Managing the Online Middle Man

By HU YUE

Managing the Online Middle Man

China clears up the crowded and sometimes chaotic third-party payment industry with new requirements

By HU YUE

As shoppers abandon four-wheel carts and long checkout lines for the convenience of a mouse click, Chinese policymakers are sparing no efforts to regulate mushrooming thirdparty payment service providers frequently used by online buyers.

The People’s Bank of China, the central bank, issued a circular on June 21, ordering non-bank payment service providers to apply for a business license from the central bank by September 2011. The new rules will offcially come into effect on September 1, 2010.

Their first step to regulate the payment services will be an entrance threshold.

Companies seeking to provide third-party payment services nationally must have a registered capital of at least 100 million yuan ($14.7 million) for a license. They should also have recorded profts for two consecutive years. The threshold for provincial-level players is 30 million yuan ($4.4 million).

Licensed providers will be required to submit financial reports and client information to the central bank, including the commission rates they charge for transactions. In addition, if they take client deposits, they must set up a special reserve account at a commercial bank and put at least 10 percent of the deposits in the account.

The order gives the central bank oversight over a huge payments network that has sprung up outside the traditional banking system due to the online business boom.

The payment companies have been a significant driver of the economy as they facilitate e-commerce and serve as a complement to traditional banking networks, said the central bank.

By the end of the first quarter of 2010, there were 260 non-bank payment service providers registered with the central bank mostly engaged in online and mobile payments, as well as pre-paid cards.

“But as the vibrant sector gets on a roll, problems are coming to light such as growing fnancial risks and illegal operations,” the circular said. “Addressing these problems requires adequate regulatory efforts.”

The providers are encouraged to press ahead with fnancial innovation and improve service effciency, but they are also supposed to ensure the health and security of the market, the central bank said.

Prospects and problems

The third-party payment industry is basking in the glow of an online business boom.

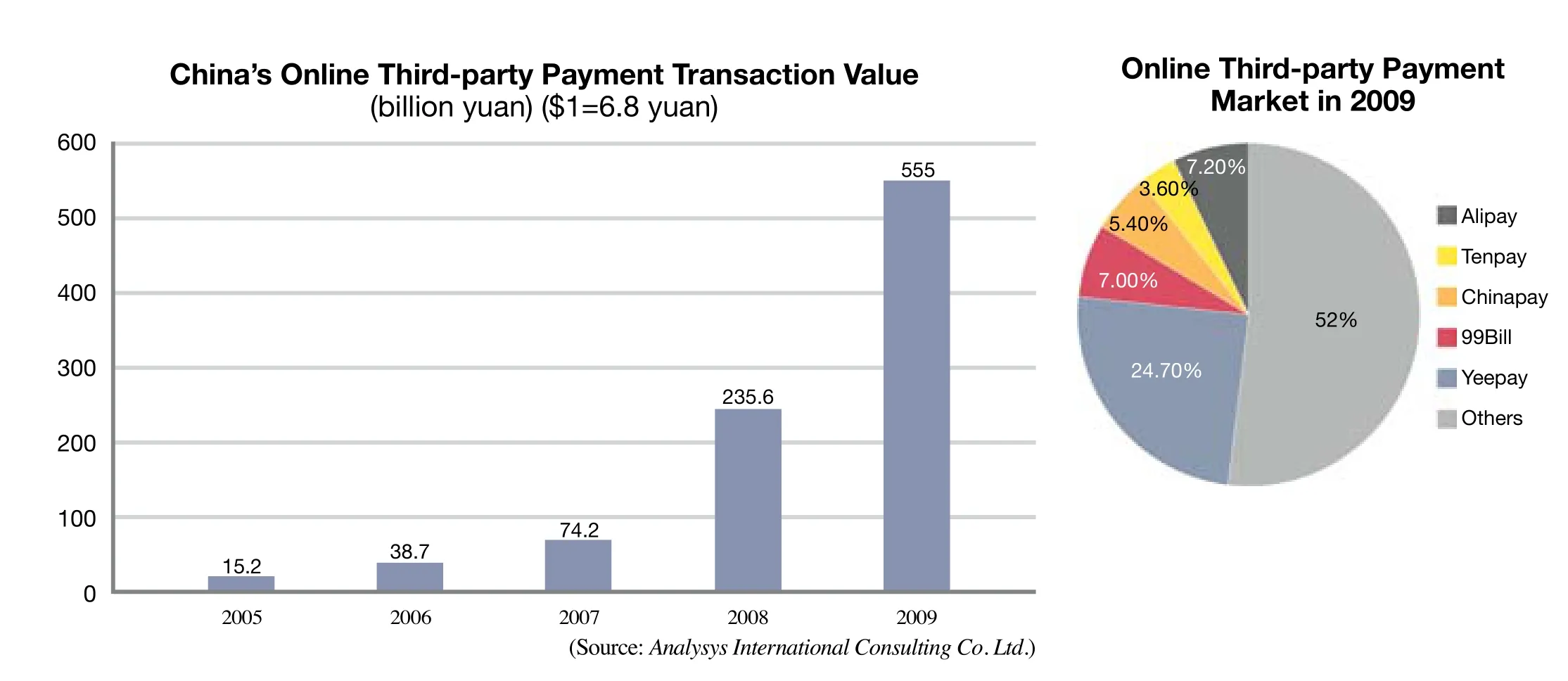

The transaction value of the third-party payment sector amounted to 580.8 billion yuan ($85.4 billion) in 2009, more than doubling that of 2008, said the Beijing-based Analysys International Consulting Co. Ltd., in a recent report. The number is likely to reach an amazing 1.2 trillion yuan ($176.5 billion) by 2012.

Leading the tide was Alipay, leveraging the unmatched customer base of Taobao.com, a C2C auction site of e-commerce giant Alibaba Group. Alipay now boasts more than 300 million users with turnover of around 1.2 billion yuan ($176.7 million) per day. It grabbed a 52-percent share of the overall online payment market in 2009, followed by a 24.7-percent acquisition of the Shenzhen-based Tenpay, an online payment unit of Tencent Group, a leading provider of Internet service and mobile value-added services in China.

Alipay was the first company in the country to initiate a transaction-guaranteed payment model that keeps both sellers and buyers away from possible risks. During the transaction, Alipay serves as a thirdparty platform—buyers transfer payment to Alipay, which then hands over the payment to the sellers after products are received.

Among the numerous Alipay users was Cheng Yang, a 26-year-old executive assistant with a fashion magazine in Beijing.

“I spend at least one hour a day surfng the Web for stuff to buy, and I hardly ever log off empty-handed,” Cheng told Beijing Review. “I never worried about the security since the payment platform provides a sound guarantee against fake and shoddy goods.”

Cheng said online payment, from making hotel reservations to recharging her mobile phone, is an integral part of her life now. Last month she wanted to register for an English language test and found that the only way to pay for the exam was via the Web.

But not every provider has such close ties with C2C platforms. As a result, it is a more viable option for most small players to specialize in a particular area. The Beijingheadquartered Yeepay, for instance, has gained a foothold in the education sector while Tenpay focuses on air ticket businesses by tapping the rich customer resources of QQ, an instant messenger service of Tencent.

But most small players are struggling to make ends meet due to ferce competition and low brand recognition, said Nuan Minmin, General Manager of International Payment Solutions Ltd.

Worse still, clouds have been gathering over the industry due to a lack of market regulation, and some unscrupulous providers are believed to be involved in illegal activities, such as money laundering and credit fraud. There are even reports that the online payment company 99Bill Corp. helped an overseas gambling group transfer funds of more than 3 billion yuan ($441.2 million) leading to the detainment of one of its senior managers.

Many analysts believed this might make it diffcult for 99Bill Corp. to get a license. But the company dismissed the worries, citing that it was also a victim in the case and was deceived by its business partners.

Streamlining

Major payment companies have welcomed the new policy.

“The regulation will accelerate consolidation within the sector. It allows more room for large players and will bring tangible benefts to our customers,” said Su Hui, spokeswoman of the Hangzhou-based Alipay.”We are preparing to apply for the license and are confdent we will get approved.”

“The policy is expected to steer the sector on a steady path toward growth,” said Yu Chen, Vice President and co-founder of Yeepay. “Due to an implicit regulatory environment, many companies have been hesitant to expand and explore innovative business models.”

Guo Tianyong, Director of the Research Center of China’s Banking Industry under the Central University of Finance and Economics, estimated that two thirds of thirdparty payment companies will be forced out of the market. “But it represents an official recognition of status of the new industry, and will help remove uncertainties hanging over the industry.”

Hu Yuanyuan, a senior analyst at the iResearch Consulting Group, agreed. “The top 10 players will not be impacted,” she said.“From a long-term perspective, it will help with risk control and will also polish the sector’s appeal to investors.”

The positive effects have already been felt. “Since the new policy was introduced, many investors have been looking for opportunities in the payment sector,” said Huang Shengli, Vice President of the China Renaissance, an independent investment bank based in Beijing.

Future payments

The new policy indicates a bright future for the sector, but players like Alipay are not without their concerns—especially since state-owned companies are already rushing to cash in on the payment bonanza.

China UnionPay, the country’s sole bankcard processor, has been upgrading its point of sale networks to support mobile payments, an emerging business with no clear champions.

Before this, Chinapay, a third-party payment platform of China UnionPay, reached an agreement with Dangdang.com to provide payment services for online bookstore customers.

In another move, China Mobile announced on March 18 that it had agreed to pay 39.8 billion yuan ($5.85 billion) for a 20-percent stake in the Shanghai-based Pudong Development Bank. The tie-up was expected to pave the way for the telecom giant to make inroads into 3G mobile payment services.

“With a better credit reputation and financial strength, state-owned companies will pose a huge threat to the private businesses,”said Cao Fei, a senior analyst with Analysys International Consulting Co. Ltd. “But private companies have their own advantages in customer resources and business innovations. Now, it’s imperative for them to improve their professional services and strengthen customer loyalty.”