A Time to Foster New Engines of Economic Growth

China slowed its economic growth in 2011 to concentrate on economic restructuring. The countrys growth rate nonetheless outstripped that of other world economies. Chinas 2011 Gross Domestic Product (GDP) was RMB 47.1564 trillion– a year-on-year increase of 9.2 percent. The countrys first 2011 quarterly financial report showed a year-on-year increase of 9.7 percent, a figure that fell to 9.5 percent in the second quarter, 9.1 percent in the third, and 8.9 percent in the fourth quarter. Gradually descending rates of growth were thus a feature of Chinas economy in 2011.

Chinas foreign trade in 2011 maintained a relatively rapid growth momentum but experienced a lower surplus. Trade volume topped RMB 3.6421 trillion, up 22.5 percent year-on-year, but Chinas trade surplus stood at US $155.1 billion – US $26.4 billion less than in 2010 – and contributed around two percent to its GDP compared to 3.1 percent in 2010. This drop is mainly attributable to the world economic slowdown that has dampened global demand for Chinas manufactured products.

The World Bank predicted in its Global Economic Prospects report, released on January 18, a world economic growth in 2012 of 2.5 percent – more than one percentage point lower than its earlier projected figure of 3.6 percent growth. The report also forecast a dip in Chinas growth to 8.4 percent.

The worldwide slowdown is bound to affect Chinas export-driven economy.

But despite the grim global economic climate, the Chinese government remains among the least indebted in the world, and one endowed with a strong ability to stimulate its economy, according to World Bank chief economist and Senior Vice President Justin Yifu Lin. Chinas government deficit accounts for just 25 percent of its GDP. Even taking into account loans taken out by local governments, Chinas public debt accounts for about 45 percent of its GDP, in sharp contrast to Japans, which is double its GDP, and that of Germany, which stands at about 83 percent of its GDP. As Lin observes, therefore, despite the worldwide slowdown, China has relatively ample room, if necessary, for maneuvers to stimulate the economy.

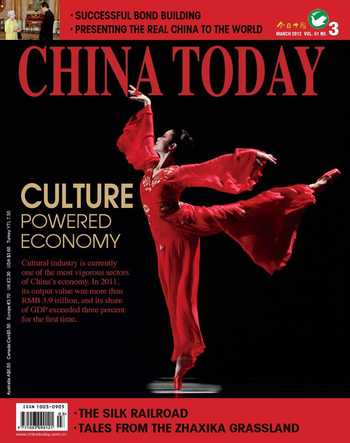

To ensure the effectiveness of such a maneuver China must determine an appropriate direction. There is scope for industrial upgrade and also for improvement of Chinas infrastructure and social welfare sectors. The countrys burgeoning cultural industry is another growth engine of high potential. The Communist Party of China proposed, at the Sixth Plenary Session of its 17th Central Committee in October 2011, promoting development of Chinas cultural industry and making it a pillar of the national economy. In the past, China looked to real estate and its auto industry to propel the countrys economic growth. The 14.6 percent increase in 2011 of Chinas auto industry, however, was 20.2 percent lower than the previous year. Chinas investment in the real estate sector eased to 20 percent year-on-year, and the total volume of sold commercial housing grew only 4.9 percent over 2010. The Chinese government is hence separating its economic growth from that of its real estate industry. Measures to prevent Chinas economy from making a hard landing have achieved a certain effect.

Chinas emerging cultural industry is expected to play a bigger role in driving the economy. At present, it contributes only three percent to the countrys GDP. Chi Fulin, director of the China Institute for Reform and Development, however, predicts that if, in the next five years, Chinas cultural consumption can account for more than five percent of its GDP, it could add a consumption volume of RMB 4 trillion to the economy. Although there is still a considerable gap, in terms of experience and expertise, between Chinas cultural industry and that of developed countries like the U.S. and Japan, the prospects for this up-and-coming sector are nonetheless upbeat.