election?

Leung Chun-ying: The chief executive of Hong Kong SAR must win support and recognition from Hong Kong residents. I visited people from all walks of life. I told people about my policy agenda and learned their concerns during these visits, which were warmly welcomed by voters.

Meanwhile, I put forward the principle of“seeking changes while maintaining stability” in my policy agenda. As social problems have been accumulating during Hong Kong’s development, residents have actively voiced their requests for changes. The “changes”in my agenda are not major changes, but minor ones introduced in the midst of stability. Still, seeking changes is the core.

What is your understanding of “Hong Kong’s return to China?”

“Hong Kong’s return to China” has double meanings. In legal principle, the Chinese Government resumed exercise of sovereignty over Hong Kong on July 1, 1997, and a SAR was set up. The Basic Law of Hong Kong SAR, which serves as its mini-constitution for the region, went into force and the principle of “one country, two systems” was successfully implemented.

Regarding the popular feelings of the people, we need to work harder in a place that was under colonial rule for more than a century. This work, including our national education, will take a long time.

Hong Kong enjoys the Central Government’s support, which is one of its development advantages. How will Hong Kong achieve even faster development by making use of this advantage?

The Outline of the 12th Five-Year Plan for the National Economic and Social Development (2011-15) of China says that the Central Government supports Hong Kong to consolidate and enhance its status as an international fnancial, trade and shipping center and expand its global clout as a fnancial center. We are grateful for the state’s support.

What is the real meaning of enhancing Hong Kong’s status as an international fnancial, trade and shipping center? I believe that such status would not be enhanced simply by doubling the throughput of Hong Kong’s container terminal. In contrast, as an international shipping center, London does not even have a port. Without being involved in onshore cargo handling, London is engaged with more technically complicated businesses, such as trade, leasing, registration, management, financing and insurance of vessels. I would say that Hong Kong’s status would be truly enhanced if we could develop into an international shipping center like London.

Hong Kong has become economically closer to the mainland after its return to China. How has Hong Kong benefted from this development? What measures will Hong Kong take to strengthen its economic and trade cooperation with the mainland in the future?

Hong Kong’s economic cooperation with the mainland is refected in three policy arrangements. First, the Mainland-Hong Kong Closer Economic Partnership Arrangement wassigned in 2003. Second, for the frst time the Outline of the 12th Five-Year Plan dedicates a whole chapter on Hong Kong and Macao, which contains a lot of content on Hong Kong’s future development. Third, Vice Premier Li Keqiang announced 36 measures set out by the Central Government to support Hong Kong’s social and economic development during his visit to Hong Kong in August 2011. Moreover, Hong Kong has signed separate cooperation agreements with Guangdong Province and Shenzhen, a boomtown in Guangdong. As the next step, we will focus on implementing policies and arrangements in these documents.

Beijing Review: The principle of “one country, two systems” has been implemented in Hong Kong since its return to China on July 1, 1997. Now, some people say that the reality is too much “one country,” not so much “two systems.” How do you see this?

Donald Tsang Yam-kuen: Since Hong Kong’s return to China, its social and economic systems and lifestyle remain unchanged. Some people say that the country has grown stronger now, and has exerted more and more infuence on Hong Kong. Nonetheless, China’s impact is global, not only on Hong Kong, but also on the United States and the European Union. Most importantly, the Central Government adheres to the principle of “one country, two systems” stipulated in the Basic Law of Hong Kong SAR. The freedom enjoyed by Hong Kong has never changed, and the lifestyle of Hong Kong people has never changed. What we have done is not perfect, we can make it better. I have every reason to say that the principle of “one country, two systems” has been successfully implemented in Hong Kong.

After Hong Kong returned to the motherland, has there been any change in its status in the global economy?

Credit rating agency Standard & Poor’s has upgraded Hong Kong’s credit rating to the highest AAA. Currently, only two Asian economies, Singapore and Hong Kong, are rated AAA. Most of the recipients of this rating are developed economies in Europe and North America. So we can see that Hong Kong’s overall financial system has come on par with that of developed economies, and Hong Kong’s status in the global economy has been recognized.

After weathering two financial tsunamis in 1997 and 2008, Hong Kong has enhanced its status as an international fnancial center. In the last 15 years, Hong Kong has never had fnancing diffculties. The most diffcult time occurred after the 2008 financial crisis, yet even then, there was foreign capital entering Hong Kong. This indicates that international investors believe Hong Kong is a stable and reliable market with relatively high returns.

Hong Kong has shifted from an economic structure dominated by manufacturing to one dominated by services. Its service industry has gradually upgraded to high-end services with high added value such as fnancial, shipping and logistical services. Recently, we have found a new direction, that is, to develop environmentfriendly industries and creative industries. So, Hong Kong is always going forward.

The Central Government actively supports Hong Kong’s efforts to develop itself into an offshore renminbi business center. Right now, how is Hong Kong’s offshore renminbi business going? How will this strengthen Hong Kong’s status as an international fnancial center?

The pilot scheme of renminbi settlement for cross-border trade was introduced in 2009, which is an important milestone in the sustained development of Hong Kong’s renminbi business. Last year, renminbi trade settlements processed in Hong Kong totaled 1.9 trillion yuan ($299.84 billion). Hong Kong has the largest pool of offshore renminbi liquidity, and has become the largest renminbi trade settlement center and the global hub for renminbi dim-sum bonds. Hong Kong has played an important role in the internationalization of the renminbi. Driven by increasing renminbi trade settlements, renminbi deposits in Hong Kong banks are surging. As of the end of this March, renminbi deposits in Hong Kong had reached 54.43 billion yuan ($8.59 billion), accounting for 8.7 percent of the total deposits in local banks.

Currently, 9 percent of China’s foreign trade is settled in renminbi, of which 90 percent is handled by banks in Hong Kong. It is very important for Hong Kong. On one hand, it is an important boost to Hong Kong’s role as a fnancial center, and Hong Kong can proft profusely from it; on the other hand, Hong Kong has made real contribution to the process of making the renminbi a convertible currency.

yaobin@bjreview.com